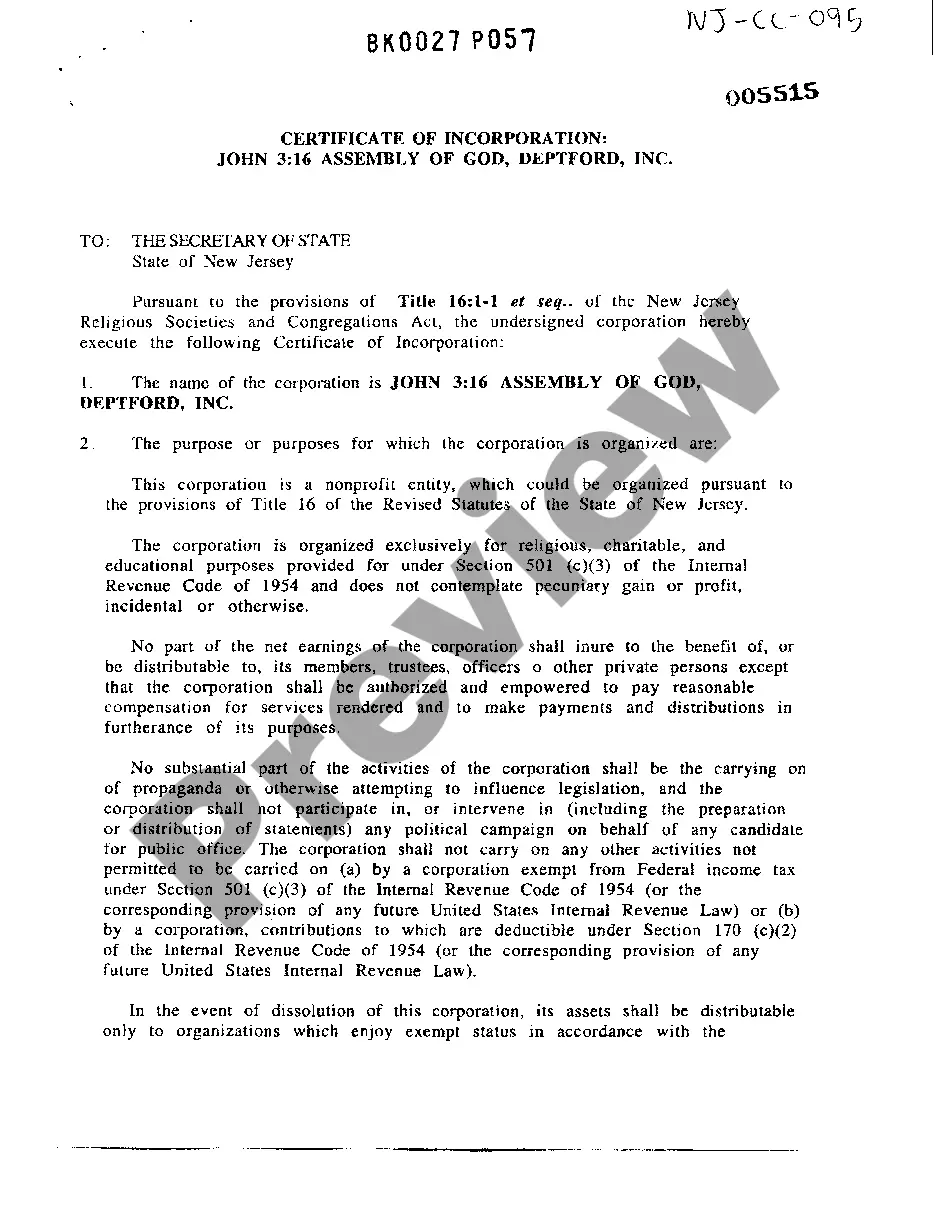

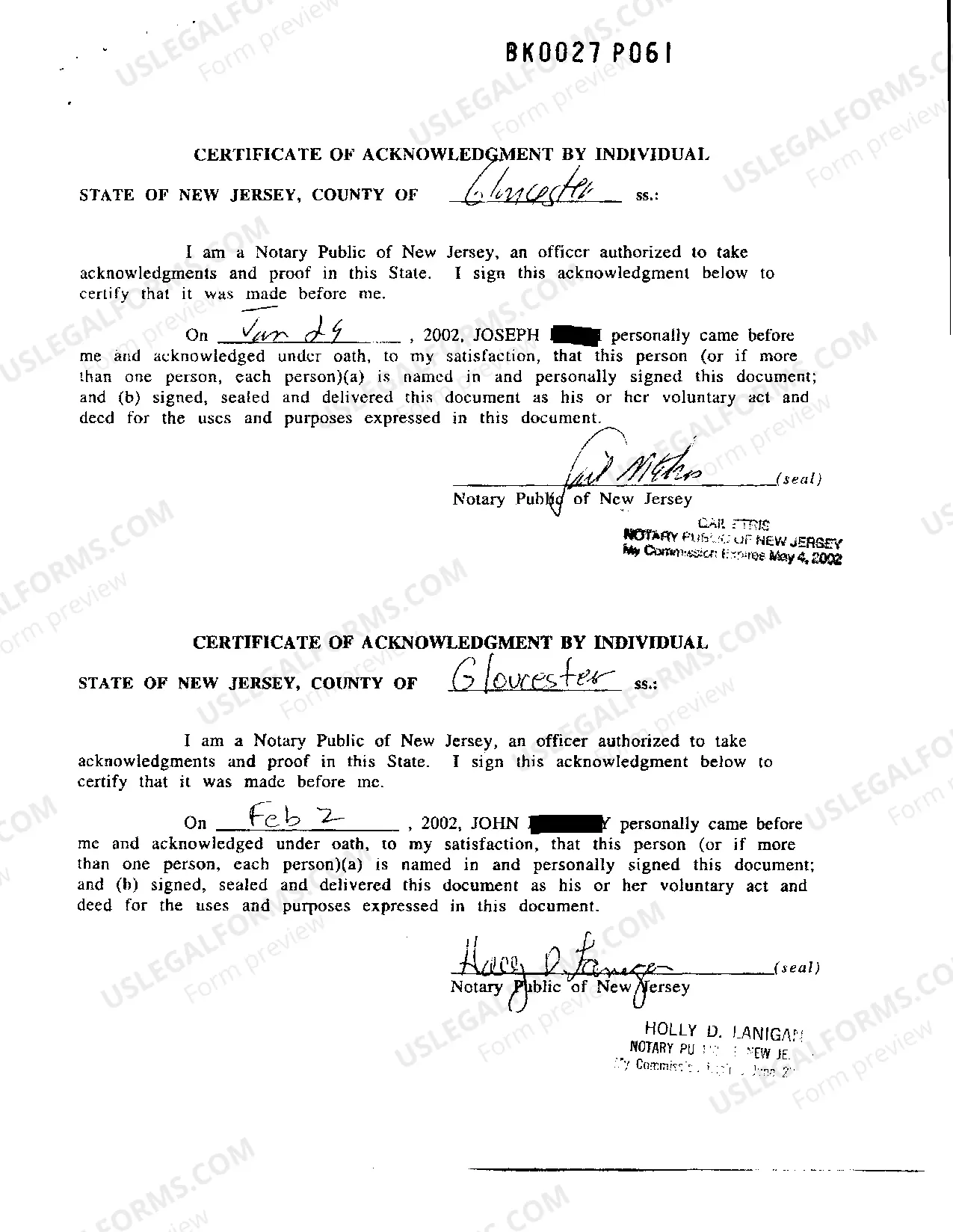

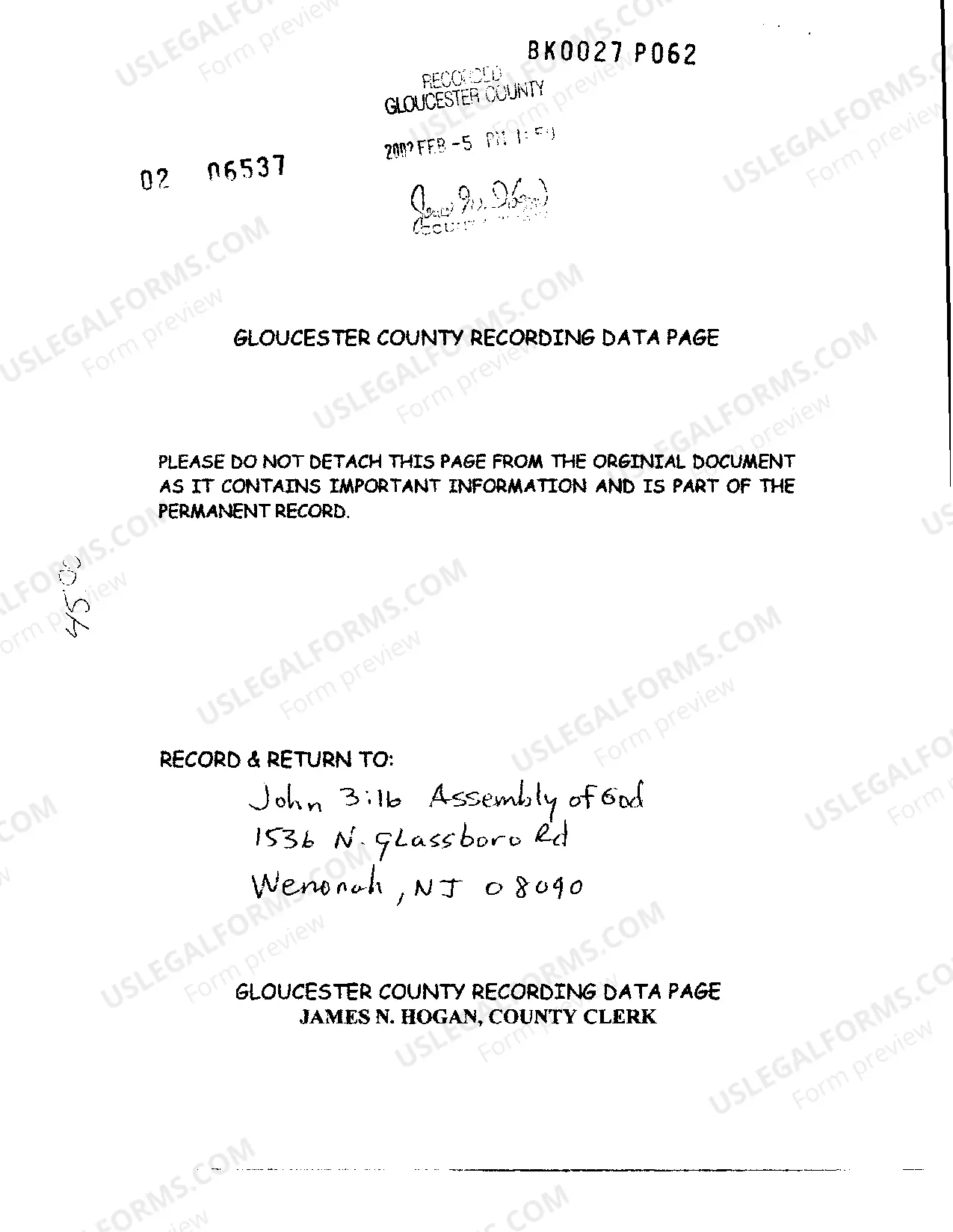

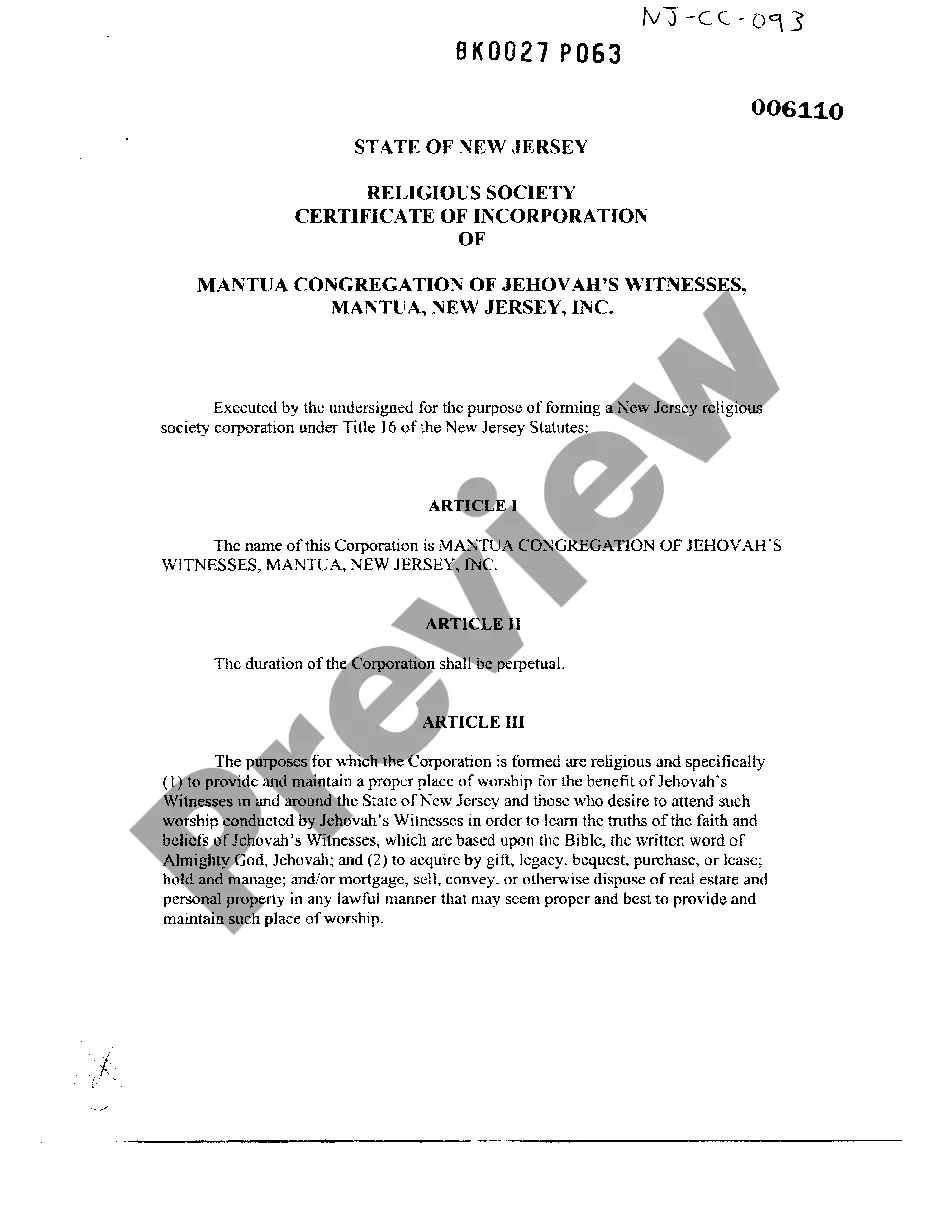

The Newark New Jersey Certificate of Incorporation for Nonprofit, Religious Organizations is a legal document that establishes a nonprofit religious entity as a corporation under New Jersey law. The certificate of incorporation serves as official recognition of the organization's legal status and outlines the specific details regarding its incorporation. This document is required for religious organizations operating within the city of Newark, New Jersey, to establish their nonprofit status and meet legal requirements. Keywords: