Las Cruces, New Mexico Certificate of Redemption is an official document issued by the County Treasurer's Office to individuals or entities who have successfully satisfied their delinquent property tax obligations. This certificate serves as proof that the property owner has fulfilled their outstanding tax debt and redeemed their property from a tax lien or foreclosure. The Las Cruces Certificate of Redemption is essential for property owners who have fallen behind on their tax payments and want to reclaim their property. It allows them to regain full ownership rights and clear any outstanding tax liens associated with their property. There are several types of Las Cruces, New Mexico Certificate of Redemption, depending on the specific circumstances: 1. Regular Certificate of Redemption: This type of certificate is issued to property owners who have fully paid off their delinquent property taxes, penalties, interest, and associated fees. It signifies that the owner has met all requirements for reclaiming their property and is now in good standing with the county tax authorities. 2. Partial Redemption Certificate: In cases where the property owner makes a partial payment towards their outstanding tax debt, a Partial Redemption Certificate is issued. This certificate demonstrates the amount paid and the remaining balance still owed by the property owner. 3. Advanced Redemption Certificate: Sometimes, property owners may choose to pay their future property taxes in advance to eliminate the risk of falling into delinquency again. The Advanced Redemption Certificate acknowledges this proactive approach and confirms that the owner has paid future taxes, securing their property from potential liens or foreclosures. 4. Redemption by a Third Party Certificate: In certain scenarios, a third party, such as an investor or trustee, may pay off the delinquent property taxes on behalf of the property owner. The Redemption by a Third Party Certificate is issued in the name of the individual or entity responsible for redeeming the property, indicating their rights to the property until repayment terms are met. Las Cruces, New Mexico Certificate of Redemption plays a crucial role in safeguarding property owners' rights and preventing unnecessary foreclosures due to unpaid taxes. It is a valuable document that signifies financial responsibility and compliance with county tax regulations. By obtaining a Certificate of Redemption, property owners can regain peace of mind and enjoy undisputed control over their valuable assets.

Las Cruces New Mexico Certificate of Redemption

Category:

State:

New Mexico

City:

Las Cruces

Control #:

NM-011LRS

Format:

Word;

