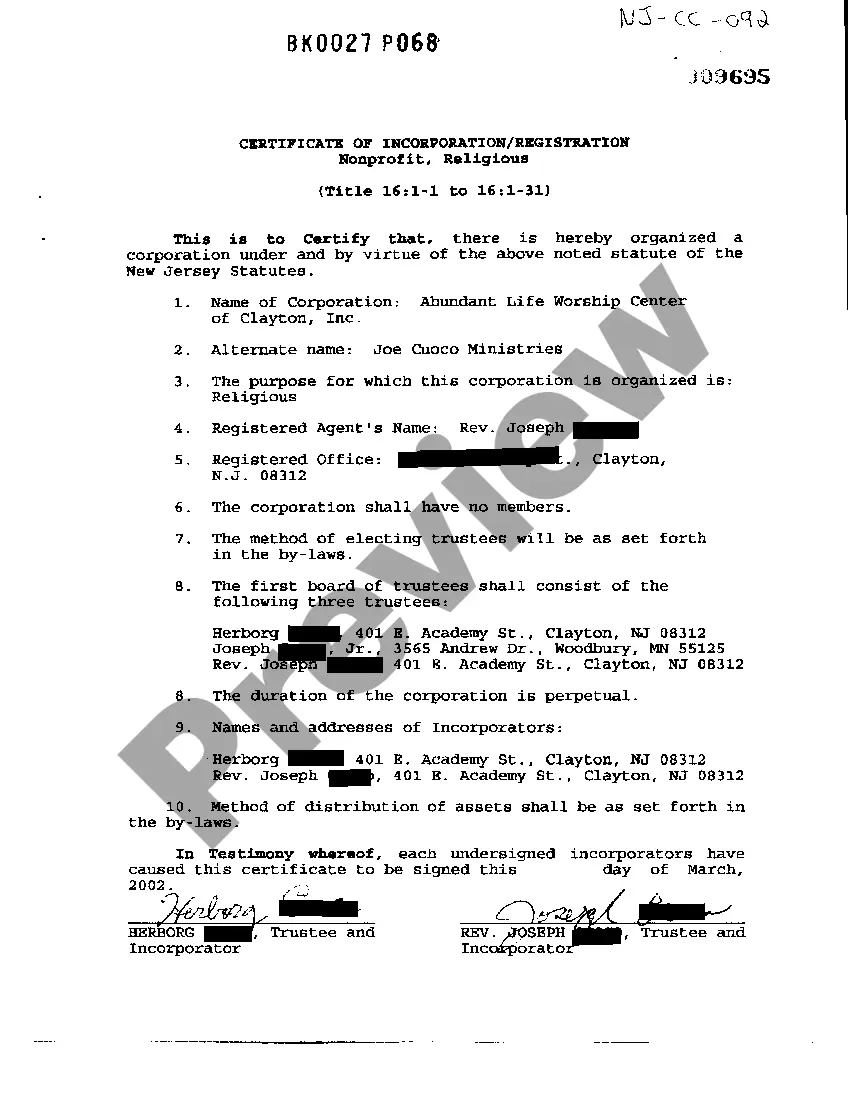

Jersey City, New Jersey Certificate of Incorporation Registration for Nonprofit Religious Organizations: A Comprehensive Guide If you are a religious organization seeking to establish a formal presence and legal recognition in Jersey City, New Jersey, the process of obtaining a Certificate of Incorporation Registration is crucial. This document not only bestows legal identity upon your organization but also offers numerous advantages, such as tax exemption, limited liability, and access to funding opportunities. Key Nonprofit Religious Organization Registration Requirements: To embark on the path of incorporation, it is important to understand and fulfill certain requirements set forth by the State of New Jersey. These requirements include: 1. Legal Name: Choose a unique and appropriate legal name for your nonprofit religious organization, while adhering to New Jersey's guidelines for naming conventions. 2. Purpose and Activities: Clearly define the mission, purpose, and activities of your religious organization, focusing on its nonprofit nature and benefits it will provide to the community. 3. Incorporates: Designate at least three individuals to act as incorporates. These individuals will be responsible for initiating the incorporation process, along with other essential tasks. 4. Registered Agent: Appoint a registered agent, residing in New Jersey, who will be the official point of contact for legal matters and correspondence with the State. 5. Bylaws: Develop comprehensive bylaws that outline the operational structure, decision-making processes, and governance of your organization. These should be consistent with New Jersey's regulatory framework, as well as any specific requirements for religious nonprofits. 6. Board of Trustees/Directors: Assemble a board of trustees or directors who will oversee the organization's activities, serve as its voice, and ensure adherence to its objectives. 7. IRS Tax-Exempt Status: Begin the process of obtaining federal 501(c)(3) tax-exempt status from the Internal Revenue Service (IRS), which is necessary to qualify for various benefits, including tax deductions for donors. 8. Compliance: Familiarize yourself with reporting and compliance obligations, such as annual financial statements, tax filings, and maintaining updated records with the State. Different Types of Nonprofit Religious Organization Registrations: While the overall process for obtaining a Certificate of Incorporation Registration for nonprofit religious organizations is similar, there can be specific distinctions depending on the entity's type. Some common types include: 1. Religious Charitable Institutions: These organizations focus on providing charitable services and aid, such as operating food banks, homeless shelters, or educational programs. 2. Faith-Based Educational Institutions: These organizations primarily focus on providing religious education and maintain schools or colleges to impart spiritual teachings alongside regular academics. 3. Religious Societies and Congregations: These organizations serve as places of worship, bringing people together to practice their shared faith, conducting religious ceremonies, and fostering community development. 4. Missionary Organizations: These entities are driven by a desire to spread their religious beliefs and values, often engaging in outreach programs or sending religious workers to areas in need. No matter the specific type, the overarching goal is to establish a legally recognized, nonprofit entity that can fulfill its religious and community-based responsibilities effectively. In conclusion, obtaining the Certificate of Incorporation Registration for a nonprofit religious organization in Jersey City, New Jersey, is a significant step towards ensuring legal recognition, financial benefits, and community impact. By adhering to the relevant requirements and following the established process, your organization can enhance its ability to positively contribute to the lives of Jersey City residents while upholding its religious principles.

