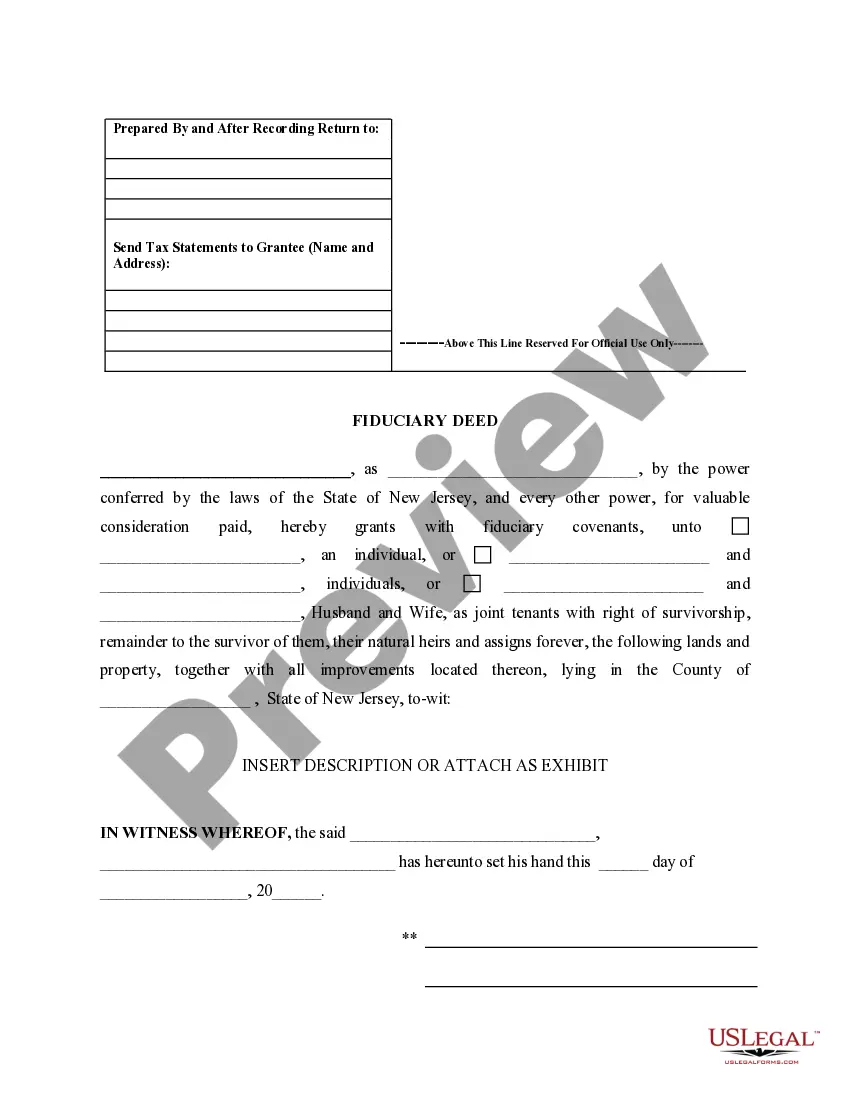

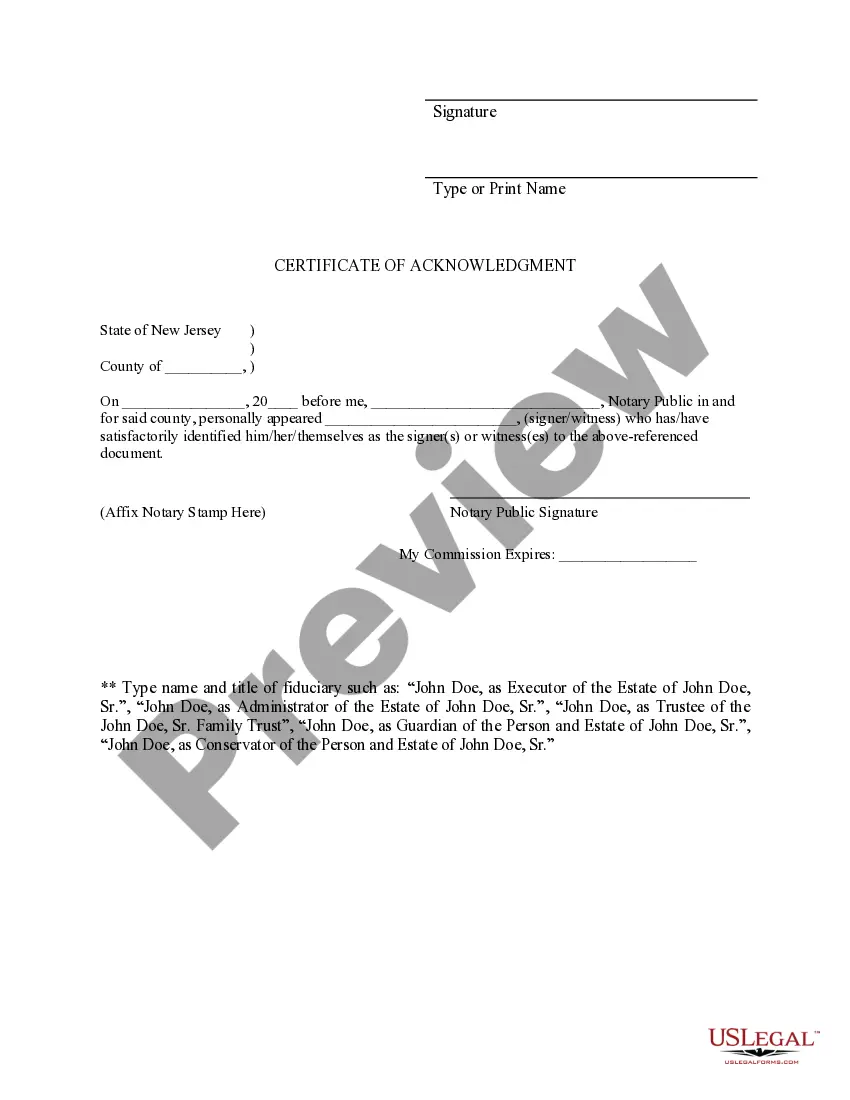

A fiduciary deed is a legal document used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries in Elizabeth, New Jersey, to transfer property rights from an estate to a beneficiary. This detailed description will highlight the purpose, process, and types of Elizabeth New Jersey Fiduciary Deeds commonly employed by different fiduciary roles. A Fiduciary Deed in Elizabeth, New Jersey, is essential for ensuring the smooth transfer of property ownership from a deceased individual's estate to the designated beneficiary. Executors, who are named in a valid will, or Administrators, who are appointed by the court when there is no will, often initiate this process. The fiduciary deed serves as the legal instrument to convey ownership rights, allowing Executors or Administrators to transfer the property to the rightful beneficiaries. Trustees or Trustees managing trusts may also utilize fiduciary deeds to transfer trust-owned properties. This deed reinforces the fiduciary's responsibility to act in the best interest of the estate or trust. The process of preparing an Elizabeth New Jersey Fiduciary Deed involves several key steps. First, the fiduciary must gather all necessary legal documents, including the original will, death certificate, and court appointment papers, if applicable. These documents will be required to establish the fiduciary's authority in transferring property. Next, the fiduciary must draft the fiduciary deed with the help of an attorney or legal professional. The fiduciary deed should include important details such as the names of the parties involved, a description of the property being transferred, and any relevant restrictions or conditions. The fiduciary must ensure that the deed complies with Elizabeth, New Jersey's specific legal requirements. Once the fiduciary deed is drafted, it needs to be signed and notarized by the fiduciary. In some cases, additional signatures may be required, such as those of beneficiaries or co-fiduciaries. Elizabeth, New Jersey Fiduciary Deeds can vary based on the fiduciary role and purpose. Here are a few common types: 1. Executor's Fiduciary Deed: Used by an Executor named in a valid will to transfer property from the deceased person's estate to the intended beneficiary. 2. Administrator's Fiduciary Deed: Applicable when the court appoints an Administrator due to the absence of a valid will, granting them the authority to transfer property rights from the estate to the rightful beneficiary. 3. Trust or's Fiduciary Deed: Used by a Trust or, who is creating a trust, to transfer their property into the trust. This allows the Trustee to manage the property on behalf of the beneficiaries. 4. Trustee's Fiduciary Deed: Executed by a Trustee to transfer the property from a trust to the intended beneficiary, following the provisions outlined in the trust agreement. It is crucial for Executors, Trustees, Trustees, Administrators, and other Fiduciaries in Elizabeth, New Jersey to understand the specific requirements and types of fiduciary deeds applicable to their role. Seeking guidance from legal professionals ensures compliance with local laws to facilitate a seamless property transfer process.

