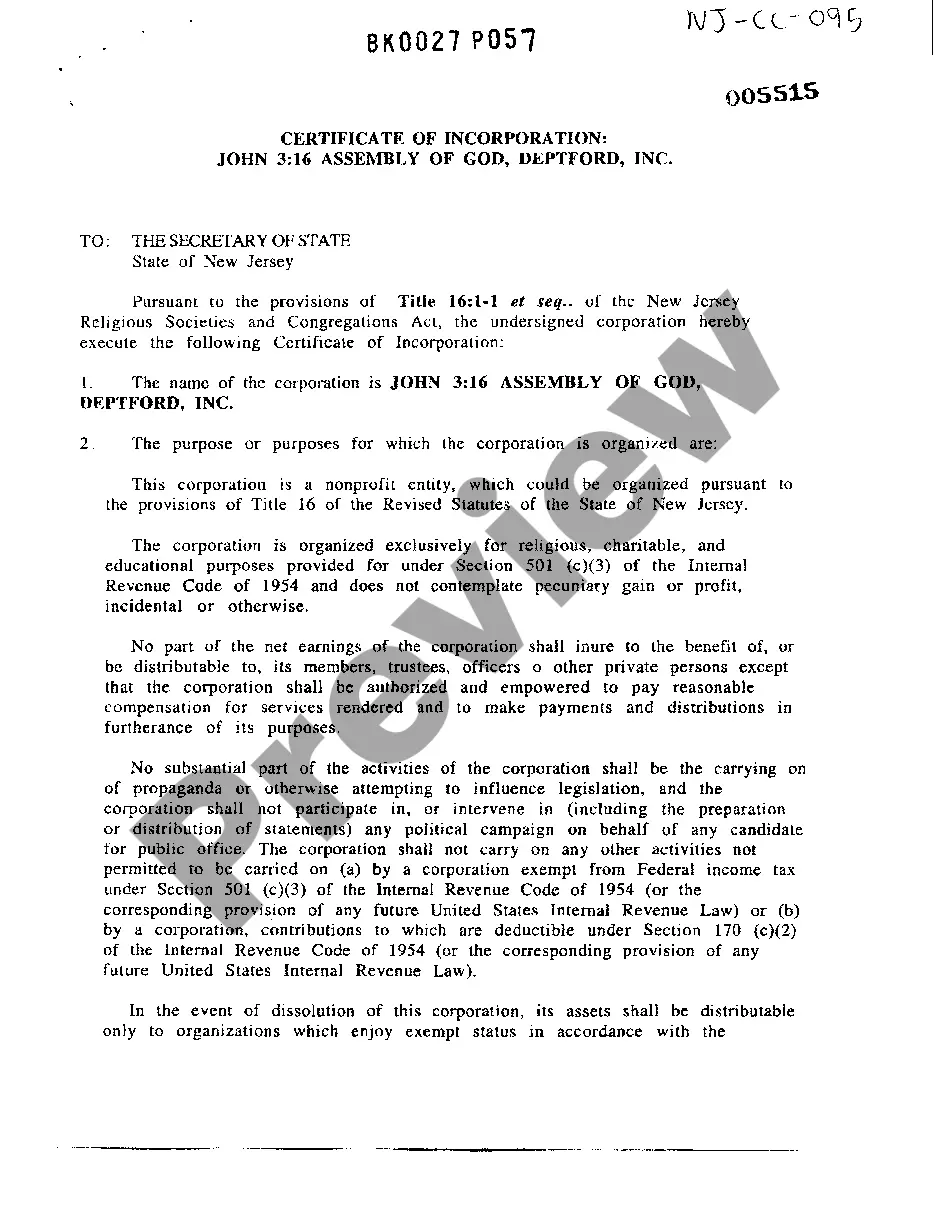

Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization

Description

How to fill out New Jersey Certificate Of Incorporation For Nonprofit, Religious Organization?

Irrespective of societal or occupational standing, completing legal paperwork is a regrettable requirement in today's work environment.

