Las Cruces, New Mexico Transfer of Lien: A Comprehensive Overview In Las Cruces, New Mexico, the transfer of lien is a legal process that involves the transfer of an existing lien from one party to another. A lien is a legal claim placed on a property to secure a debt or an obligation. When a property owner fails to fulfill their financial obligations towards a creditor, such as unpaid debts, taxes, or mortgages, a lien may be placed on the property as a means of enforcing payment. Keywords: Las Cruces, New Mexico, transfer of lien, legal process, existing lien, party, claim, property, secure, debt, obligation, property owner, financial obligations, creditor, unpaid debts, taxes, mortgages, means, enforcing payment. Types of Las Cruces, New Mexico Transfer of Lien: 1. Mortgage Transfer of Lien: This type of transfer of lien occurs when a property owner transfers their mortgage to another party. This can happen during a property sale, where the buyer assumes the existing mortgage and becomes responsible for the remaining payments. 2. Tax Lien Transfer: In Las Cruces, New Mexico, the transfer of a tax lien occurs when a property owner is delinquent in paying their property taxes. The local tax authority may place a lien on the property, and it can be transferred to another party, such as a tax lien investor, who can then take legal actions to enforce payment. 3. Mechanic's Lien Transfer: If a contractor or subcontractor performs work on a property and is not compensated adequately, they can file a mechanic's lien as a claim against the property. This lien can be transferred to another party, potentially allowing the unpaid contractor to receive the compensation they are owed. 4. Judgment Lien Transfer: When a court awards a financial judgment against a property owner, it can be converted into a judgment lien. This lien ensures that the debtor pays their obligations. In some cases, a judgment lien can be transferred to another party, granting them the right to collect the owed amount. 5. HOA Lien Transfer: Homeowners Associations (Has) in Las Cruces, New Mexico, have the authority to place liens on properties for unpaid fees, fines, or assessments. These liens can be transferred to another party, such as a collection agency, to facilitate debt recovery. 6. State Tax Lien Transfer: In addition to local property taxes, the State of New Mexico can also place liens on properties for unpaid state taxes. These liens can be transferred to another party, giving them the power to enforce payment and potentially initiate foreclosure proceedings. In Las Cruces, New Mexico, the transfer of lien plays a crucial role in the resolution of financial obligations and the enforcement of debt repayment. Understanding the different types of transfer of lien helps property owners, buyers, and creditors navigate through the complex legal processes involved. It is advisable to seek professional legal advice when dealing with such matters to ensure compliance with applicable laws and protect your interests.

Las Cruces New Mexico Transfer of Lien

Category:

State:

New Mexico

City:

Las Cruces

Control #:

NM-028LRS

Format:

Word;

