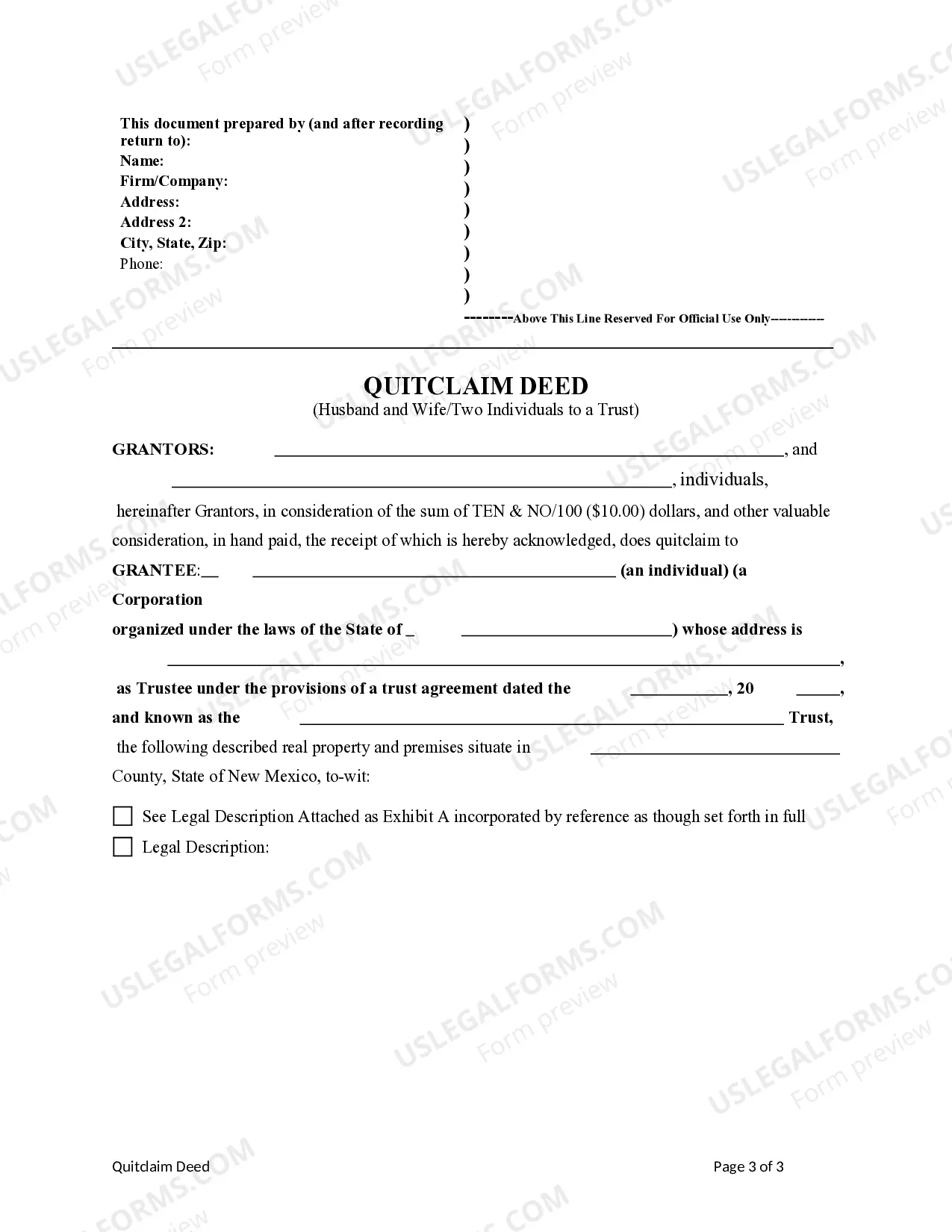

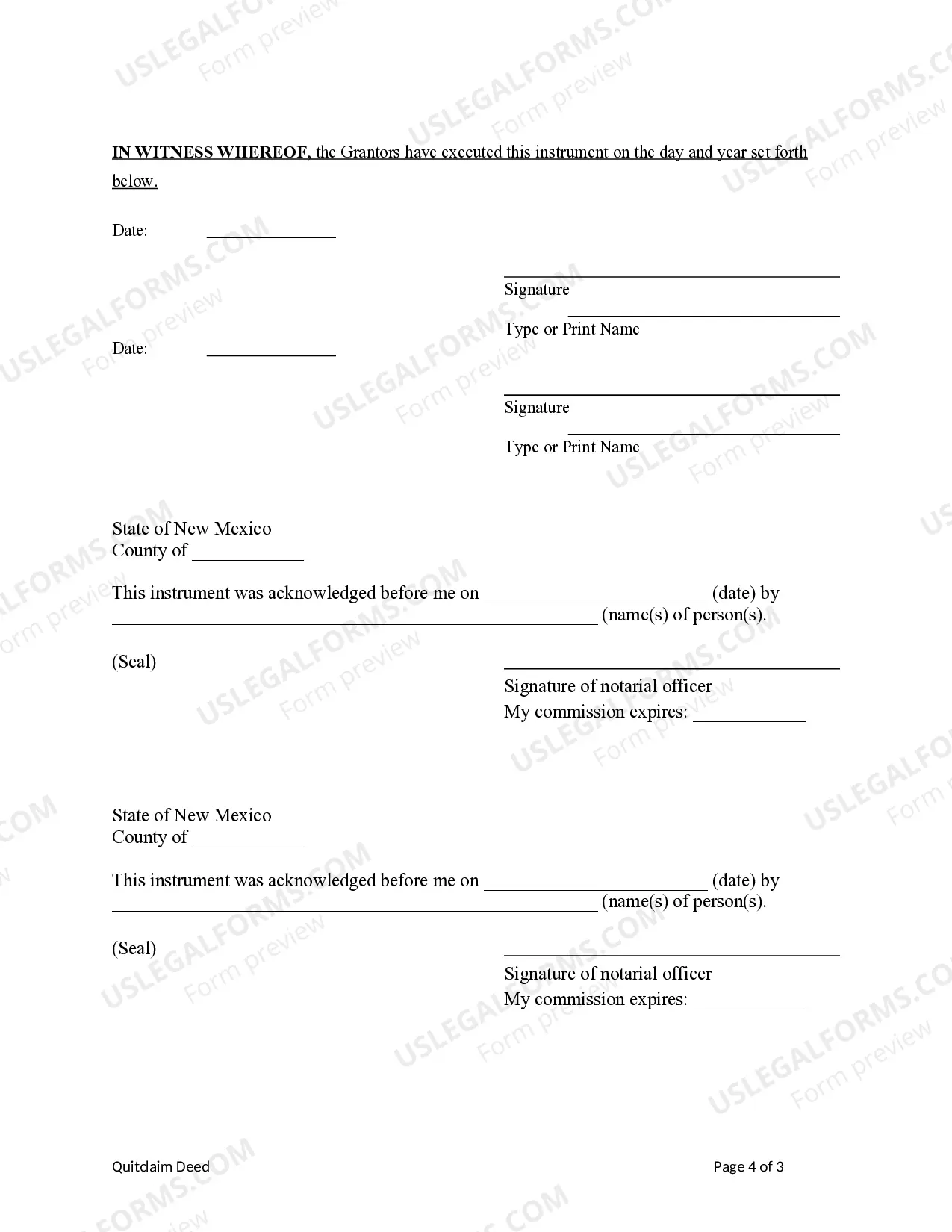

This form is a Quitclaim Deed where the Grantors are two individuals ro husband and wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Las Cruces, New Mexico Quitclaim Deed — Two Individuals / Husband and Wife to a Trust: Detailed Description and Types A Las Cruces, New Mexico quitclaim deed is a legal document used to transfer property ownership rights from two individuals, specifically a husband and wife, to a trust. This type of deed is commonly utilized to protect assets and ensure a seamless transfer of property within a family. The quitclaim deed serves as a legal instrument that allows the couple to convey any interests they possess in the property to their trust. By transferring ownership to a trust, the property can be managed and protected according to the couple's predetermined wishes and estate planning objectives. This type of transfer can provide numerous benefits, such as the ability to avoid probate, protect assets from creditors, and ensure smooth succession planning. When opting for a Las Cruces quitclaim deed between two individuals, specifically a husband and wife, there can be different types of such transactions, including: 1. Traditional Transfer: This involves the transfer of ownership between the husband and wife to the trust, without any specific conditions or limitations attached. 2. Life Estate Transfer: In this variation, the husband and wife transfer their ownership interest in the property to the trust while retaining a life estate. A life estate grants them the right to use and enjoy the property during their lifetimes. Once they pass away, ownership automatically transfers to the trust. 3. Medicaid Planning: For couples planning ahead for possible long-term care expenses, a quitclaim deed to a trust can be used as part of Medicaid planning. By transferring ownership to a trust, they may potentially protect the property from being counted as an asset when determining Medicaid eligibility. 4. Joint Tenancy with Right of Survivorship: Instead of transferring ownership to a trust, the husband and wife can elect to hold the property as joint tenants with the right of survivorship. This means that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. Utilizing a quitclaim deed to transfer property to a trust requires careful consideration of legal implications, tax consequences, and the specific objectives of the transferring couple. It is always advisable to consult with a qualified attorney or real estate professional experienced in Las Cruces, New Mexico real estate law to ensure the process is executed properly and meets the desired outcomes. In conclusion, a Las Cruces, New Mexico quitclaim deed — two individuals / husband and wife to a trust is a legal document used to transfer property ownership from a couple to a trust. Different variations of this transaction include traditional transfers, life estate transfers, Medicaid planning, and joint tenancy with the right of survivorship. Consulting an attorney or real estate expert is crucial to navigate the complexities and successfully execute the transfer while effectively protecting and managing assets.