Frequently, it's virtually unattainable for individuals lacking legal expertise to generate this type of documentation independently, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms proves beneficial.

Ensure the form you have located is appropriate for your locality as the regulations of one state or area may not apply to another state or area.

Preview the document and review a brief description (if available) of situations for which the document can be utilized.

- Our platform offers an extensive collection with over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also an excellent tool for partners or legal advisors aiming to improve their efficiency by using our DIY forms.

- Whether you need the Jersey City New Jersey Certificate of Incorporation for a Nonprofit or Religious Organization, or any other document applicable in your region, with US Legal Forms, everything is accessible.

- Here's how to quickly obtain the Jersey City New Jersey Certificate of Incorporation for Nonprofit, Religious Organization using our reliable platform.

- If you are currently an existing member, you can proceed to Log In to your account to retrieve the relevant form.

- However, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Jersey City New Jersey Certificate of Incorporation for a Nonprofit or Religious Organization.

Form popularity

FAQ

To determine if a nonprofit is a 501c3, you can check the IRS database of tax-exempt organizations. This tool provides verification of their tax-exempt status and ensures that donations to that nonprofit are tax-deductible. Additionally, reputable nonprofits often include their 501c3 status in their promotional materials and website. If you are considering starting a nonprofit in Jersey City, New Jersey, apply for a Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization and then pursue 501c3 status to enhance credibility.

No, a non-profit corporation and a 501c3 organization are not the same. A nonprofit corporation is a type of organization recognized at the state level, while 501c3 status is a federal designation given by the IRS. To achieve 501c3 status, a nonprofit corporation must meet specific requirements and apply for the designation. If you plan to establish a nonprofit in Jersey City, New Jersey, obtaining the Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization is just the first step.

Yes, you can refer to an organization as a nonprofit without obtaining 501c3 status. However, without this designation, you may not be eligible for tax-exempt status, and donations to your organization may not be tax-deductible for donors. It's essential to understand that while forming a nonprofit in Jersey City, New Jersey, and obtaining a Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization is a critical step, achieving 501c3 status offers significant benefits.

One disadvantage of a nonprofit corporation is limited financial resources since profit cannot be distributed to owners or shareholders. This can make it challenging to generate funds for your mission. Additionally, securing donations or grants may require extensive paperwork and compliance with regulations. While a Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization provides certain benefits, it may not always guarantee financial stability.

