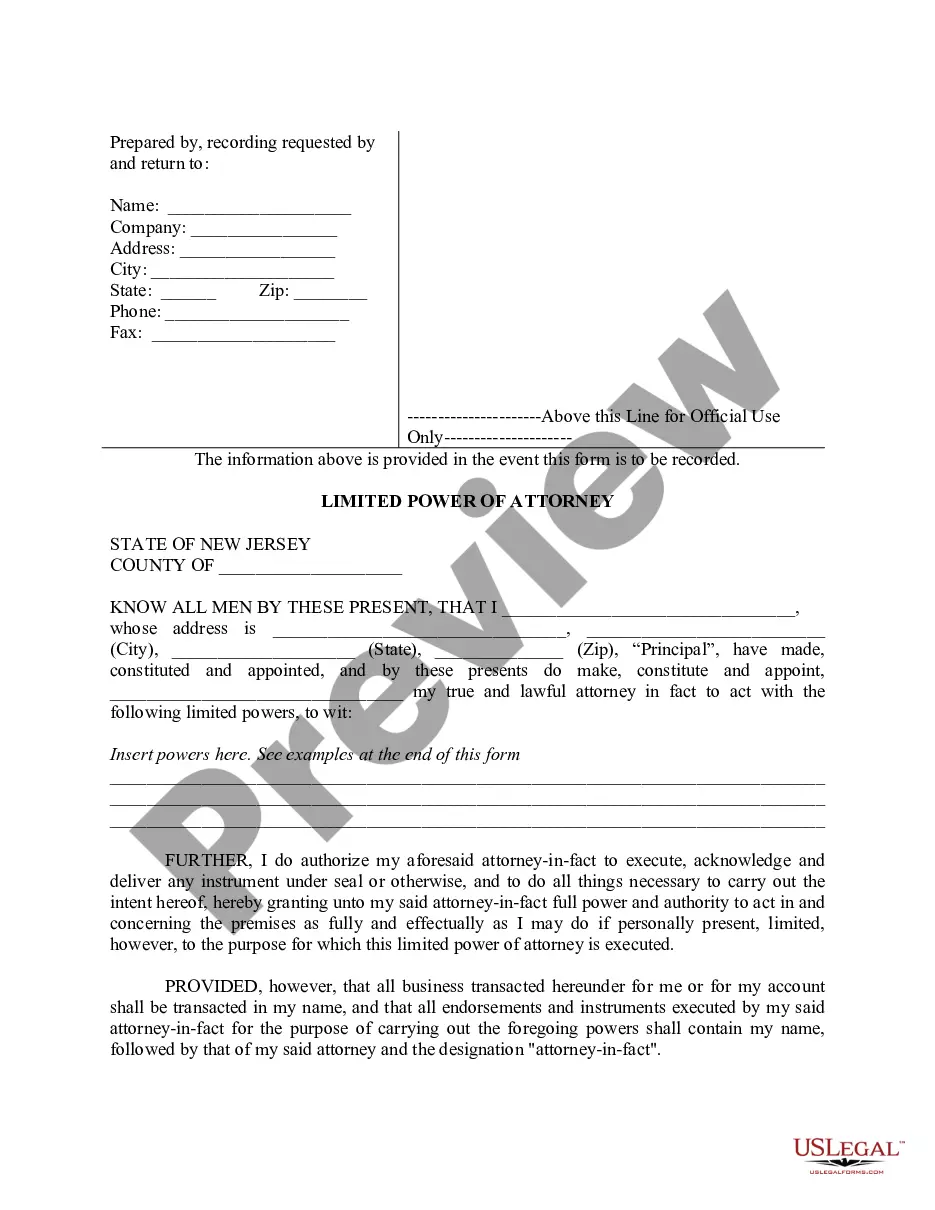

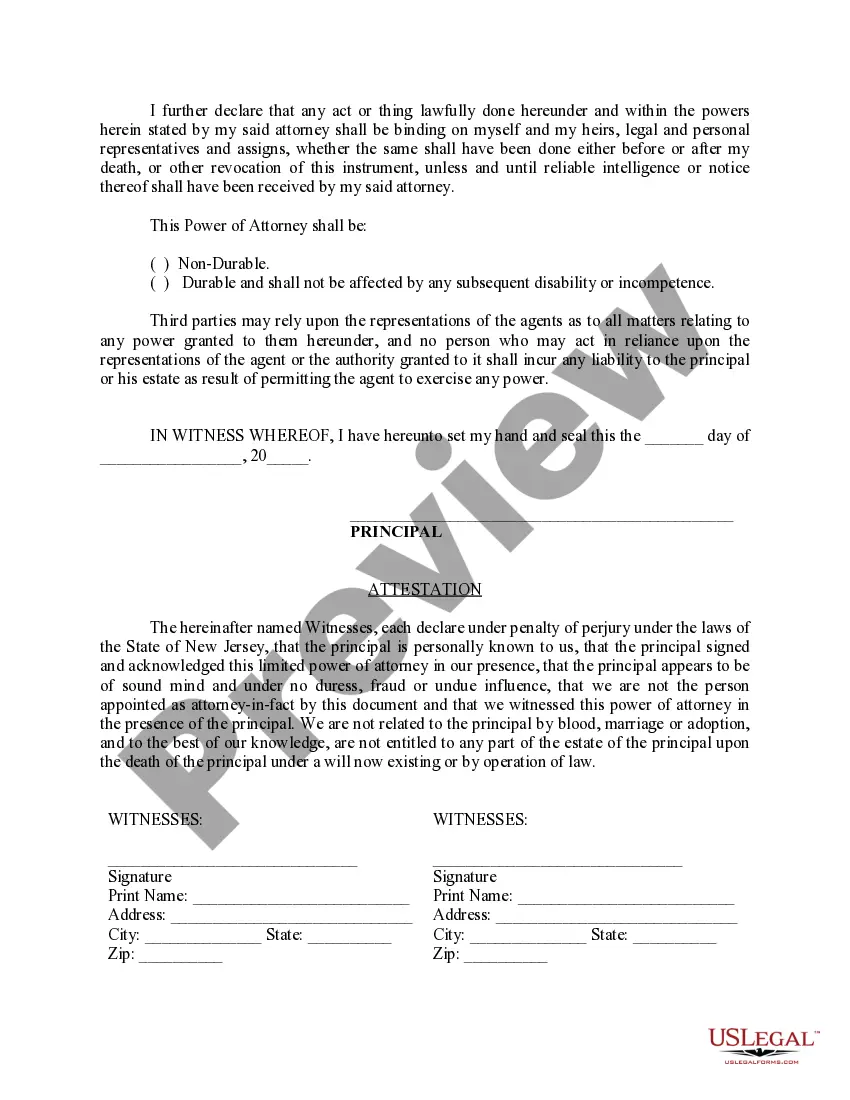

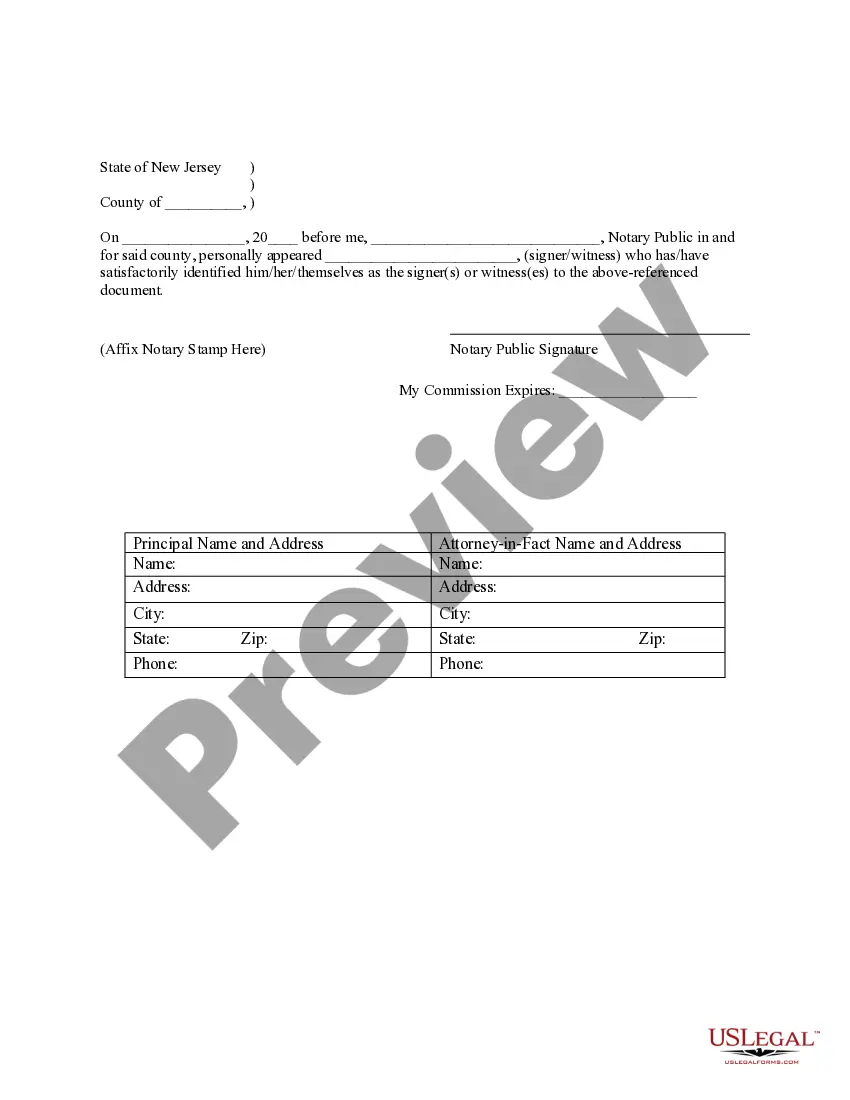

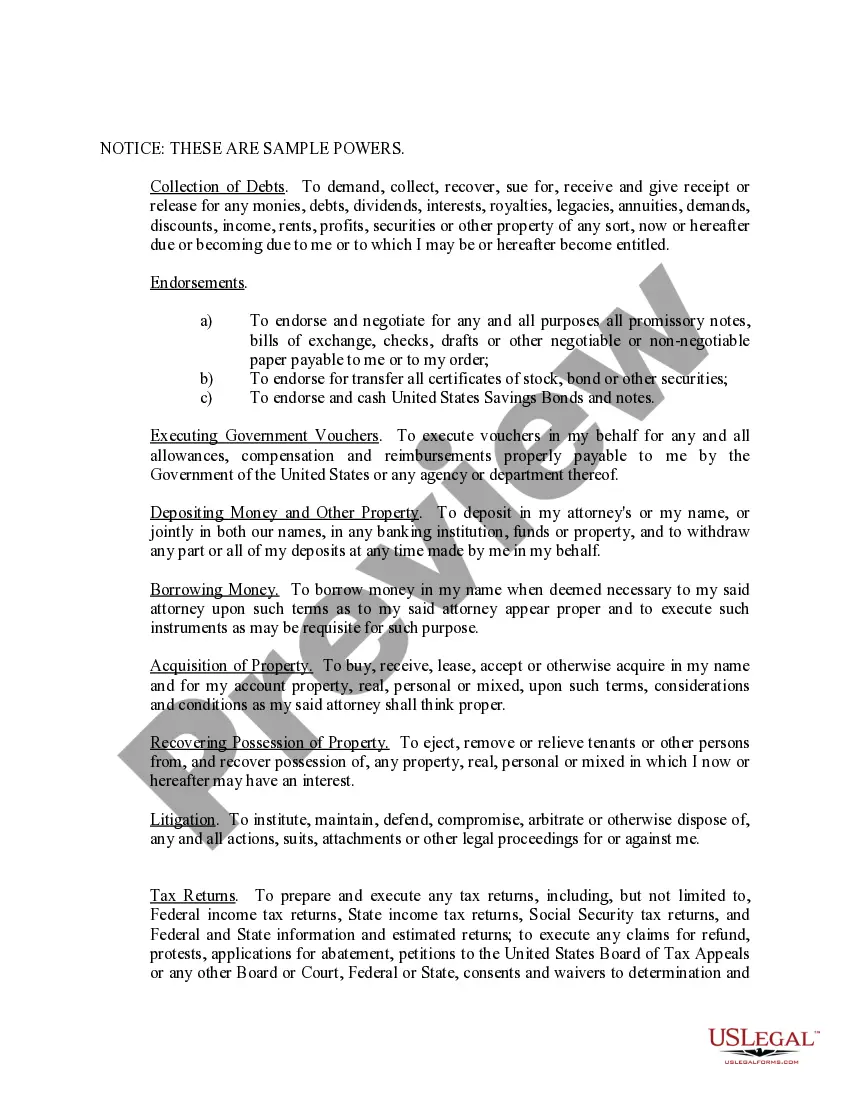

Elizabeth, New Jersey Limited Power of Attorney, also known as POA, is a legal document that grants authority to an individual, referred to as the agent or attorney-in-fact, to make decisions and act on behalf of another person, known as the principal. This document specifies the powers and limitations that the agent is permitted to exercise. There are several types of Elizabeth, New Jersey Limited Power of Attorney with different specified powers. Some common types include: 1. Financial Power of Attorney: This type of limited POA grants the agent the power to handle financial matters on behalf of the principal. These powers may include managing bank accounts, paying bills, collecting debts, making investments, and filing taxes. 