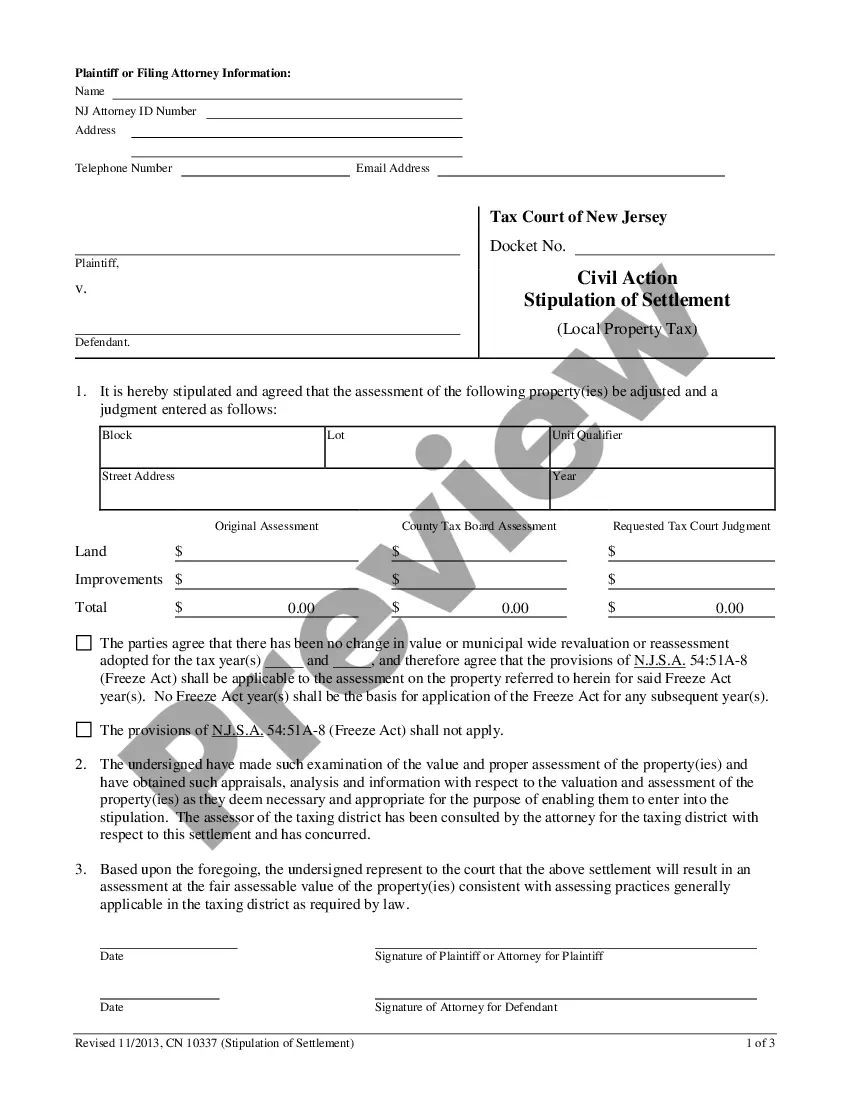

The Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8, also known as the Tax Court Freeze Act, is a legal mechanism designed to provide relief to taxpayers who believe their property assessments are incorrect or unfair. This application allows the taxpayers to freeze their property tax assessment at a certain level during the pendency of their tax appeal in the Tax Court of New Jersey. Under the Tax Court Freeze Act, taxpayers in Elizabeth, New Jersey, can file an application with the Tax Court to request a judgment that freezes their property tax assessment. The purpose of this freeze is to maintain the property's assessment value at the level it was when the appeal was initiated, preventing any potential increase during the time the appeal is being reviewed. This is particularly helpful for taxpayers who believe that their property's assessed value will continue to rise while the appeal is pending. By utilizing the Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8, taxpayers can benefit from the protection provided by the Tax Court Freeze Act. This application is essential in preserving fairness and ensuring that taxpayers are not burdened by excessive property tax assessments during the appeal process. It offers them a fair chance to contest their property's assessed value without additional financial strain or penalties. Different types of applications under the Tax Court Freeze Act may include residential property tax assessment freeze applications or commercial property tax assessment freeze applications. The eligibility and process for these applications may vary depending on the nature of the property. However, the overarching goal remains the same, i.e., providing relief to taxpayers by freezing their property's assessed value during the tax appeal process. In conclusion, the Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8, known as the Tax Court Freeze Act, allows taxpayers to request a freeze on their property tax assessment during the appeal process. This application aims to ensure fairness and provides relief to taxpayers who believe their assessments are incorrect or unjust. Through this mechanism, both residential and commercial property owners in Elizabeth, New Jersey, can contest their property's assessed value without the fear of further increases during the appeal.

Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8 the Tax Court Freeze Act

Description

How to fill out Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8 The Tax Court Freeze Act?

If you are searching for a valid form, it’s difficult to choose a more convenient platform than the US Legal Forms website – one of the most extensive online libraries. Here you can get a huge number of templates for organization and personal purposes by types and regions, or keywords. Using our high-quality search function, getting the most up-to-date Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8 the Tax Court Freeze Act is as easy as 1-2-3. Moreover, the relevance of each document is confirmed by a group of professional lawyers that regularly check the templates on our website and update them according to the most recent state and county regulations.

If you already know about our platform and have a registered account, all you need to receive the Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8 the Tax Court Freeze Act is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the form you want. Read its information and utilize the Preview feature (if available) to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to get the appropriate record.

- Confirm your selection. Click the Buy now option. Following that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and download it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8 the Tax Court Freeze Act.

Each form you save in your profile does not have an expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to receive an additional version for modifying or creating a hard copy, you may return and export it once more at any moment.

Make use of the US Legal Forms professional collection to get access to the Elizabeth New Jersey Civil Action Application For Judgment Pursuant To N.J.S.A. 54:51A-8 the Tax Court Freeze Act you were looking for and a huge number of other professional and state-specific samples on a single website!