A blanket loan, or blanket mortgage, is a type of loan used to fund the purchase of more than one piece of real property. Blanket loans are popular with builders and developers who buy large tracts of land, then subdivide them to create many individual parcels to be gradually sold one at a time. Traditional mortgages typically have a "due-on-sale clause", which stipulates that if property secured by the mortgage is sold, the entire outstanding mortgage debt must be paid in full immediately. With a blanket mortgage, a "release clause" allows the sale of portions of the secured property and corresponding partial repayment of the loan. This is done to facilitate purchases and sales of multiple units of property with the convenience of a single mortgage.

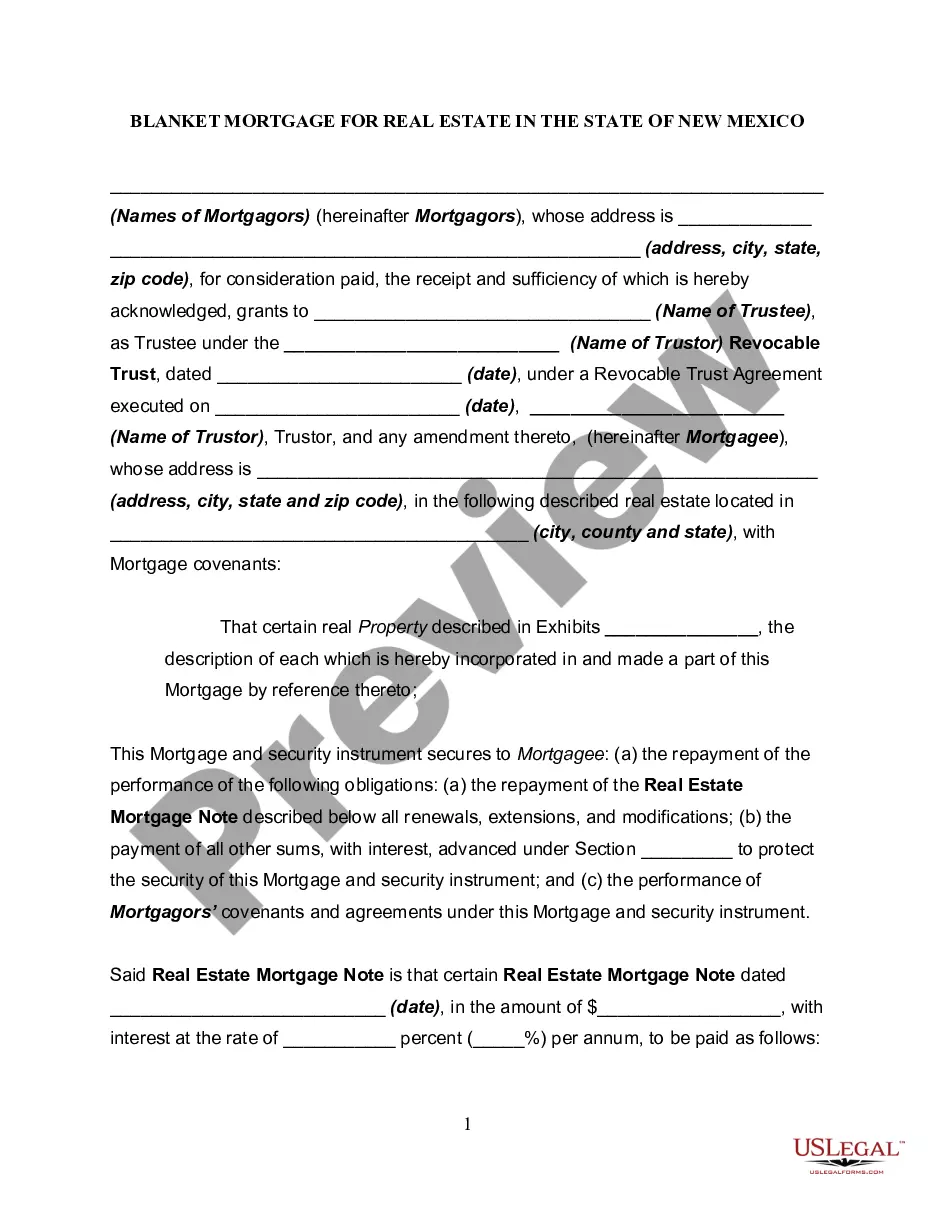

Albuquerque Blanket Mortgage for Real Estate in the State of New Mexico: A Comprehensive Overview When it comes to investing in real estate in Albuquerque, New Mexico, understanding the various financing options available is essential. One such financing tool is the Albuquerque blanket mortgage, a unique mortgage option that can offer distinct advantages for real estate investors. In this detailed description, we will explore what an Albuquerque blanket mortgage entails, its benefits, and the different types available in the state of New Mexico. What is an Albuquerque Blanket Mortgage? An Albuquerque blanket mortgage is a single loan that covers multiple properties or lots. It allows real estate investors or developers to consolidate financing for multiple properties under a single mortgage, streamlining the borrowing process. Instead of taking out individual mortgages for each property, investors can use a blanket mortgage to finance the acquisition, development, or construction of multiple properties simultaneously. The Benefits of Albuquerque Blanket Mortgages: 1. Simplified Financing: The primary advantage of an Albuquerque blanket mortgage is that it simplifies the financing process. By combining multiple properties into a single loan, investors can save time and effort by dealing with a single lender, application process, and loan repayment. This convenience can be especially advantageous when managing a real estate portfolio comprising numerous properties. 2. Cost Savings: Another significant benefit of an Albuquerque blanket mortgage is potential cost savings. Rather than paying separate closing costs and fees for each property, a blanket mortgage allows investors to minimize these expenses by consolidating them into a single transaction. This can result in significant savings over time, particularly for those investing in multiple properties. 3. Flexible Financing Options: Blanket mortgages often offer more flexibility compared to traditional mortgages. Investors can use the loan to purchase properties across different locations or even different property types, such as residential and commercial real estate. This flexibility makes blanket mortgages an attractive option for those seeking varied real estate investments. Different Types of Albuquerque Blanket Mortgages: 1. Residential Blanket Mortgages: This type of blanket mortgage is designed for investors or developers who want to finance multiple residential properties simultaneously. Whether it's a portfolio of rental homes or a residential development project, residential blanket mortgages allow for consolidated financing across multiple properties. 2. Commercial Blanket Mortgages: A commercial blanket mortgage is tailored for investors or businesses looking to purchase multiple commercial properties. From office buildings to retail spaces or even industrial complexes, this type of blanket mortgage enables streamlined financing for a variety of commercial real estate investments. 