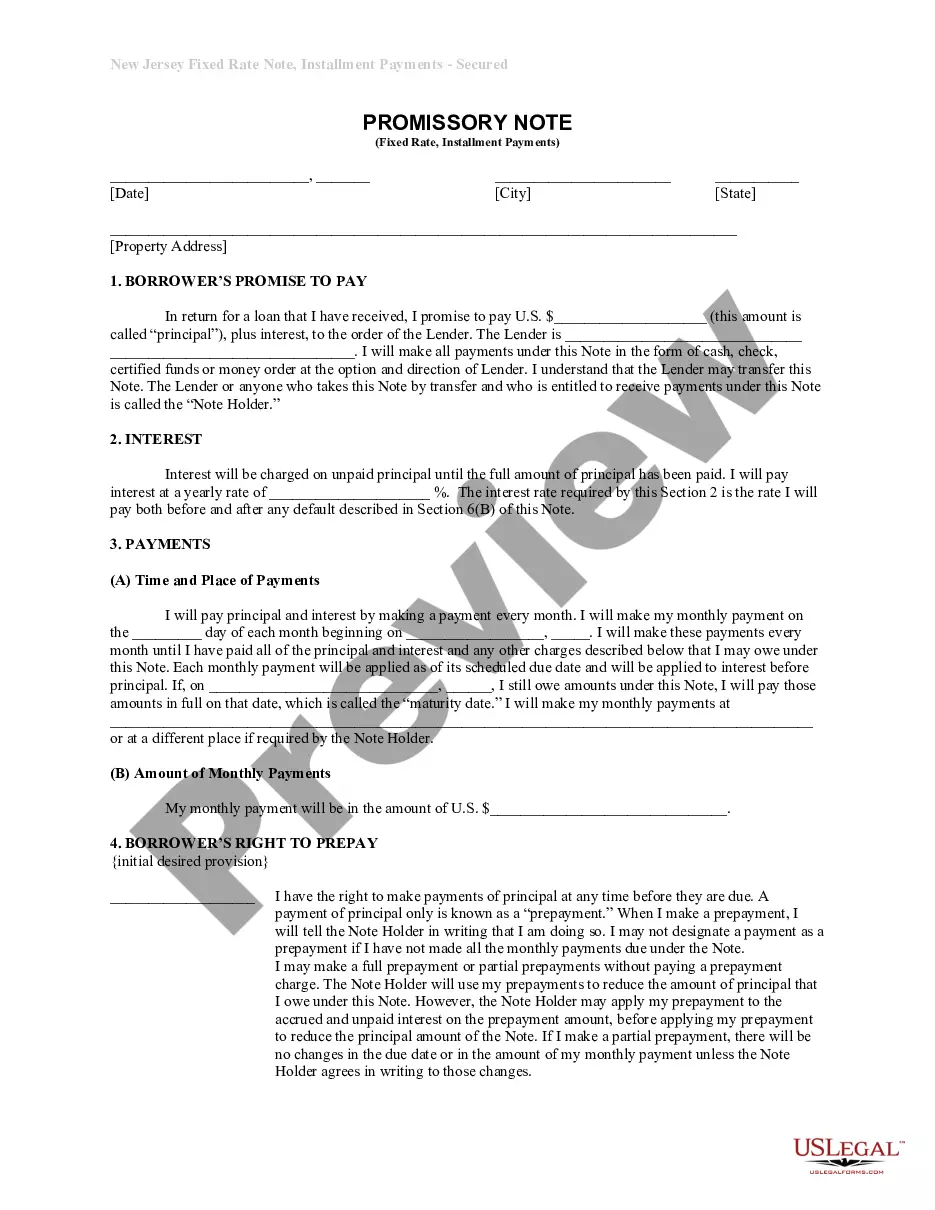

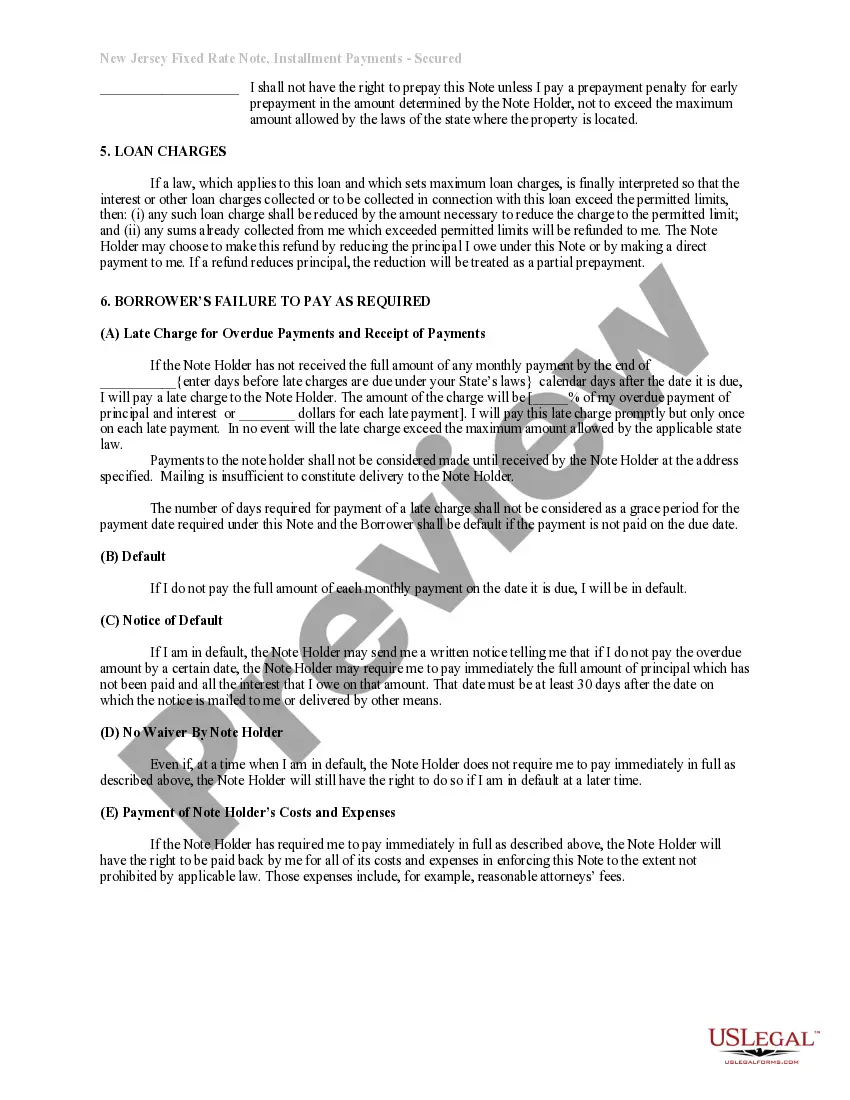

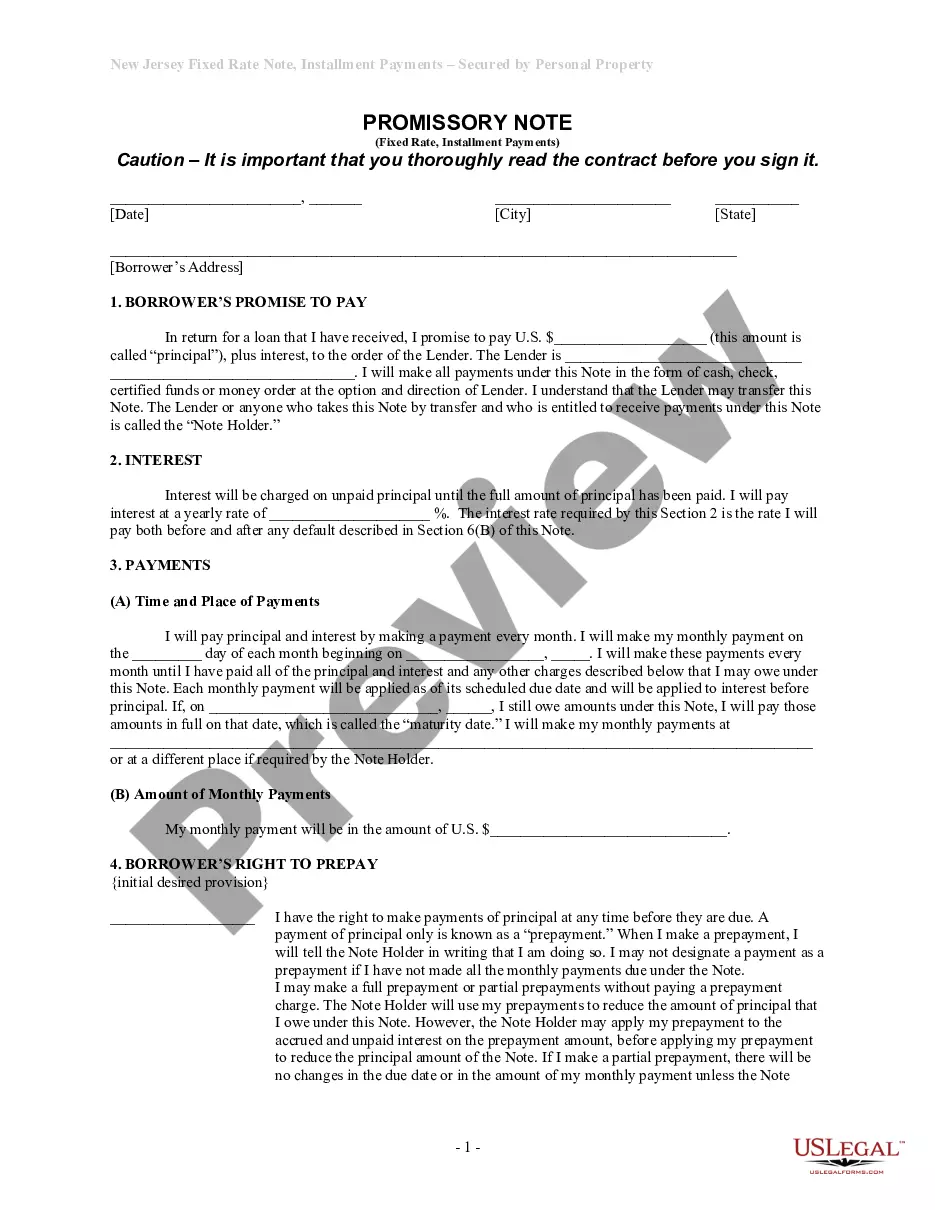

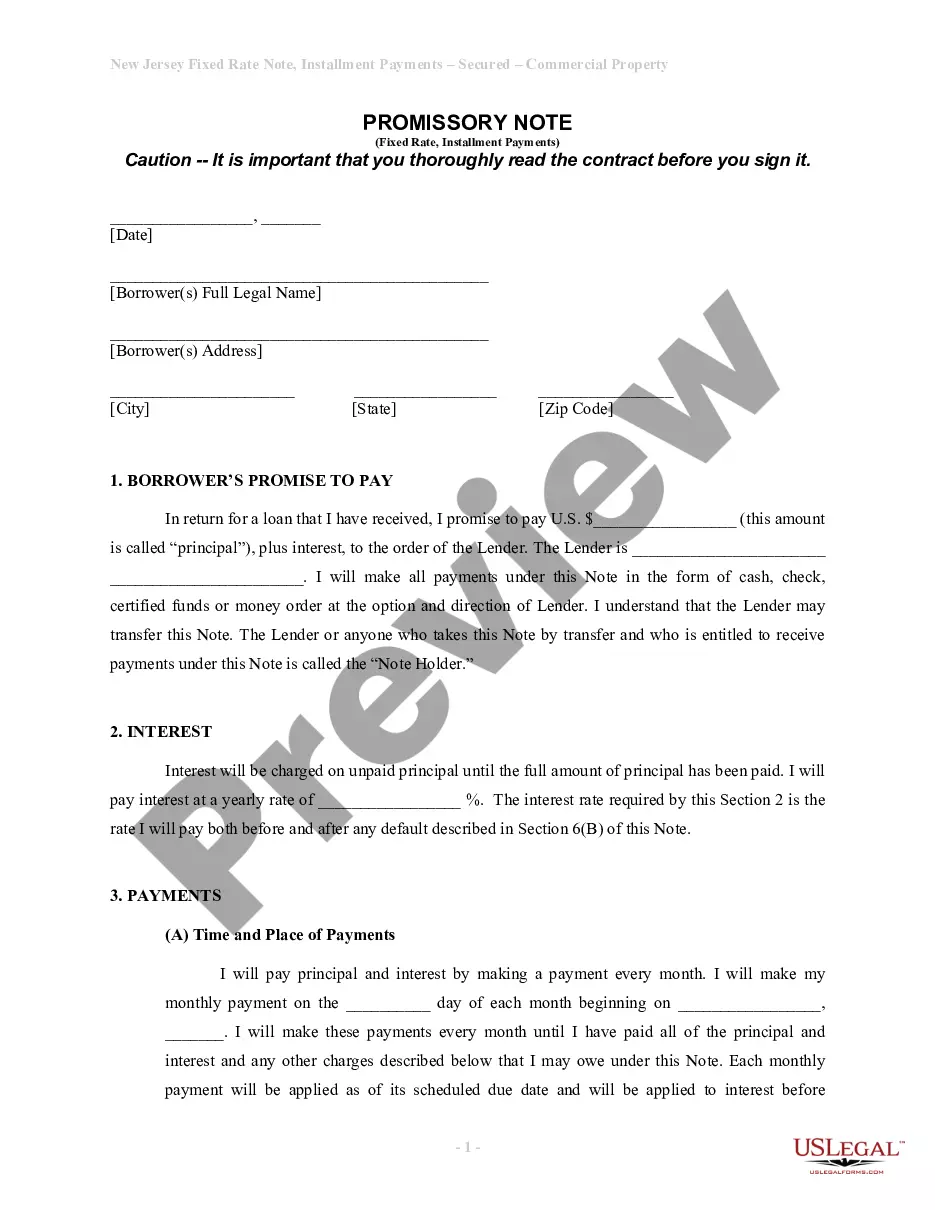

Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you have previously utilized our service, Log In to your account and download the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate to your device by clicking the Download button. Confirm that your subscription is active. If it’s not, renew it following your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to each document you have acquired: you can find it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business needs!

- Ensure you’ve located a suitable document. Browse through the description and utilize the Preview option, if it exists, to verify if it meets your needs. If it does not fit your requirements, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make a payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Obtain your Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Select the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

In New Jersey, a promissory note does not necessarily need to be notarized to be enforceable. However, notarization can add an extra layer of authenticity to your Installments Fixed Rate Promissory Note Secured by Residential Real Estate, which