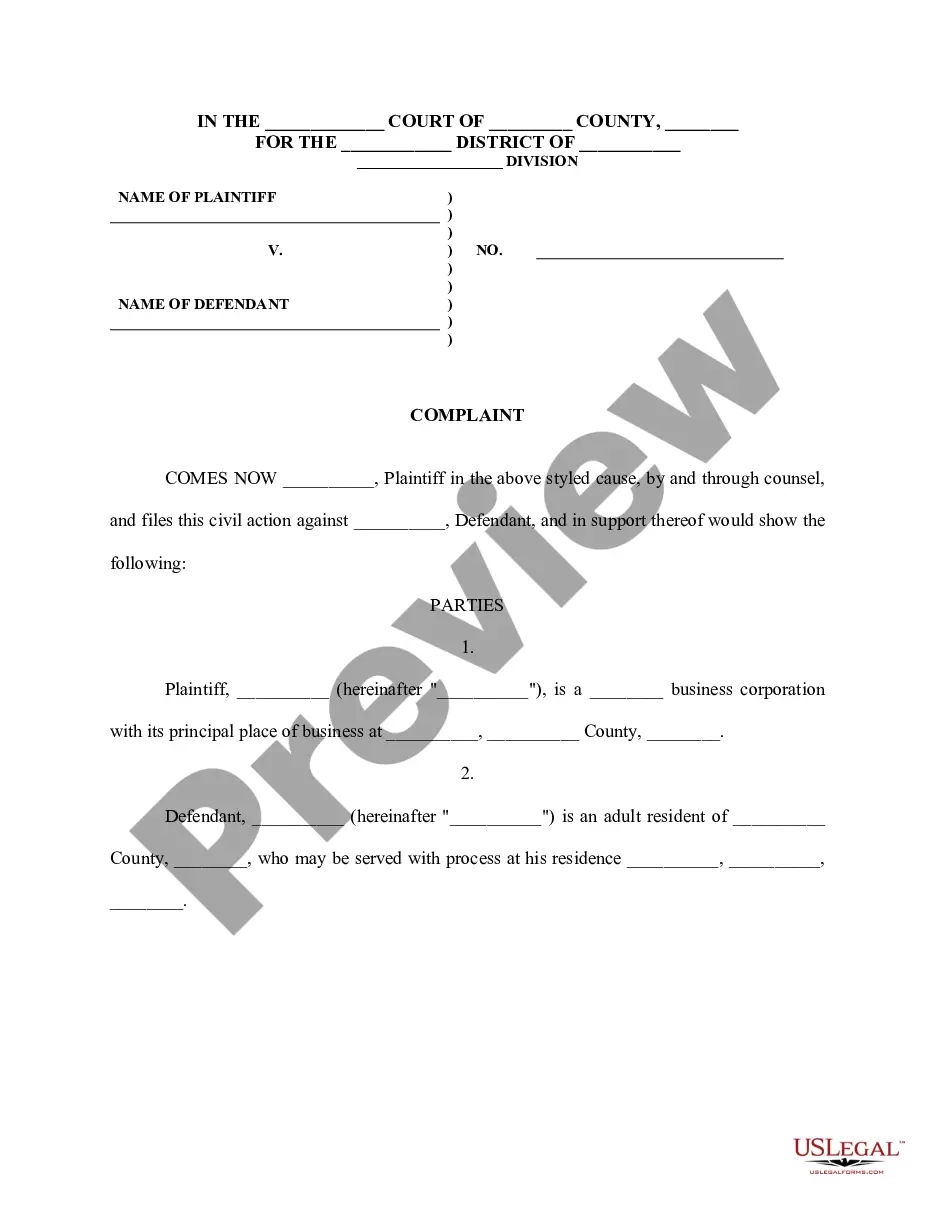

Jersey City, New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26 is a legal process that allows individuals or entities to file a claim for the collection of unpaid property taxes. This application is applicable in Jersey City, New Jersey, and follows the guidelines set forth by N.J.S.A. 54:3-26, which outlines the procedures for initiating a civil action to recover unpaid taxes. When it comes to different types of Jersey City, New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26, there are no specific subcategories, as it refers to the general process of applying for a judgment to collect unpaid property taxes. However, it is important to note that this application may vary based on individual circumstances and the specific details of the case. In order to initiate an application for judgment pursuant to N.J.S.A. 54:3-26, the claimant must file a complaint with the appropriate court in Jersey City. This complaint should include relevant details such as the property owner's name, property address, the amount of unpaid taxes, and any other pertinent information related to the debt. After filing the complaint, the claimant must serve the property owner with a copy of the complaint, providing them with an opportunity to respond to the allegations. If the property owner fails to respond or disputes the claim, a court hearing may be scheduled to review the evidence and determine whether a judgment should be granted. If the court grants the judgment, it enables the claimant to take further action to collect the unpaid taxes. This may include placing a lien on the property or pursuing other legal remedies to recover the outstanding debt. The judgment also allows the claimant to proceed with foreclosure proceedings if necessary. It is important to note that the Jersey City, New Jersey Civil Action Application for Judgment Pursuant to N.J.S.A. 54:3-26 is a complex legal process. Therefore, individuals or entities considering this course of action should seek the advice of a qualified attorney experienced in property tax collection and civil litigation to ensure all steps are followed correctly. In summary, the Jersey City, New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26 is a legal procedure used to collect unpaid property taxes. While there are no specific subcategories, this application falls under the general process outlined in N.J.S.A. 54:3-26. It involves filing a complaint, serving the property owner, attending a court hearing (if necessary), and ultimately obtaining a judgment that allows for the collection of unpaid taxes. Professional legal guidance is essential when navigating this process.

