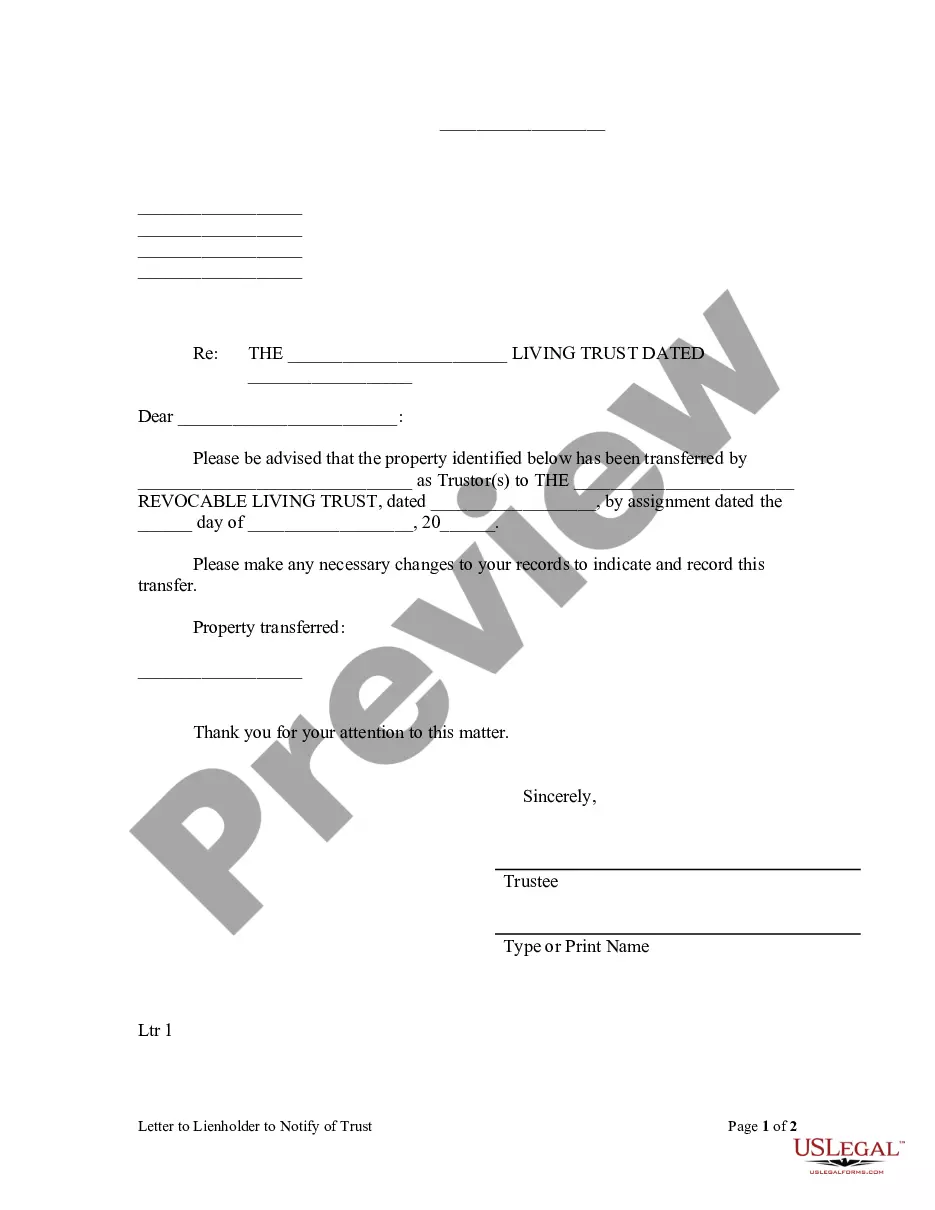

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Paterson New Jersey Letter to Lienholder to Notify of Trust

Description

How to fill out New Jersey Letter To Lienholder To Notify Of Trust?

Take advantage of the US Legal Forms and gain instant access to any document template you need.

Our user-friendly website with a vast array of documents streamlines the process of locating and acquiring nearly any document sample you want.

You can download, complete, and sign the Paterson New Jersey Letter to Lienholder to Notify of Trust in only a few moments instead of spending hours online searching for a suitable template.

Using our library is an excellent method to enhance the security of your form submissions. Our skilled legal experts regularly review all records to ensure that the forms are suitable for specific states and comply with current laws and regulations.

Initiate the downloading process. Click Buy Now and select your preferred pricing option. Then, register for an account and pay for your order using a credit card or PayPal.

Download the document. Choose the format to acquire the Paterson New Jersey Letter to Lienholder to Notify of Trust and modify and complete, or sign it as per your needs.

- How can you obtain the Paterson New Jersey Letter to Lienholder to Notify of Trust.

- If you have an account, simply Log In to your profile. The Download button will show up on all the templates you preview.

- Additionally, you can access all the previously saved files from the My documents section.

- If you haven’t created an account yet, follow the steps outlined below.

- Visit the page with the form you need. Verify that it is the document you're looking for: review its title and description, and use the Preview option if available. Otherwise, use the Search box to find the necessary form.