Newark New Jersey, Certificate of Incorporation, nonprofit, religious organization, legal document, corporation, New Jersey law, legal status, incorporation, nonprofit status, religious entity, Newark, nonprofit religious organization, religious institutions. There might be different types of Newark New Jersey Certificate of Incorporation for Nonprofit, Religious Organizations, namely: 1. General Certificate of Incorporation: This is the standard certificate of incorporation that is used by most religious organizations when incorporating in Newark, New Jersey. It includes basic information such as the name of the organization, its purpose, address, and details about its structure and governance. 2. Certificate of Incorporation for Specific Religious Denominations: Some religious organizations may have specific requirements based on their denomination or religious affiliation. In such cases, the certificate of incorporation may include additional provisions or clauses that are specific to that particular denomination or religious group. 3. Certificate of Incorporation for Tax-Exempt Status: Many nonprofit religious organizations seek tax-exempt status from the Internal Revenue Service (IRS). In addition to the general certificate of incorporation, these organizations may need to provide additional documentation or include specific language in the certificate to meet the criteria for tax-exempt status. 4. Certificate of Incorporation for Charitable Activities: Some religious organizations engage in charitable activities or provide community services. In these cases, the certificate of incorporation may include provisions related to the organization's charitable purposes, programs, or initiatives. It is important for nonprofit religious organizations in Newark, New Jersey, to consult with legal professionals or seek guidance from the appropriate government agencies to ensure that their certificate of incorporation meets all the necessary requirements and includes any specific provisions related to their religious or organizational needs.

Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization

Description

How to fill out New Jersey Certificate Of Incorporation For Nonprofit, Religious Organization?

Are you searching for a trustworthy and budget-friendly provider of legal documents to purchase the Newark New Jersey Certificate Of Incorporation for a Nonprofit, Religious Organization? US Legal Forms is your ultimate answer.

Whether you need a simple agreement to establish rules for living with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our website offers more than 85,000 current legal document templates for personal and business purposes. All the templates we provide are not generic and are tailored to meet the regulations of specific states and counties.

To obtain the form, you must Log In to your account, locate the required form, and click the Download button next to it. Kindly remember that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your first time visiting our site? No problem. You can easily set up an account, but before doing so, ensure that you follow these steps: Check if the Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization complies with the laws of your state and locality. Review the form’s details (if available) to understand who and what the form is designed for. Restart your search if the form does not suit your particular situation.

Try US Legal Forms today, and stop wasting time learning about legal documents online once and for all.

- You can now create your account.

- Then select a subscription plan and proceed to checkout.

- Once your payment is processed, download the Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization in any available format.

- You can return to the website whenever necessary and redownload the form without incurring any additional charges.

- Locating current legal forms has never been simpler.

Form popularity

FAQ

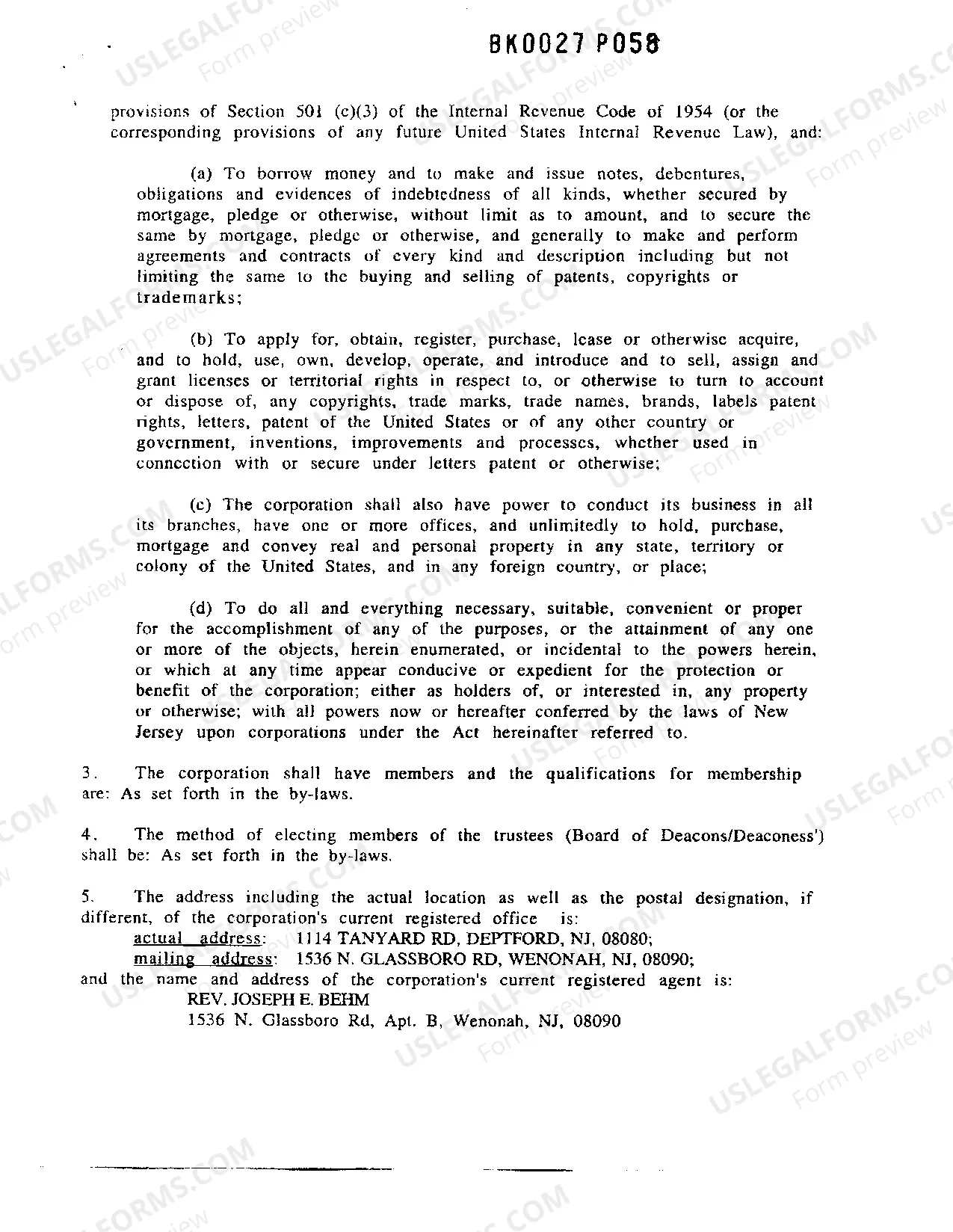

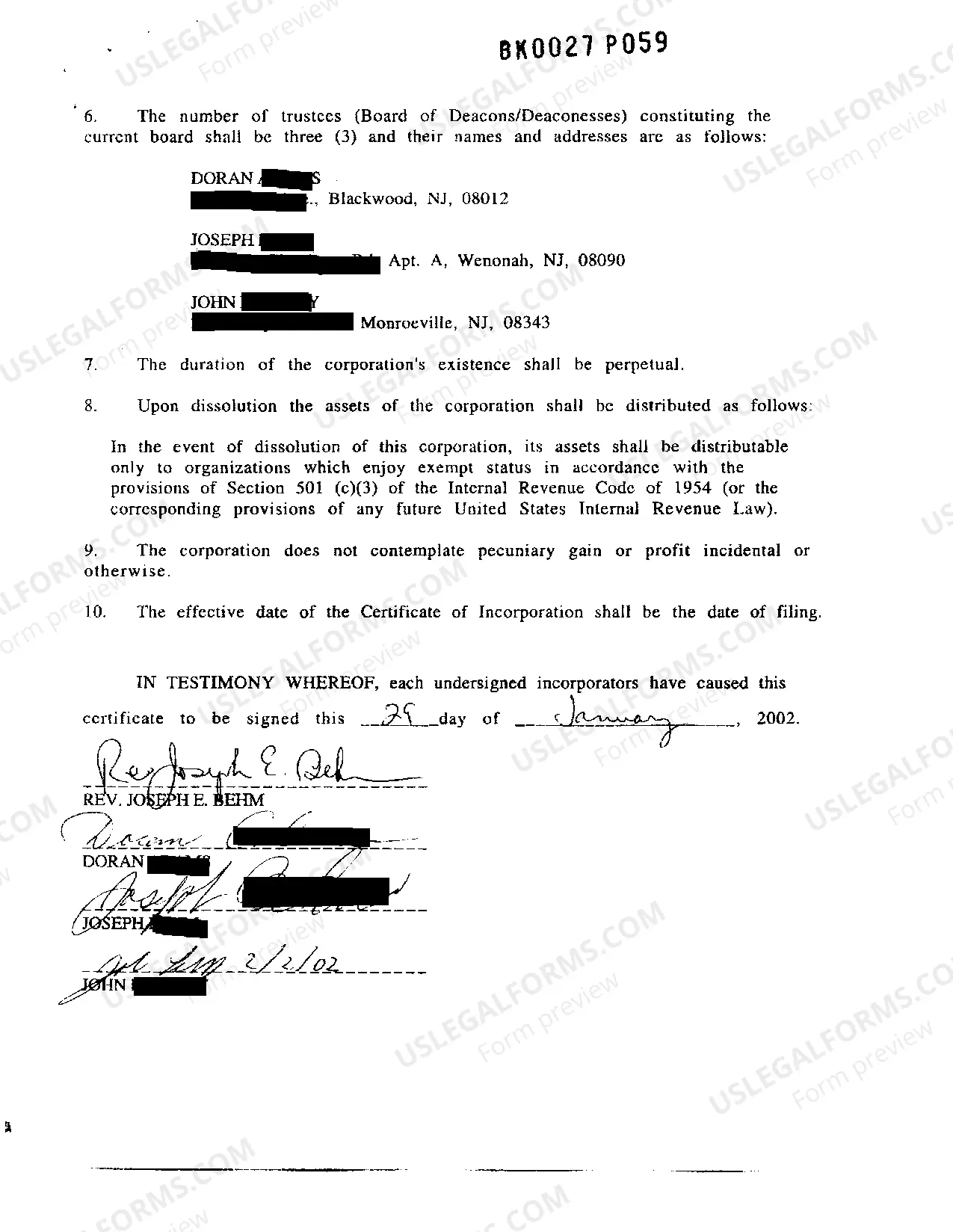

In New Jersey, a nonprofit organization requires a minimum of three board members. These members should possess diverse skills and backgrounds to promote effective governance. If you plan to establish a nonprofit in Newark, understanding this requirement is crucial for obtaining your Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization. Using services like US Legal Forms can simplify this process for you.