Rich Text

Instant download

Description

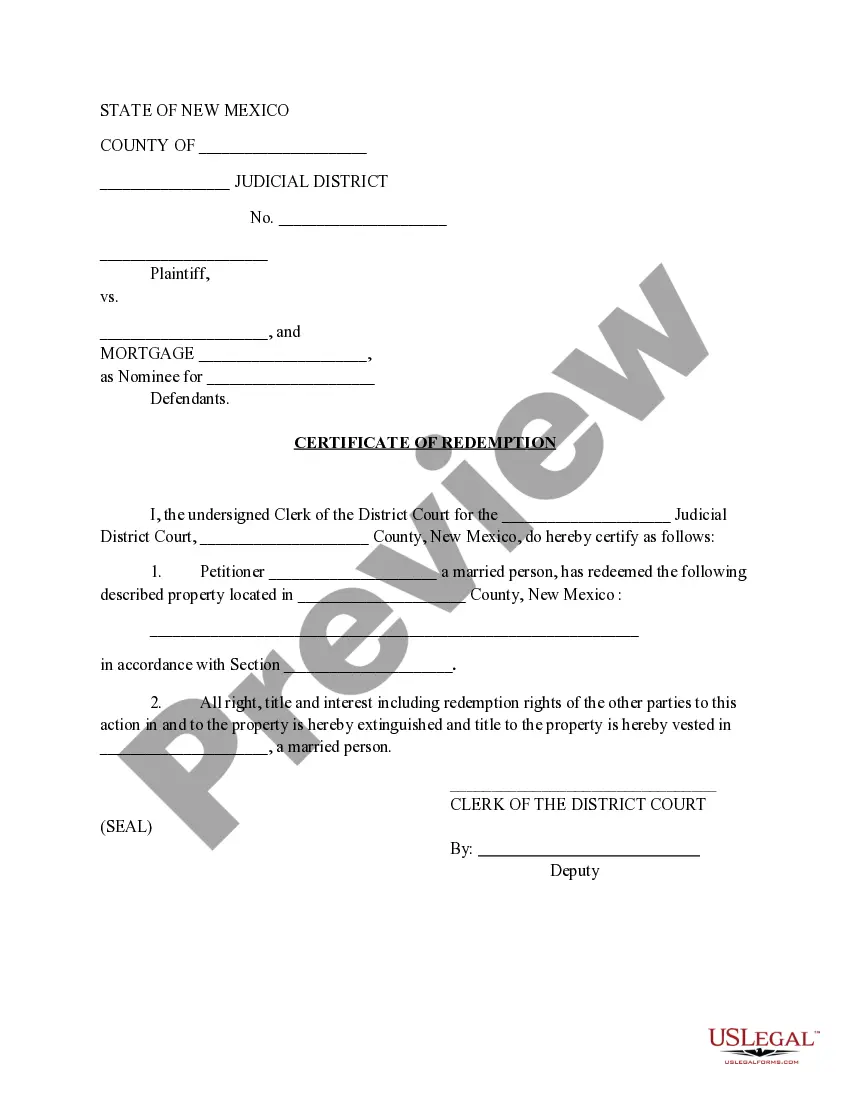

A certificate of redemption is a document that indicates that a delinquent borrower who is facing foreclosure has paid all outstanding tax amounts and fines. It entitles a borrower to regain ownership over the property after foreclosure but before an auction sale.

Las Cruces, New Mexico Certificate of Redemption is an official document issued by the County Treasurer's Office to individuals or entities who have successfully satisfied their delinquent property tax obligations. This certificate serves as proof that the property owner has fulfilled their outstanding tax debt and redeemed their property from a tax lien or foreclosure. The Las Cruces Certificate of Redemption is essential for property owners who have fallen behind on their tax payments and want to reclaim their property. It allows them to regain full ownership rights and clear any outstanding tax liens associated with their property. There are several types of Las Cruces, New Mexico Certificate of Redemption, depending on the specific circumstances: 1. Regular Certificate of Redemption: This type of certificate is issued to property owners who have fully paid off their delinquent property taxes, penalties, interest, and associated fees. It signifies that the owner has met all requirements for reclaiming their property and is now in good standing with the county tax authorities. 2. Partial Redemption Certificate: In cases where the property owner makes a partial payment towards their outstanding tax debt, a Partial Redemption Certificate is issued. This certificate demonstrates the amount paid and the remaining balance still owed by the property owner. 3. Advanced Redemption Certificate: Sometimes, property owners may choose to pay their future property taxes in advance to eliminate the risk of falling into delinquency again. The Advanced Redemption Certificate acknowledges this proactive approach and confirms that the owner has paid future taxes, securing their property from potential liens or foreclosures. 4. Redemption by a Third Party Certificate: In certain scenarios, a third party, such as an investor or trustee, may pay off the delinquent property taxes on behalf of the property owner. The Redemption by a Third Party Certificate is issued in the name of the individual or entity responsible for redeeming the property, indicating their rights to the property until repayment terms are met. Las Cruces, New Mexico Certificate of Redemption plays a crucial role in safeguarding property owners' rights and preventing unnecessary foreclosures due to unpaid taxes. It is a valuable document that signifies financial responsibility and compliance with county tax regulations. By obtaining a Certificate of Redemption, property owners can regain peace of mind and enjoy undisputed control over their valuable assets.

How to fill out Las Cruces New Mexico Certificate Of Redemption?

If you’ve already used our service before, log in to your account and download the Las Cruces New Mexico Certificate of Redemption on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Las Cruces New Mexico Certificate of Redemption. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!