3. Mixed-Use or Multi-Unit Blanket Mortgages: For investors involved in mixed-use developments or multi-unit properties, this type of blanket mortgage can be an excellent option. It provides consolidated financing for properties with both residential and commercial components, allowing for efficient management of mixed-use real estate projects. In conclusion, an Albuquerque blanket mortgage offers an attractive financing solution for real estate investors or developers looking to consolidate financing across multiple properties. The simplified financing process, potential cost savings, and flexibility make blanket mortgages a valuable tool in managing diverse real estate portfolios. Whether it's residential, commercial, or mixed-use properties, understanding the different types of Albuquerque blanket mortgages available in the state of New Mexico can help investors make informed decisions and maximize their real estate investments.Albuquerque Blanket Mortgage for Real Estate in the State of New Mexico: A Comprehensive Overview When it comes to investing in real estate in Albuquerque, New Mexico, understanding the various financing options available is essential. One such financing tool is the Albuquerque blanket mortgage, a unique mortgage option that can offer distinct advantages for real estate investors. In this detailed description, we will explore what an Albuquerque blanket mortgage entails, its benefits, and the different types available in the state of New Mexico. What is an Albuquerque Blanket Mortgage? An Albuquerque blanket mortgage is a single loan that covers multiple properties or lots. It allows real estate investors or developers to consolidate financing for multiple properties under a single mortgage, streamlining the borrowing process. Instead of taking out individual mortgages for each property, investors can use a blanket mortgage to finance the acquisition, development, or construction of multiple properties simultaneously. The Benefits of Albuquerque Blanket Mortgages: 1. Simplified Financing: The primary advantage of an Albuquerque blanket mortgage is that it simplifies the financing process. By combining multiple properties into a single loan, investors can save time and effort by dealing with a single lender, application process, and loan repayment. This convenience can be especially advantageous when managing a real estate portfolio comprising numerous properties. 2. Cost Savings: Another significant benefit of an Albuquerque blanket mortgage is potential cost savings. Rather than paying separate closing costs and fees for each property, a blanket mortgage allows investors to minimize these expenses by consolidating them into a single transaction. This can result in significant savings over time, particularly for those investing in multiple properties. 3. Flexible Financing Options: Blanket mortgages often offer more flexibility compared to traditional mortgages. Investors can use the loan to purchase properties across different locations or even different property types, such as residential and commercial real estate. This flexibility makes blanket mortgages an attractive option for those seeking varied real estate investments. Different Types of Albuquerque Blanket Mortgages: 1. Residential Blanket Mortgages: This type of blanket mortgage is designed for investors or developers who want to finance multiple residential properties simultaneously. Whether it's a portfolio of rental homes or a residential development project, residential blanket mortgages allow for consolidated financing across multiple properties. 2. Commercial Blanket Mortgages: A commercial blanket mortgage is tailored for investors or businesses looking to purchase multiple commercial properties. From office buildings to retail spaces or even industrial complexes, this type of blanket mortgage enables streamlined financing for a variety of commercial real estate investments. 3. Mixed-Use or Multi-Unit Blanket Mortgages: For investors involved in mixed-use developments or multi-unit properties, this type of blanket mortgage can be an excellent option. It provides consolidated financing for properties with both residential and commercial components, allowing for efficient management of mixed-use real estate projects. In conclusion, an Albuquerque blanket mortgage offers an attractive financing solution for real estate investors or developers looking to consolidate financing across multiple properties. The simplified financing process, potential cost savings, and flexibility make blanket mortgages a valuable tool in managing diverse real estate portfolios. Whether it's residential, commercial, or mixed-use properties, understanding the different types of Albuquerque blanket mortgages available in the state of New Mexico can help investors make informed decisions and maximize their real estate investments.