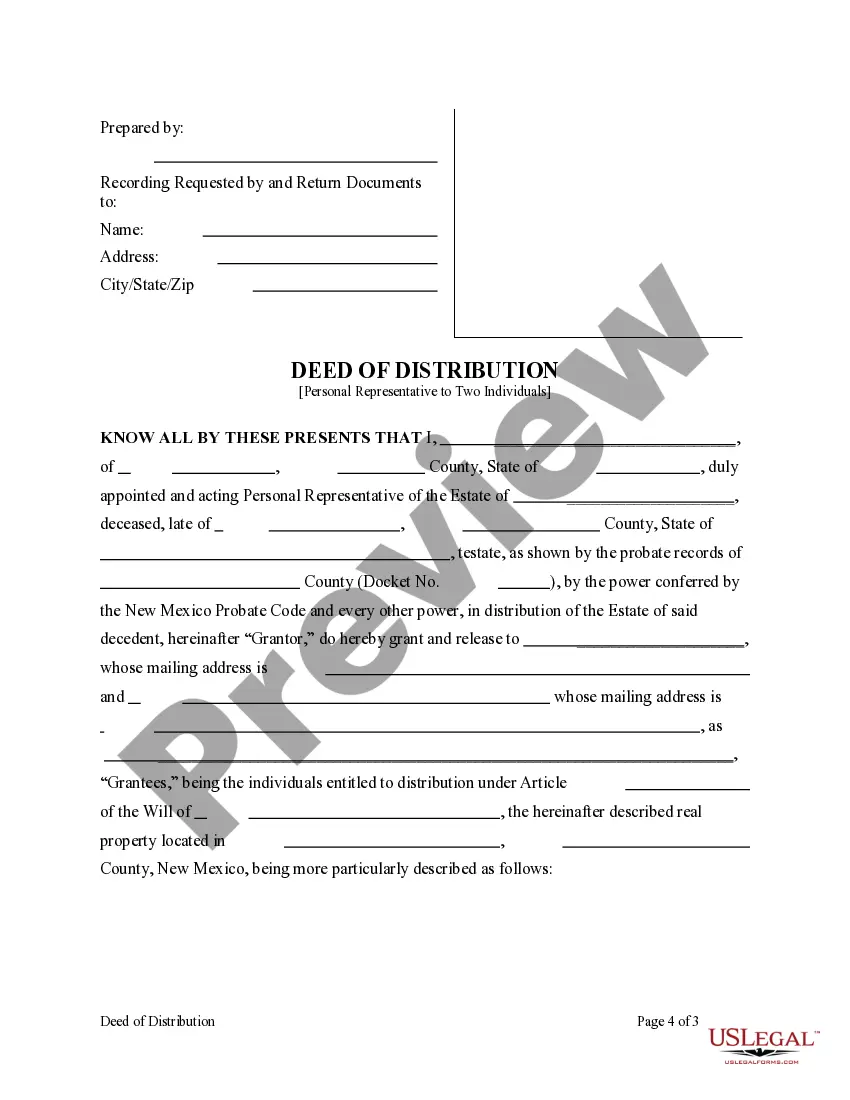

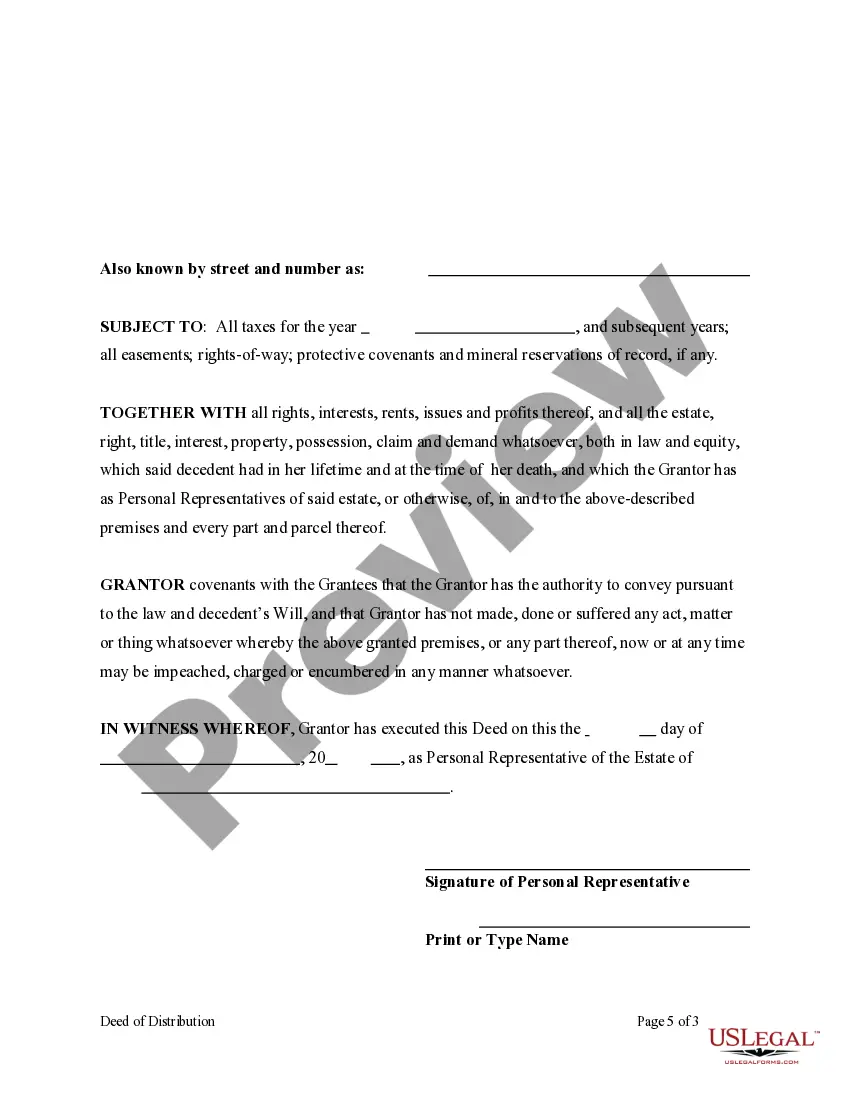

This form is a Personal Representative's Deed of Distribution where the Grantor is the Personal Representative of an estate and the Grantees are the beneficiaries of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

Las Cruces, New Mexico Deed of Distribution — Personal Representative to Two Individuals The Las Cruces, New Mexico Deed of Distribution — Personal Representative to Two Individuals is a legal document that outlines the transfer of assets or property from the estate of a deceased person to two specific individuals. This deed serves as an official record of the distribution process and ensures a fair division of the estate's assets. In Las Cruces, New Mexico, there are two primary types of Deeds of Distribution — Personal Representative to Two Individuals: 1. General Deed of Distribution: This type of deed is used when the deceased person's estate is being distributed among two individuals according to the provisions outlined in their will. The personal representative, who is usually appointed by the court, is responsible for carrying out the distribution process in accordance with the deceased person's wishes. The general deed of distribution ensures that the assets, such as properties, bank accounts, investments, and personal belongings, are distributed fairly and according to the instructions provided in the will. 2. Deed of Distribution without a Will: When a person passes away without leaving behind a valid will, the distribution of their estate is governed by the laws of intestacy. In such cases, the court appoints a personal representative, often a close family member or a legal professional, to handle the distribution process. The deed of distribution without a will outlines the distribution of assets, adhering