Elizabeth New Jersey Living Trust for Husband and Wife with No Children

Description

How to fill out New Jersey Living Trust For Husband And Wife With No Children?

If you are seeking a legitimate form template, it’s incredibly challenging to discover a superior platform than the US Legal Forms website – likely the largest online collections.

With this collection, you can locate a vast array of templates for corporate and personal aims by categories and regions, or keywords.

With our enhanced search capability, locating the most current Elizabeth New Jersey Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the file format and download it to your device.

- Moreover, the accuracy of each and every document is affirmed by a team of seasoned attorneys who regularly assess the templates on our site and update them according to the most up-to-date state and county requirements.

- If you are already familiar with our service and have an account, all you need to do to obtain the Elizabeth New Jersey Living Trust for Husband and Wife with No Children is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps outlined below.

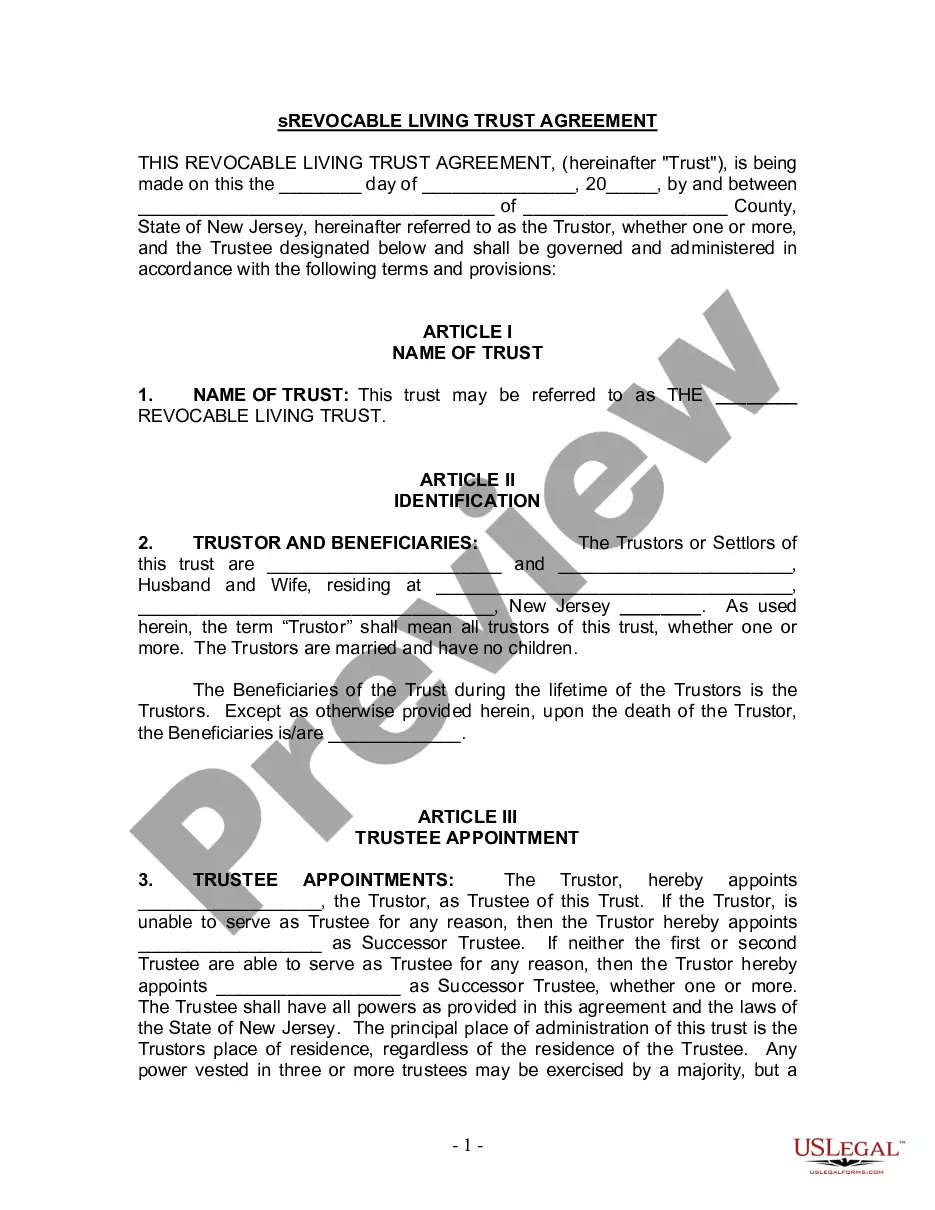

- Ensure you have found the template you need. Review its description and utilize the Preview feature (if available) to examine its contents. If it doesn’t meet your requirements, use the Search function at the top of the page to find the appropriate document.

- Confirm your selection. Click the Buy now button. Then, choose your desired subscription plan and fill in the information to create an account.

Form popularity

FAQ

To file a living trust in New Jersey, you first need to prepare the trust document, specifically tailored for your needs. If you are considering an Elizabeth New Jersey Living Trust for Husband and Wife with No Children, the document should clearly outline your assets, beneficiaries, and management instructions. Once completed, sign the trust document in the presence of a notary to ensure its validity. Finally, fund the trust by transferring your assets into it, which may involve changing titles and beneficiary designations.

Married couples typically benefit from having a joint living trust, particularly when they do not have children. This approach simplifies asset management and provides a clear plan for asset distribution. However, if individual assets or personal preferences play a significant role, separate trusts could be worth considering. Evaluating your unique situation with a professional can help you choose the best trust setup for your needs.

Generally, a husband and wife do not need separate living trusts unless they have significant individual assets or specific concerns they want to address. An Elizabeth New Jersey Living Trust for Husband and Wife with No Children can effectively combine their assets under one trust, ensuring both partners are protected. However, if there are unique personal assets or differing wishes regarding inheritance, separate trusts might be beneficial. Consulting with a legal expert can clarify the best decision for your circumstances.

A joint living trust is appropriate for married couples, especially those in Elizabeth, New Jersey, without children. This trust allows both spouses to name each other as beneficiaries while also specifying how their assets will be distributed after both pass away. It provides control and flexibility over assets during their lifetime and facilitates a straightforward transfer of wealth. Using a living trust helps couples avoid the lengthy probate process, ensuring a seamless transition.

While focusing on establishing a trust for their children, parents often overlook the importance of planning for their own needs first. Failing to create a suitable Elizabeth New Jersey Living Trust for Husband and Wife with No Children can lead to complications in managing assets. Parents sometimes neglect to update their plans as their circumstances change, which can diminish the benefits of the trust. Remember, effective trust planning requires regular reviews to ensure it aligns with current family dynamics.

The best living trust for a married couple, especially for those who live in Elizabeth, New Jersey, is often a joint living trust. This type of trust allows both spouses to manage their assets together, offering simplicity and unity. It efficiently transitions assets without the need for probate, ensuring a smooth transfer of wealth. For couples with no children, this living trust can accurately reflect their unique needs and desires.

Creating an Elizabeth New Jersey Living Trust for Husband and Wife with No Children can still be beneficial, even if you do not have children. A trust allows you to manage your assets and ensures your wishes are carried out after your passing. It can provide peace of mind, protecting your spouse and simplifying the transfer of assets. If you want to maintain control over how your assets are distributed, a living trust might be the right choice for your situation.