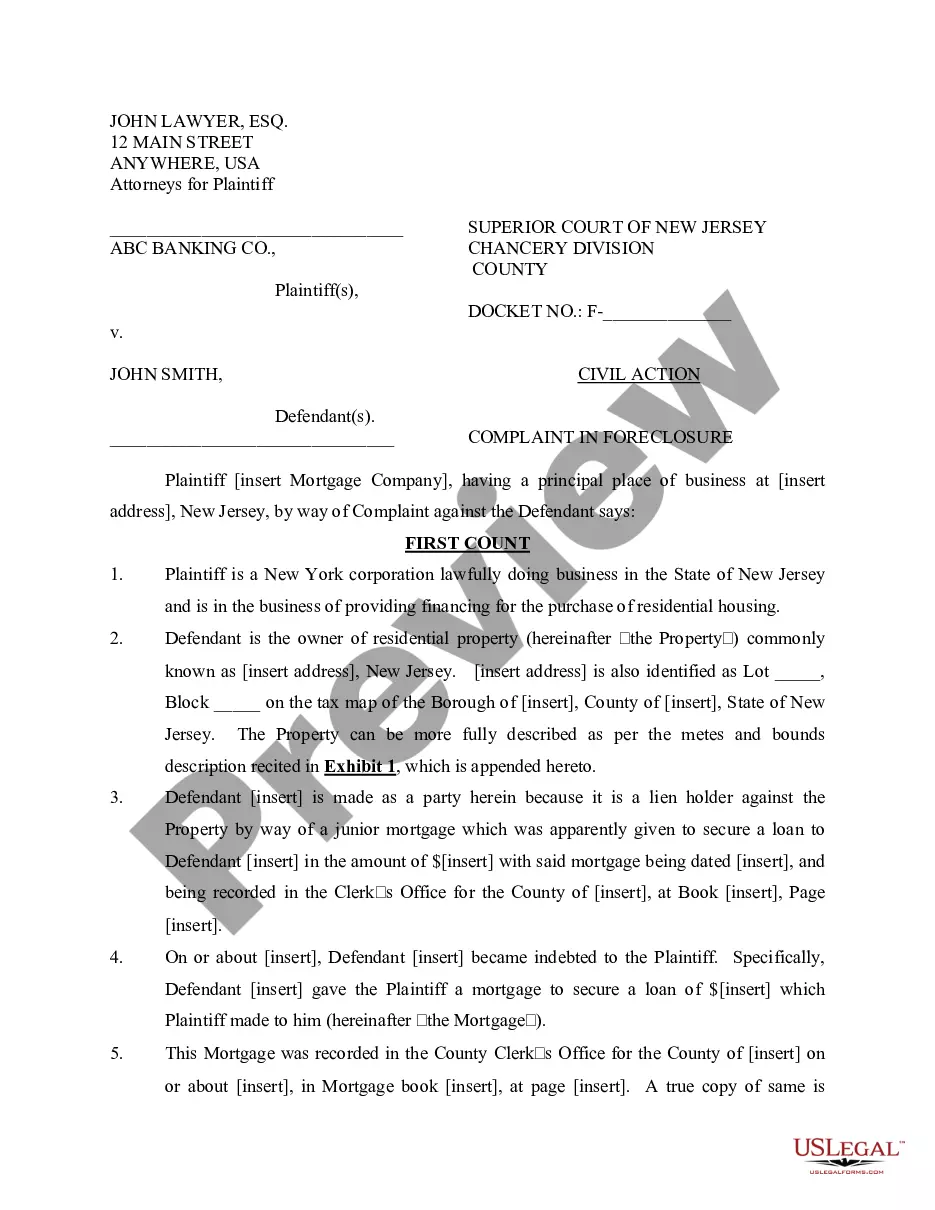

This form is a Complaint for Foreclosure of a Commercial property for use in civil proceedings within the state of New Jersey.

Elizabeth New Jersey Complaint for Foreclosure Commercial

Description

How to fill out New Jersey Complaint For Foreclosure Commercial?

No matter your societal or occupational position, completing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it’s almost impossible for an individual without any legal education to create such documents from the ground up, primarily due to the complicated terminology and legal subtleties involved.

This is where US Legal Forms becomes useful.

Ensure that the template you select is appropriate for your region since the laws of one state or area may not apply to another.

Review the document and read a concise summary (if available) of the situations the form can be utilized for.

- Our platform offers an extensive library of over 85,000 ready-to-use state-specific forms applicable to nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance their efficiency using our DIY templates.

- Whether you need the Elizabeth New Jersey Complaint for Foreclosure Commercial or any other documentation that is valid in your jurisdiction, US Legal Forms has everything readily available.

- Here’s how you can quickly obtain the Elizabeth New Jersey Complaint for Foreclosure Commercial using our reliable platform.

- If you are already a customer, simply Log In to your account to download the necessary form.

- If you are new to our platform, make sure to follow these instructions before acquiring the Elizabeth New Jersey Complaint for Foreclosure Commercial.

Form popularity

FAQ

When facing an Elizabeth New Jersey Complaint for Foreclosure Commercial, property owners have several defenses they can consider. One common defense is proving that the lender did not follow proper legal procedures during the foreclosure process. Additionally, demonstrating a lack of standing by the lender can also serve as a strong defense. It’s essential to consult legal advice and explore all available options to protect your interests in such situations.

In New Jersey, you typically have 35 days to respond to a foreclosure complaint after it has been served. Failing to respond within this time frame can lead to a default judgment against you, giving the lender the right to proceed with foreclosure. It is important to take this timeline seriously and seek legal assistance or use resources like USLegalForms to help you prepare your response effectively.

The Fair Foreclosure Act in New Jersey establishes guidelines that protect homeowners facing foreclosure. This law requires lenders to follow specific procedures before proceeding with a foreclosure complaint, ensuring transparency and fairness. It aims to provide homeowners in Elizabeth, New Jersey, who are dealing with a complaint for foreclosure commercial the opportunity to understand their rights and seek assistance.

To file an answer to a foreclosure complaint, gather relevant information regarding your case, and prepare your response according to your local court's rules. You must file your answer with the court and serve it to the lender or their legal representative within the required timeframe. Using resources from US Legal Forms can help ensure your answer is complete and accurate, especially for an Elizabeth New Jersey Complaint for Foreclosure Commercial.

To report a foreclosure, you should contact your local county clerk's office or the municipal office where the property is located. They can provide guidance on the necessary steps and forms needed for reporting. Utilizing platforms like US Legal Forms can simplify this process by offering templates and legal guidance tailored for an Elizabeth New Jersey Complaint for Foreclosure Commercial.

In New Jersey, a tenant can typically remain in a foreclosed property until the new owner takes formal possession. This process often involves an eviction action, which allows ample time for tenants to find new housing. If you are facing an Elizabeth New Jersey Complaint for Foreclosure Commercial, it's essential to know your rights and responsibilities during this transition.

The new foreclosure law in New Jersey aims to streamline the process while providing protections to homeowners. This law includes requirements for lenders to engage in mediation before moving forward with foreclosure actions. Understanding this law is crucial if you are dealing with an Elizabeth New Jersey Complaint for Foreclosure Commercial, as it impacts timelines and options available.