Elizabeth, New Jersey is a vibrant city located in Union County, with a thriving economy and a rich cultural heritage. One crucial aspect of the financial landscape in Elizabeth is the UCC1 Financing Statement. This legal document plays a significant role in commercial transactions by providing valuable information about secured interests, ensuring transparency and protecting the rights of both creditors and debtors. A UCC1 Financing Statement in Elizabeth, New Jersey is filed in accordance with the Uniform Commercial Code (UCC), a comprehensive set of laws governing commercial transactions in the United States. This statement serves as a public record, providing notice of an individual or entity's security interest in specific collateral. It effectively establishes priority among competing creditors and helps potential lenders assess the risk associated with a particular debtor. In Elizabeth, various types of UCC1 Financing Statements may be filed, depending on the nature of the transaction. The most common include: 1. General UCC1 Financing Statement: This is the standard form used for most transactions involving personal property collateral. It covers a wide range of assets, such as inventory, equipment, accounts receivable, and intellectual property rights. 2. Agricultural UCC1 Financing Statement: Specifically designed for transactions involving agricultural products, this statement covers crops, livestock, and farming equipment. It provides information on security interests related to agricultural operations in Elizabeth, ensuring transparency within the agricultural sector. 3. Fixture UCC1 Financing Statement: This statement is crucial when a debtor grants a security interest in fixtures (items attached to real estate) located in Elizabeth, New Jersey. It allows lenders to establish their priority rights in fixtures, protecting their investments. 4. Public-Finance or Manufactured-Home UCC1 Financing Statement: These statements are specialized filings needed for transactions related to public financing, such as municipal bonds. Additionally, in cases involving manufactured homes, this statement covers the security interest in these types of properties. It is important to note that filing a UCC1 Financing Statement in Elizabeth, New Jersey does not reflect the legality or enforcement of a debtor-creditor relationship. Instead, it serves as a public record to establish priority among competing creditors and provides important information to potential lenders. In conclusion, the UCC1 Financing Statement in Elizabeth, New Jersey plays a crucial role in commercial transactions, ensuring transparency, protecting the rights of creditors and debtors, and enabling lenders to make informed decisions. Various types of UCC1 Financing Statements exist, covering general personal property collateral, agricultural transactions, fixture interests, and public-financed transactions. By understanding and complying with the UCC requirements, individuals and businesses in Elizabeth can navigate the financial landscape with greater confidence and security.

Elizabeth New Jersey UCC1 Financing Statement

State:

New Jersey

City:

Elizabeth

Control #:

NJ-UCC1

Format:

Word;

PDF;