Jersey City New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26

Instant download

Public form

Description

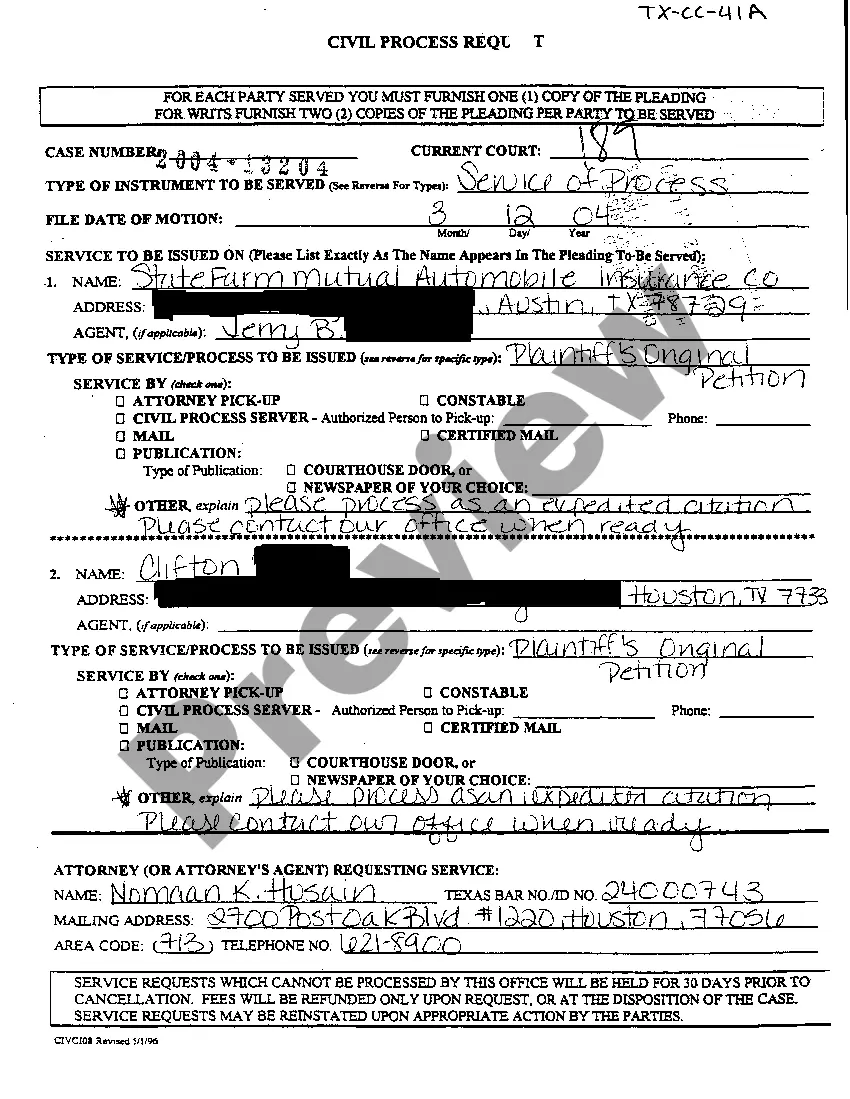

Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26

How to fill out Jersey City New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26?

Regardless of social or occupational rank, finishing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unfeasible for an individual lacking any legal expertise to create such documents from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms proves to be beneficial.

Ensure the template you've located is fitting for your locality since the regulations of one state or county do not apply to another state or county.

Examine the document and review a brief summary (if available) of situations where the document may be applicable.

- Our service provides a vast collection of over 85,000 state-specific documents that cater to nearly any legal circumstance.

- US Legal Forms also acts as a fantastic tool for associates or legal advisors seeking to enhance their efficiency in terms of time with our DIY documents.

- Whether you require the Jersey City New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26 or any other documentation appropriate for your state or county, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the Jersey City New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26 within minutes using our dependable service.

- If you are an existing user, you may proceed to Log In to your account to download the relevant form.

- However, if you are not acquainted with our platform, ensure to follow these instructions before retrieving the Jersey City New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:3-26.

Form popularity

Interesting Questions

More info

Tax Court pursuant to N.J.S.A. 21(a)(1). N.J.S.A.. 608.07. -15.See N.J.S.A. -27.2. Assessment-sales ratios pursuant to N.J.S.A. -35. NEW JERSEY CAUSES OF ACTION. 3. 3 CTION ON COURT JUDGMENT. Current Model – Martin W. Lynch, CTA, Manchester Township. Tax Assessor, Past President of AMANJ. О Impact on State Tax Court. О Assessment Volatility During Implementation.