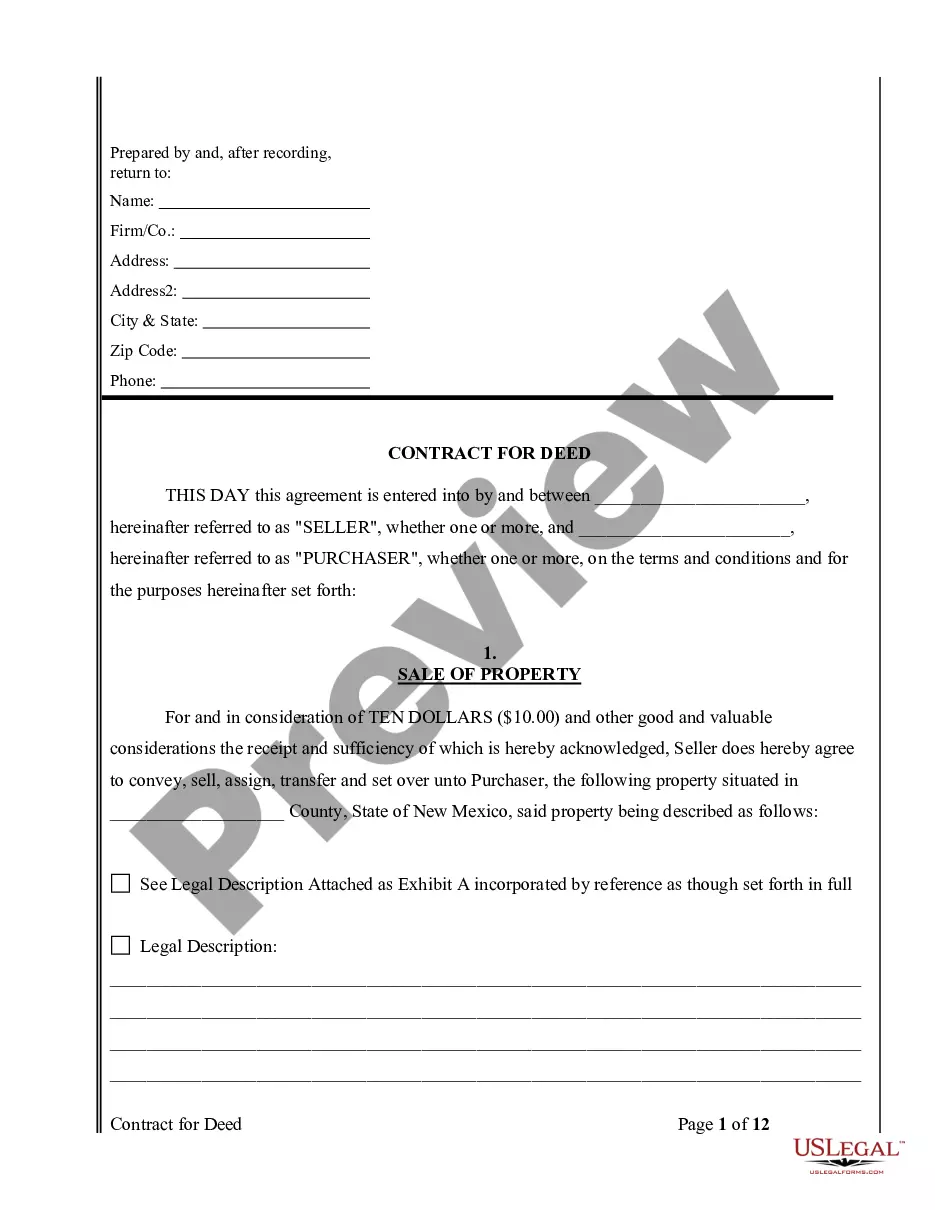

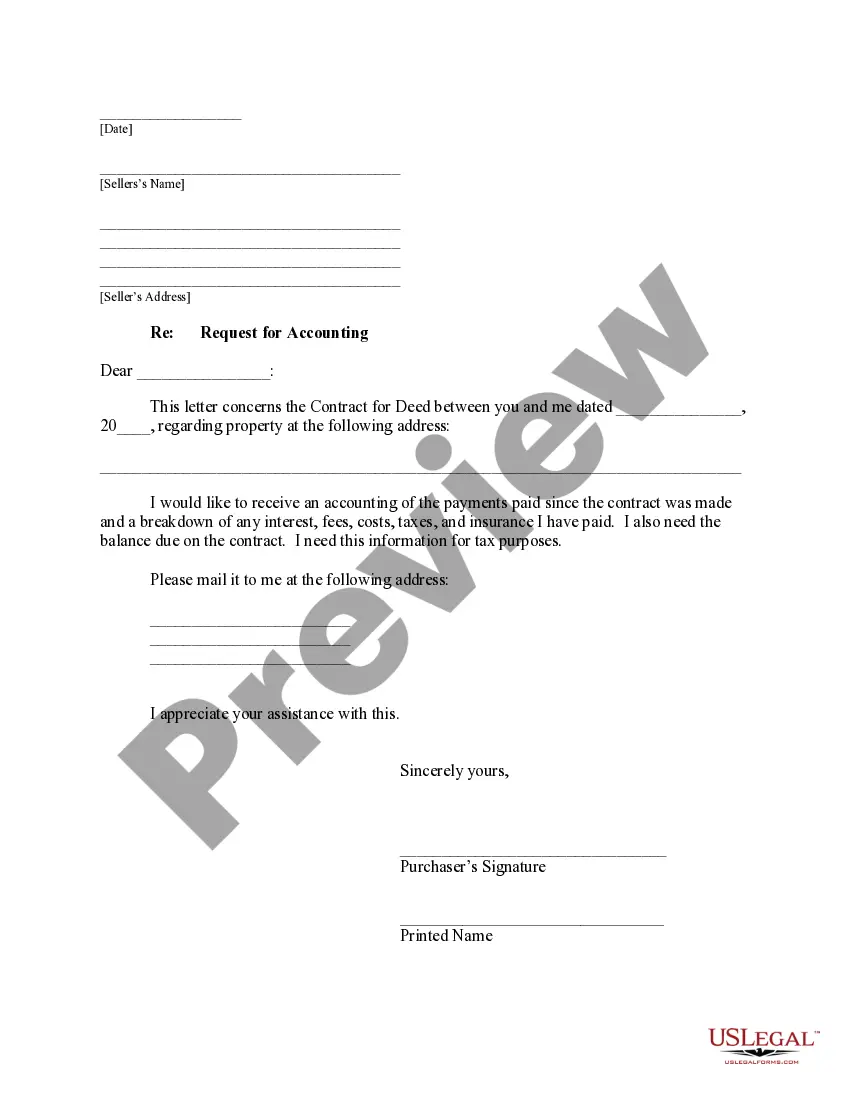

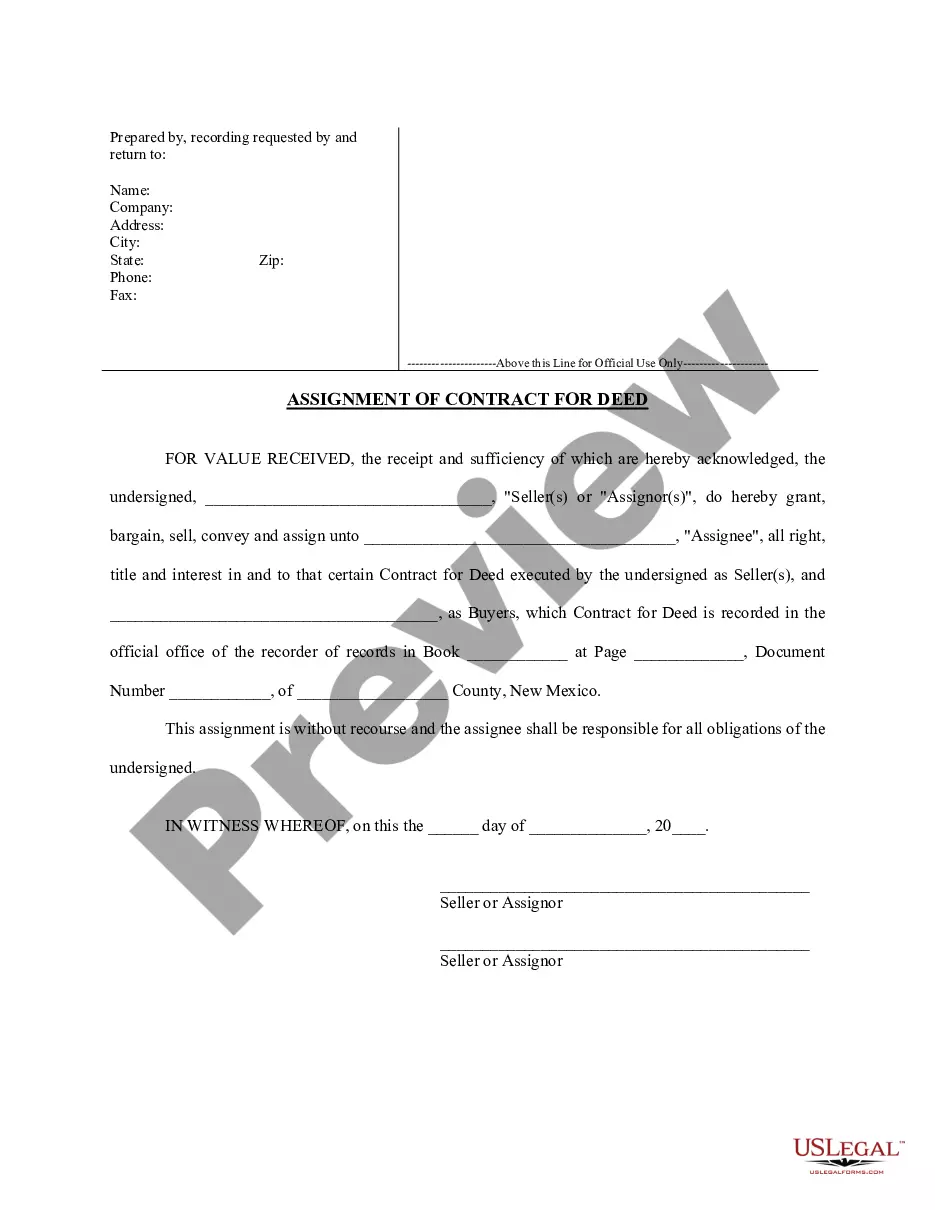

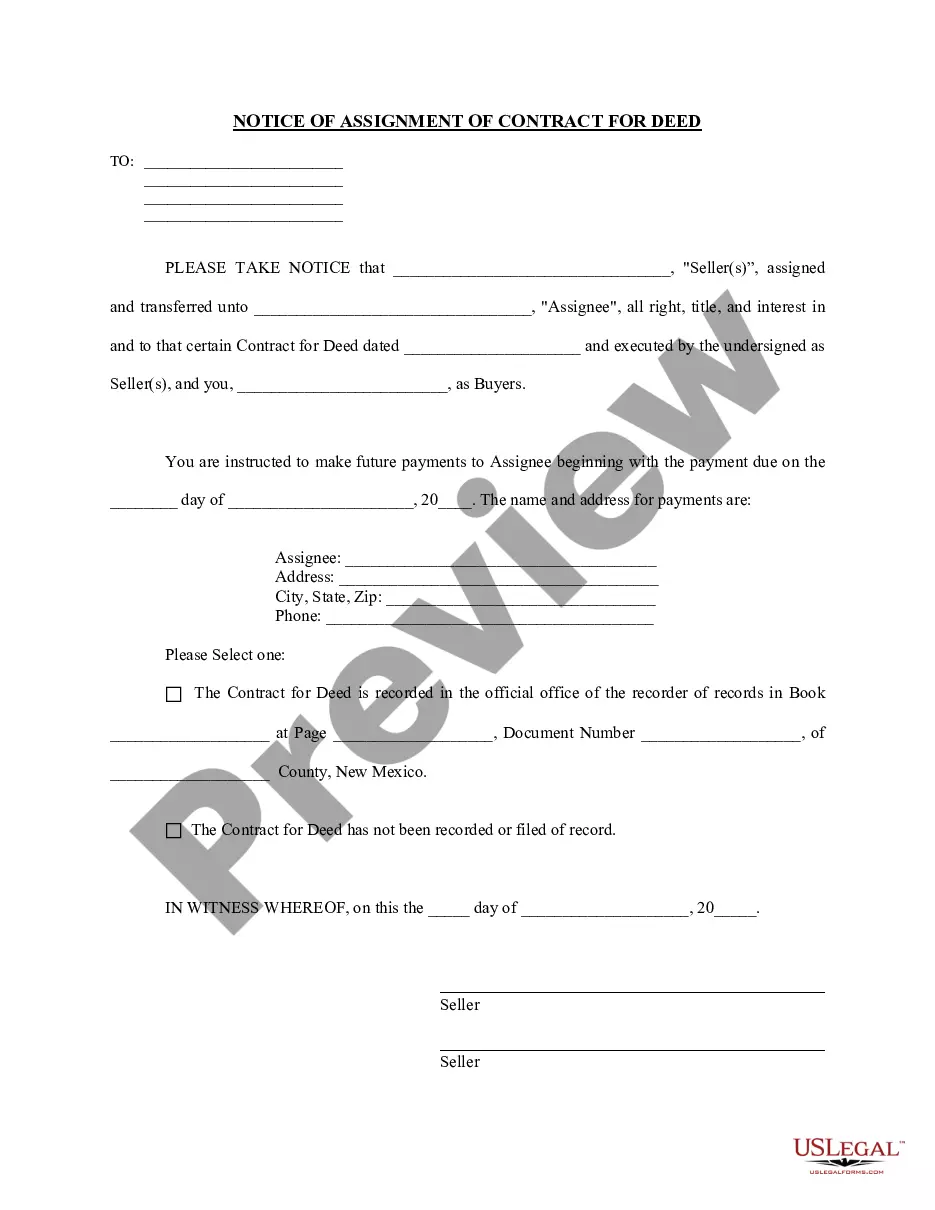

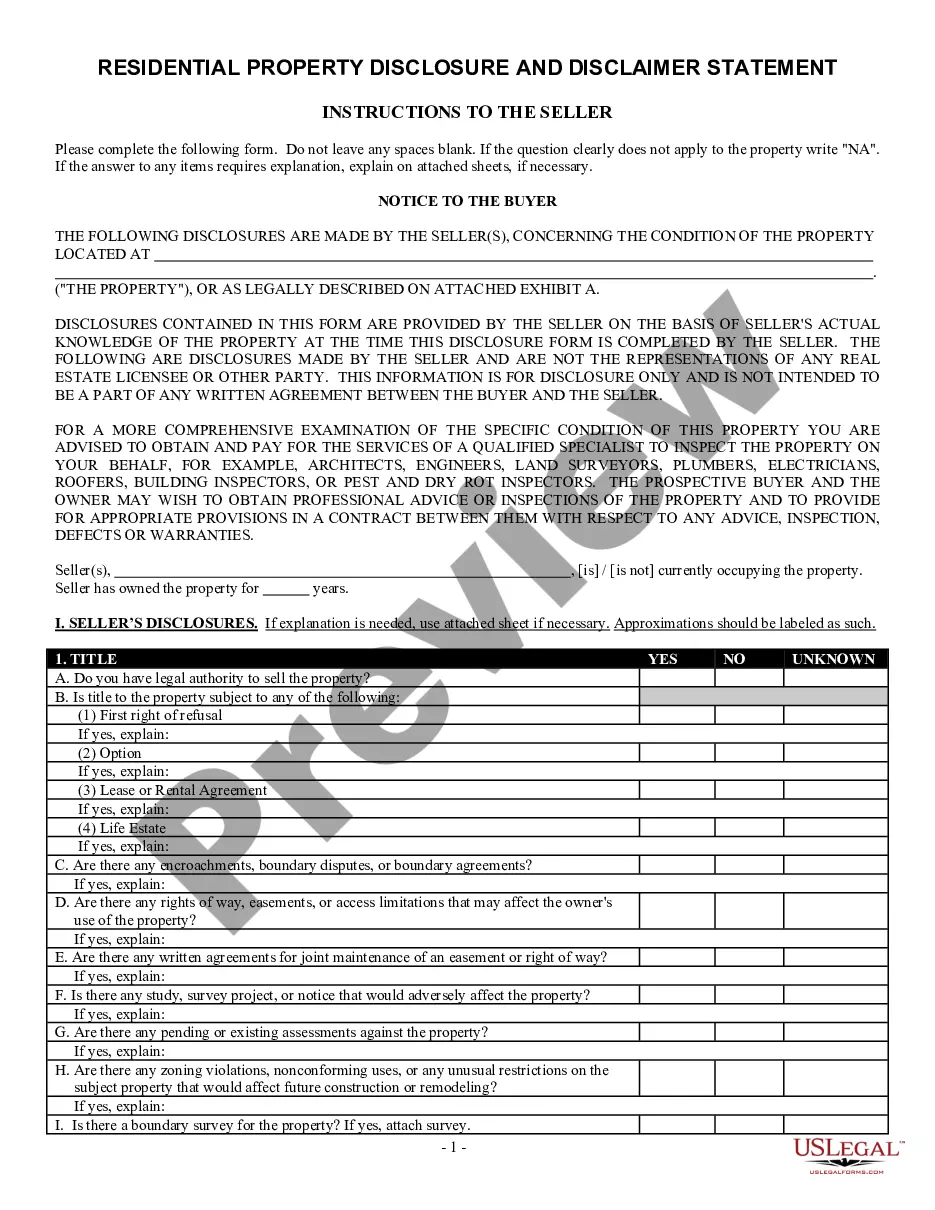

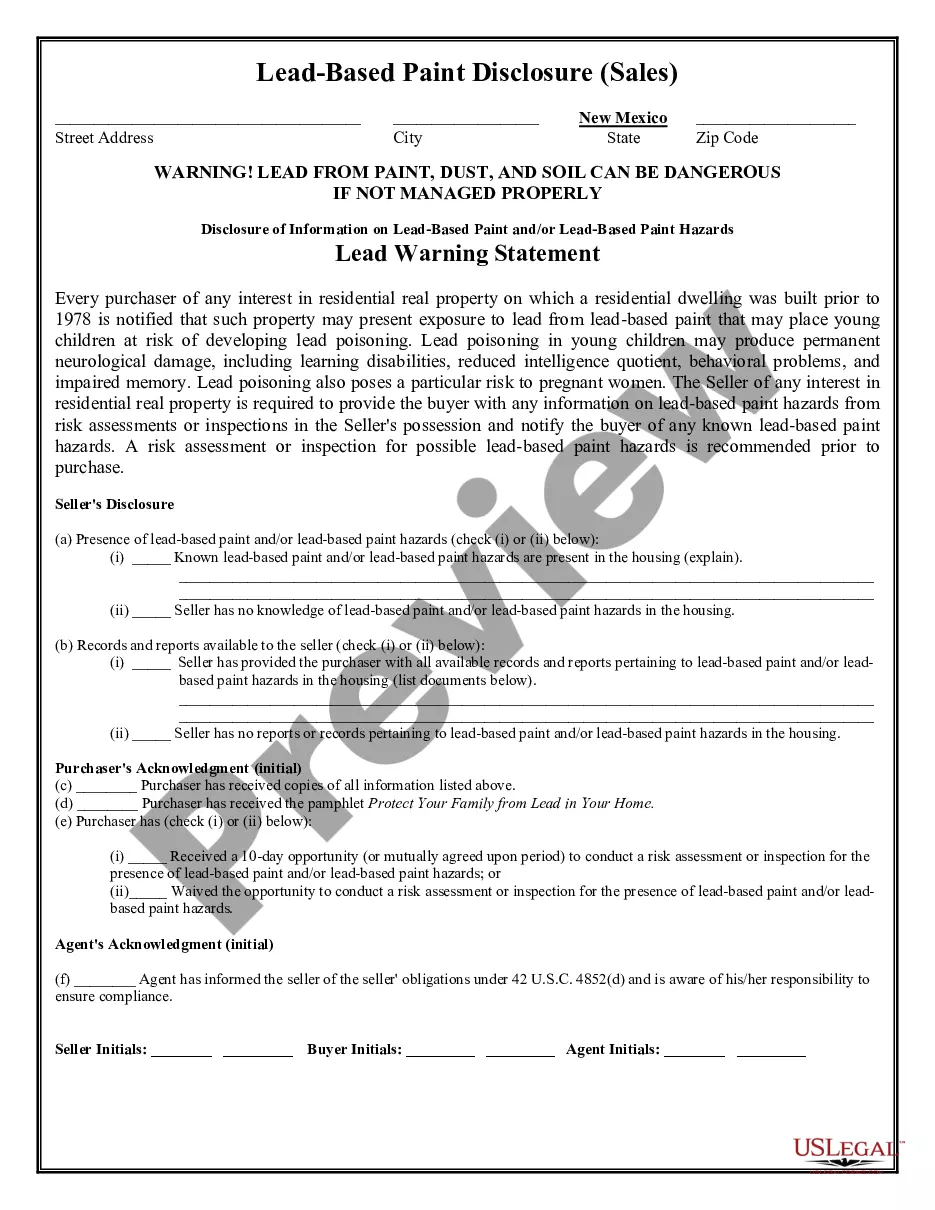

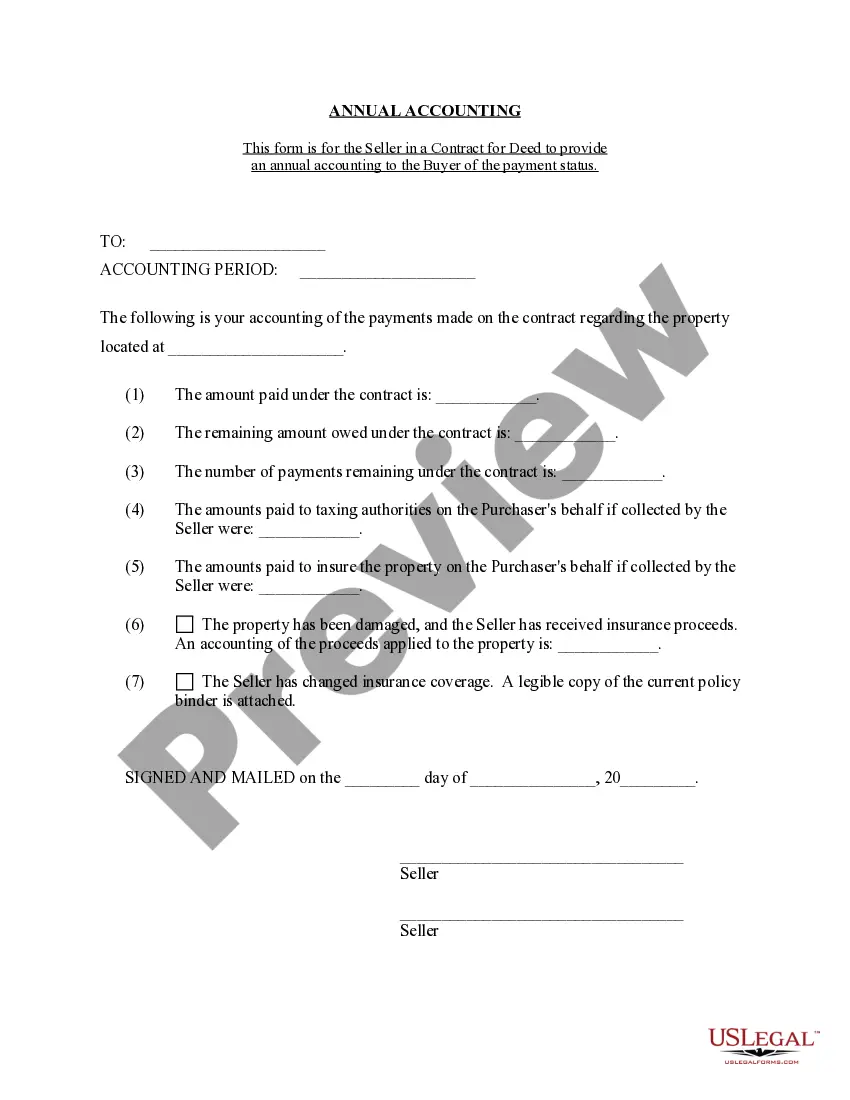

The Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides detailed financial information to both the buyer and seller involved in a contract for deed transaction in Las Cruces, New Mexico. This statement serves as an important tool for