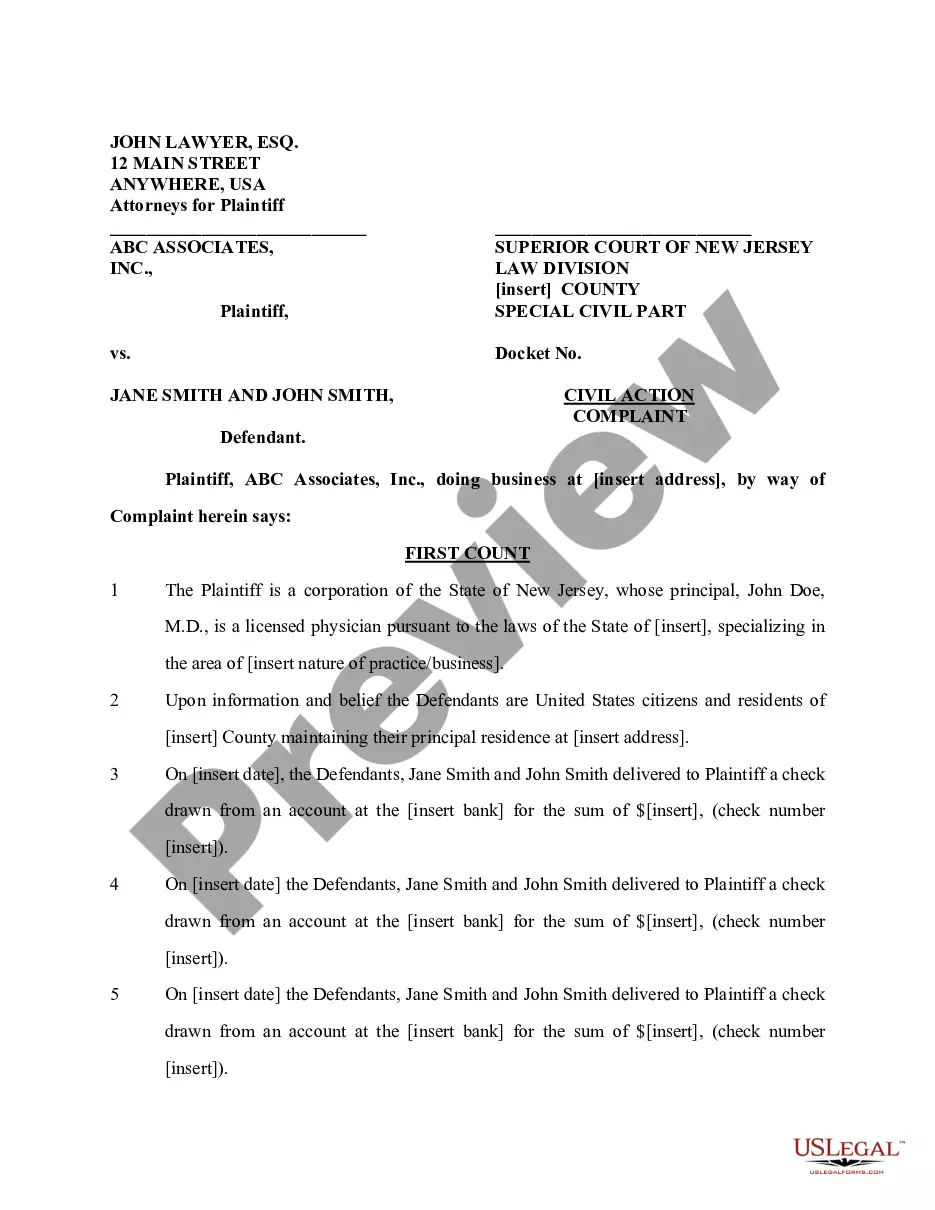

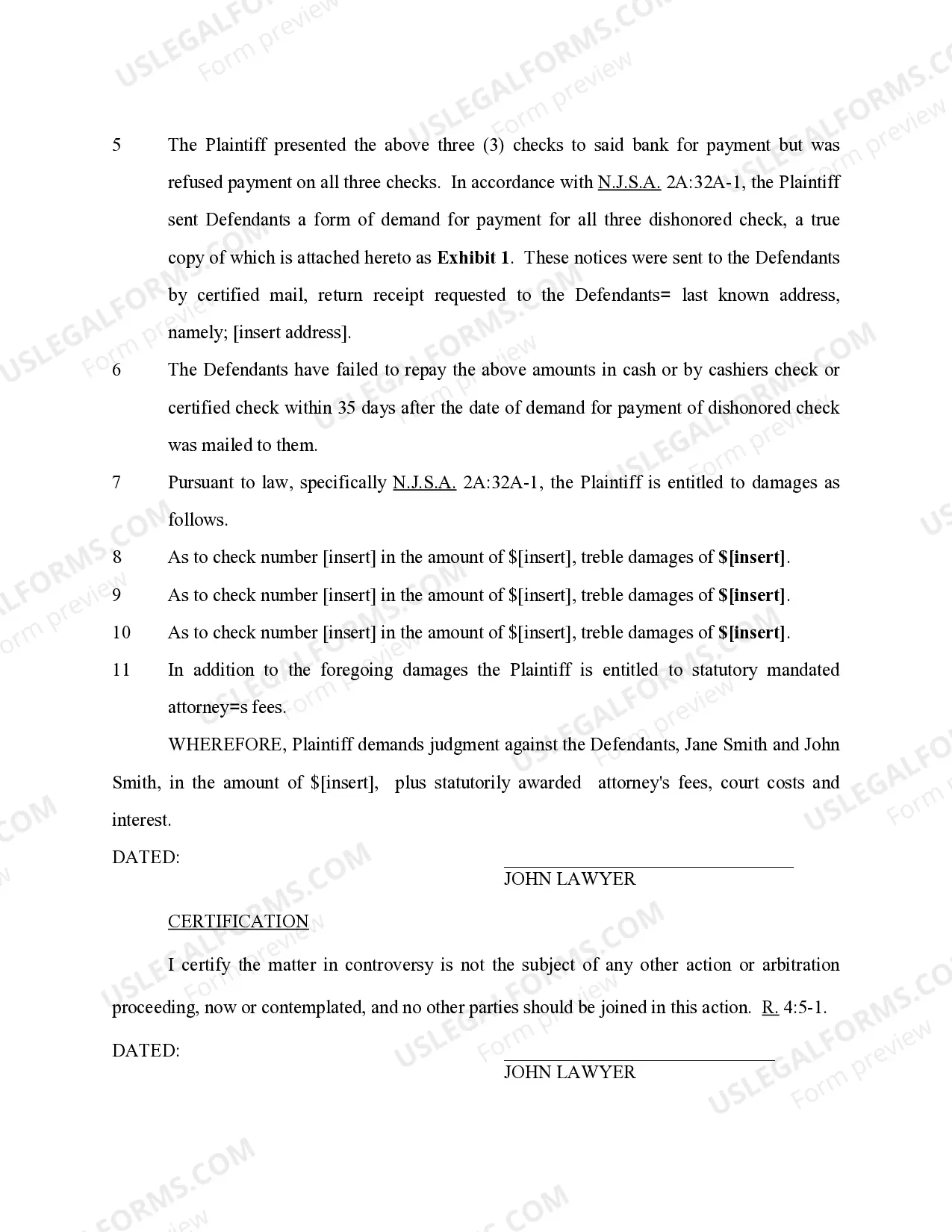

Title: Jersey City New Jersey Complaint for Dishonored Check — Understanding the Process and Types of Complaints Introduction: In the bustling city of Jersey City, New Jersey, the occurrence of dishonored checks can lead to legal consequences. This detailed description aims to shed light on what a Jersey City New Jersey Complaint for Dishonored Check entails, guiding individuals through the process while covering different types of complaints one may come across. 1. Understanding the Complaint for Dishonored Check: A complaint for dishonored check is a legal document filed in Jersey City, New Jersey, by the payee or the recipient of a bounced or dishonored check. It serves as a formal complaint against the issuer of the check for their failure to honor it due to insufficient funds or other reasons. 2. Components of a Jersey City New Jersey Complaint for Dishonored Check: a. Plaintiff's Information: The complainant's details, such as their name, address, and contact information, are mentioned here. b. Defendant's Information: This section includes the details of the party responsible for the dishonored check, such as their name, address, and contact information. c. Check Details: The specifics of the dishonored check, including check number, amount, and date of issuance, are stated. d. Bank Information: Pertinent banking information related to the check, such as the bank's name, branch, and account details, should be provided. e. Cause of Action: The complainant explains the legal grounds for the complaint, usually citing violation of the state's dishonored check laws or general contract law. f. Net Amount Owed: The total amount due, combining the original amount and any additional fees or penalties, is clearly stated. 