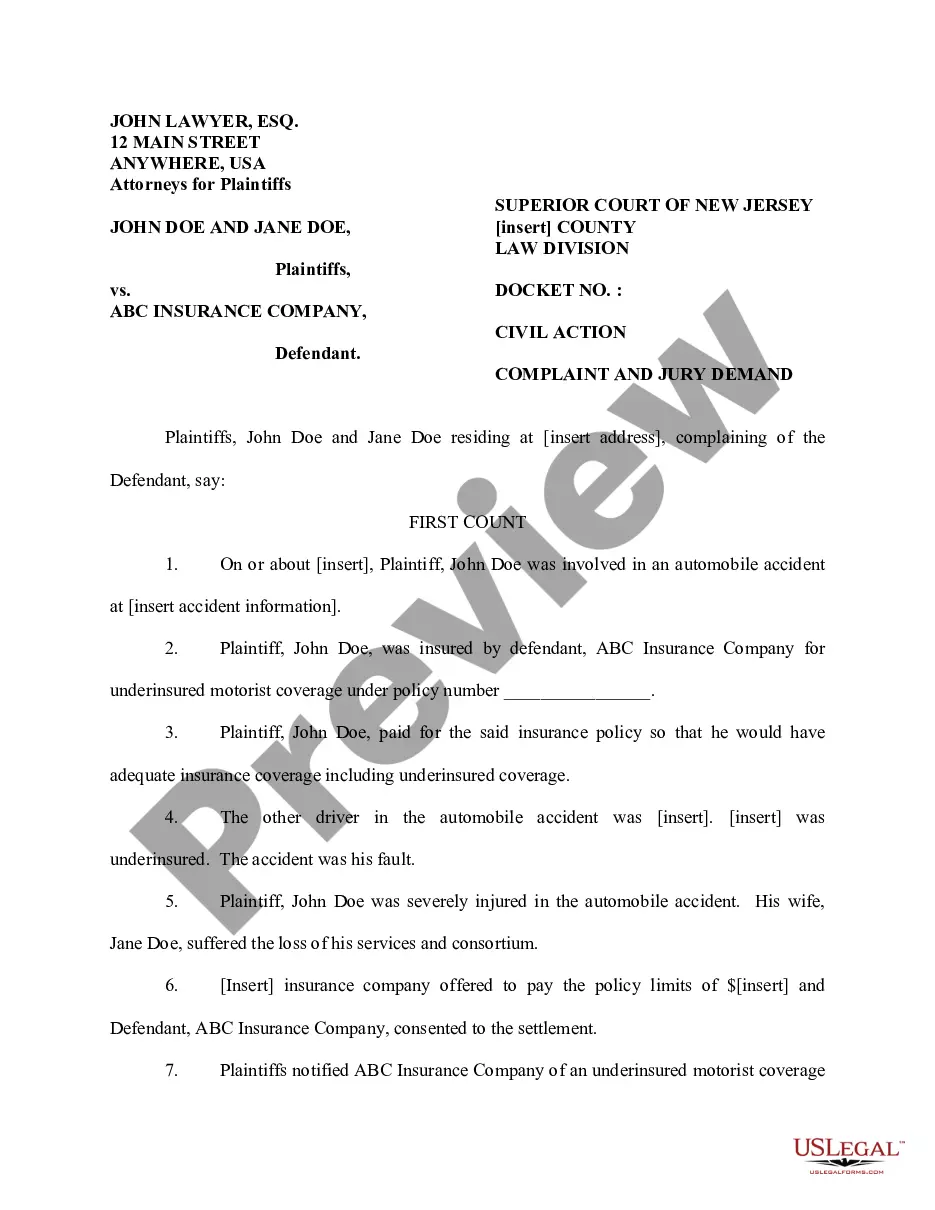

This form is a Complaint Seeking Underinsured Motorist Coverage for use in civil proceedings within the state of New Jersey.