transparency and accountability throughout the contract period. The Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement includes various essential elements. Firstly, it encompasses a comprehensive breakdown of income received by the seller over the course of the year from the contract for deed agreement. This might include monthly installment payments, interest, and any other additional charges agreed upon in the contract. Secondly, the statement includes a meticulous list of expenses incurred by the seller during the same period. These expenses typically cover property taxes, insurance, maintenance costs, and other fees related to the property. It also includes any outstanding debts that were paid on behalf of the buyer. Thirdly, the Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement precisely calculates the remaining balance on the contract for deed, considering the payments made by the buyer and any interest accumulated. It ensures that both parties are aware of the exact status of the agreement and the buyer's progress towards full ownership. Moreover, the statement may include information about any modifications or amendments made to the contract for deed during the year. This allows for complete transparency and ensures that all changes are documented and understood by both parties. In Las Cruces, New Mexico, there may be different types of Contract for Deed Seller's Annual Accounting Statements based on specific requirements or variations in contract terms. Examples of these variations include: 1. Standard Contract for Deed Seller's Annual Accounting Statement: This is the most common type that encompasses general information about the transaction, including income, expenses, and outstanding balance. 2. Customized Contract for Deed Seller's Annual Accounting Statement: Some contracts may have unique terms and conditions, warranting a customized statement that reflects the specific financial arrangements agreed upon between the buyer and seller. 3. Partial Contract for Deed Seller's Annual Accounting Statement: In cases where the contract for deed has been in effect for a shorter period, a partial accounting statement may be issued, providing a snapshot of the financial status up to that point. In conclusion, the Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement plays a critical role in maintaining transparency and documenting the financial aspects of a contract for deed agreement. It ensures that both the buyer and seller have a clear understanding of the financial transactions and progress throughout the contract period.

Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Las Cruces New Mexico Contract For Deed Seller's Annual Accounting Statement?

Are you looking for a trustworthy and affordable legal forms provider to get the Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your go-to choice.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of particular state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Las Cruces New Mexico Contract for Deed Seller's Annual Accounting Statement in any provided format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal papers online once and for all.