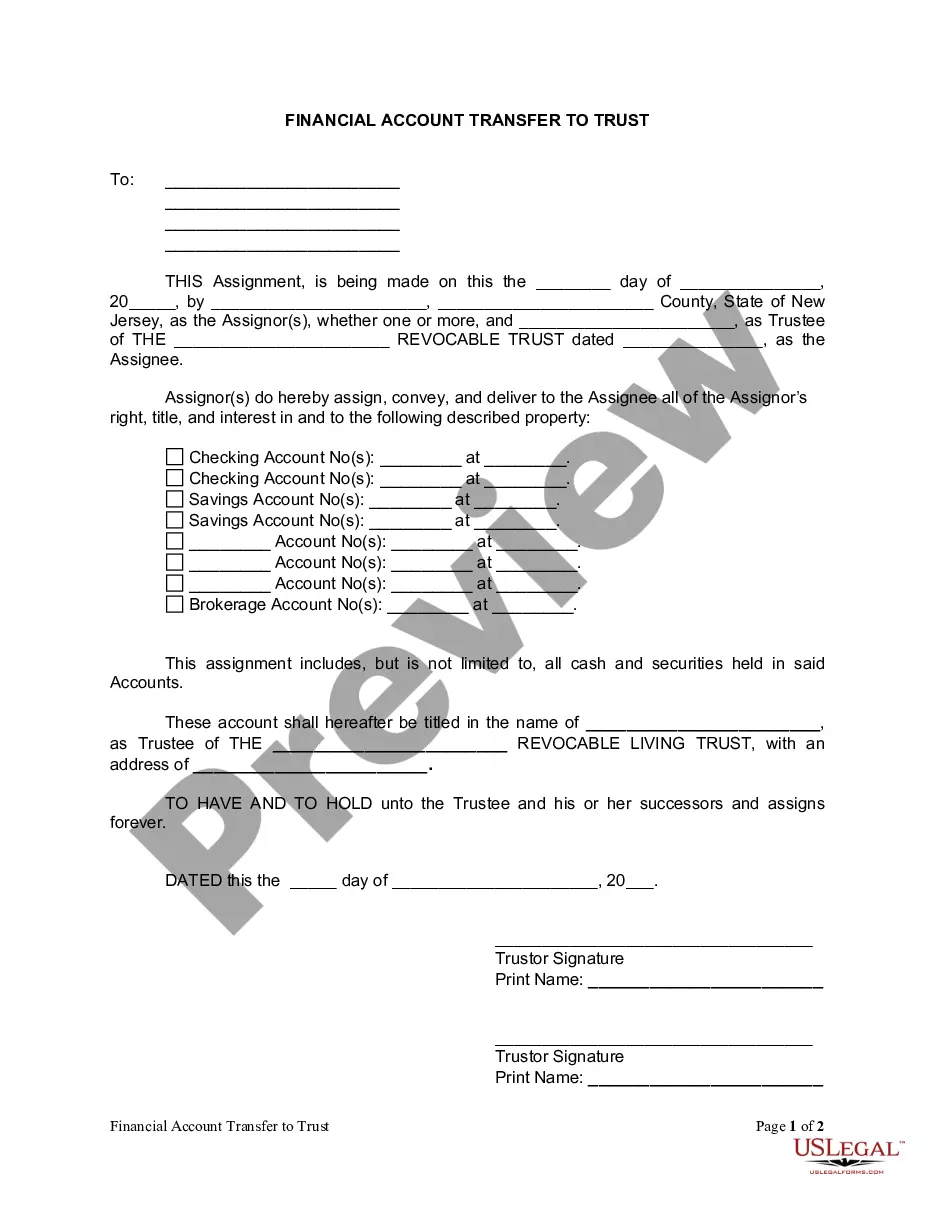

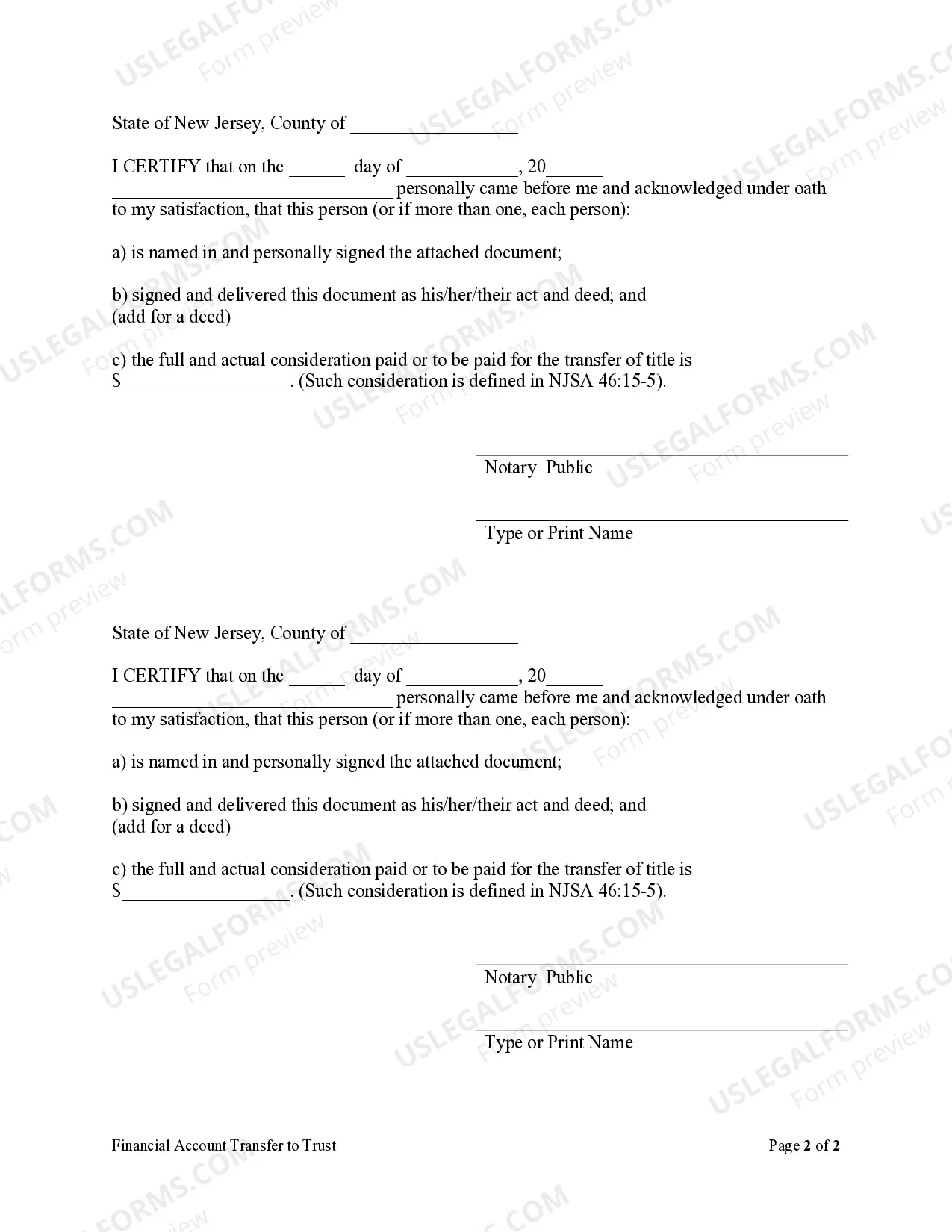

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

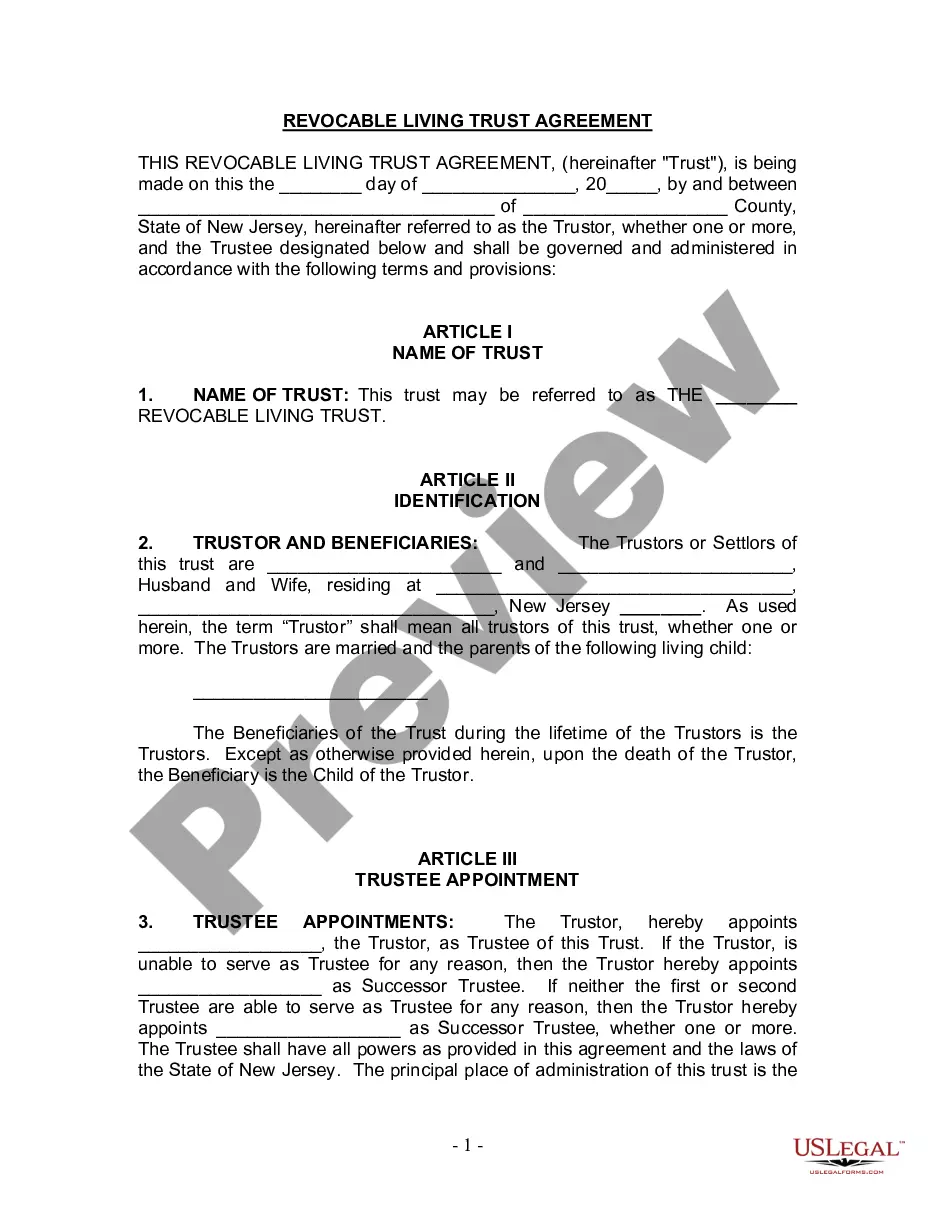

Elizabeth, New Jersey Financial Account Transfer to Living Trust: A Comprehensive Guide In Elizabeth, New Jersey, individuals seeking to safeguard their assets and ensure a smooth transfer of financial accounts to their loved ones often consider utilizing a Living Trust. This legal document allows individuals to maintain control over their assets during their lifetime while outlining the seamless transition of these accounts to designated beneficiaries upon their passing. Below, we delve into the details of the Financial Account Transfer to Living Trust process, highlighting its significance and various types. Financial Account Transfer Process: The financial account transfer to a Living Trust in Elizabeth, New Jersey comprises several crucial steps. To initiate the process, individuals must first establish a comprehensive Living Trust, also known as a Revocable Trust. This trust acts as the primary entity for holding and managing one's financial accounts, including bank accounts, investment portfolios, retirement funds, and more. Once the Living Trust is successfully formed, it is essential to retitle the desired financial accounts in the Trust's name. This involves contacting the relevant financial institutions and providing them with the necessary legal documentation. These institutions may include banks, brokerage firms, insurance companies, and other entities where financial assets are held. During this process, individuals must consult with an experienced estate planning attorney in Elizabeth, New Jersey, who specializes in Living Trusts. The attorney will guide individuals through the legal requirements and ensure a seamless transfer of financial accounts to the Living Trust, minimizing potential tax implications and probate proceedings. Types of Elizabeth, New Jersey Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This type involves transferring traditional bank accounts such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs) to the Living Trust. By doing so, individuals maintain control over their funds while designating beneficiaries who will ultimately receive the assets. 