The Elizabeth New Jersey State Tax Case Information Schedule is a crucial document that provides detailed information about tax cases in the state of New Jersey, specifically related to the city of Elizabeth. It serves as a comprehensive record for taxpayers, legal professionals, and tax authorities to reference while managing or resolving tax-related matters. This detailed schedule contains a variety of essential information regarding tax cases in Elizabeth, including the names and contact details of the parties involved, case numbers, corresponding court or administrative agency, filing dates, and important updates and dispositions. It chronicles the progression of tax cases from the initial filing to their final resolution or judgment. Different types of Elizabeth New Jersey State Tax Case Information Schedules may exist based on the specific tax laws or regulations. Some key categories may include: 1. Individual Income Tax Cases: These are cases related to tax assessments, disputes, or audits involving individual taxpayers' income taxes in Elizabeth. 2. Business Tax Cases: This category covers tax-related issues pertaining to businesses operating in Elizabeth, such as sales tax liabilities, corporate income tax disputes, or payroll tax violations. 3. Property Tax Cases: These cases revolve around property tax assessments, appeals, or disputes within the city of Elizabeth. 4. Estate and Inheritance Tax Cases: This type of schedule focuses on matters concerning estate and inheritance taxes, including challenges taxing valuations, probate issues, or disputes over tax liabilities. 5. Nonprofit and Exempt Organizations Tax Cases: This category encompasses cases pertaining to tax-exempt organizations in Elizabeth, such as investigations into their compliance with tax laws, audits, or challenges to their tax-exempt status. 6. Local Tax Cases: This group includes cases associated with various local taxes imposed by the city of Elizabeth, such as municipal taxes, business license taxes, or occupancy taxes. 7. Tax Fraud and Evasion Cases: These schedules document cases involving alleged tax fraud or evasion, encompassing investigations, audits, or prosecutions by tax authorities in Elizabeth. It is important to note that the specific types and categories of tax cases listed above are intended as examples and may vary based on the jurisdiction and requirements of Elizabeth, New Jersey. Taxpayers and legal professionals are advised to consult the official Elizabeth New Jersey State Tax Case Information Schedule for accurate and up-to-date information relevant to their specific tax case.

Elizabeth New Jersey State Tax Case Information Schedule

Description

How to fill out Elizabeth New Jersey State Tax Case Information Schedule?

Are you searching for a trustworthy and cost-effective provider of legal forms to purchase the Elizabeth New Jersey State Tax Case Information Schedule? US Legal Forms is your ideal choice.

Whether you require a basic agreement to establish rules for living with your partner or a collection of papers to facilitate your separation or divorce through the court system, we have everything you need. Our platform offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic but tailored to meet the regulations of specific states and regions.

To obtain the form, you must Log In to your account, find the necessary form, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can easily set up an account, but before doing so, please ensure to.

Now you can create your account. Then select the subscription plan and proceed to payment. Once your payment is processed, download the Elizabeth New Jersey State Tax Case Information Schedule in any available file format. You can revisit the website whenever necessary and redownload the form at no additional cost.

Locating current legal documents has never been simpler. Try out US Legal Forms today and stop wasting your precious time searching for legal paperwork online.

- Check if the Elizabeth New Jersey State Tax Case Information Schedule meets the requirements of your state and locality.

- Review the form’s description (if available) to understand who and what the form is designed for.

- Repeat the search if the form is unsuitable for your legal needs.

Form popularity

FAQ

To request court records from the KDLA, email kdla.archives@ky.gov or call 502-564-1787.

Except where prohibited by Supreme Court Rule or by statute, the following court records are available for public inspection: Civil Division including Chancery General Equity Records. Special Civil Part Records. Criminal Division Records.

