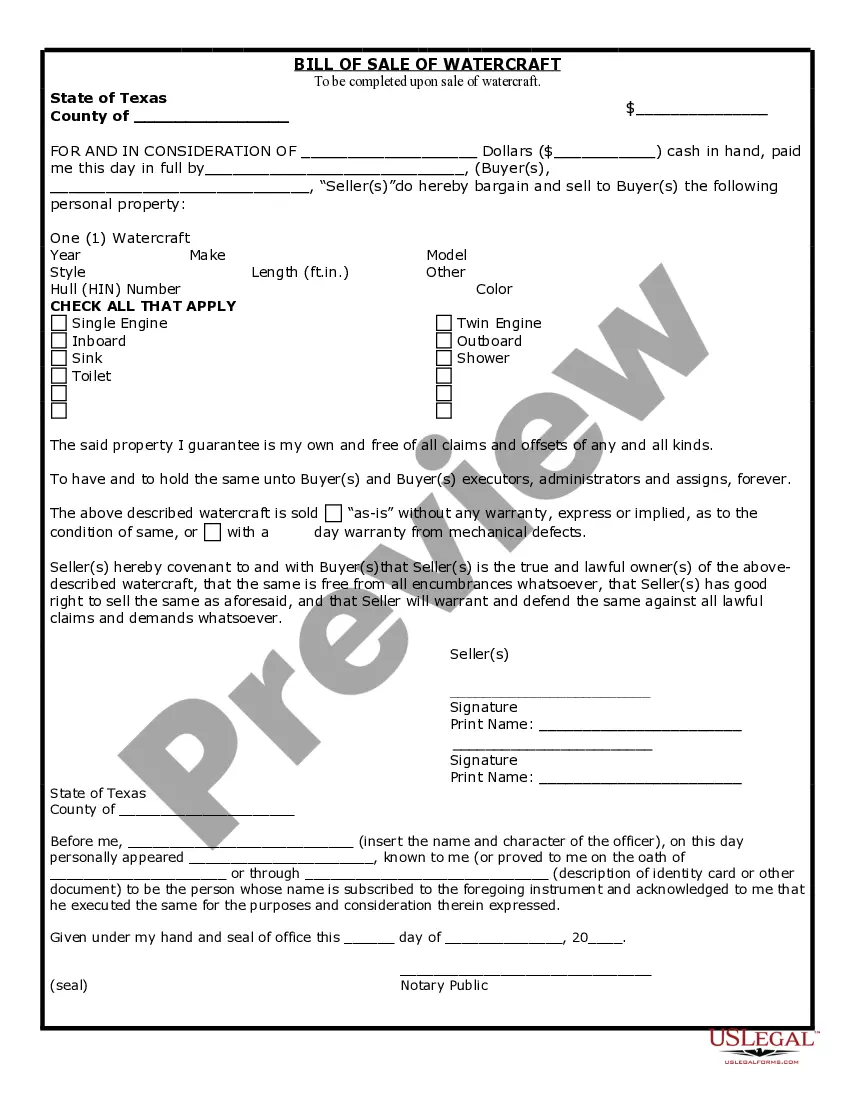

Newark New Jersey Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with Children: A Comprehensive Guide Living trusts are powerful estate planning tools that allow individuals to have control over their assets and ensure a smooth transfer of wealth to their loved ones after their passing. In Newark, New Jersey, these trusts are particularly beneficial for individuals who are single, divorced, or widowed (or widower) with children, as they provide flexibility, privacy, and protection. Here, we will delve into the various types of living trusts available to residents of Newark, New Jersey, who fall under these categories: 1. Revocable Living Trusts: A revocable living trust is the most common option for individuals who want to maintain control of their assets during their lifetime. It allows you to make changes, add or remove assets, or even revoke the trust if desired. As the primary granter, you can also name yourself as the trustee, retaining full control and management of your assets until your passing. 2. Irrevocable Living Trusts: An irrevocable living trust is another type of trust that cannot be altered or revoked once established, making it a popular choice for Newark residents looking for asset protection and tax planning purposes. By transferring assets into this trust, you effectively remove them from your estate, potentially reducing estate taxes and protecting them from creditors. 3. Testamentary Trusts: A testamentary trust comes into effect upon the death of the granter. This type of trust is established through a will and allows the granter to create a trust for the benefit of their children or other beneficiaries. By using a testamentary trust, you can ensure that your children receive a designated portion of your assets at a specified age or milestone, and you have control over how the assets are managed until then. 4. Special Needs Trusts: For Newark residents with children or dependents with special needs, establishing a special needs trust is crucial. This trust safeguards the financial future of the individual with special needs while also ensuring they remain eligible for government assistance programs. By placing assets into this trust, you can provide supplementary support without disqualifying them from vital benefits. 5. Standalone Retirement Trusts: To protect and distribute your retirement assets, such as IRAs or 401(k)s, a standalone retirement trust can be established. This specialized trust ensures that your retirement assets are shielded from unnecessary taxation and safeguards them for your children's benefit upon your passing. By designating the trust as the beneficiary of your retirement accounts, you enhance asset protection and provide structured income for your children. Overall, Newark, New Jersey living trusts for individuals who are single, divorced, or widowed (or widower) with children offer numerous advantages, including probate avoidance, privacy, efficient asset management, and protection. By selecting the most suitable type of trust based on your unique circumstances, you can ensure your assets are preserved and seamlessly transferred to your children, adhering to your wishes and providing for their future. Consulting with an experienced estate planning attorney is vital to tailor the trust to your specific needs and navigate the legal nuances associated with Newark, New Jersey living trusts.

Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Newark New Jersey Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any legal education to draft such paperwork from scratch, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children quickly employing our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are new to our library, ensure that you follow these steps before obtaining the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children:

- Be sure the template you have chosen is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Review the form and read a brief description (if provided) of cases the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start again and look for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment method and proceed to download the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children once the payment is completed.

You’re all set! Now you can go ahead and print out the form or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.