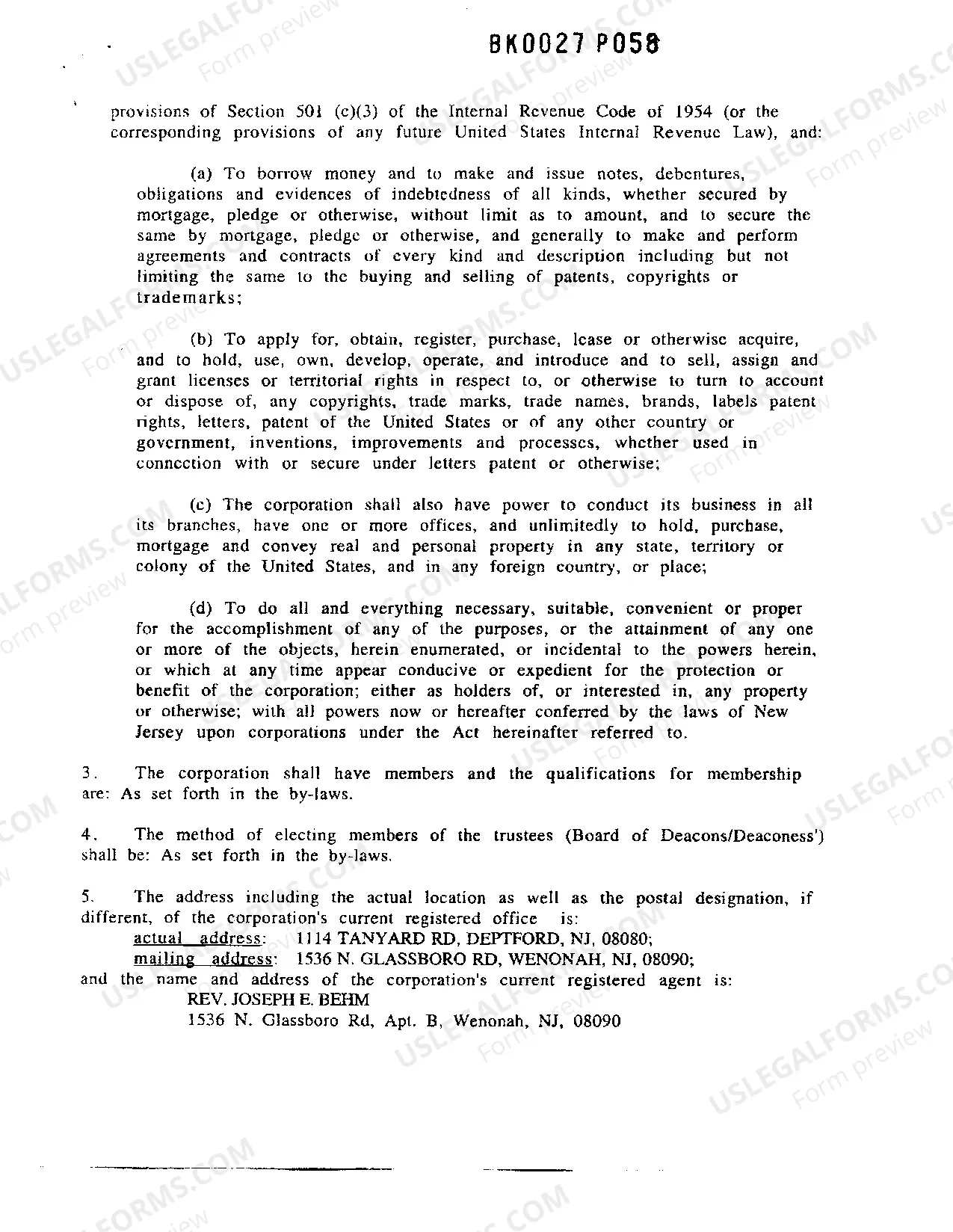

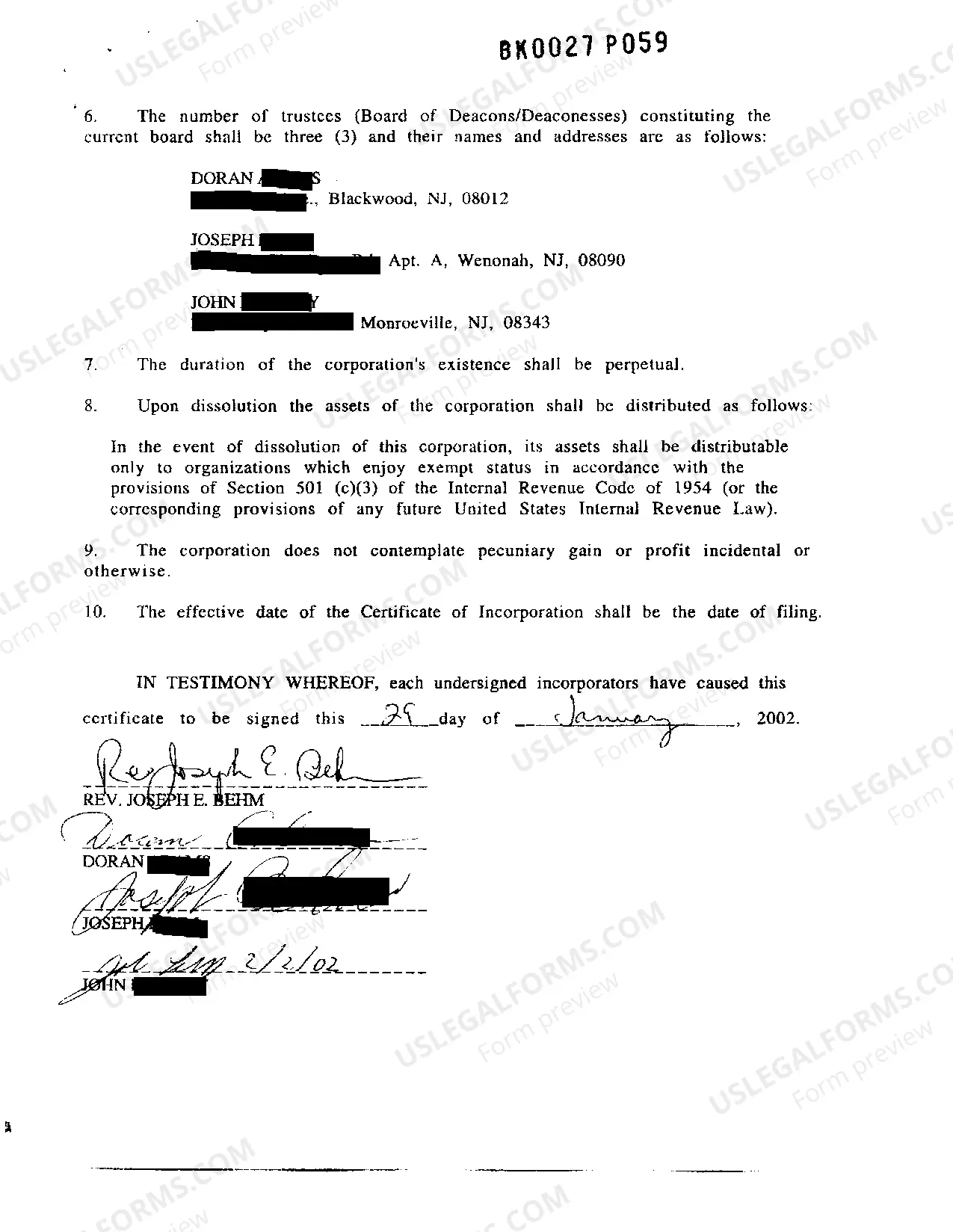

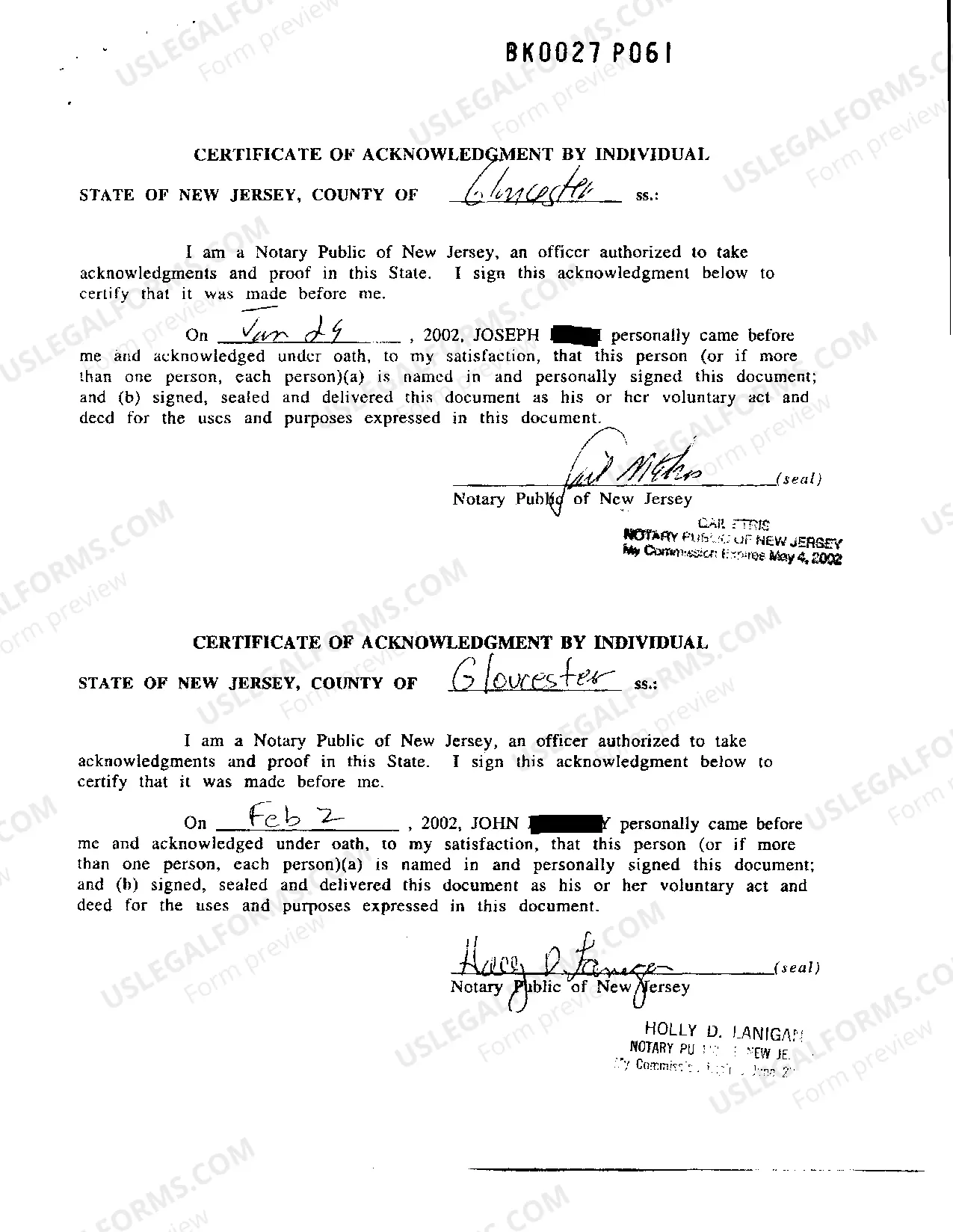

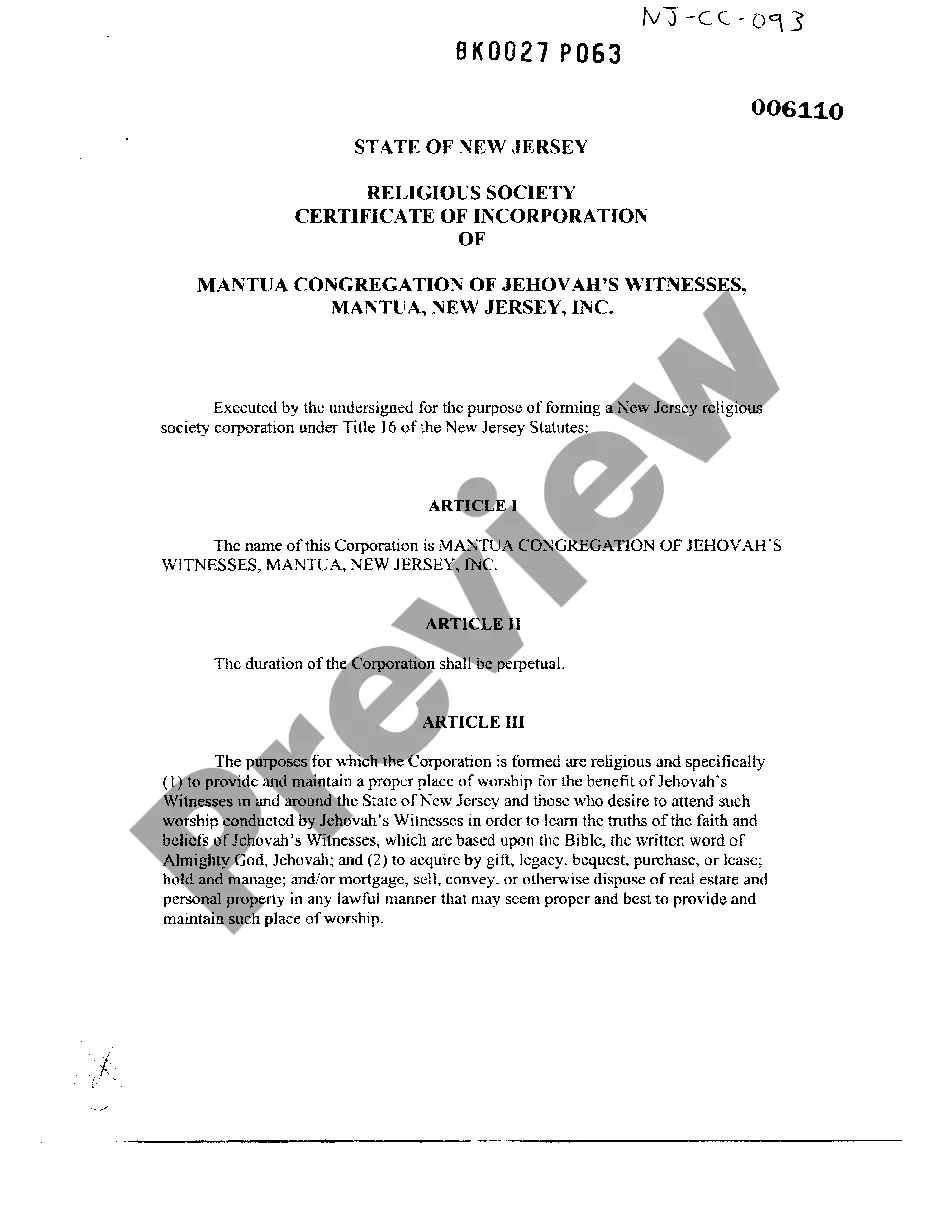

A certificate of incorporation for a nonprofit is a legal document that establishes your organization as a recognized entity in the state of New Jersey. This document includes essential information such as the name of your nonprofit, its purpose, and the address of its principal office. Obtaining a Jersey City New Jersey Certificate of Incorporation for Nonprofit, Religious Organization is necessary for fundraising and tax-exempt status. Uslegalforms provides resources that simplify this process, ensuring you meet all requirements.

