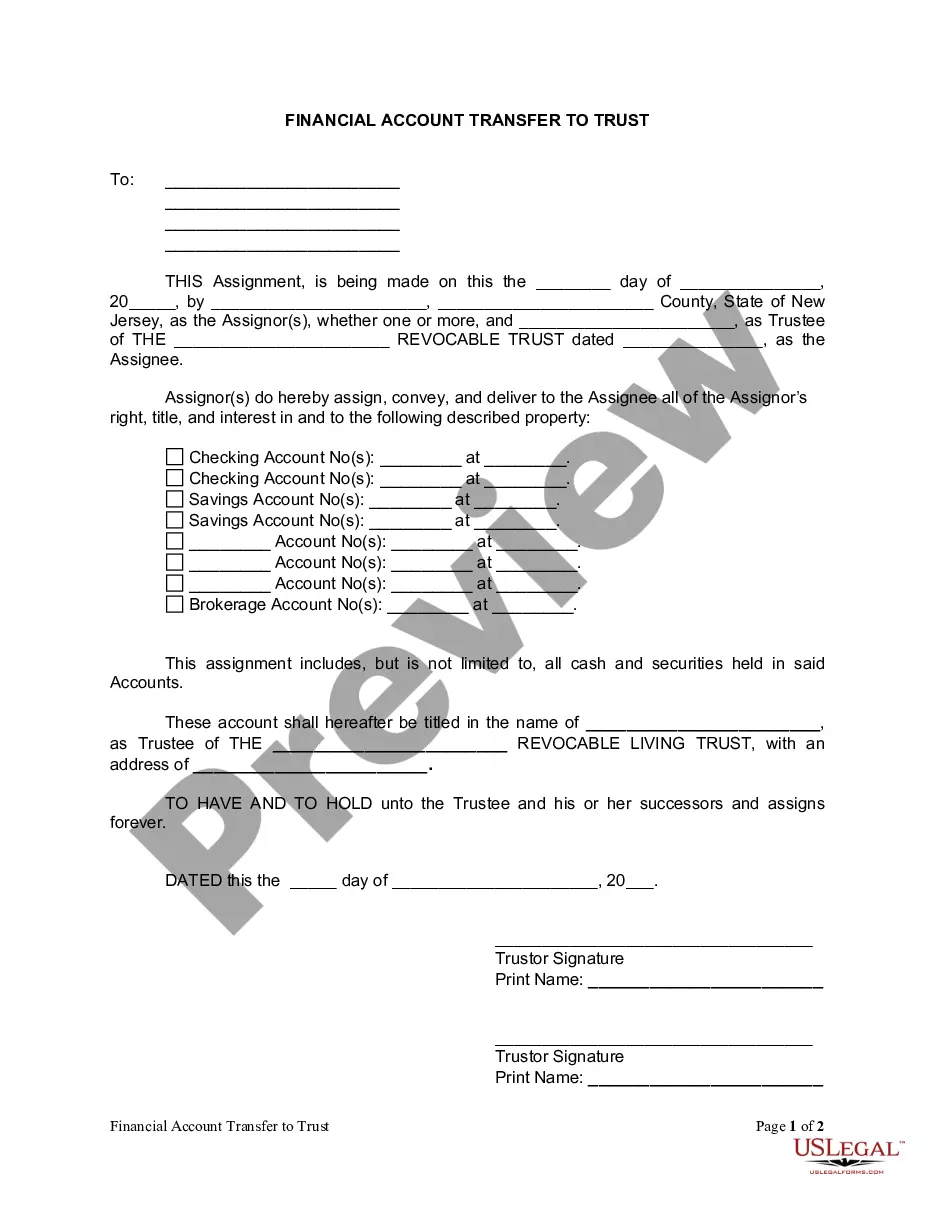

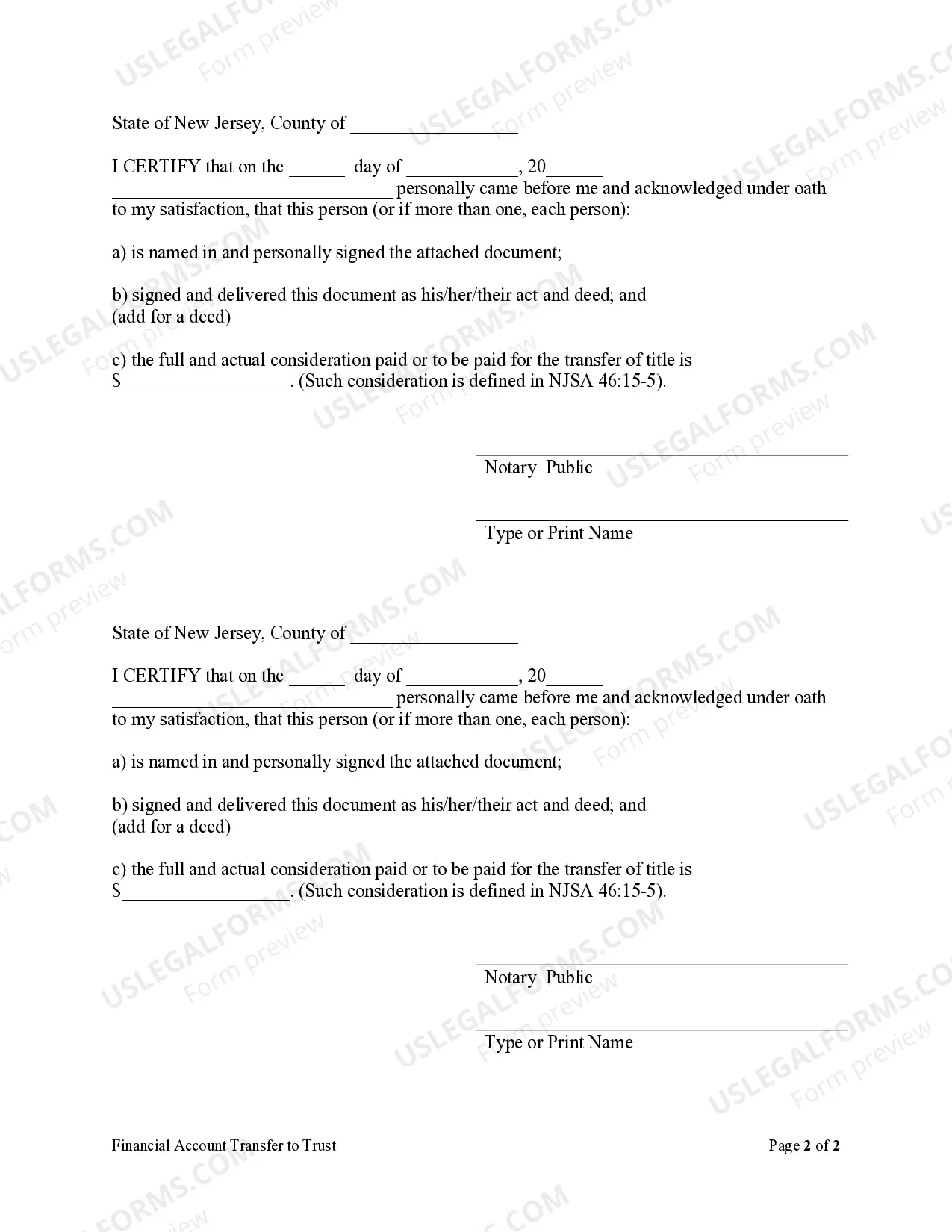

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Paterson New Jersey Financial Account Transfer to Living Trust

Description

How to fill out New Jersey Financial Account Transfer To Living Trust?

If you have previously utilized our service, sign in to your account and download the Paterson New Jersey Financial Account Transfer to Living Trust onto your device by clicking the Download button. Ensure that your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have acquired: you can find them in your profile under the My documents menu whenever you wish to reuse them. Make the most of the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Ensure you’ve located a suitable document. Review the description and use the Preview feature, if available, to verify if it satisfies your requirements. If it does not fit your needs, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Paterson New Jersey Financial Account Transfer to Living Trust. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

While a trust can offer many advantages, there are potential downsides to consider, especially with a Paterson New Jersey Financial Account Transfer to Living Trust. Creating and managing a trust involves costs, such as legal fees and ongoing administrative expenses. Additionally, if not appropriately funded, a trust may not serve its intended purpose effectively. Understanding these factors can help you make informed decisions.

Transferring assets to a trust can present risks, especially in a Paterson New Jersey Financial Account Transfer to Living Trust. Mismanagement by a trustee can lead to financial losses. Additionally, if the trust is not properly structured, it may not achieve your intended tax benefits. Always consult with a legal professional to mitigate these risks.

