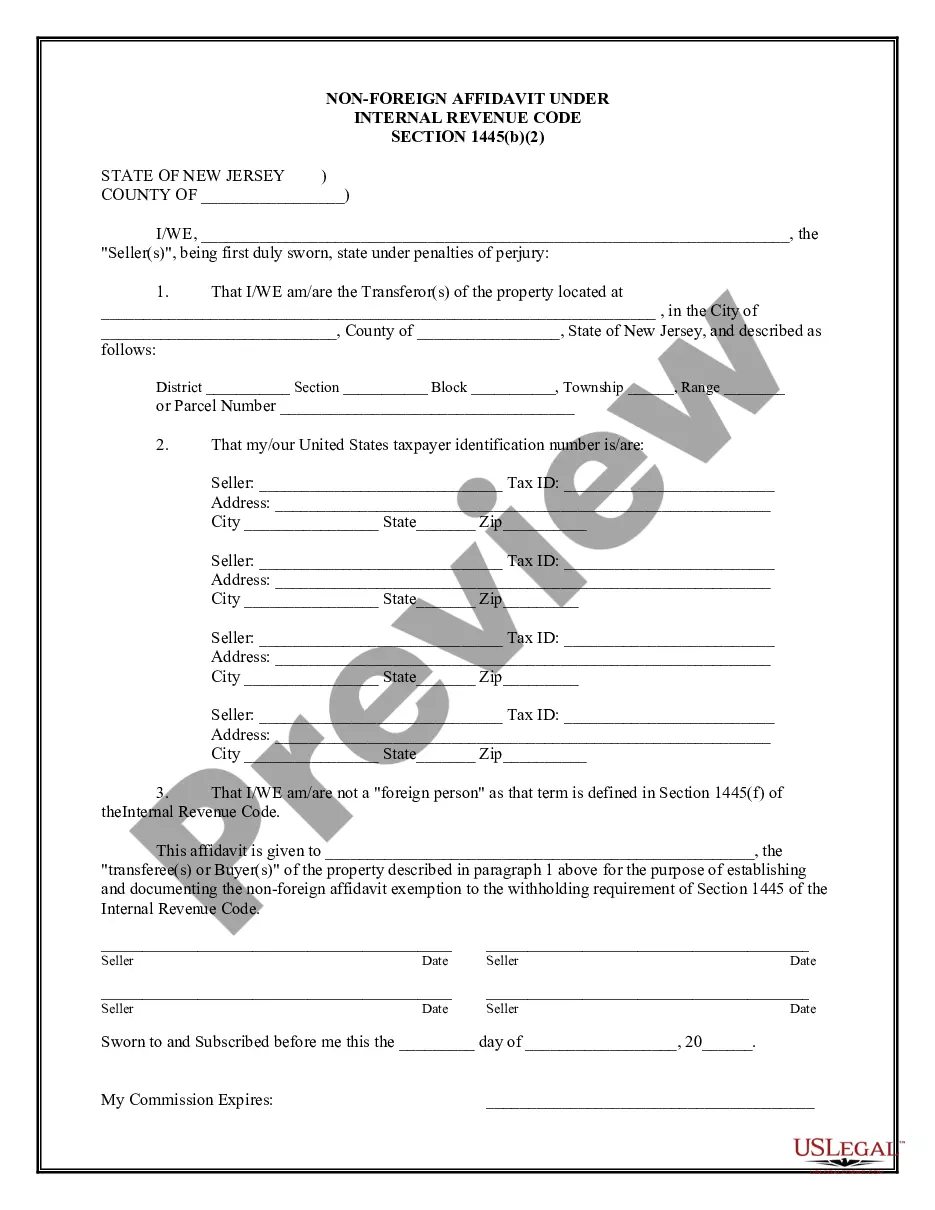

A Newark New Jersey Non-Foreign Affidavit Under IRC 1445 is a legal document that is used in real estate transactions. It serves as proof that the seller of a property is not a foreign person as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is necessary to comply with federal tax laws and regulations. When a foreign person sells a U.S. real property interest, such as a house or land, the buyer is generally required to withhold a certain percentage of the purchase price and remit it to the Internal Revenue Service (IRS). However, if the seller is a U.S. citizen, U.S. resident alien, domestic partnership, or corporation, they are considered non-foreign and not subject to this withholding requirement. To establish their non-foreign status, the seller must complete a Newark New Jersey Non-Foreign Affidavit Under IRC 1445. This affidavit will contain detailed information about the seller, including their name, address, taxpayer identification number (TIN), and citizenship status. It may also require the seller to provide supporting documentation, such as a valid U.S. passport or Social Security number. It is important to note that there can be different types of Newark New Jersey Non-Foreign Affidavits Under IRC 1445, depending on the specific circumstances of the seller. For instance, there may be separate affidavits for individual sellers, partnerships, or corporations. Each type of affidavit focuses on the seller's specific entity and tax status, ensuring compliance with the IRS guidelines. The purpose of the Newark New Jersey Non-Foreign Affidavit Under IRC 1445 is twofold. Firstly, it allows the buyer and their legal representatives to confirm that the seller is not a foreign person, thus exempting them from the withholding requirement. Secondly, it provides documentation for the buyer to keep in their records, demonstrating their compliance with IRS regulations. Failure to properly complete and provide a non-foreign affidavit when required can lead to legal consequences, including penalties and potential liabilities for the buyer. Therefore, it is critical for both sellers and buyers to understand their obligations under IRC Section 1445 and ensure that all necessary forms are completed accurately and timely. In summary, a Newark New Jersey Non-Foreign Affidavit Under IRC 1445 is a vital document used in real estate transactions to establish the seller's non-foreign status for tax purposes. By completing this affidavit, sellers confirm their eligibility to be exempted from the withholding requirements imposed on foreign individuals. Different types of affidavits may be necessary depending on the entity of the seller, ensuring compliance with IRS guidelines and regulations.

Newark New Jersey Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Newark New Jersey Non-Foreign Affidavit Under IRC 1445?

