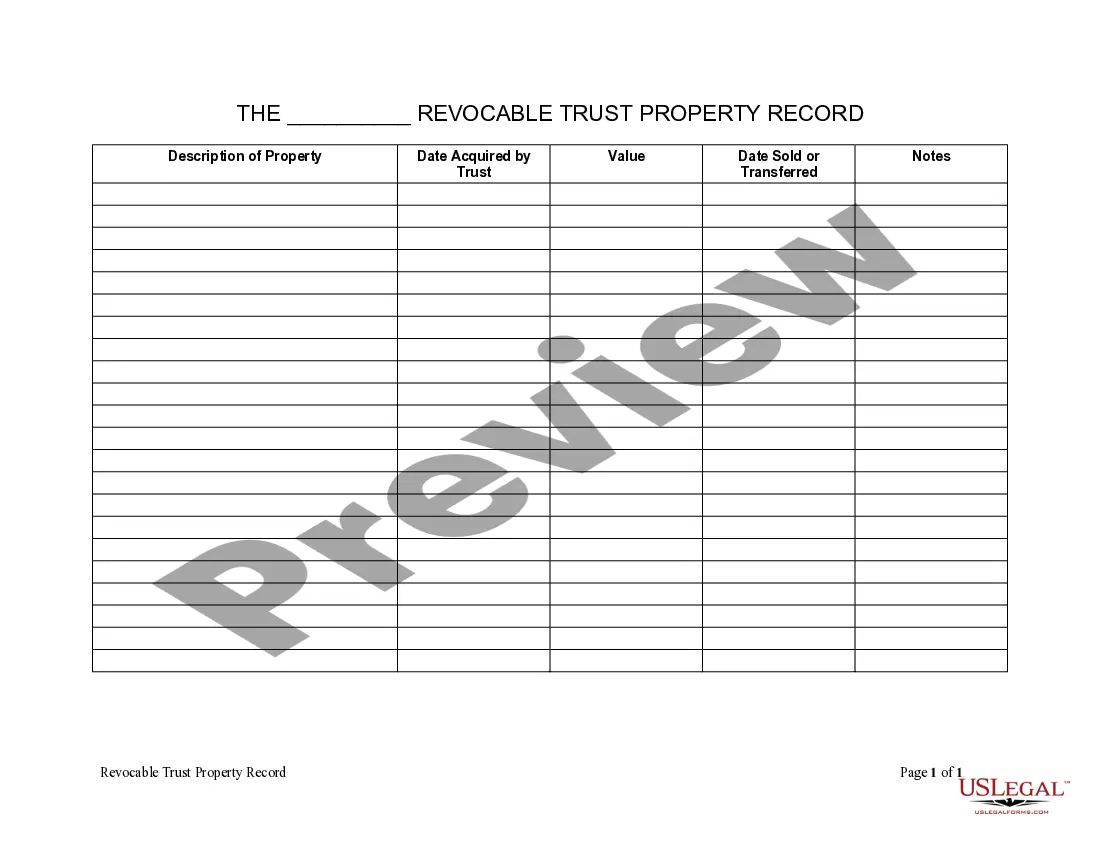

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Newark, New Jersey Living Trust Property Records: A Comprehensive Overview Introduction: Living trusts are commonly used legal tools that allow individuals in Newark, New Jersey, to transfer their assets to beneficiaries seamlessly. Property records associated with living trusts play a crucial role in ensuring the efficient management and distribution of assets. This article aims to provide a detailed description of Newark New Jersey Living Trust Property Records, highlighting their importance and different types. 1. Definition of Living Trust: A living trust, also known as an inter vivos trust, is a legal arrangement where an individual (granter) transfers their assets into a trust during their lifetime. The granter designates a trustee to manage and administer these assets on behalf of the beneficiaries. This arrangement provides numerous benefits, such as avoiding probate, maintaining privacy, and facilitating the smooth transition of assets upon the granter's death. 2. Importance of Living Trust Property Records: Living Trust Property Records serve as crucial documentation that substantiates the existence and details of assets held within a living trust. These records are essential for ensuring accurate management, distribution, and protection of the trust property. Additionally, they provide transparency and legal documentation to prevent disputes among beneficiaries. 3. Different Types of Newark New Jersey Living Trust Property Records: a) Trust Property Inventory: This record entails a comprehensive list of all assets included in the living trust, such as real estate properties, bank accounts, investment portfolios, valuable possessions, and intellectual property rights. The inventory consists of detailed descriptions, values, and necessary legal documentation for each asset. b) Property Deeds: Property deeds are crucial living trust property records, especially for real estate assets. These documents establish the legal ownership of properties and outline their transfer into the trust. Property deeds provide detailed information on the property's location, boundaries, title history, and associated financial obligations. c) Financial Account Statements: Living trusts frequently include bank accounts, brokerage accounts, and other financial assets. Detailed financial account statements serve as records to verify the inclusion of these assets in the trust. They provide information about the account holder, balance, transactions, and any associated beneficiaries or joint account holders. d) Appraisals and Valuations: To ensure accurate asset distribution, living trust property records often include professional appraisals and valuations of significant assets. These records determine the fair market value of properties, collectibles, or valuables, helping trustees make informed decisions during the trust administration and distribution process. e) Amendments and Updates: Over time, living trusts may require amendments or updates due to changes in beneficiaries, trustees, or asset allocations. Maintaining records of all trust amendments and updates is crucial for legal compliance and maintaining an accurate representation of the trust's structure and provisions. Conclusion: Newark New Jersey Living Trust Property Records are fundamental documents for efficient trust administration, accurate asset management, and seamless distribution. From trust property inventories and property deeds to financial account statements and appraisals, these records provide the necessary legal documentation and transparency. Through proper record-keeping and documentation, beneficiaries, trustees, and legal professionals can ensure the successful implementation of living trusts, protecting the assets and fulfilling the granter's intentions.Newark, New Jersey Living Trust Property Records: A Comprehensive Overview Introduction: Living trusts are commonly used legal tools that allow individuals in Newark, New Jersey, to transfer their assets to beneficiaries seamlessly. Property records associated with living trusts play a crucial role in ensuring the efficient management and distribution of assets. This article aims to provide a detailed description of Newark New Jersey Living Trust Property Records, highlighting their importance and different types. 