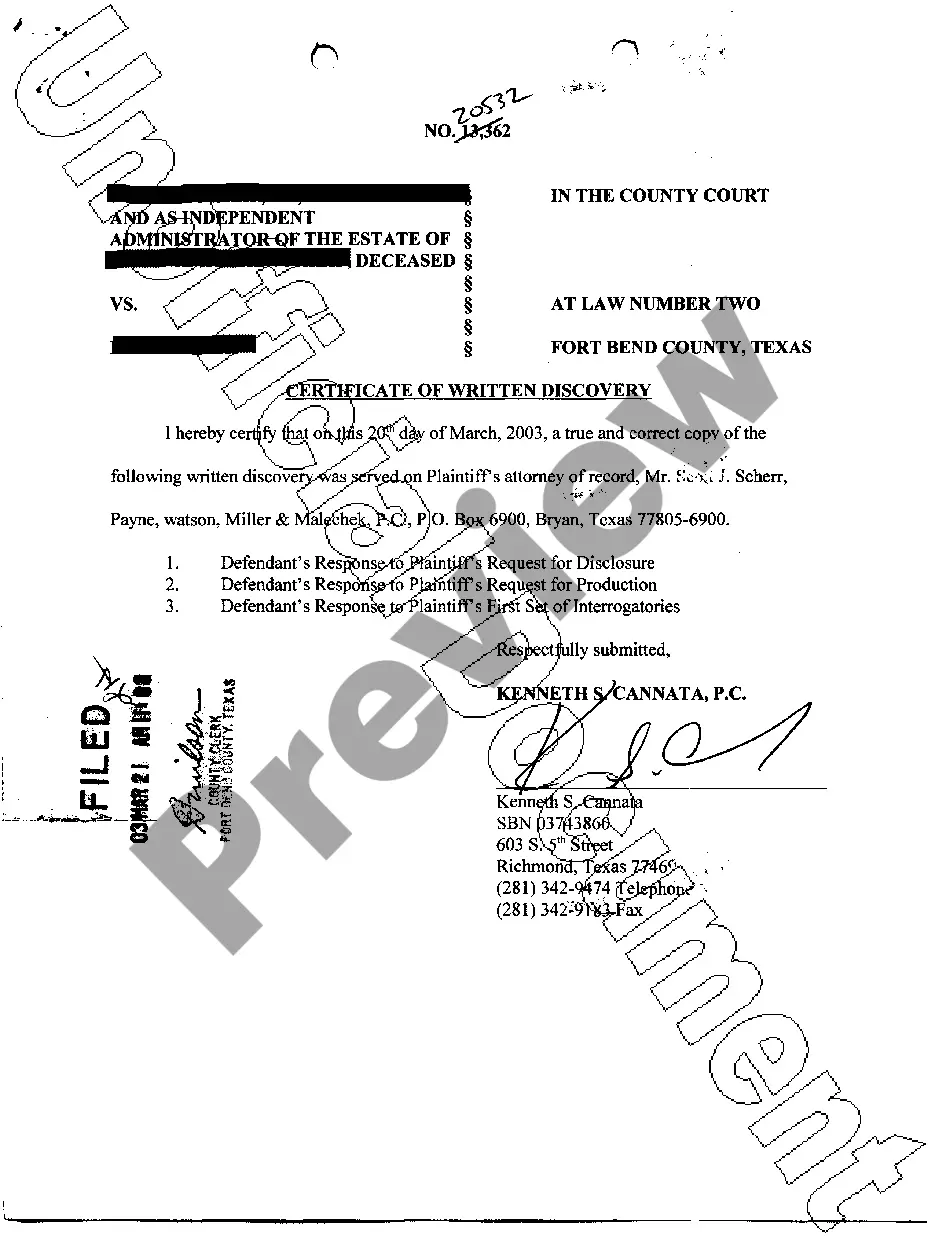

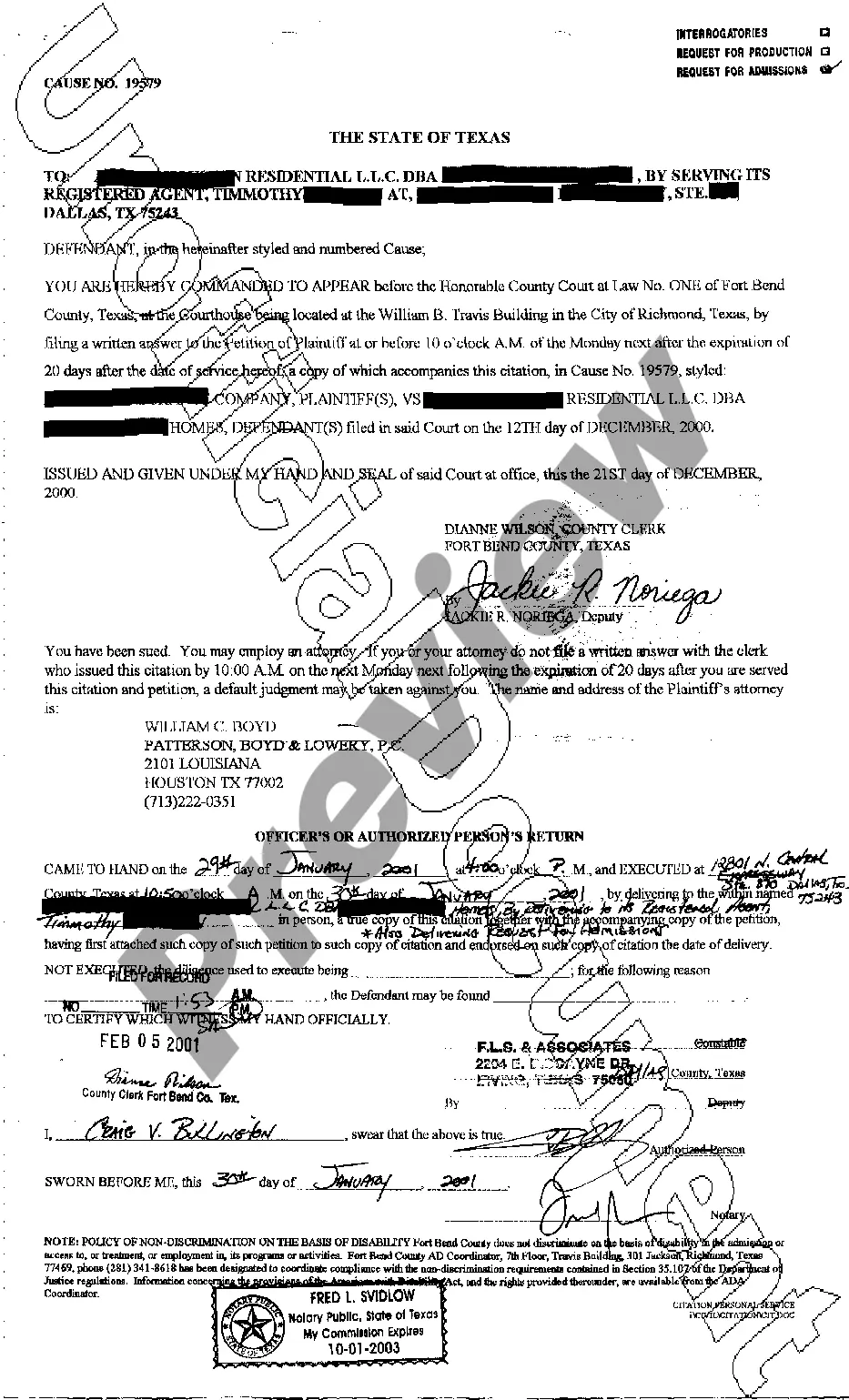

Jersey City New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization

Description

How to fill out Jersey City New Jersey Certificate Of Incorporation Registration For Nonprofit, Religious Organization?

Irrespective of one’s social or occupational standing, finalizing legal paperwork is an unfortunate requirement in the modern world.

Frequently, it’s nearly impossible for an individual lacking any legal expertise to generate this type of document independently, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms comes to the rescue.

Verify that the template you selected is suitable for your region as the regulations of one state or county are not applicable to another.

Preview the document and review a brief summary (if available) of situations the form can be utilized for.

- Our service provides an extensive repository of over 85,000 state-specific documents ready for use that address nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for individuals or legal advisors looking to conserve time using our DIY templates.

- Whether you need the Jersey City New Jersey Certificate Of Incorporation Registration for a Nonprofit, Religious Organization or any other documentation that will be accepted in your state or municipality, US Legal Forms has it all at your disposal.

