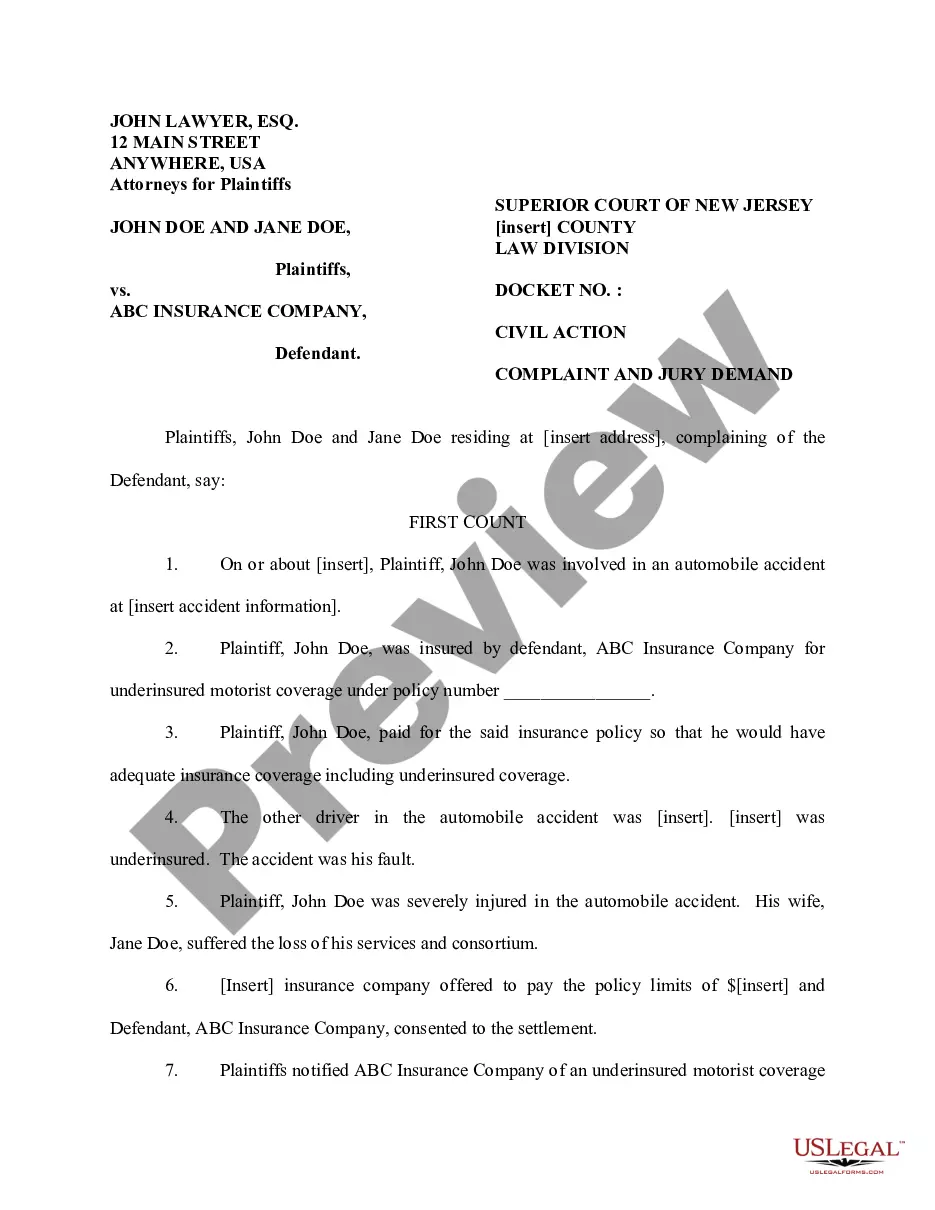

This form is a Complaint Seeking Underinsured Motorist Coverage for use in civil proceedings within the state of New Jersey.

