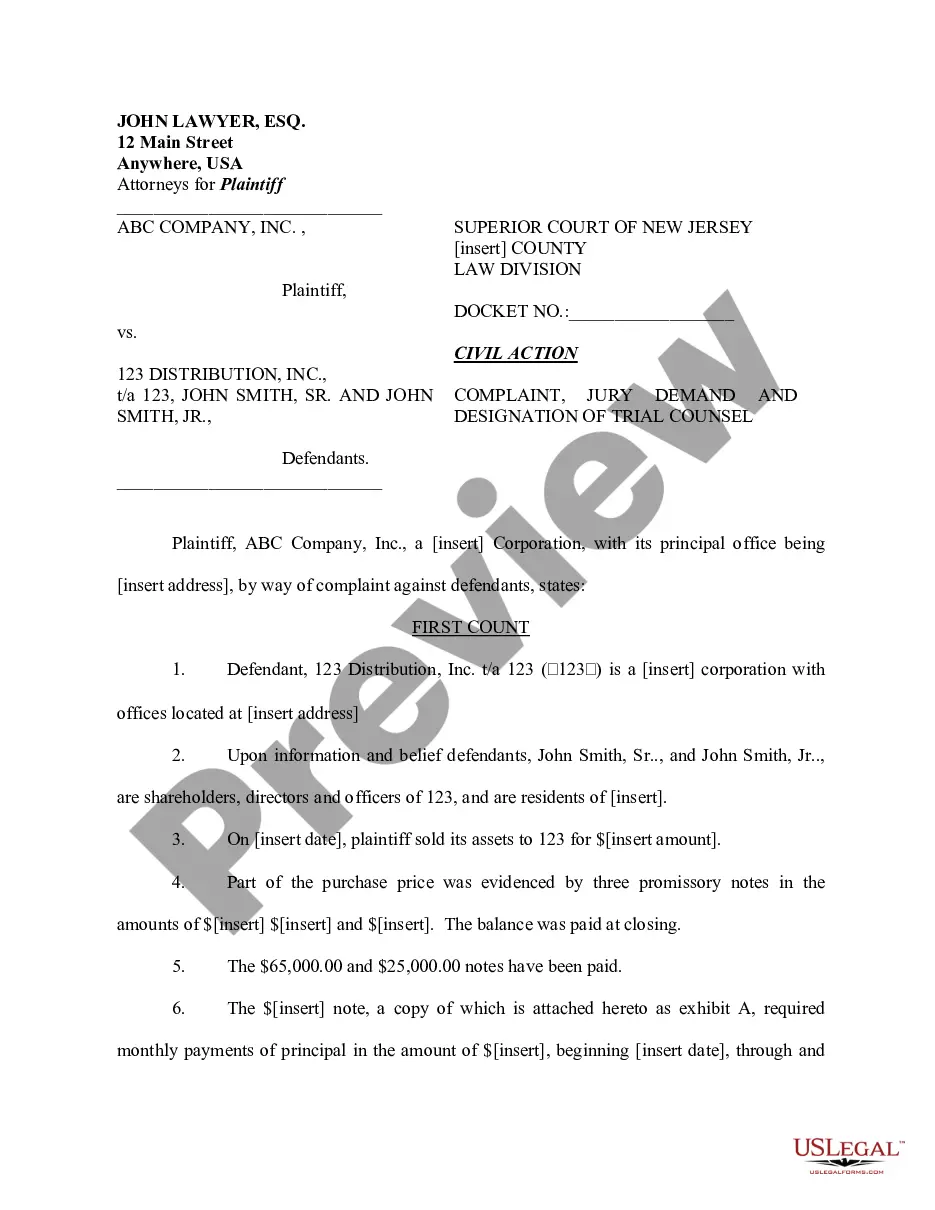

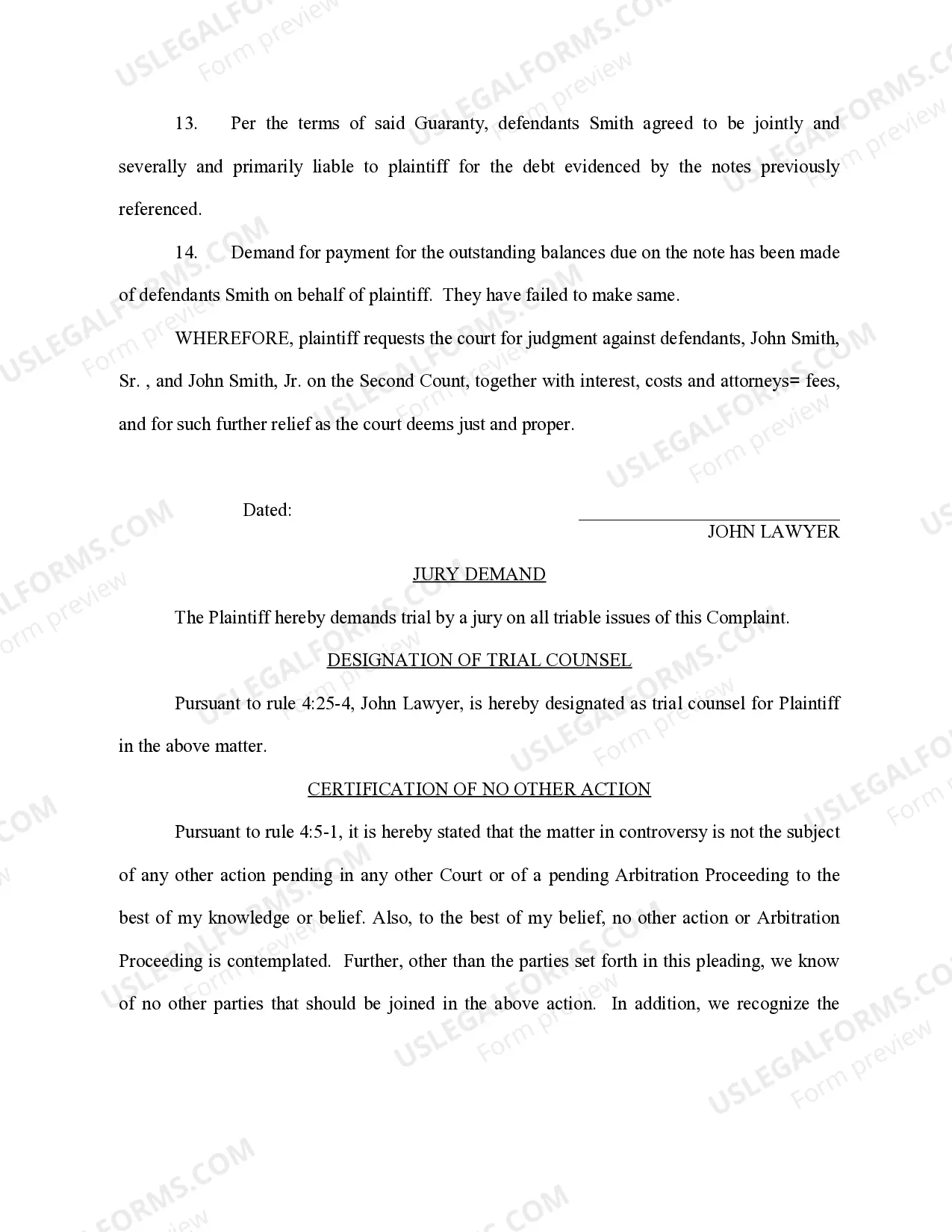

A complaint for breach of promissory note is a legal document that outlines allegations made by the plaintiff against the defendant for failing to fulfill the terms and conditions of a promissory note in Jersey City, New Jersey. This type of legal action is taken when one party fails to make the agreed-upon payments or otherwise breaches the terms laid out in the promissory note. A Jersey City New Jersey complaint for breach of promissory note typically includes the following information: 1. Parties involved: The complaint will identify the plaintiff, who is the party initiating the legal action, and the defendant, the party accused of breaching the promissory note. 2. Jurisdiction: It will state that the complaint is filed in the appropriate court in Jersey City, New Jersey, ensuring the case falls under the jurisdiction of the court system. 3. Background: The complaint will provide a detailed description of the promissory note, including the date it was executed, the principal amount, the interest rate, and any other relevant terms agreed upon between the parties involved. 4. Breach of contract: The complaint will outline the specific ways in which the defendant has breached the terms of the promissory note. This may include failure to make payments on time, defaulting on the entire loan amount, or violating any other provision outlined in the document. 5. Damages: The complaint will state the damages suffered by the plaintiff as a result of the defendant's breach. This can include the outstanding balance owed, accrued interest, late fees, legal fees, and any other applicable costs. Different types of Jersey City New Jersey complaints for breach of promissory note may include: 1. Complaint for Breach of Promissory Note — Lack of Repayment: This type of complaint is filed when the defendant fails to make any payments on the promissory note, resulting in a full breach of the contract. 2. Complaint for Breach of Promissory Note — Default on Specific Payment Terms: This type of complaint is filed when the defendant fails to fulfill specific payment obligations within the promissory note, such as missed payments, inconsistent payments, or partial payments. 