2. Real Estate Power of Attorney: With this limited POA, the agent is authorized to handle real estate transactions for the principal. This may include buying or selling property, signing contracts, managing rental properties, or dealing with mortgage and insurance matters. 3. Healthcare Power of Attorney: This type of limited POA grants the agent the authority to make medical decisions for the principal. The agent has the power to choose doctors, consent to or refuse medical procedures, access medical records, and make end-of-life decisions if the principal is unable to do so. When drafting an Elizabeth, New Jersey Limited Power of Attorney, it is crucial to specify the powers and limitations clearly. Here are some sample powers that can be included: 1. Conduct financial transactions on behalf of the principal, including banking, investments, and the purchase or sale of assets. 2. Manage and operate any business interests owned by the principal. 3. Collect debts owed to the principal and file or defend lawsuits on their behalf if necessary. 4. Make healthcare decisions, including consent to or refusal of medical treatments, surgeries, or medications. 5. Access and disclose medical records, communicate with healthcare providers, and select appropriate treatment facilities. 6. Handle real estate matters, such as buying, selling, leasing, or mortgaging properties. 7. Manage insurance policies, file claims, and represent the principal in insurance-related matters. 8. Handle tax-related matters, including filing returns, paying taxes, and communicating with tax authorities. 9. Act as a representative in government-related affairs, including signing documents and receiving official correspondence. 10. Make decisions regarding the care and education of minor children or dependents. It is essential to consult an attorney while drafting a limited power of attorney document to ensure it complies with the specific laws and regulations of Elizabeth, New Jersey. Additionally, both the principal and agent must carefully review and understand the document before signing it to avoid any confusion or misunderstanding.

Elizabeth New Jersey Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Elizabeth New Jersey Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Elizabeth New Jersey Limited Power of Attorney where you Specify Powers with Sample Powers Included becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Elizabeth New Jersey Limited Power of Attorney where you Specify Powers with Sample Powers Included takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Elizabeth New Jersey Limited Power of Attorney where you Specify Powers with Sample Powers Included. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!