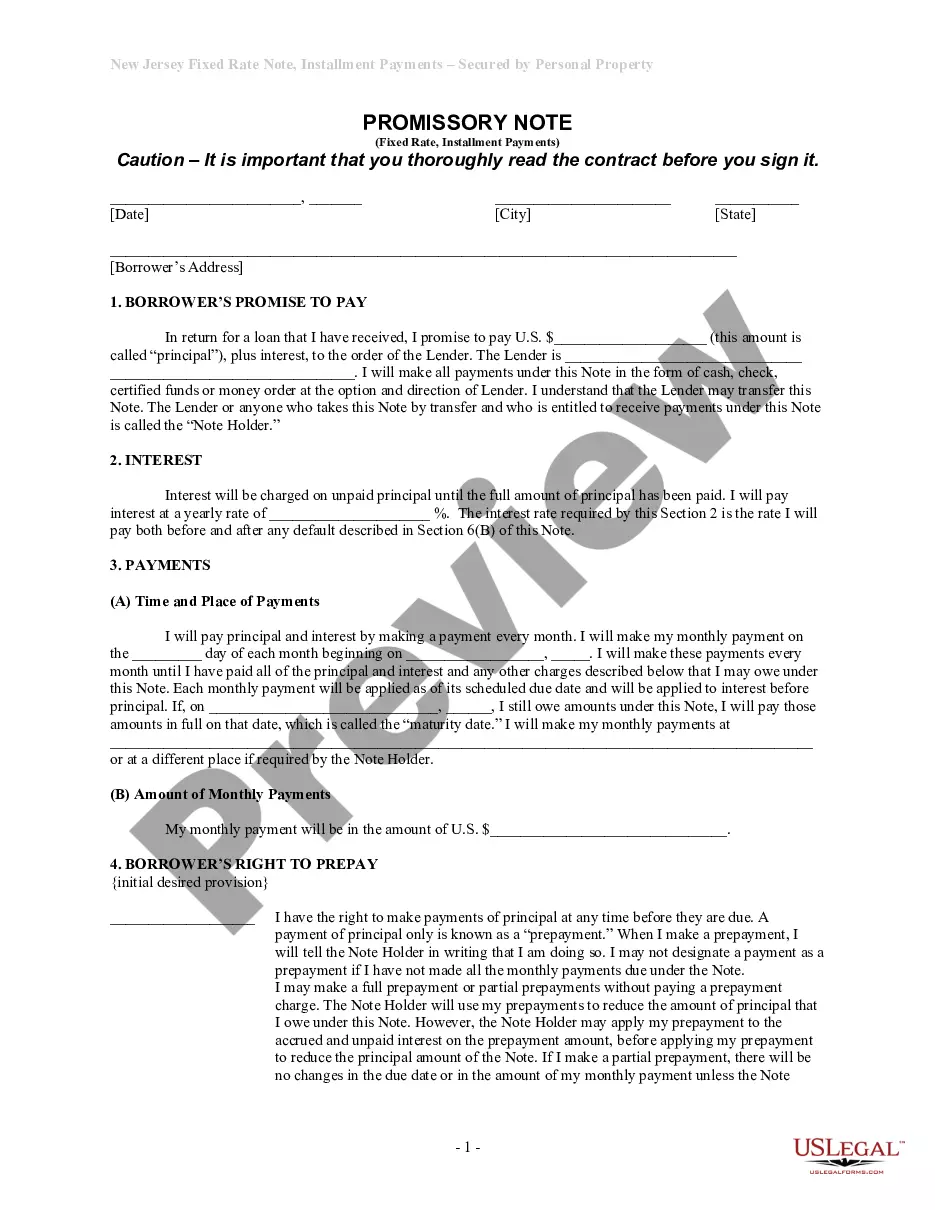

A Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Paterson, New Jersey. This type of promissory note is specifically designed to secure the loan with personal property, providing the lender with added protection in case of default. The terms and conditions of the promissory note include the principal amount borrowed, the fixed interest rate applied to the loan, and the agreed-upon installment payments to be made by the borrower. The borrower pledges personal property as collateral, which can include vehicles, real estate, jewelry, or any other valuable assets. This collateral will be seized by the lender in the event of default as a means of repayment. There are several variations of the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, depending on the specific requirements and preferences of the lender and borrower. These variations may include: 1. Vehicle Installments Fixed Rate Promissory Note Secured by Personal Property: This type of promissory note is used when the borrower pledges a vehicle as collateral for the loan. It is commonly utilized for auto loans or loans secured by recreational vehicles (RVs), motorcycles, or boats. 2. Real Estate Installments Fixed Rate Promissory Note Secured by Personal Property: When the borrower secures the loan with residential or commercial property, this variation is used. It provides an added layer of security to the lender, ensuring the borrower's commitment to making regular installment payments. 3. Jewelry Installments Fixed Rate Promissory Note Secured by Personal Property: In cases where valuable jewelry, such as precious stones or watches, is pledged as collateral, this type of promissory note comes into play. It ensures that the lender has the right to seize the pledged jewelry in case of default. The Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property is a critical legal document that safeguards the interests of both the lender and borrower. It establishes clear guidelines regarding the repayment schedule, interest rate, and consequences of default. This type of promissory note is commonly used in Paterson, New Jersey, as a means of providing financial assistance while mitigating the risks involved for the lender through the inclusion of secured personal property.

Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Paterson New Jersey Installments Fixed Rate Promissory Note Secured By Personal Property?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person without any legal education to draft this sort of papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform offers a massive collection with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property in minutes using our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to download the appropriate form.

However, in case you are new to our library, make sure to follow these steps prior to obtaining the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property:

- Ensure the template you have chosen is good for your area because the rules of one state or county do not work for another state or county.

- Preview the document and read a short outline (if available) of cases the document can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and look for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or create one from scratch.

- Pick the payment gateway and proceed to download the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property once the payment is completed.

You’re good to go! Now you can proceed to print the document or complete it online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.