Rich Text

Instant download

Description

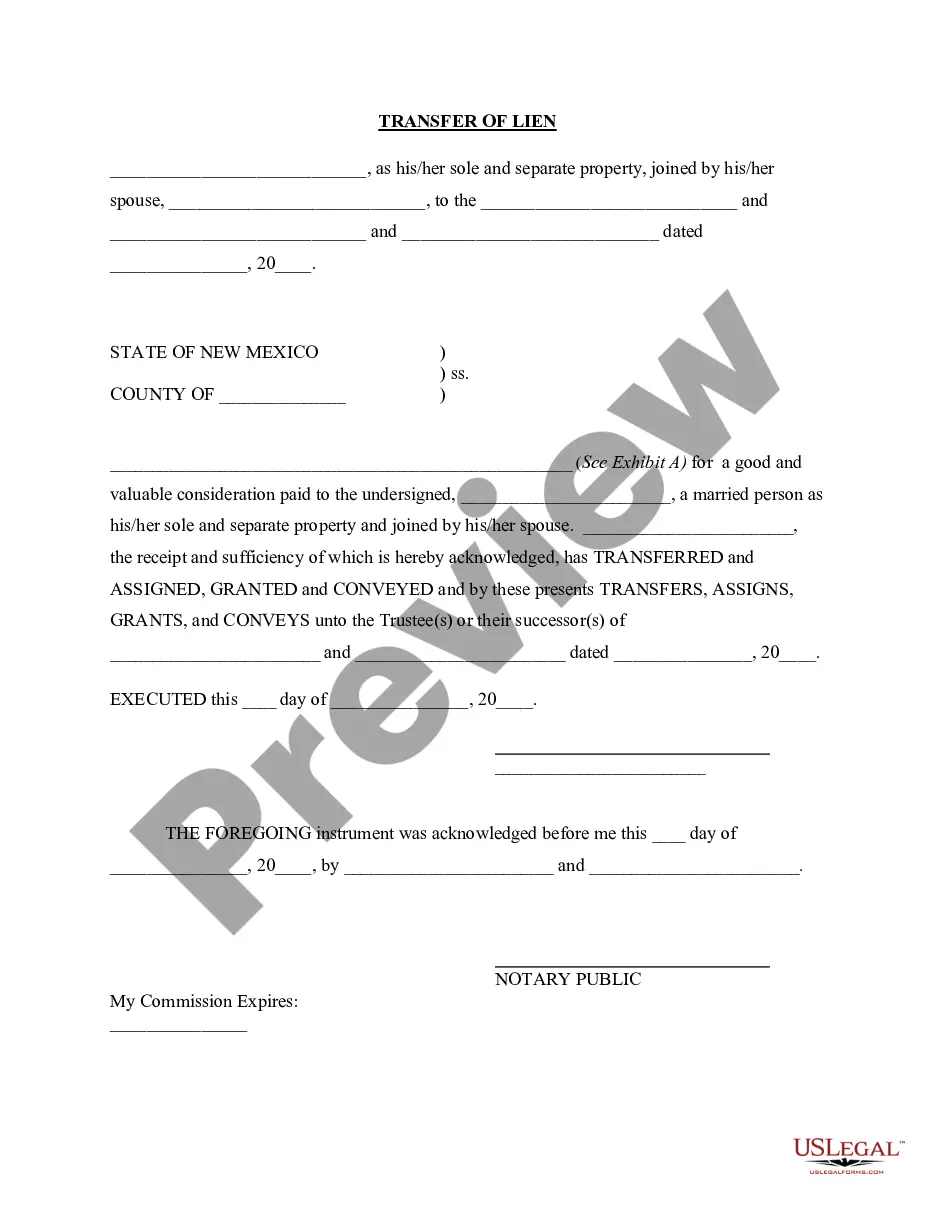

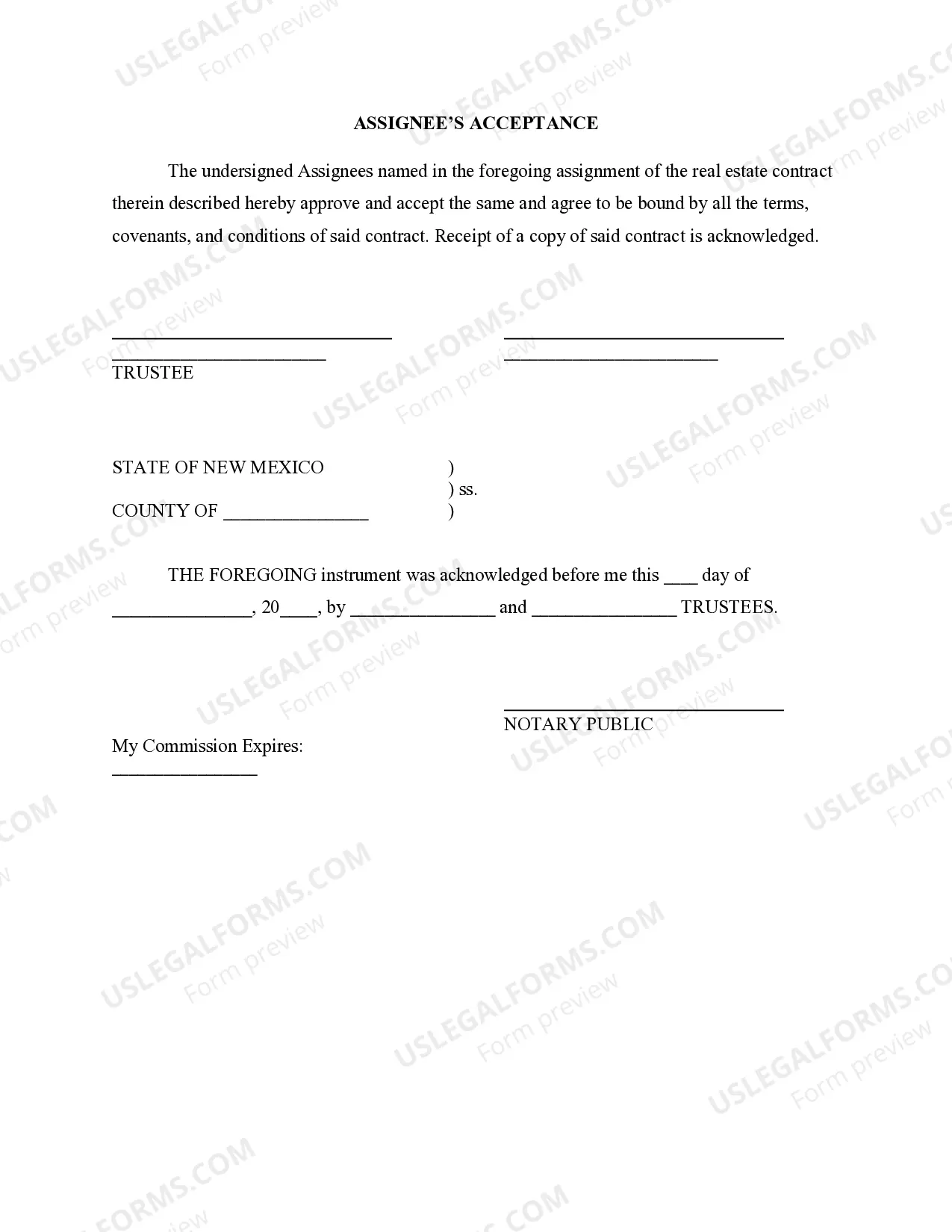

A married individual transfers a lien to a Trustee.

Las Cruces, New Mexico Transfer of Lien: A Comprehensive Overview In Las Cruces, New Mexico, the transfer of lien is a legal process that involves the transfer of an existing lien from one party to another. A lien is a legal claim placed on a property to secure a debt or an obligation. When a property owner fails to fulfill their financial obligations towards a creditor, such as unpaid debts, taxes, or mortgages, a lien may be placed on the property as a means of enforcing payment. Keywords: Las Cruces, New Mexico, transfer of lien, legal process, existing lien, party, claim, property, secure, debt, obligation, property owner, financial obligations, creditor, unpaid debts, taxes, mortgages, means, enforcing payment. Types of Las Cruces, New Mexico Transfer of Lien: 1. Mortgage Transfer of Lien: This type of transfer of lien occurs when a property owner transfers their mortgage to another party. This can happen during a property sale, where the buyer assumes the existing mortgage and becomes responsible for the remaining payments. 2. Tax Lien Transfer: In Las Cruces, New Mexico, the transfer of a tax lien occurs when a property owner is delinquent in paying their property taxes. The local tax authority may place a lien on the property, and it can be transferred to another party, such as a tax lien investor, who can then take legal actions to enforce payment. 