Irrespective of social or professional rank, completing legal documentation is a regrettable obligation in the modern world. Frequently, it’s nearly unfeasible for an individual lacking legal knowledge to draft these kinds of papers from scratch, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms becomes beneficial. Our platform provides a substantial repository with over 85,000 ready-to-use, state-specific forms suitable for almost any legal scenario. US Legal Forms also acts as an exceptional aid for partners or legal advisors aiming to save time by utilizing our DIY forms.

Whether you are looking for the Newark New Jersey Non-Foreign Affidavit Under IRC 1445 or any other documentation that will be applicable in your state or county, with US Legal Forms, everything is accessible. Here’s how you can obtain the Newark New Jersey Non-Foreign Affidavit Under IRC 1445 promptly through our reliable service. If you are an existing customer, you can proceed to Log In to your account to fetch the correct form.

You’re all done! Now feel free to print the document or complete it online. Should you encounter any problems retrieving your purchased documents, you can easily locate them in the My documents section.

No matter what issue you’re aiming to resolve, US Legal Forms has got you supported. Give it a shot today and witness the benefits firsthand.

- Ensure the template you’ve identified is suitable for your locality, considering that the laws of one state or county may not apply to another.

- Examine the document and review a brief synopsis (if available) of situations the form may be utilized for.

- If the form you selected does not cater to your requirements, you can start over and search for the appropriate document.

- Select Buy now and choose the subscription plan that fits you best.

- Using your credentials or creating a new one from scratch.

- Choose the payment method and continue to download the Newark New Jersey Non-Foreign Affidavit Under IRC 1445 once the transaction is complete.

Form popularity

FAQ

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an individual General Partner of the Company, by a responsible officer of a corporate General Partner of the Company (or of the Company, if the Company is a corporation), or by the trustee, executor, or equivalent fiduciary of

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

CERTIFICATION OF FOREIGN STATUS UNDER FIRPTA The purpose of this Certification is to notify Buyer of Seller's/Sellers' status under FIRPTA (Section 1445 of the Internal Revenue Code) with regard to a prospective real estate transaction involving the Property identified below.

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

A citizen or resident of the United States, ? A domestic partnership, or ? A domestic corporation, or ? An estate or trust (other than a foreign estate of foreign trust as those terms are defined in Section 7701 (a) (31) of the Code.