1. Definition of Living Trust: A living trust, also known as an inter vivos trust, is a legal arrangement where an individual (granter) transfers their assets into a trust during their lifetime. The granter designates a trustee to manage and administer these assets on behalf of the beneficiaries. This arrangement provides numerous benefits, such as avoiding probate, maintaining privacy, and facilitating the smooth transition of assets upon the granter's death. 2. Importance of Living Trust Property Records: Living Trust Property Records serve as crucial documentation that substantiates the existence and details of assets held within a living trust. These records are essential for ensuring accurate management, distribution, and protection of the trust property. Additionally, they provide transparency and legal documentation to prevent disputes among beneficiaries. 3. Different Types of Newark New Jersey Living Trust Property Records: a) Trust Property Inventory: This record entails a comprehensive list of all assets included in the living trust, such as real estate properties, bank accounts, investment portfolios, valuable possessions, and intellectual property rights. The inventory consists of detailed descriptions, values, and necessary legal documentation for each asset. b) Property Deeds: Property deeds are crucial living trust property records, especially for real estate assets. These documents establish the legal ownership of properties and outline their transfer into the trust. Property deeds provide detailed information on the property's location, boundaries, title history, and associated financial obligations. c) Financial Account Statements: Living trusts frequently include bank accounts, brokerage accounts, and other financial assets. Detailed financial account statements serve as records to verify the inclusion of these assets in the trust. They provide information about the account holder, balance, transactions, and any associated beneficiaries or joint account holders. d) Appraisals and Valuations: To ensure accurate asset distribution, living trust property records often include professional appraisals and valuations of significant assets. These records determine the fair market value of properties, collectibles, or valuables, helping trustees make informed decisions during the trust administration and distribution process. e) Amendments and Updates: Over time, living trusts may require amendments or updates due to changes in beneficiaries, trustees, or asset allocations. Maintaining records of all trust amendments and updates is crucial for legal compliance and maintaining an accurate representation of the trust's structure and provisions. Conclusion: Newark New Jersey Living Trust Property Records are fundamental documents for efficient trust administration, accurate asset management, and seamless distribution. From trust property inventories and property deeds to financial account statements and appraisals, these records provide the necessary legal documentation and transparency. Through proper record-keeping and documentation, beneficiaries, trustees, and legal professionals can ensure the successful implementation of living trusts, protecting the assets and fulfilling the granter's intentions.