Form popularity

FAQ

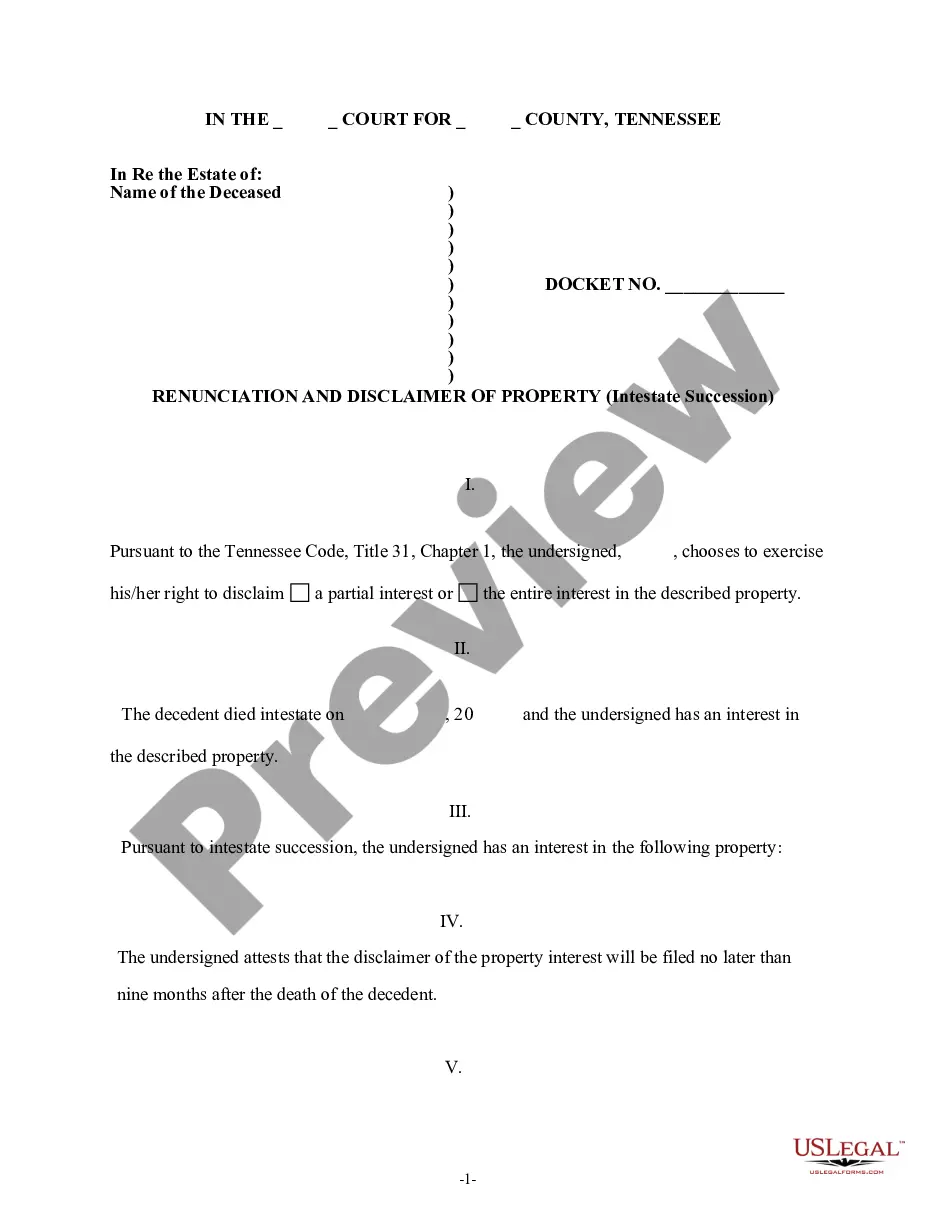

To set up a trust in New Jersey, start by defining the purpose of the trust and selecting the assets to be included. Next, choose a trustee responsible for managing the trust and drafting a trust document that outlines the terms. Consider using a Paterson New Jersey Letter to Lienholder to Notify of Trust to ensure all necessary parties are informed about the trust arrangements and to streamline any required notifications.

In New Jersey, creating a trust requires a settlor, the individual who establishes the trust, and a clear intention to transfer ownership of assets to the trust. Additionally, a trustee must be appointed to manage the trust, and the trust must have identifiable beneficiaries. Utilizing a Paterson New Jersey Letter to Lienholder to Notify of Trust can help inform relevant parties about the trust and its terms.

A trust certification letter is a document that confirms the existence and terms of a trust. It is often used to inform third parties, like lienholders, about the trust's details, which is crucial when creating a Paterson New Jersey Letter to Lienholder to Notify of Trust. This letter helps to clarify the authority of the trustee and the nature of the assets held within the trust.

To establish a trust in New Jersey, you must draft a trust document outlining the specifics of the trust arrangement, appoint a trustee, and transfer assets into the trust. It is essential to have a clear plan to ensure the trust meets your objectives and to prepare a Paterson New Jersey Letter to Lienholder to Notify of Trust as part of the process. Using our user-friendly tools can streamline the creation of your trust documents.