Writing an article of incorporation for a nonprofit entails several key components. You need to include the organization's name, mission statement, and details about the board of directors. It is crucial to follow state-specific guidelines to remain compliant. If you are looking for a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, consider using online platforms like US Legal Forms for templates and expert guidance.

In Newark, New Jersey, a nonprofit must have at least three board members. This ensures diverse perspectives and effective governance. Each board member plays a vital role in aligning the organization's mission with its activities. For those seeking a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, having an adequate number of board members is essential for compliance.

The primary tax form for a nonprofit organization in New Jersey is IRS Form 990, which reports annual financial information. This form is crucial for maintaining tax-exempt status and must be filed annually after obtaining your Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization. Depending on your organization’s revenue, you may be eligible to file a simpler version, like Form 990-EZ or Form 990-N. Staying compliant with these filing requirements helps ensure transparency and accountability.

Nonprofits in New Jersey must be aware of various tax obligations even after obtaining a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization. Generally, these organizations are exempt from income tax, but they must still file Form 990 with the IRS annually. Some local taxes may apply, depending on the type of services provided and revenue generated. It’s essential for nonprofits to stay informed about these requirements to maintain their tax-exempt status.

In New Jersey, nonprofits must file a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization to establish their legal presence. This certificate includes key details such as the organization’s name, purpose, and principal office address. Additionally, nonprofits should prepare bylaws that outline their governance structure. Proper filing ensures compliance with state regulations and allows the organization to function effectively.

