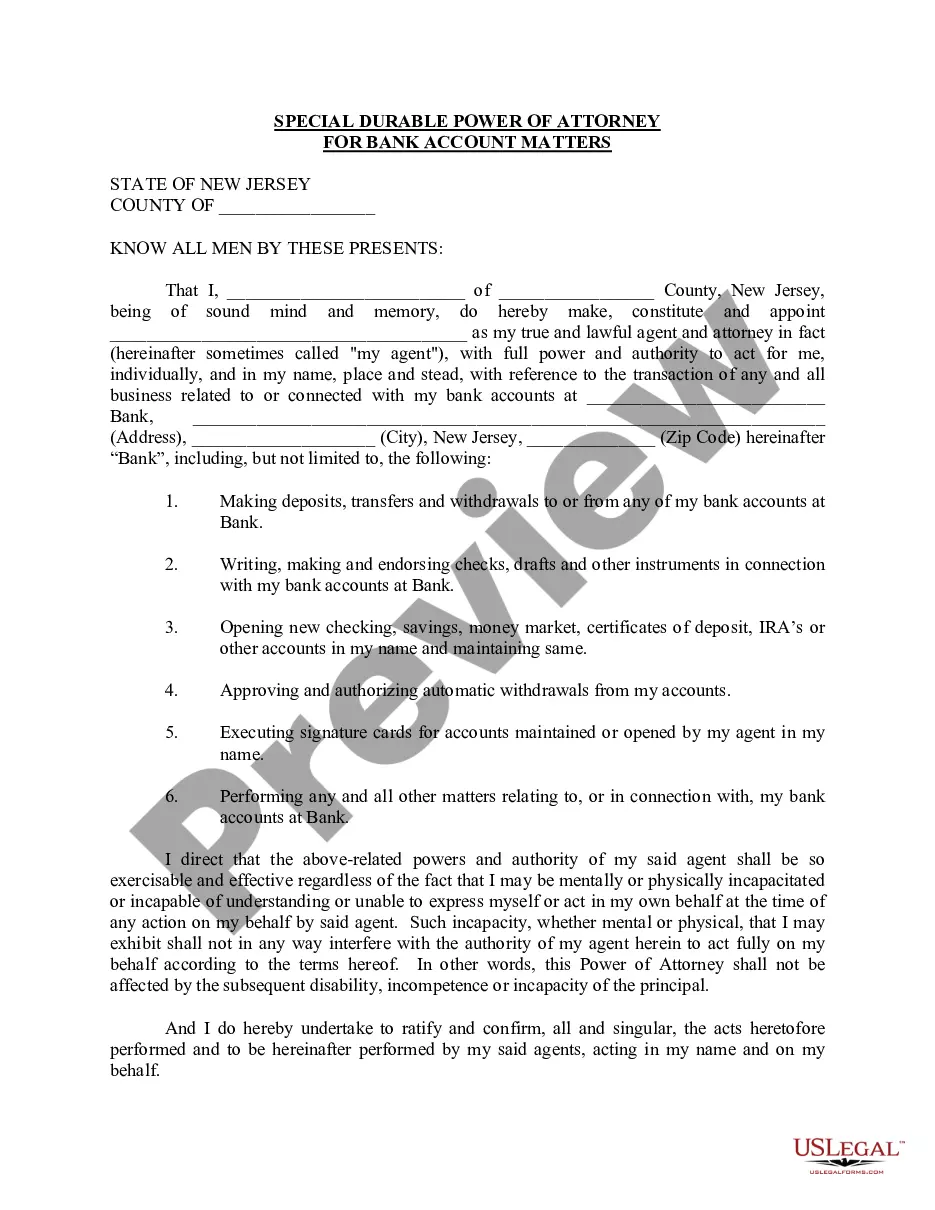

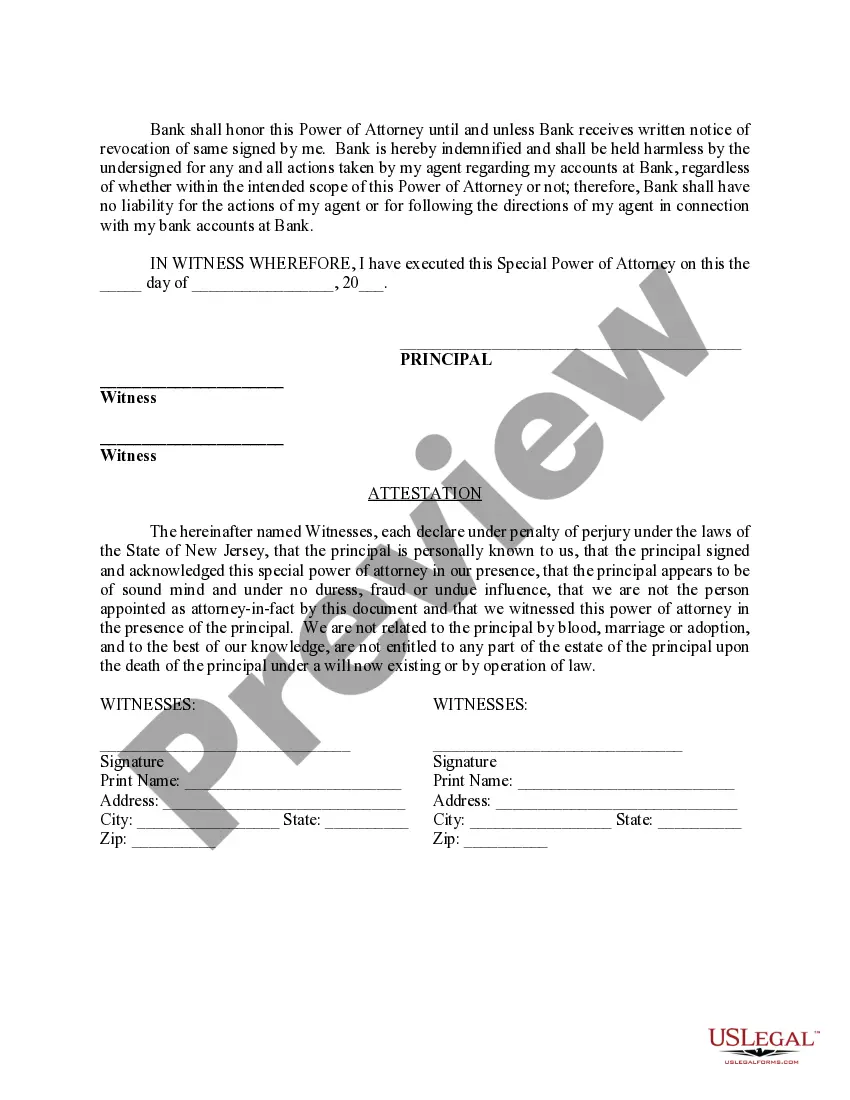

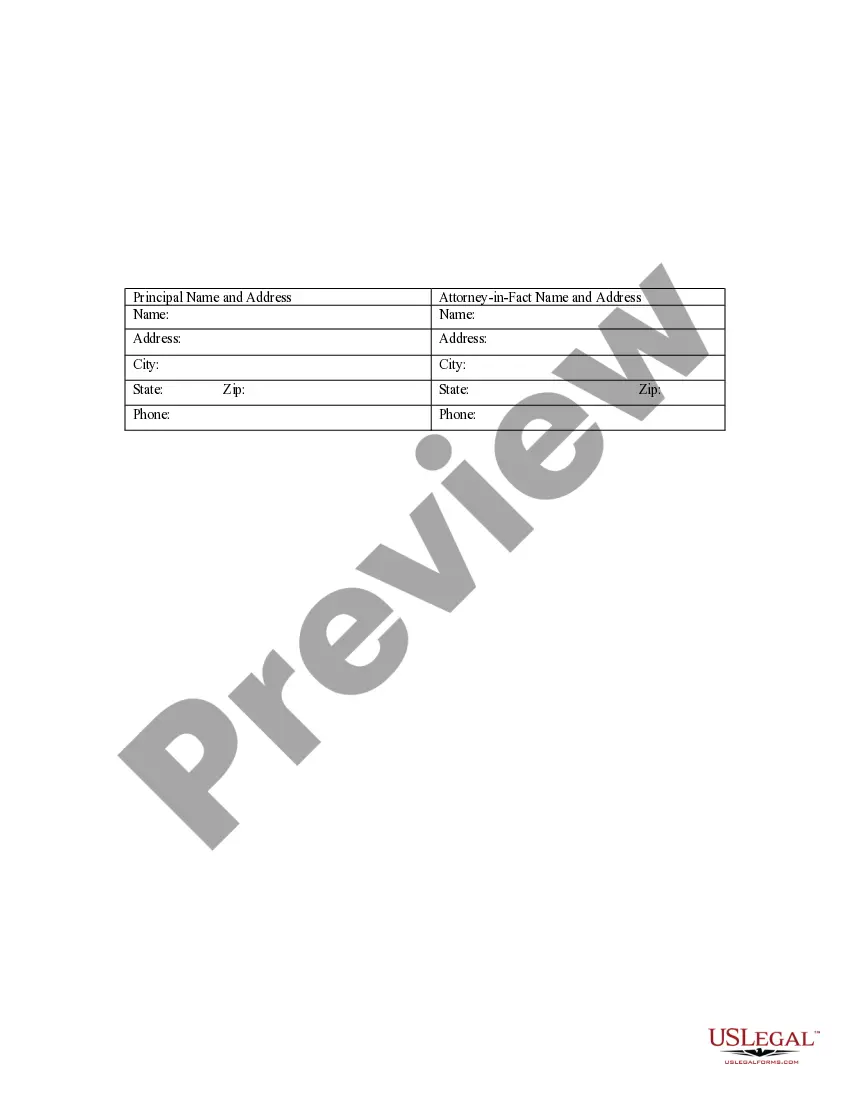

Newark New Jersey Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual, referred to as the "agent" or "attorney-in-fact," the authority to manage specific bank account matters on behalf of another person, known as the "principal." This legal arrangement ensures that the principal's financial affairs, specifically related to bank accounts, are taken care of during periods of incapacitation, absence, or any other specified circumstances. A Special Durable Power of Attorney for Bank Account Matters in Newark, New Jersey, allows the principal to define the specific powers granted to the agent. These powers can include managing bank accounts, making deposits or withdrawals, paying bills, transferring funds, resolving issues with the bank, accessing financial records, and engaging in any other bank account-related activities specifically designated by the principal. There are various types of Newark New Jersey Special Durable Power of Attorney for Bank Account Matters that can be tailored to