A living trust is a legal arrangement that allows individuals to transfer their assets into a trust during their lifetime, to be managed and distributed according to their wishes. In Paterson, New Jersey, couples with one child may opt for a specific type of living trust known as a "Living Trust for Husband and Wife with One Child." This type of trust provides certain advantages and protections to the family, ensuring their assets are properly managed and distributed. To create a Living Trust for Husband and Wife with One Child in Paterson, New Jersey, several important steps are involved. Firstly, the couple must appoint themselves as "trustees," meaning they retain control and management over their assets within the trust. They also need to name a successor trustee who will take over the management and distribution of the trust upon their incapacity or demise. When establishing a Living Trust for Husband and Wife with One Child, it is crucial to outline clear provisions for the distribution of assets in case of incapacity or death. This includes specifying the child as the primary beneficiary, as well as outlining how and when the assets will be distributed to them. Additionally, the trust can provide instructions for the child's guardianship in case both parents pass away before the child reaches adulthood. Another important aspect of this type of living trust is the ability to minimize estate taxes and probate costs. By transferring assets into the trust, couples can reduce the taxable value of their estate, consequently lowering potential estate tax obligations. Furthermore, couples can use this living trust to establish specific conditions for asset distributions, such as setting up a trust fund for the child's education or other future needs. This ensures that the child's inheritance is protected, and the assets are used for their intended purpose. While the concept of a Paterson New Jersey Living Trust for Husband and Wife with One Child remains consistent, there may be different subtypes or variations based on the unique needs and circumstances of each family. Some common variations include: 1. Revocable Living Trust for Husband and Wife with One Child: This trust allows the couple to make changes or revoke the trust during their lifetime if circumstances require it. 2. Irrevocable Living Trust for Husband and Wife with One Child: Once established, this trust cannot be modified or revoked without the consent of all parties involved. It is often used for specific tax planning purposes. 3. Testamentary Trust: Unlike a traditional living trust, a testamentary trust is created through a will and goes into effect upon the death of the testator. This type of trust can be an option for couples with elaborate estate plans. In summary, a Paterson New Jersey Living Trust for Husband and Wife with One Child is a legal instrument that allows couples to manage and distribute their assets efficiently, while protecting their child's future inheritance.

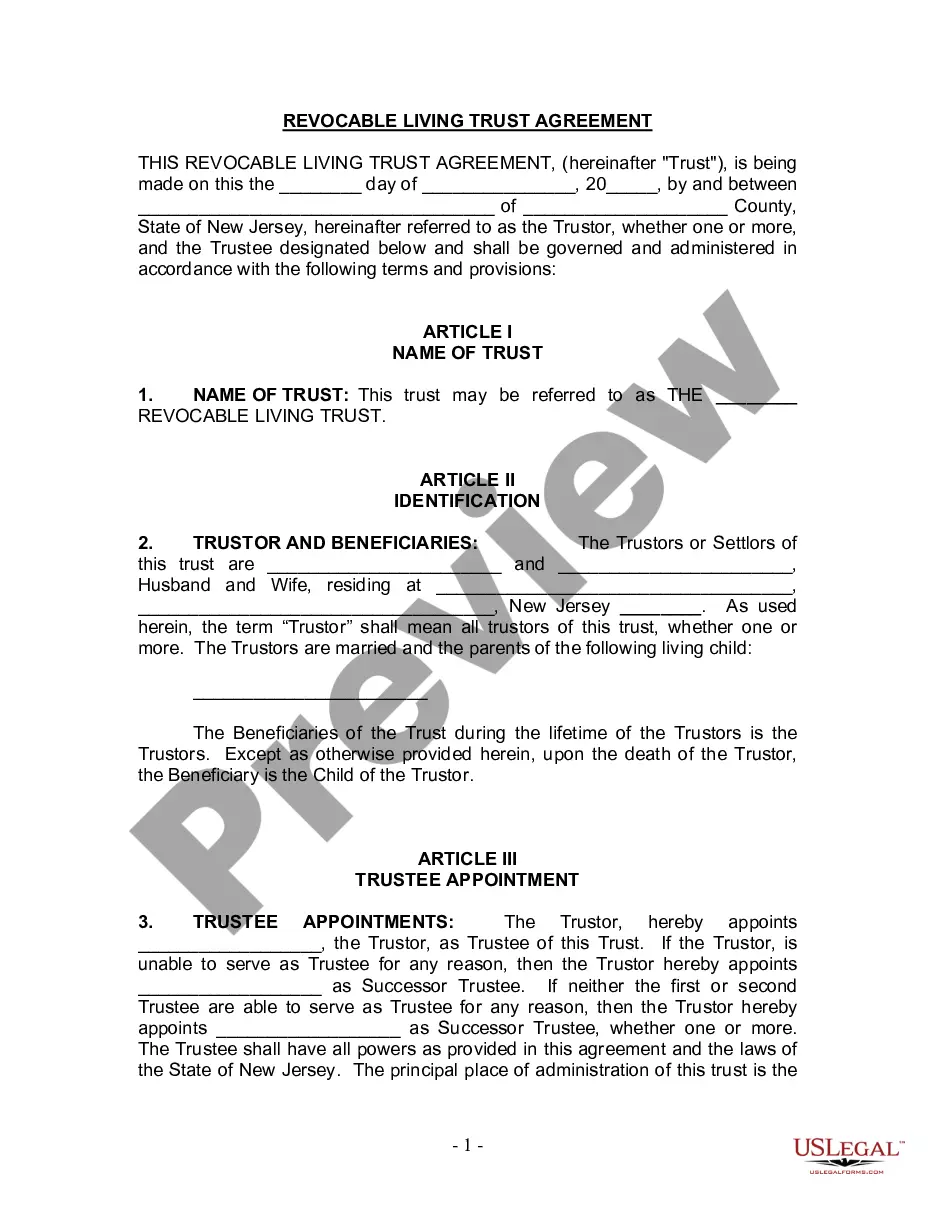

Paterson New Jersey Living Trust for Husband and Wife with One Child

Description

How to fill out Paterson New Jersey Living Trust For Husband And Wife With One Child?

Do you need a reliable and inexpensive legal forms provider to buy the Paterson New Jersey Living Trust for Husband and Wife with One Child? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Paterson New Jersey Living Trust for Husband and Wife with One Child conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is good for.

- Restart the search if the form isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Paterson New Jersey Living Trust for Husband and Wife with One Child in any provided format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online once and for all.