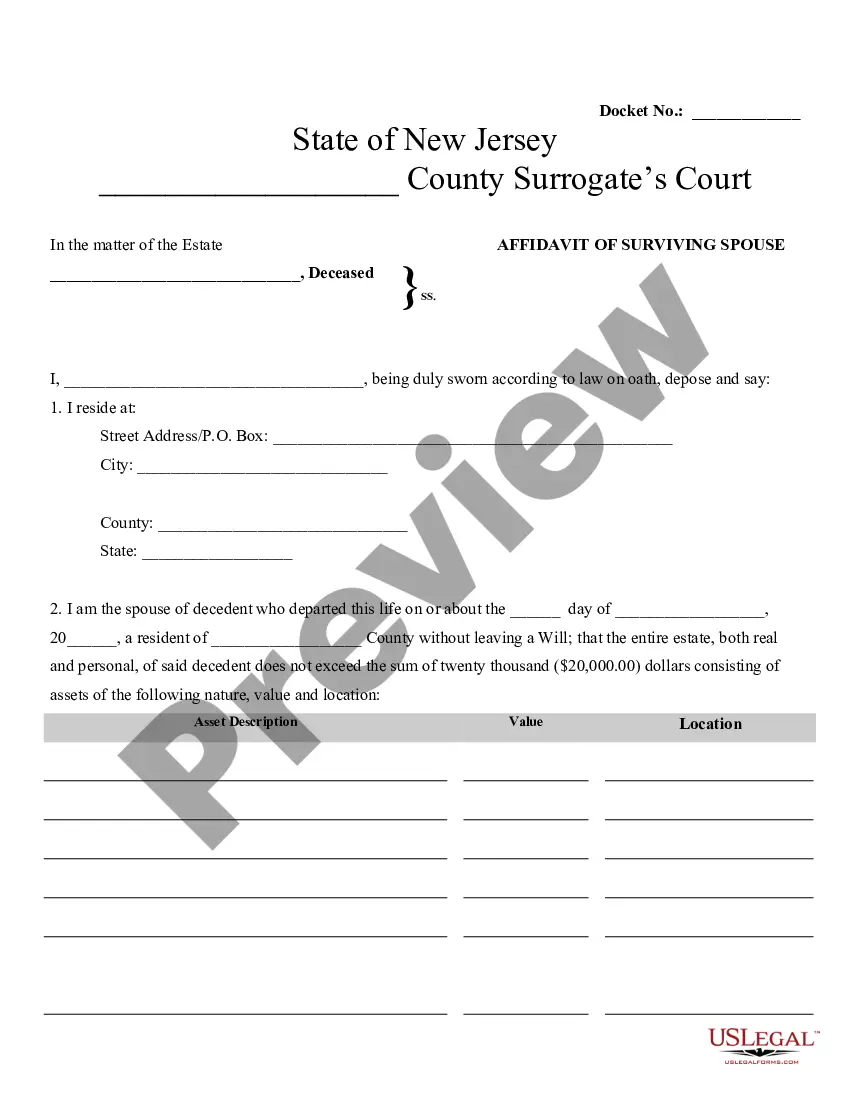

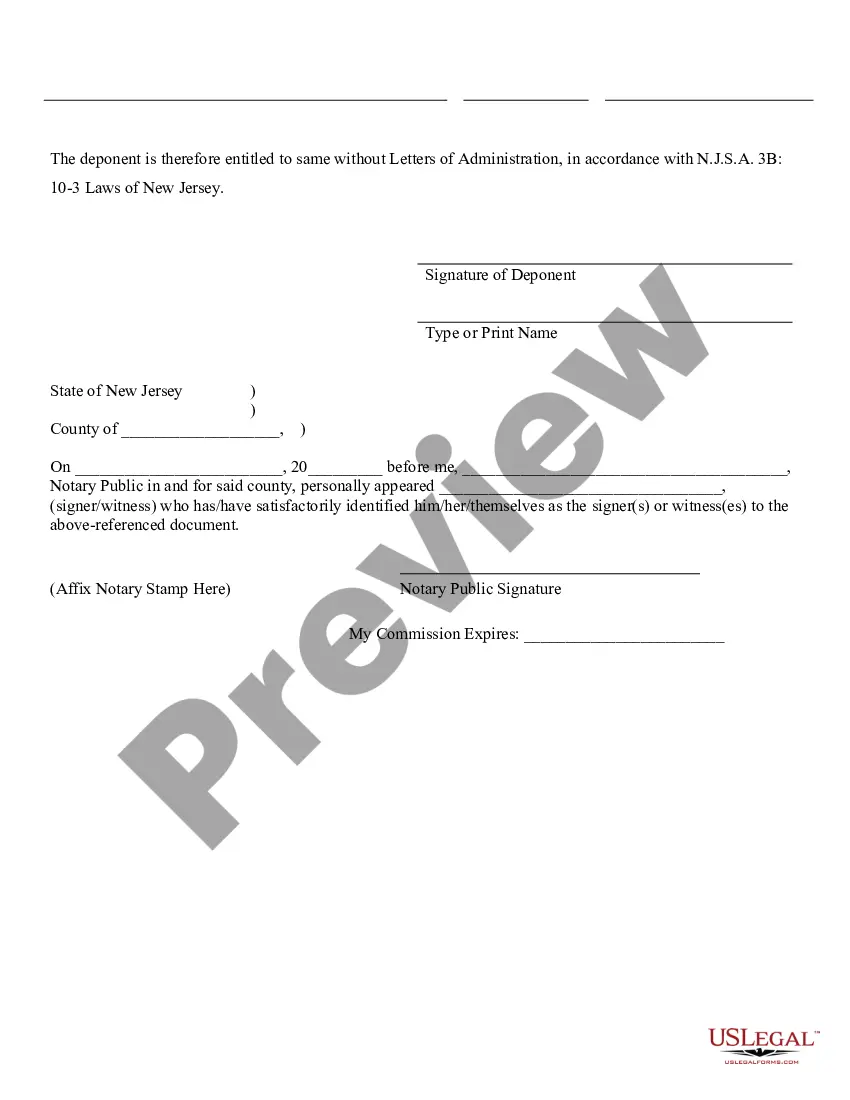

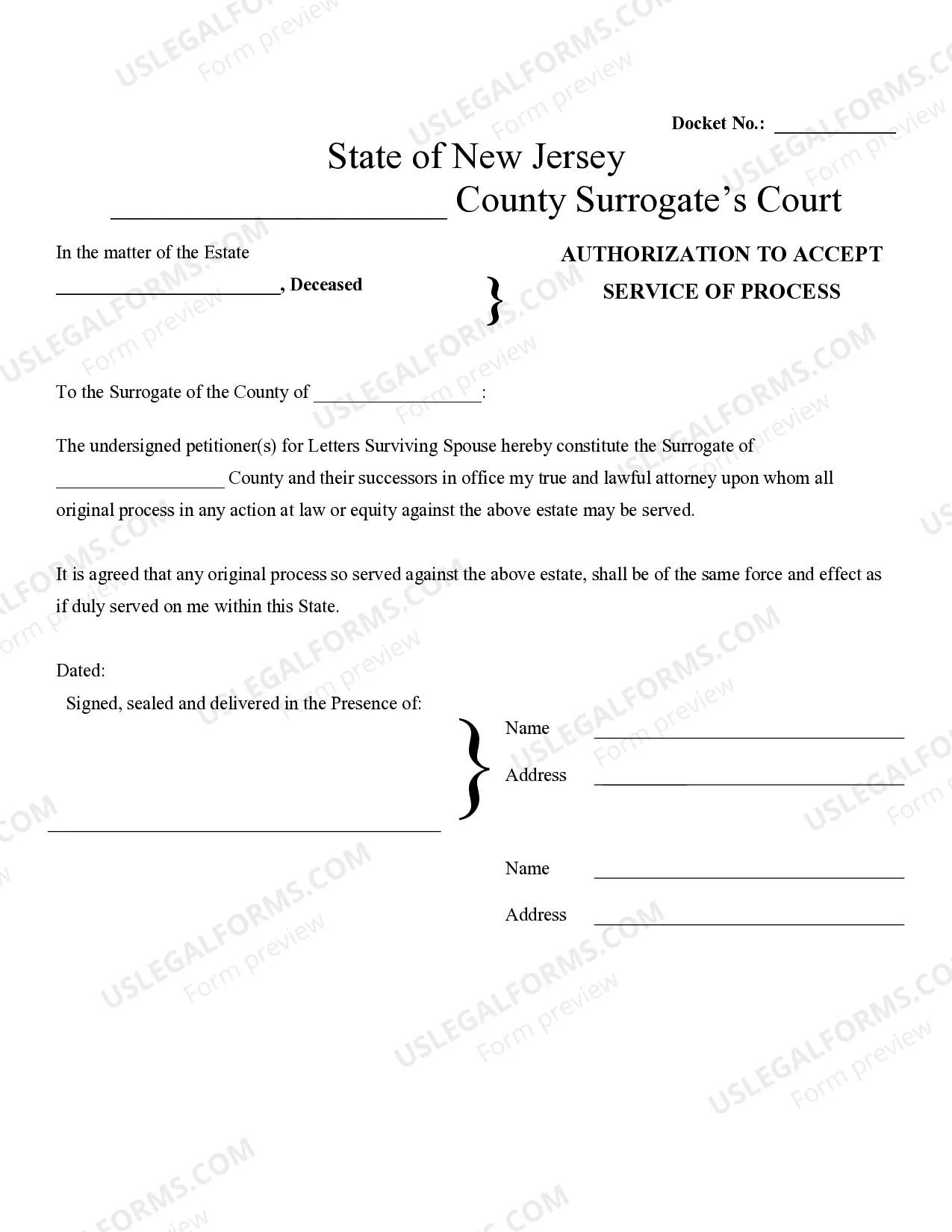

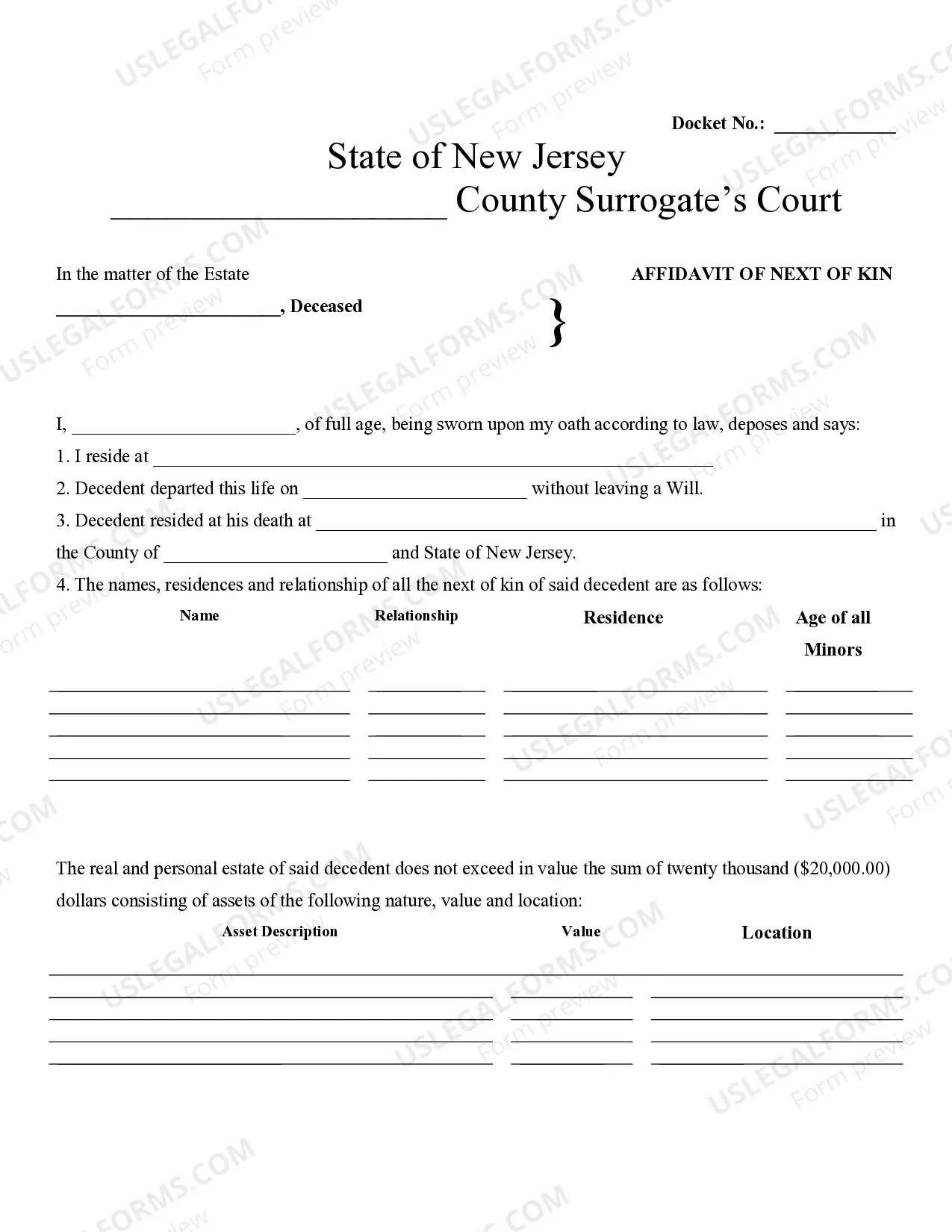

The Elizabeth New Jersey Small Estate Affidavit for estates under $20,000 is a legal document designed to simplify the process of distributing the assets of a deceased individual's estate. This affidavit is specifically suited for cases where the total value of the estate does not exceed $20,000. By utilizing this affidavit, the time-consuming and expensive probate process can be avoided, providing a quicker and more cost-effective solution for distributing the assets. The Elizabeth New Jersey Small Estate Affidavit for estates under $20,000 grants the appointed executor or administrator the authority to collect and distribute the assets of the deceased individual's estate. This document requires specific information such as the name and address of the deceased, date of death, a list of assets, and their estimated values. Additionally, the affidavit must include details about