meet the principal's unique needs and preferences. Some common types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent limited authority to handle specific bank account matters designated by the principal. The agent's powers may be restricted to a particular bank account or a particular purpose, such as paying bills or managing investments. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to limited power of attorney, this type grants the agent broad authority to handle all bank account matters on behalf of the principal. The agent can perform any action related to the principal's bank accounts, as specified in the power of attorney document. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only upon the occurrence of a specific event or condition, typically the incapacity of the principal. This type ensures that the agent's powers are activated only when the principal is unable to manage their bank accounts themselves. 4. Non-Springing Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney takes effect as soon as it is executed and remains in effect until it is revoked by the principal, or the principal passes away. The agent's authority is not contingent on any specific event or condition. It's important to consult with a qualified attorney in Newark, New Jersey, who specializes in estate planning and power of attorney matters to ensure the document's proper drafting and execution. This attorney can guide the principal through the legal requirements and assist in tailoring the power of attorney to the principal's specific needs and circumstances.

Newark New Jersey Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Newark New Jersey Special Durable Power Of Attorney For Bank Account Matters?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are very costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Newark New Jersey Special Durable Power of Attorney for Bank Account Matters or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Newark New Jersey Special Durable Power of Attorney for Bank Account Matters complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Newark New Jersey Special Durable Power of Attorney for Bank Account Matters would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!