2. Investment Account Transfer: Individuals with investment portfolios, including stocks, bonds, mutual funds, and brokerage accounts, can transfer these assets to the Living Trust. This transfer ensures that the investment accounts are managed according to the Trust's terms and conditions, providing continued financial growth opportunities for beneficiaries. 3. Retirement Account Transfer: Retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, and pension plans, can also be transferred to the Living Trust. By doing so, individuals can specify the distribution rules for these accounts posthumously, potentially minimizing tax burdens and ensuring a smooth transition to designated beneficiaries. 4. Life Insurance Policy Transfer: Individuals holding life insurance policies can transfer ownership of these policies to the Living Trust. This transfer allows for the efficient management of policy proceeds and can help in avoiding potential estate tax burdens upon the policyholder's passing. Overall Benefits of Financial Account Transfer to Living Trust in Elizabeth, New Jersey: — Avoidance of probate: Assets transferred to a Living Trust do not go through the probate process, thus ensuring a faster and smoother transfer to beneficiaries. — Maintaining privacy: Unlike probate, Living Trusts generally remain private documents, allowing for the confidentiality of financial details and beneficiaries' identities. — Reducing estate taxes: Proper estate planning through a Living Trust can potentially minimize estate tax obligations, benefiting both the granter and beneficiaries. — Providing for incapacity: A Living Trust can include provisions for managing financial assets in case of the granter's incapacity, ensuring continued financial stability. In conclusion, Elizabeth, New Jersey Financial Account Transfer to Living Trust offers individuals an effective means to protect and manage their financial accounts, while ensuring a seamless distribution of assets to their loved ones. By consulting estate planning professionals and understanding the different types of transfers, individuals