Newark, New Jersey Complaint Seeking Under insured Motorist Coverage: Explained in Detail Under insured Motorist Coverage (UIM) plays a crucial role in protecting residents of Newark, New Jersey against financial losses caused by accidents involving drivers whose insurance coverage is insufficient to cover the damages. If you find yourself in such a situation, it is essential to understand the process of filing a complaint seeking under insured motorist coverage. Let's delve into the details. In Newark, New Jersey, individuals who sustain injuries or property damage due to an accident caused by an underinsured motorist have the right to file a complaint seeking under insured motorist coverage. This type of claim allows an injured party to receive compensation for medical expenses, lost wages, pain and suffering, and other damages not covered by the at-fault driver's insurance. When filing a complaint, it is essential to consult with an experienced attorney specializing in personal injury and insurance law. They will help guide you through the legal process, ensure your rights are protected, and maximize the chances of a successful claim. Here are the different types of Newark, New Jersey Complaint Seeking Under insured Motorist Coverage: 1. Bodily Injury Coverage: This coverage provides compensation for injuries sustained as a result of an accident caused by an underinsured motorist. It includes medical expenses, rehabilitation costs, pain and suffering, and other related damages. 2. Property Damage Coverage: If your vehicle or property suffers damage in an accident with an underinsured motorist, this coverage will help pay for repairs or replacement costs. 3. Uninsured Motorist Property Damage Coverage (UMPS): This specialized coverage is designed to protect your property against damages caused by an uninsured or under insured driver. UMPS can help cover repairs or replacement costs for your vehicle or other damaged property. 4. Hit-and-Run Coverage: In cases where the at-fault driver leaves the scene of the accident without providing necessary identification or insurance information, this coverage can provide compensation for your injuries and property damage. 5. Stackable Coverage: Stackable under insured motorist coverage allows individuals to combine the coverage limits of multiple vehicles on one policy. This means that if you have multiple insured vehicles, you can "stack" the coverage limits to increase the potential payout in the event of an accident with an underinsured motorist. When filing a complaint seeking under insured motorist coverage, it is crucial to provide all necessary documentation, including accident reports, medical records, proof of damages, insurance policies, and any other relevant evidence. Working closely with your attorney, you can ensure that your claim is strong and well-supported. If you have been involved in an accident with an underinsured motorist in Newark, New Jersey, it is imperative to understand your rights and options regarding under insured motorist coverage. Consulting a knowledgeable attorney will help you navigate the complaint process and pursue the compensation you deserve.Newark, New Jersey Complaint Seeking Under insured Motorist Coverage: Explained in Detail Under insured Motorist Coverage (UIM) plays a crucial role in protecting residents of Newark, New Jersey against financial losses caused by accidents involving drivers whose insurance coverage is insufficient to cover the damages. If you find yourself in such a situation, it is essential to understand the process of filing a complaint seeking under insured motorist coverage. Let's delve into the details. In Newark, New Jersey, individuals who sustain injuries or property damage due to an accident caused by an underinsured motorist have the right to file a complaint seeking under insured motorist coverage. This type of claim allows an injured party to receive compensation for medical expenses, lost wages, pain and suffering, and other damages not covered by the at-fault driver's insurance. When filing a complaint, it is essential to consult with an experienced attorney specializing in personal injury and insurance law. They will help guide you through the legal process, ensure your rights are protected, and maximize the chances of a successful claim. Here are the different types of Newark, New Jersey Complaint Seeking Under insured Motorist Coverage: 1. Bodily Injury Coverage: This coverage provides compensation for injuries sustained as a result of an accident caused by an underinsured motorist. It includes medical expenses, rehabilitation costs, pain and suffering, and other related damages. 2. Property Damage Coverage: If your vehicle or property suffers damage in an accident with an underinsured motorist, this coverage will help pay for repairs or replacement costs. 3. Uninsured Motorist Property Damage Coverage (UMPS): This specialized coverage is designed to protect your property against damages caused by an uninsured or under insured driver. UMPS can help cover repairs or replacement costs for your vehicle or other damaged property. 4. Hit-and-Run Coverage: In cases where the at-fault driver leaves the scene of the accident without providing necessary identification or insurance information, this coverage can provide compensation for your injuries and property damage. 5. Stackable Coverage: Stackable under insured motorist coverage allows individuals to combine the coverage limits of multiple vehicles on one policy. This means that if you have multiple insured vehicles, you can "stack" the coverage limits to increase the potential payout in the event of an accident with an underinsured motorist. When filing a complaint seeking under insured motorist coverage, it is crucial to provide all necessary documentation, including accident reports, medical records, proof of damages, insurance policies, and any other relevant evidence. Working closely with your attorney, you can ensure that your claim is strong and well-supported. If you have been involved in an accident with an underinsured motorist in Newark, New Jersey, it is imperative to understand your rights and options regarding under insured motorist coverage. Consulting a knowledgeable attorney will help you navigate the complaint process and pursue the compensation you deserve.