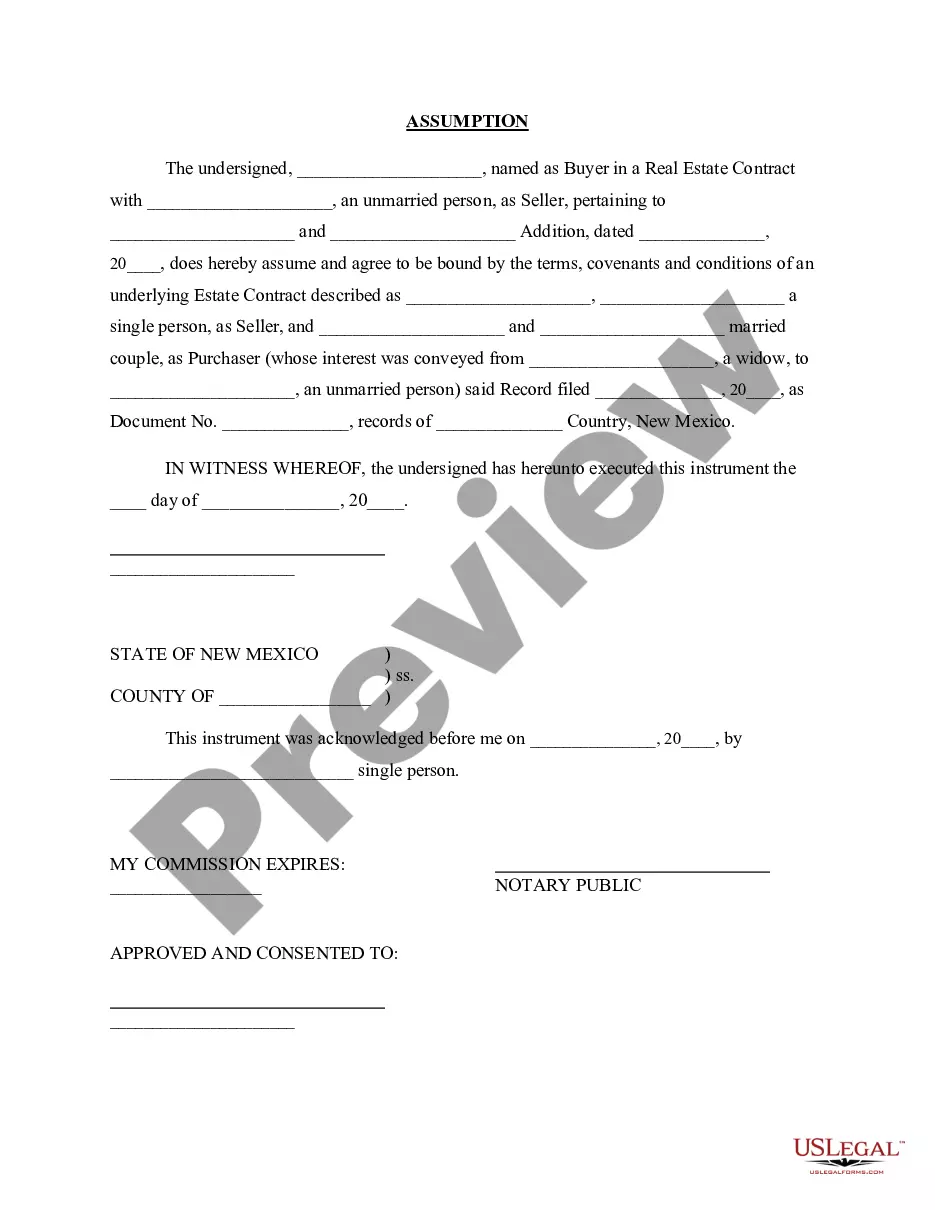

The Las Cruces Assumption of Real Estate Contract is a legal agreement made between a buyer and a seller in Las Cruces, New Mexico, pertaining to the transfer of real property ownership. This contractual arrangement allows a buyer to assume the existing mortgage and financial responsibilities associated with the property from the seller, rather than obtaining a new loan. The Assumption of Real Estate Contract is a significant option for homebuyers who want to avoid the process of applying for a new mortgage loan, as well as for sellers who are willing to transfer their existing mortgage obligation to a qualified buyer. It provides a way for buyers to seamlessly take over monthly mortgage payments, terms, and conditions that were initially agreed upon by the seller and the lender. In Las Cruces, there are various types of Assumption of Real Estate Contracts that can be utilized based on specific circumstances and needs: 1. Fixed-rate Assumption: This type of contract involves a fixed interest rate, ensuring that the mortgage payment remains the same throughout the loan term. It provides predictability and stability for both the buyer and the seller. 2. Adjustable-rate Assumption: With an adjustable-rate contract, the interest rate fluctuates at predetermined intervals in accordance with the market index. This type of arrangement may be advantageous during times when interest rates are low and expected to remain so in the near future. 3. Wraparound Assumption: A wraparound contract combines the existing mortgage with an additional loan from the seller. The buyer assumes the original loan while making monthly payments to the seller, who in turn makes payments on the existing mortgage. This type of contract allows for more flexibility and can be beneficial when the seller has a low-interest rate loan. 4. Subject-to Assumption: In a subject-to contract, the buyer assumes the mortgage without formally notifying or obtaining consent from the lender. The seller remains ultimately responsible for the loan, but the buyer takes over the regular payments. This arrangement is often used when a seller urgently needs to transfer ownership but lacks the ability to pay off the mortgage. Before engaging in an Assumption of Real Estate Contract, it is crucial for both parties to conduct extensive due diligence to ensure smooth and legal transaction. Buyers should thoroughly examine the financial health of the property, including assessing the property's value and condition, reviewing the terms of the existing mortgage, and confirming the ability to meet the financial obligations associated with the assumption. Sellers should verify the buyer's creditworthiness and ability to assume the mortgage. In summary, the Las Cruces New Mexico Assumption of Real Estate Contract offers an alternative approach to purchasing real property by assuming the existing mortgage. It provides flexibility and convenience for both buyers and sellers, allowing them to achieve their respective goals in a mutually agreeable manner.

Las Cruces New Mexico Assumption of Real Estate Contract

Description

How to fill out Las Cruces New Mexico Assumption Of Real Estate Contract?

If you’ve already used our service before, log in to your account and save the Las Cruces New Mexico Assumption of Real Estate Contract on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Las Cruces New Mexico Assumption of Real Estate Contract. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!

Form popularity

FAQ

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

The Five Elements of a Contract Offer. Acceptance. Consideration. Capacity. Lawful Purpose.

6 Essential Elements of a Contract Offer. Acceptance. Awareness. Consideration. Capacity. Legality.

New Mexico Residential Purchase Agreement - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip A new mexico residential purchase agreement is a legally binding contract between the buyer andMoreA new mexico residential purchase agreement is a legally binding contract between the buyer and seller of a home it outlines all of the important terms and conditions of the transaction. Such as the

A legal contract must have a lawful purpose, mutual agreement, consideration, competent parties, and genuine assent to be enforceable. If a contract is breached, you may be able to sue for damages or seek other remedies.

Offer. Acceptance. Capacity. Consideration. Legality.

A due diligence investigation clause providing a purchaser with the right to perform due diligence investigations on the property after it has executed the purchase and sale agreement, including title searches and physical investigations on the property.

6 Essential Elements of a Contract Offer. Acceptance. Awareness. Consideration. Capacity. Legality.