Rich Text

Instant download

Public form

Description

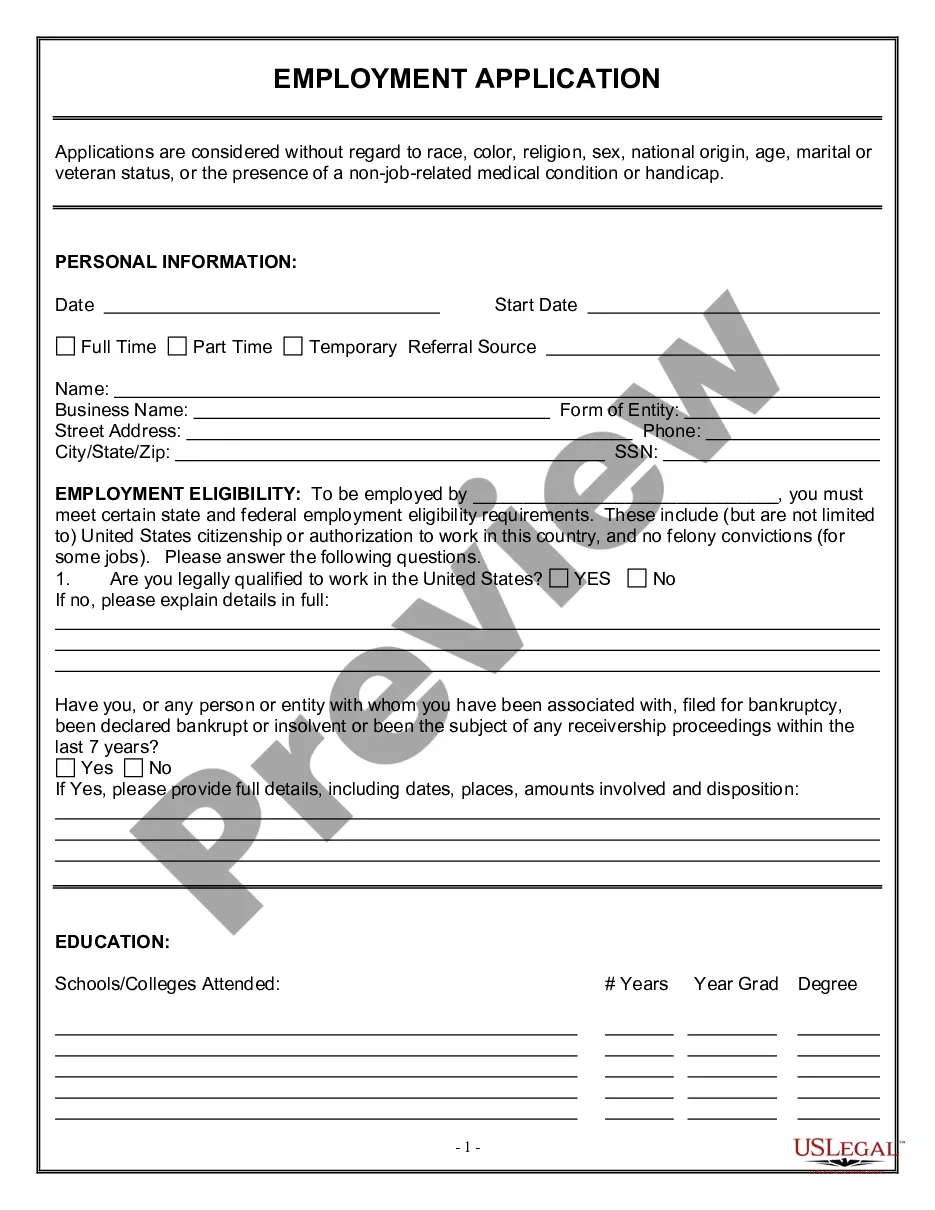

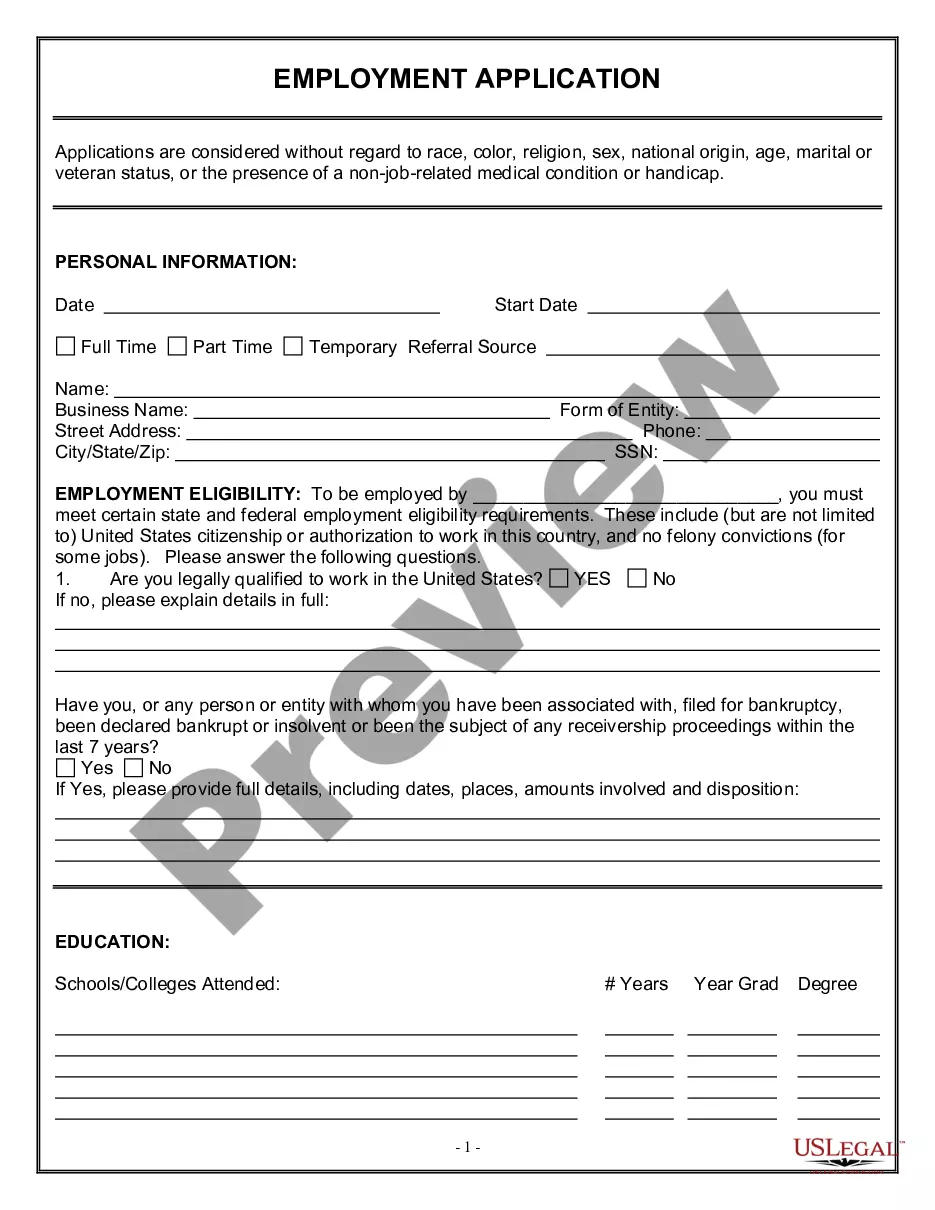

UCC1 - Financing Statement - New Jersey - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Elizabeth, New Jersey is a vibrant city located in Union County, with a thriving economy and a rich cultural heritage. One crucial aspect of the financial landscape in Elizabeth is the UCC1 Financing Statement. This legal document plays a significant role in commercial transactions by providing valuable information about secured interests, ensuring transparency and protecting the rights of both creditors and debtors. A UCC1 Financing Statement in Elizabeth, New Jersey is filed in accordance with the Uniform Commercial Code (UCC), a comprehensive set of laws governing commercial transactions in the United States. This statement serves as a public record, providing notice of an individual or entity's security interest in specific collateral. It effectively establishes priority among competing creditors and helps potential lenders assess the risk associated with a particular debtor. In Elizabeth, various types of UCC1 Financing Statements may be filed, depending on the nature of the transaction. The most common include: 1. General UCC1 Financing Statement: This is the standard form used for most transactions involving personal property collateral. It covers a wide range of assets, such as inventory, equipment, accounts receivable, and intellectual property rights. 2. Agricultural UCC1 Financing Statement: Specifically designed for transactions involving agricultural products, this statement covers crops, livestock, and farming equipment. It provides information on security interests related to agricultural operations in Elizabeth, ensuring transparency within the agricultural sector. 