3. Complaint for Breach of Promissory Note — Violation of Other Terms: This type of complaint is filed when the defendant violates other terms outlined in the promissory note, such as the use of the borrowed funds for unauthorized purposes or failing to maintain necessary collateral. Regardless of the specific type, a Jersey City New Jersey complaint for breach of promissory note aims to seek appropriate legal remedies for the plaintiff, such as monetary damages or specific performance of the promissory note's terms. Consulting with a qualified attorney is crucial in understanding the legal process and determining the best course of action.

Jersey City New Jersey Complaint for Breach of Promissory Note

Description

How to fill out Jersey City New Jersey Complaint For Breach Of Promissory Note?

If you are searching for a relevant form template, it’s extremely hard to find a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the internet. Here you can find a huge number of form samples for organization and personal purposes by categories and regions, or keywords. With the advanced search option, discovering the latest Jersey City New Jersey Complaint for Breach of Promissory Note is as easy as 1-2-3. Furthermore, the relevance of each file is confirmed by a group of professional attorneys that on a regular basis check the templates on our platform and update them based on the most recent state and county laws.

If you already know about our system and have an account, all you should do to get the Jersey City New Jersey Complaint for Breach of Promissory Note is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have found the form you need. Read its information and use the Preview option to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to get the proper record.

- Confirm your decision. Choose the Buy now button. Next, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the format and download it to your system.

- Make changes. Fill out, revise, print, and sign the received Jersey City New Jersey Complaint for Breach of Promissory Note.

Each and every form you save in your user profile has no expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to have an additional copy for modifying or creating a hard copy, you can come back and export it once again anytime.

Make use of the US Legal Forms professional catalogue to get access to the Jersey City New Jersey Complaint for Breach of Promissory Note you were seeking and a huge number of other professional and state-specific samples on a single platform!