The biggest mistake parents often make when establishing a trust fund is failing to properly fund it. Many believe that simply creating a trust guarantees protection for their assets. However, without completing the necessary Paterson New Jersey Financial Account Transfer to Living Trust, the trust remains empty and ineffective. Additionally, parents might overlook updating their financial accounts and properties to reflect the trust, which can lead to complications in the future.

To transfer a bank account to a living trust, begin by notifying your bank and requesting their transfer forms. Fill out these forms, providing details of your living trust, and submit any required supporting documentation. Successfully completing the Paterson New Jersey Financial Account Transfer to Living Trust ensures your bank account aligns with your estate planning goals.

Some assets should typically be excluded from a trust. For example, retirement accounts such as IRAs can have specific tax implications if transferred into a trust. Understanding these nuances, particularly concerning the Paterson New Jersey Financial Account Transfer to Living Trust, is vital as you plan your estate.

To transfer your brokerage account to a living trust, start by contacting your brokerage firm for their specific requirements. You will likely need to fill out a change of ownership form and present your trust documents. Completing this transfer streamlines your estate planning under the Paterson New Jersey Financial Account Transfer to Living Trust.

Yes, you can place a checking account in a trust. This legal step allows the trust to control the account, simplifying management and distribution of your assets according to your instructions. Therefore, utilizing the Paterson New Jersey Financial Account Transfer to Living Trust process helps safeguard your financial interests.

To transfer your checking account to your living trust, first contact your bank to inform them of your intention. Obtain the necessary forms for the transfer and provide them with your living trust documents. This process is straightforward and ensures your assets are managed according to your wishes, especially under the Paterson New Jersey Financial Account Transfer to Living Trust guidelines.