can secure their financial future and fulfill their estate planning goals effectively.Elizabeth, New Jersey Financial Account Transfer to Living Trust: A Comprehensive Guide In Elizabeth, New Jersey, individuals seeking to safeguard their assets and ensure a smooth transfer of financial accounts to their loved ones often consider utilizing a Living Trust. This legal document allows individuals to maintain control over their assets during their lifetime while outlining the seamless transition of these accounts to designated beneficiaries upon their passing. Below, we delve into the details of the Financial Account Transfer to Living Trust process, highlighting its significance and various types. Financial Account Transfer Process: The financial account transfer to a Living Trust in Elizabeth, New Jersey comprises several crucial steps. To initiate the process, individuals must first establish a comprehensive Living Trust, also known as a Revocable Trust. This trust acts as the primary entity for holding and managing one's financial accounts, including bank accounts, investment portfolios, retirement funds, and more. Once the Living Trust is successfully formed, it is essential to retitle the desired financial accounts in the Trust's name. This involves contacting the relevant financial institutions and providing them with the necessary legal documentation. These institutions may include banks, brokerage firms, insurance companies, and other entities where financial assets are held. During this process, individuals must consult with an experienced estate planning attorney in Elizabeth, New Jersey, who specializes in Living Trusts. The attorney will guide individuals through the legal requirements and ensure a seamless transfer of financial accounts to the Living Trust, minimizing potential tax implications and probate proceedings. Types of Elizabeth, New Jersey Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This type involves transferring traditional bank accounts such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs) to the Living Trust. By doing so, individuals maintain control over their funds while designating beneficiaries who will ultimately receive the assets. 