A detailed description of Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property: In Elizabeth, New Jersey, individuals seeking financial assistance have the option to apply for an Installments Fixed Rate Promissory Note Secured by Personal Property. This type of loan offers borrowers a reliable solution when in need of immediate funds while securing their personal property as collateral. The Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property is designed to provide financial flexibility and stability for borrowers. With a fixed interest rate, borrowers can comfortably plan their repayment schedule, knowing that the interest rate will remain constant throughout the loan term. This feature allows for accurate financial planning and budgeting. By securing the promissory note with personal property, borrowers can access larger loan amounts and potentially receive more favorable interest rates compared to unsecured loans. Personal property that can be used as collateral may include valuable assets, such as a vehicle, real estate, jewelry, or other valuable possessions. The collateral serves as a way to mitigate the lender's risk, providing assurance that the loan will be repaid. Different types or variations of the Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property may exist depending on specific requirements or preferences. Some variations might include options for different repayment periods, specific interest rates, or loan structures tailored to individual needs. Additionally, the eligibility criteria or terms and conditions might vary based on the lending institution providing the loan. It is important for borrowers to thoroughly review the terms and conditions of the promissory note, including interest rates, repayment schedule, late payment penalties, and any additional fees. Borrowers are encouraged to compare different lenders to ensure they choose a reputable and reliable institution offering competitive rates and favorable terms. Overall, the Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property presents a valuable opportunity for individuals in need of financial assistance. By combining the benefits of structured repayment, fixed interest rates, and collateralized security, this loan option provides a practical and adaptable solution for borrowers in Elizabeth, New Jersey, while also ensuring the lender's investment is protected.

Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured By Personal Property?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

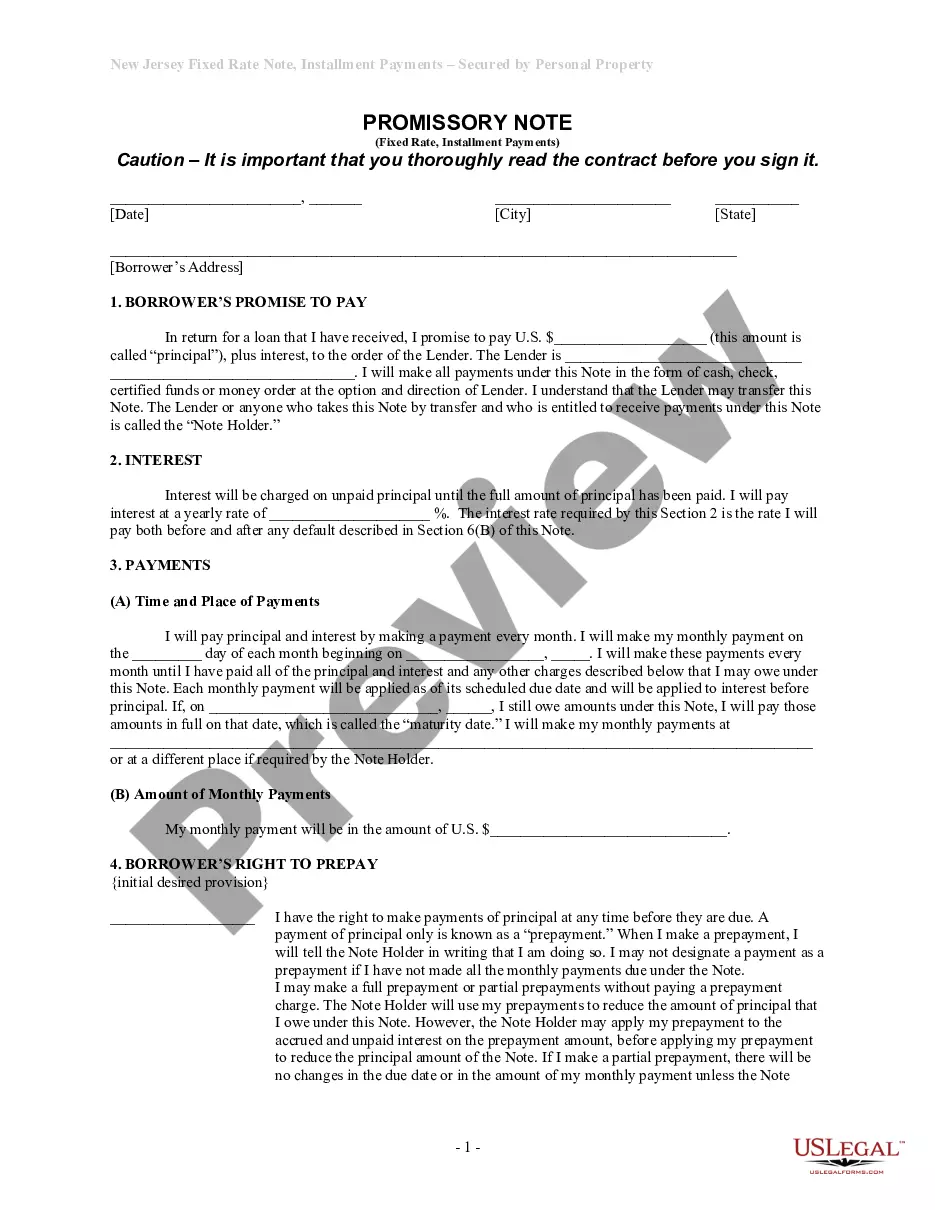

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!