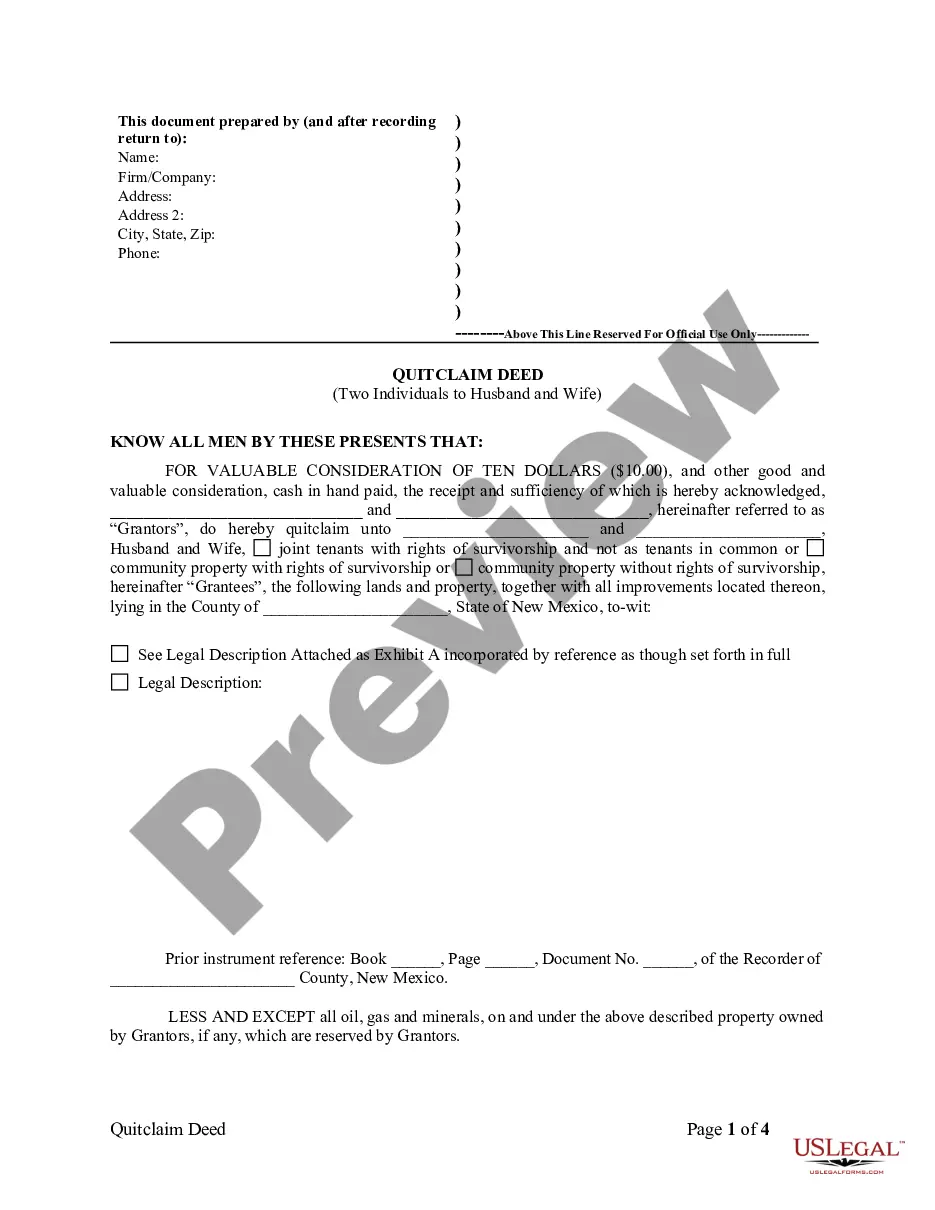

Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife

Description

How to fill out New Mexico Quitclaim Deed By Two Individuals To Husband And Wife?

If you’ve previously made use of our service, sign in to your account and store the Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife on your device by clicking the Download button. Ensure your subscription is current. If it’s not valid, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You retain permanent access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly locate and store any template for your personal or business needs!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview feature, if available, to determine if it satisfies your needs. If it doesn’t suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife. Select the file format for your document and store it on your device.

- Finalize your document. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

A quit claim deed can be voided if it lacks the proper signatures, is not notarized, or does not comply with state property laws. Additionally, issues such as fraud or misrepresentation during the transfer can invalidate the deed. Understanding these factors is critical, especially when dealing with a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife. To avoid complications, consider using USLegalForms, which guides you through creating a valid deed.

Yes, a quit claim deed in New Mexico must be notarized to be legally binding. Notarization provides essential proof that the document was signed willingly and in the presence of a notary public. For couples executing a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife, this step is crucial for safeguarding their interests. You can find detailed guidance on this process through USLegalForms.

In New Mexico, any qualified notary public can notarize a quit claim deed, provided they follow state regulations. It is crucial that the notary verifies the identity of the individuals signing the deed. This is especially important in situations like a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife, where clarity and legal assurance matter. For convenience, you might want to check with USLegalForms for information on finding a certified notary.

A quit claim deed in New Mexico must include the names of the parties involved and a clear description of the property being transferred. It's essential that the deed specifies the relationship of the individuals, such as 'two individuals to husband and wife.' Additionally, the document must be signed and dated by the grantor to ensure its validity. For those seeking to create a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife, utilizing platforms like USLegalForms offers helpful resources and templates.

A quitclaim deed is commonly used to simplify the transfer of property between family members or close associates without the complexities of a traditional sale. Many people use a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife to clarify ownership, particularly when adding or removing an individual from the title for financial or estate planning purposes. This type of deed offers a practical solution to manage property ownership changes effectively.

Filling out a quitclaim deed to add a spouse involves identifying the property and the parties involved clearly. You will need to enter the names of both individuals and specify the relationship when executing a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife. It is crucial to ensure that all names are spelled correctly and that the deed is signed in front of a notary. Once completed, record the deed with your local county clerk to finalize the process.

A quitclaim deed in New Mexico allows one person to transfer their interest in a property to another person without making any guarantees about ownership. When using a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife, the grantor relinquishes their claim, and the grantee accepts it. This type of deed is often used to add or remove a person's name from a title, providing a straightforward way to change ownership.

To remove your ex-wife from the deed, you may need to execute a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife. This deed allows the removal of her name from the property title. It’s important to ensure that you have a mutual agreement or court order to support this action. For detailed assistance and templates, consider using the US Legal Forms platform.

Adding a spouse to a deed can be seen as a gift under certain circumstances. When you use a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife, you're transferring ownership to include your spouse. This transfer must be handled with care to understand any tax implications. Consulting a legal expert can provide clarity on whether this acts as a gift.

Individuals seeking to simplify property transfers often benefit the most from a quitclaim deed. This document streamlines the process, making it easy to grant property rights to family members without lengthy legal procedures. In the context of a Las Cruces New Mexico Quitclaim Deed by Two Individuals to Husband and Wife, couples can efficiently manage their property ownership.