To start a 501(c)(3) in NJ, you must first choose a unique name for your organization that complies with state naming rules. Next, you must prepare and file the Jersey City New Jersey Certificate of Incorporation for Nonprofit, Religious Organization with the New Jersey Division of Revenue. After incorporation, you will need to apply for federal tax-exempt status through the IRS. Utilizing platforms like uslegalforms can guide you through these steps effortlessly.

It appears there is some confusion, as the 33% rule has been mentioned previously. This rule typically signifies that a substantial portion of a nonprofit's income should derive from contributions to ensure dependability and support. By understanding these principles, you can better navigate the process of obtaining your Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, ensuring your organization is built on solid financial ground.

The 80 20 rule in nonprofit management suggests that 80% of your results stem from 20% of your efforts. This principle emphasizes the importance of focusing on the most impactful activities and donors for your organization. Implementing this strategy can significantly enhance the effectiveness of your operations once you complete your Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization.

Several activities can jeopardize a nonprofit's 501c3 status, including engaging in excessive political campaigning or lobbying, or failing to operate primarily for charities. Nonprofits must adhere to IRS guidelines to maintain their tax-exempt status. Properly addressing these requirements from the beginning can ensure your Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization remains valid and effective.

The 33 percent rule for nonprofits generally refers to the guideline that 33 percent of a nonprofit's income should come from public donations, while the rest can be derived from grants, program revenues, and other sources. This rule helps ensure financial sustainability and broad community support. Understanding how this applies to your Jersey City New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization can strengthen your fundraising strategy and compliance.