- Here’s how you can quickly obtain the Jersey City New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization using our trustworthy platform.

- If you’re already a member, just Log In to your account to download the necessary form.

- However, if you are new to our collection, please follow these instructions before acquiring the Jersey City New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization.

Form popularity

FAQ

To apply for Section 501(c)(3) exempt status, you need to properly complete and file Federal Form 1023. To apply for exempt status under other sections of the Internal Revenue Code, you generally need to properly complete and file Federal Form 1024.

Division Initiatives. Angelie's Law. Board Related Information. Adoptions & Rule Proposals. Email. General AskConsumerAffairs@dca.lps.state.nj.us. Call. Consumer Service Center Hotline (973) 504-6200. Toll free (NJ only) (800) 242-5846. Press Office (For Reporters Only) 609-292-4791. Visit. 124 Halsey Street.

State law generally requires a minimum number of board members (also referred to as ?directors? in Connecticut and New York and ?trustees? in New Jersey). Connecticut, New Jersey, and New York require at least three (3) board members, all of whom must be at least 18 years old.

§ A-110 requires the Department of State to maintain, in a single, accessible location, a directory of State departments and agencies that provide resources to assist nonprofits in their daily operations. Accordingly, below, please find links to department and agency webpages dedicated to nonprofit resources.

To obtain 501(c)(3) status, a nonprofit corporation must apply to the Internal Revenue Service for recognition of tax exemption by filing IRS Form 1023. Relatively speaking, forming the corporation is fairly straightforward (assuming that one completely understands the process).

The Division of Consumer Affairs' Charities Registration and Investigation Section registers and regulates charitable organizations, professional fund raisers, and fund raising counsels operating in New Jersey.

9 Step Process to Start a 501(C)(3) Organization. Step 1: Get clear on your purpose. Step 2: Decide what type of nonprofit you want to establish. Step 3: Name your nonprofit. Step 4: Form a Board. Step 5: Write up your bylaws. Step 6: Prepare and file your incorporation paperwork. Step 7: File for 501(c)(3) tax-exempt status.

How to Start a Nonprofit in New Jersey Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.