any outstanding debts or liabilities of the estate. It is important to note that there may be different types of Elizabeth New Jersey Small Estate Affidavits for estates under $20,000, which can vary based on the specific circumstances. For instance, if the deceased individual had a will, the executor named in the will may need to complete a specific type of small estate affidavit. On the other hand, if the deceased individual did not have a will or appointed executor, a different type of small estate affidavit may be required for the next of kin or a court-appointed administrator. It is strongly recommended consulting with an experienced attorney who specializes in estate administration to ensure compliance with the specific requirements for the Elizabeth New Jersey Small Estate Affidavit. The attorney can provide guidance on the exact steps to take, the necessary forms to be completed, and the supporting documentation needed to successfully complete the process. Overall, the Elizabeth New Jersey Small Estate Affidavit for estates under $20,000 offers a streamlined approach to estate administration for smaller estates. By utilizing this affidavit, individuals can save time and money while efficiently distributing the assets of their deceased loved ones.

Elizabeth New Jersey Small Estate Affidavit for estates under 20,000

Description

How to fill out Elizabeth New Jersey Small Estate Affidavit For Estates Under 20,000?

If you are looking for a valid form, it’s impossible to find a better platform than the US Legal Forms site – probably the most comprehensive libraries on the web. With this library, you can get thousands of form samples for organization and personal purposes by categories and states, or keywords. Using our high-quality search feature, getting the latest Elizabeth New Jersey Small Estate Affidavit for estates under 20,000 is as elementary as 1-2-3. Additionally, the relevance of each file is proved by a team of skilled lawyers that on a regular basis check the templates on our platform and revise them according to the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to receive the Elizabeth New Jersey Small Estate Affidavit for estates under 20,000 is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the form you want. Check its explanation and make use of the Preview function to explore its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to find the proper record.

- Affirm your decision. Choose the Buy now button. After that, pick the preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the template. Select the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Elizabeth New Jersey Small Estate Affidavit for estates under 20,000.

Each template you add to your user profile has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to have an extra copy for editing or creating a hard copy, you may return and export it again at any moment.

Make use of the US Legal Forms professional catalogue to get access to the Elizabeth New Jersey Small Estate Affidavit for estates under 20,000 you were seeking and thousands of other professional and state-specific samples on a single website!