2. Investment Account Transfer: Individuals with investment portfolios, including stocks, bonds, mutual funds, and brokerage accounts, can transfer these assets to the Living Trust. This transfer ensures that the investment accounts are managed according to the Trust's terms and conditions, providing continued financial growth opportunities for beneficiaries. 3. Retirement Account Transfer: Retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, and pension plans, can also be transferred to the Living Trust. By doing so, individuals can specify the distribution rules for these accounts posthumously, potentially minimizing tax burdens and ensuring a smooth transition to designated beneficiaries. 4. Life Insurance Policy Transfer: Individuals holding life insurance policies can transfer ownership of these policies to the Living Trust. This transfer allows for the efficient management of policy proceeds and can help in avoiding potential estate tax burdens upon the policyholder's passing. Overall Benefits of Financial Account Transfer to Living Trust in Elizabeth, New Jersey: — Avoidance of probate: Assets transferred to a Living Trust do not go through the probate process, thus ensuring a faster and smoother transfer to beneficiaries. — Maintaining privacy: Unlike probate, Living Trusts generally remain private documents, allowing for the confidentiality of financial details and beneficiaries' identities. — Reducing estate taxes: Proper estate planning through a Living Trust can potentially minimize estate tax obligations, benefiting both the granter and beneficiaries. — Providing for incapacity: A Living Trust can include provisions for managing financial assets in case of the granter's incapacity, ensuring continued financial stability. In conclusion, Elizabeth, New Jersey Financial Account Transfer to Living Trust offers individuals an effective means to protect and manage their financial accounts, while ensuring a seamless distribution of assets to their loved ones. By consulting estate planning professionals and understanding the different types of transfers, individuals can secure their financial future and fulfill their estate planning goals effectively.