A trust agreement outlines the terms and conditions of the trust, while a trust certificate serves as evidence of the trust's existence. When preparing a Paterson New Jersey Letter to Lienholder to Notify of Trust, understanding this distinction can be vital. The agreement provides the framework for how the trust operates, while the certificate offers proof of that operation to external parties.

The purpose of a trust certificate is to authenticate the existence of a trust and verify its terms. It plays a crucial role when creating a Paterson New Jersey Letter to Lienholder to Notify of Trust, as it informs lienholders about the trust arrangement. This document helps protect the interests of all parties involved, providing clarity and transparency throughout the management of the trust.

To obtain your trust certificate, you typically need to request it from your trust administrator or the financial institution where the trust is held. This certificate proves the trust's validity and is necessary for drafting a Paterson New Jersey Letter to Lienholder to Notify of Trust. Utilizing our platform can simplify this process, enabling you to access your certificate with ease.

A certified trust report provides an official account of the assets and details of a trust. This report serves as a key document when creating a Paterson New Jersey Letter to Lienholder to Notify of Trust. It ensures that all relevant parties are informed about the trust’s existence and its management. By using our provided tools, you can quickly generate this report.

To transfer your property to a trust in New Jersey, you must execute a deed transferring ownership into the trust name. It's vital to follow legal guidelines and ensure the deed is properly prepared and recorded. If any liens exist, consider a Paterson New Jersey Letter to Lienholder to Notify of Trust to inform all parties involved about the trust arrangements. With US Legal Forms, you gain access to templates that make this transfer seamless and legally sound.

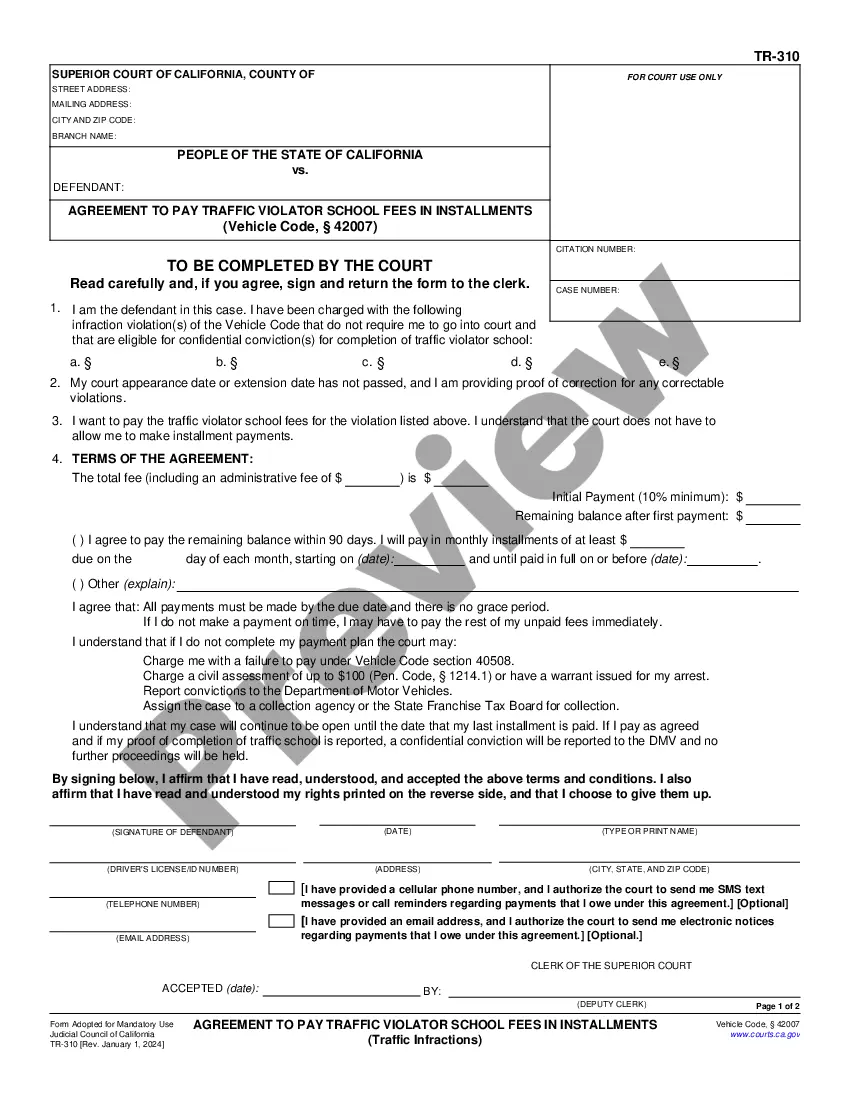

If you need to obtain a title for a car without one in New Jersey, you must apply for a duplicate title through the New Jersey Motor Vehicle Commission. Start by providing proof of ownership, such as a bill of sale or previous registration. If there's a lienholder on the vehicle, you may need a Paterson New Jersey Letter to Lienholder to Notify of Trust to clarify ownership and lien status. US Legal Forms can assist you with the necessary documents to simplify this process.