3. Types of Jersey City New Jersey Complaint for Dishonored Check: a. Civil Complaint for Dishonored Check: This complaint is initiated by the payee against the issuer to recover the owed amount, usually seeking compensation for the face value of the check plus legal costs and any applicable interest. b. Criminal Complaint for Dishonored Check: In some cases, dishonored checks that go unpaid may result in criminal charges against the issuer. This type of complaint seeks legal remedies and potential penalties, including fines or even imprisonment, as determined by the court. c. Small Claims Complaint for Dishonored Check: Small claims courts handle disputes involving smaller amounts in Jersey City. A complainant may choose this option if the dishonored check falls under the jurisdiction of the small claims court's monetary limits. It offers a simplified and cost-effective process to seek resolution. Conclusion: A Jersey City New Jersey Complaint for Dishonored Check is a crucial legal tool for individuals facing a bounced or dishonored check situation. By understanding the components and types of complaints, Jersey City residents can effectively pursue remedies for the financial damages incurred and seek justice within the legal framework.

Jersey City New Jersey Complaint for Dishonored Check

Description

How to fill out Jersey City New Jersey Complaint For Dishonored Check?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Jersey City New Jersey Complaint for Dishonored Check? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and county.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Jersey City New Jersey Complaint for Dishonored Check conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Jersey City New Jersey Complaint for Dishonored Check in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online once and for all.