Elizabeth, New Jersey Complaint (To Be Used For Tax Relief Programs) When it comes to tax relief programs in Elizabeth, New Jersey, it is crucial to understand the concept of a complaint. In this context, a complaint refers to a formal written expression of dissatisfaction or concern raised by taxpayers regarding their tax-related matters. These complaints are typically submitted to the relevant tax authority or agency responsible for overseeing and implementing tax relief programs in Elizabeth, New Jersey. Taxpayers may have various types of complaints when seeking tax relief programs in Elizabeth, New Jersey. Some of the most common categories of complaints include: 1. Incorrect Tax Assessment Complaint: This type of complaint arises when taxpayers believe that their property or income has been inaccurately assessed, resulting in an unfairly high tax burden. Individuals who feel that their tax assessment is incorrect can file a complaint to the local tax authority, requesting a reassessment or correction of the tax liability. 2. Unfair Tax Collection Complaint: Taxpayers may lodge complaints against the tax collection processes if they believe they have been treated unfairly, unethically, or subjected to unlawful practices by tax collection agencies or officials. These complaints can address issues like excessive penalties, improper garnishment of wages or bank accounts, or harassment during the tax collection process. 3. Delayed Refund Complaint: In some cases, taxpayers might experience delays in receiving their tax refunds, which can cause financial strain. Complaints related to delayed refunds can be submitted to the tax authority responsible for processing refunds, urging them to expedite the process and provide necessary updates. 4. Miscommunication Complaint: This type of complaint arises when taxpayers feel that they have been provided with incorrect information, or they have experienced challenges in obtaining accurate and consistent guidance or support from tax agency representatives. Submitting a miscommunication complaint ensures that these issues are addressed and that taxpayers receive proper clarification. 5. Inadequate Tax Relief Program Complaint: Tax relief programs are designed to provide assistance to eligible individuals or businesses facing financial hardships. However, if taxpayers believe that they have been unfairly denied or inadequately aided by these programs, they can file a complaint to challenge the decision, request a reassessment, or seek further clarification about their eligibility. Overall, Elizabeth, New Jersey complaints relevant to tax relief programs encompass a wide range of issues, including incorrect assessments, unfair collections, delayed refunds, miscommunication, and inadequate program assistance. By leveraging the complaint process, taxpayers can voice their concerns and work towards obtaining the tax relief they deserve.

Elizabeth New Jersey Complaint (To Be Used For Tax Relief Programs)

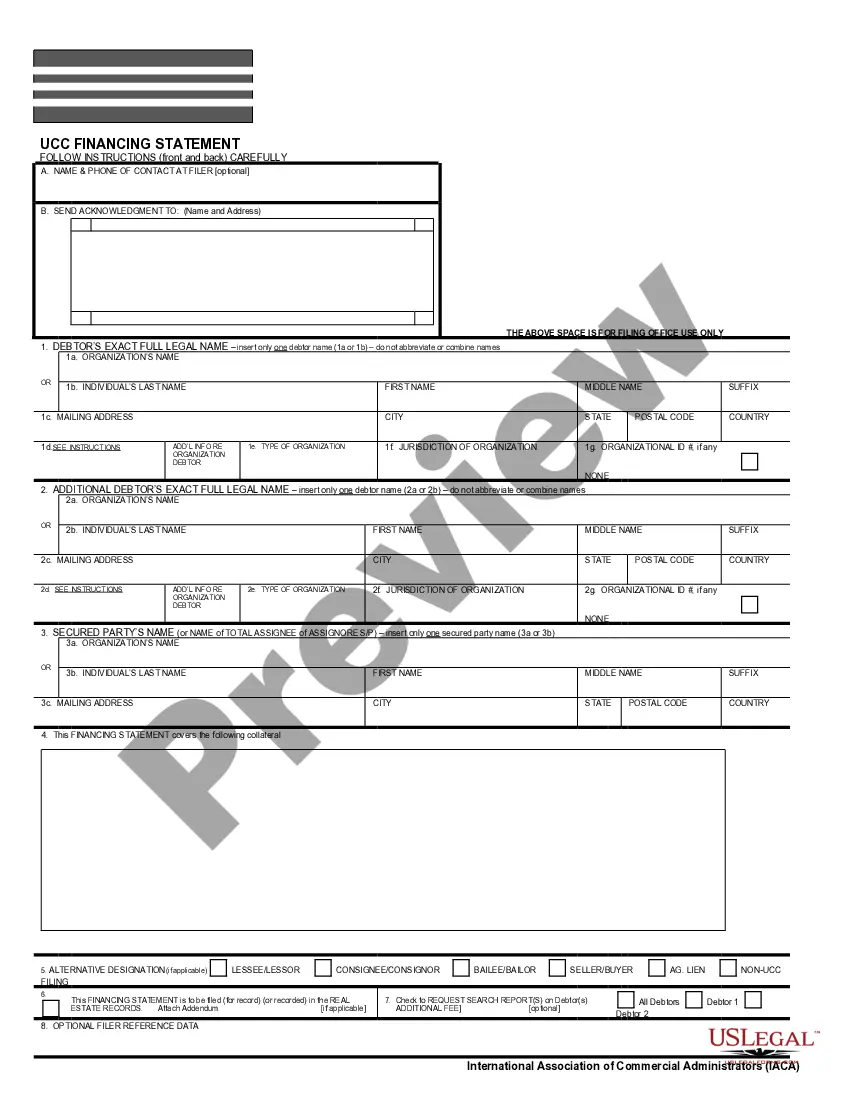

Description

How to fill out Elizabeth New Jersey Complaint (To Be Used For Tax Relief Programs)?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal solutions that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Elizabeth New Jersey Complaint (To Be Used For Tax Relief Programs) or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Elizabeth New Jersey Complaint (To Be Used For Tax Relief Programs) adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Elizabeth New Jersey Complaint (To Be Used For Tax Relief Programs) is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!