3. Fixture UCC1 Financing Statement: This statement is crucial when a debtor grants a security interest in fixtures (items attached to real estate) located in Elizabeth, New Jersey. It allows lenders to establish their priority rights in fixtures, protecting their investments. 4. Public-Finance or Manufactured-Home UCC1 Financing Statement: These statements are specialized filings needed for transactions related to public financing, such as municipal bonds. Additionally, in cases involving manufactured homes, this statement covers the security interest in these types of properties. It is important to note that filing a UCC1 Financing Statement in Elizabeth, New Jersey does not reflect the legality or enforcement of a debtor-creditor relationship. Instead, it serves as a public record to establish priority among competing creditors and provides important information to potential lenders. In conclusion, the UCC1 Financing Statement in Elizabeth, New Jersey plays a crucial role in commercial transactions, ensuring transparency, protecting the rights of creditors and debtors, and enabling lenders to make informed decisions. Various types of UCC1 Financing Statements exist, covering general personal property collateral, agricultural transactions, fixture interests, and public-financed transactions. By understanding and complying with the UCC requirements, individuals and businesses in Elizabeth can navigate the financial landscape with greater confidence and security.

How to fill out Elizabeth New Jersey UCC1 Financing Statement?

If you’ve already used our service before, log in to your account and download the Elizabeth New Jersey UCC1 Financing Statement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Elizabeth New Jersey UCC1 Financing Statement. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!