3. Mechanic's Lien Transfer: If a contractor or subcontractor performs work on a property and is not compensated adequately, they can file a mechanic's lien as a claim against the property. This lien can be transferred to another party, potentially allowing the unpaid contractor to receive the compensation they are owed. 4. Judgment Lien Transfer: When a court awards a financial judgment against a property owner, it can be converted into a judgment lien. This lien ensures that the debtor pays their obligations. In some cases, a judgment lien can be transferred to another party, granting them the right to collect the owed amount. 5. HOA Lien Transfer: Homeowners Associations (Has) in Las Cruces, New Mexico, have the authority to place liens on properties for unpaid fees, fines, or assessments. These liens can be transferred to another party, such as a collection agency, to facilitate debt recovery. 6. State Tax Lien Transfer: In addition to local property taxes, the State of New Mexico can also place liens on properties for unpaid state taxes. These liens can be transferred to another party, giving them the power to enforce payment and potentially initiate foreclosure proceedings. In Las Cruces, New Mexico, the transfer of lien plays a crucial role in the resolution of financial obligations and the enforcement of debt repayment. Understanding the different types of transfer of lien helps property owners, buyers, and creditors navigate through the complex legal processes involved. It is advisable to seek professional legal advice when dealing with such matters to ensure compliance with applicable laws and protect your interests.

Free preview

How to fill out Las Cruces New Mexico Transfer Of Lien?

If you’ve already utilized our service before, log in to your account and download the Las Cruces New Mexico Transfer of Lien on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Las Cruces New Mexico Transfer of Lien. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!