The 80 20 rule, often referred to in nonprofit contexts, states that typically 80% of funding comes from 20% of donors. Understanding this can help organizations strategize fundraising efforts and focus on cultivating strong relationships with major donors. When establishing a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, this knowledge can guide your outreach efforts and ensure sustainable financial support. Building a solid base of committed supporters is crucial to your nonprofit's success.

The 27 month rule refers to a provision that allows organizations to apply for retroactive recognition of 501c3 status effective from their incorporation date, as long as they apply within 27 months of formation. This is significant for groups seeking a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, because it can provide essential tax-exempt benefits even if the application is submitted later. To maximize this opportunity, it is advisable to prepare and submit your application promptly after incorporation.

Several factors can jeopardize your 501c3 status, including failure to operate within your stated purpose, engaging in substantial political activities, or not keeping accurate records. It is also crucial to adhere to the annual reporting requirements set by the IRS. Maintaining compliance ensures that your Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization remains intact and that you retain your tax-exempt status. Staying informed about regulations can help you avoid pitfalls that might threaten your organization.

A nonprofit corporation is a legal entity formed to operate for a charitable purpose without generating profit for its owners. On the other hand, a 501c3 is a specific tax-exempt status granted by the IRS to nonprofit organizations that meet certain criteria. To obtain a Newark New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, you must first establish your nonprofit corporation, and then you can apply for 501c3 status to enjoy tax benefits. This distinction is important for understanding obligations and advantages.