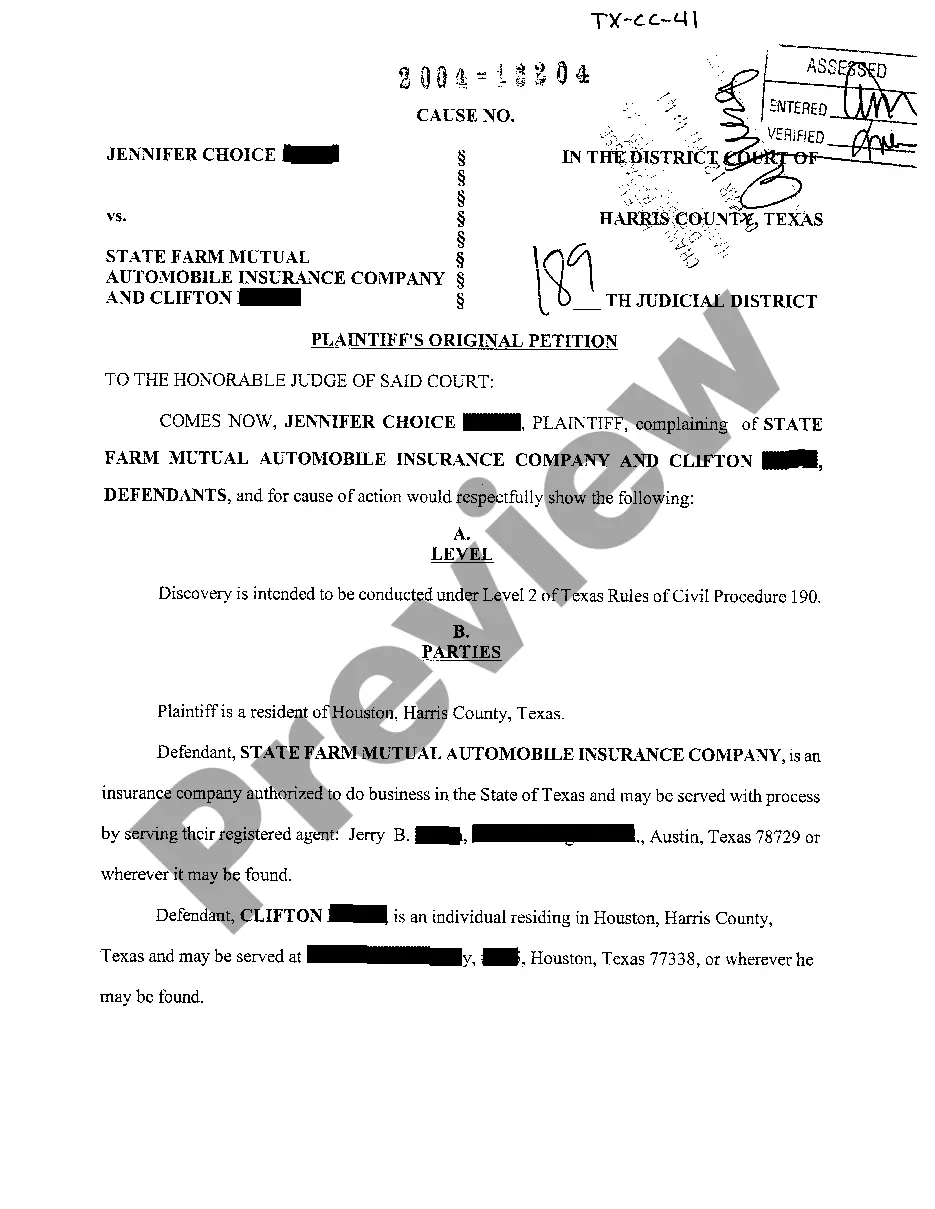

Explanation of Case Numbers Case numbers look like the following: 94-C-140 This would mean that this is the 140th general civil case filed during 1994. Case number is year-case type-amount so far. Case numbers are assigned when a case initiating document is filed.

There are three ways to look at court records: Go to the courthouse and ask to look at paper records. Go to the courthouse and look at electronic court records. If your court offers it, look at electronic records over the internet.

A case number has the following information: the year the lawsuit was filed, usually a two or four-digit format; the type of case, e.g., a civil case; a randomly assigned sequence number generated by the court; the court the lawsuit was filed, represented by letters or numbers.

Reports are purchased through the Superior Court Clerk's Office. In order to obtain any report listed, you will need to fill out a Public Access Request Form. All fields must be filled out on the request form and saved to your computer as Public Access Request Form.

Call the public agency and ask for a records request form use to request records under OPRA.

Case types assigned by the Court include Civil (?cv?), Criminal (?cr?) and Miscellaneous (?mc?). The number 17 represents the year the case was filed. The number 00010 is the number of the case. The first case filed in a particular year for each division is ?1,? and so on.

Public Access: Public Access Request Reports are purchased through the Superior Court Clerk's Office. In order to obtain any report listed, you will need to fill out a Public Access Request Form. All fields must be filled out on the request form and saved to your computer as Public Access Request Form.

To find a case number in New Jersey, interested persons may search via the New Jersey Court website and click on the ecourts case jacket portal. A case number search may be carried out by selecting the county where the case took and searching with the party's name.