Title: Paterson, New Jersey Complaint Seeking Under insured Motorist Coverage: Understanding the Types and Process Keywords: Paterson, New Jersey, complaint, seeking, under insured motorist coverage, types, process Introduction: In Paterson, New Jersey, individuals who have been involved in accidents with under insured motorists have the right to file a complaint seeking under insured motorist coverage. This coverage is designed to protect individuals from the financial burden that arises when the at-fault driver doesn't have sufficient insurance to cover the damages. In this article, we will provide a detailed description of the process involved in filing a complaint seeking under insured motorist coverage in Paterson, New Jersey. Additionally, we will outline different types of coverage available for Paterson residents. Types of Paterson New Jersey Complaint Seeking Under insured Motorist Coverage: 1. Standard Under insured Motorist Coverage: This type of under insured motorist coverage is the basic option offered in Paterson, New Jersey. It provides coverage for medical expenses, lost wages, and pain and suffering when the at-fault driver's insurance coverage is insufficient to fully compensate the injured party. 2. Enhanced Under insured Motorist Coverage: Enhanced under insured motorist coverage provides higher limits compared to standard coverage. It offers additional protection, ensuring that individuals involved in accidents with under insured drivers receive compensation for their damages up to the policy limits. Process for Filing a Complaint Seeking Under insured Motorist Coverage in Paterson, New Jersey: 1. Gather Necessary Information: Collect all relevant information related to the accident, including police reports, photographs, witness statements, and medical records. This information will be crucial in supporting your case and filing a successful complaint. 2. Notify Your Insurance Company: Immediately after the accident, inform your insurance company about the incident and the fact that the at-fault driver is under insured. This step is crucial as there are strict time limits for filing a complaint seeking under insured motorist coverage in Paterson, New Jersey. 3. Consult an Attorney: Engage the services of an experienced attorney specializing in personal injury and insurance law. They will guide you through the legal process, evaluate your case, ensure you meet all requirements, and help maximize your chances of receiving the compensation you deserve. 4. File a Complaint: With the assistance of your attorney, file a complaint seeking under insured motorist coverage with your insurance company. This formal legal document outlines your case, the damages suffered, and the compensation you are seeking. 5. Negotiations and Settlement: Your attorney will handle negotiations with your insurance company to reach a fair settlement. They will advocate for your rights, ensuring you receive the maximum compensation permitted under the policy. 6. Litigation: If a fair settlement cannot be reached through negotiations, your attorney may recommend filing a lawsuit to pursue the compensation you are entitled to. They will guide you through the court process and fight for your rights in front of a judge and jury. Conclusion: Paterson, New Jersey Complaint Seeking Under insured Motorist Coverage provides residents with the necessary protection when involved in accidents with drivers who lack adequate insurance coverage. Understanding the different types of coverage available and the process involved in filing a complaint is crucial for individuals seeking just compensation. By following the appropriate steps and seeking legal representation, Paterson residents can ensure their rights are protected and receive the financial support they need to recover from accidents caused by under insured motorists.Title: Paterson, New Jersey Complaint Seeking Under insured Motorist Coverage: Understanding the Types and Process Keywords: Paterson, New Jersey, complaint, seeking, under insured motorist coverage, types, process Introduction: In Paterson, New Jersey, individuals who have been involved in accidents with under insured motorists have the right to file a complaint seeking under insured motorist coverage. This coverage is designed to protect individuals from the financial burden that arises when the at-fault driver doesn't have sufficient insurance to cover the damages. In this article, we will provide a detailed description of the process involved in filing a complaint seeking under insured motorist coverage in Paterson, New Jersey. Additionally, we will outline different types of coverage available for Paterson residents. Types of Paterson New Jersey Complaint Seeking Under insured Motorist Coverage: 1. Standard Under insured Motorist Coverage: This type of under insured motorist coverage is the basic option offered in Paterson, New Jersey. It provides coverage for medical expenses, lost wages, and pain and suffering when the at-fault driver's insurance coverage is insufficient to fully compensate the injured party. 2. Enhanced Under insured Motorist Coverage: Enhanced under insured motorist coverage provides higher limits compared to standard coverage. It offers additional protection, ensuring that individuals involved in accidents with under insured drivers receive compensation for their damages up to the policy limits. Process for Filing a Complaint Seeking Under insured Motorist Coverage in Paterson, New Jersey: 1. Gather Necessary Information: Collect all relevant information related to the accident, including police reports, photographs, witness statements, and medical records. This information will be crucial in supporting your case and filing a successful complaint. 2. Notify Your Insurance Company: Immediately after the accident, inform your insurance company about the incident and the fact that the at-fault driver is under insured. This step is crucial as there are strict time limits for filing a complaint seeking under insured motorist coverage in Paterson, New Jersey. 3. Consult an Attorney: Engage the services of an experienced attorney specializing in personal injury and insurance law. They will guide you through the legal process, evaluate your case, ensure you meet all requirements, and help maximize your chances of receiving the compensation you deserve. 4. File a Complaint: With the assistance of your attorney, file a complaint seeking under insured motorist coverage with your insurance company. This formal legal document outlines your case, the damages suffered, and the compensation you are seeking. 5. Negotiations and Settlement: Your attorney will handle negotiations with your insurance company to reach a fair settlement. They will advocate for your rights, ensuring you receive the maximum compensation permitted under the policy. 6. Litigation: If a fair settlement cannot be reached through negotiations, your attorney may recommend filing a lawsuit to pursue the compensation you are entitled to. They will guide you through the court process and fight for your rights in front of a judge and jury. Conclusion: Paterson, New Jersey Complaint Seeking Under insured Motorist Coverage provides residents with the necessary protection when involved in accidents with drivers who lack adequate insurance coverage. Understanding the different types of coverage available and the process involved in filing a complaint is crucial for individuals seeking just compensation. By following the appropriate steps and seeking legal representation, Paterson residents can ensure their rights are protected and receive the financial support they need to recover from accidents caused by under insured motorists.