to the laws of intestacy, and ensures that the assets are transferred equitably between the two identified individuals. Key considerations for the Las Cruces, New Mexico Deed of Distribution — Personal Representative to Two Individuals: 1. Property Inventory: The personal representative must prepare a comprehensive inventory of the deceased person's assets, including all properties, bank accounts, investments, and personal belongings. This inventory serves as the basis for the distribution process and is essential for an accurate and fair division of assets. 2. Appraisal of Assets: For properties or valuable assets, it may be necessary to obtain professional appraisals to determine their market value. This is crucial to ensure an equitable distribution based on the assessed value of each asset. 3. Debts and Taxes: Any outstanding debts or taxes owed by the deceased person or the estate must be settled before the distribution of assets can take place. The personal representative must carefully review and address any outstanding financial obligations to avoid any legal issues or complications. 4. Legal Assistance: Given the complex nature of estate distribution, it is highly recommended seeking the guidance of a qualified attorney experienced in probate law. They can provide legal expertise, ensure adherence to legal requirements, and help facilitate a smooth and proper distribution process. Overall, the Las Cruces, New Mexico Deed of Distribution — Personal Representative to Two Individuals is a critical legal document used to ensure a fair and equitable distribution of assets from a deceased person's estate. Whether based on a will or the laws of intestacy, this deed serves as a vital record, protecting the rights of both the personal representative and the identified individuals receiving the assets.