Elizabeth New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Elizabeth New Jersey Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Obtaining validated templates tailored to your regional regulations can be difficult unless you access the US Legal Forms library.

It’s an internet repository of over 85,000 legal forms for both personal and professional requirements as well as various real-world situations.

All the documents are accurately classified by field of use and jurisdictional areas, making it simple and straightforward to find the Elizabeth New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Maintaining documentation orderly and compliant with legal standards is critically important. Leverage the US Legal Forms library to always have crucial document templates for any needs readily available!

- For those already acquainted with our catalog and have utilized it previously, obtaining the Elizabeth New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries only requires a few clicks.

- You simply need to Log Into your account, select the document, and click Download to store it on your device.

- The procedure will necessitate just a few extra steps for new users.

- Follow the instructions below to commence with the most comprehensive online form collection.

- Examine the Preview mode and form description. Ensure you’ve selected the correct one that fulfills your requirements and entirely aligns with your local jurisdiction specifications.

Form popularity

FAQ

Generally, they are 9 months from the date of death for a Federal Estate Tax Return and 8 months for a NJ Inheritance Tax Return. When all obligations of the estate are satisfied, the executor should disburse the remaining estate assets to beneficiaries.

If the decedent was married or was a registered domestic partner, the person having the first right to apply for Letters of Administration is the surviving spouse or domestic partner. If the property owned by the decedent alone exceeds $ 20,000 an administration needs to be done.

Who Can Challenge An Executor? You can apply to remove the executor if you're a beneficiary or a co-executor. A third party with an interest in the estate (such as a creditor) can also apply to have an executor removed.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

Upon the death of a beneficiary who has a valid will or heirs, the fiduciary must hold the remaining funds under management in trust for the deceased beneficiary's estate until the will is probated or heirs are ascertained, and disburse the funds according to applicable state law.

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients' interests ahead of their own, with a duty to preserve good faith and trust.

New Jersey estates cannot settle any sooner than six months from the date a will enters probate. The decedent's creditors have this long to make claims against the estate for payment.