can be beneficial in the case of disputes. It’s a good practice to have witnesses or a notary public present during the signing to enhance the legitimacy of the document. Consulting resources like US Legal Forms can help you navigate this process.

In New Jersey, the statute of limitations for a promissory note is generally six years from the date of default. This means that if you fail to make a payment on your Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the lender has six years to take legal action. Understanding this timeframe can help both lenders and borrowers plan appropriately. It’s important to maintain open communication to avoid issues that could lead to default.

A promissory note is generally enforceable if it includes essential components like the borrower's acknowledgment of debt, repayment terms, and signatures. In Paterson, New Jersey, your Installments Fixed Rate Promissory Note Secured by Residential Real Estate will gain a higher level of enforceability if it follows state regulations and is clearly drafted. Courts prioritize clarity and intent over technical errors in most cases. However, obtaining legal advice can bolster your note’s enforceability.

Yes, a promissory note can hold up in a court of law when properly executed. In Paterson, New Jersey, a well-drafted Installments Fixed Rate Promissory Note Secured by Residential Real Estate can serve as a binding agreement. The court typically looks for specific terms, such as repayment schedule and interest rate, to validate the note. It's advisable to consult with a legal expert to ensure your note meets all necessary requirements.

You can obtain a promissory note for your mortgage through various financial institutions, including banks and credit unions. Additionally, platforms like US Legal Forms provide templates that you can customize to fit your specific situation. With access to a reliable template for the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can ensure that your document complies with local requirements. This can save you time and make the process smoother.

The document that secures the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate is commonly referred to as a mortgage or a deed of trust. This document establishes a legal claim against the property, providing lenders with security in case of default. The mortgage ensures that repayment of the promissory note is tied directly to the residential real estate. Therefore, it protects both the borrower and the lender during the mortgage process.

You file a promissory note with the county clerk's office in the jurisdiction where the property is located. In Paterson, New Jersey, this means visiting the local county clerk to ensure proper filing. This action creates a public record, enhancing the enforceability of your Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate. If you need assistance with the filing process, platforms like uslegalforms can guide you through the necessary steps.

Yes, recording a secured promissory note is often beneficial. By recording the note, you establish a public record of your claim against the property. This process can protect your rights as a lender in the case of disputes. If you are considering a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate, utilizing a formal recording process can provide added security.

The security for a promissory note typically consists of collateral, which can include real property or other valuable assets. This collateral acts as a guarantee for repayment, protecting the lender in case of default. When dealing with a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate, having tangible assets as security can lead to more advantageous terms.

Yes, promissory notes are legal in New Jersey. They must comply with state laws to ensure enforceability. Utilizing a well-drafted Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate will help protect your interests while adhering to legal requirements.