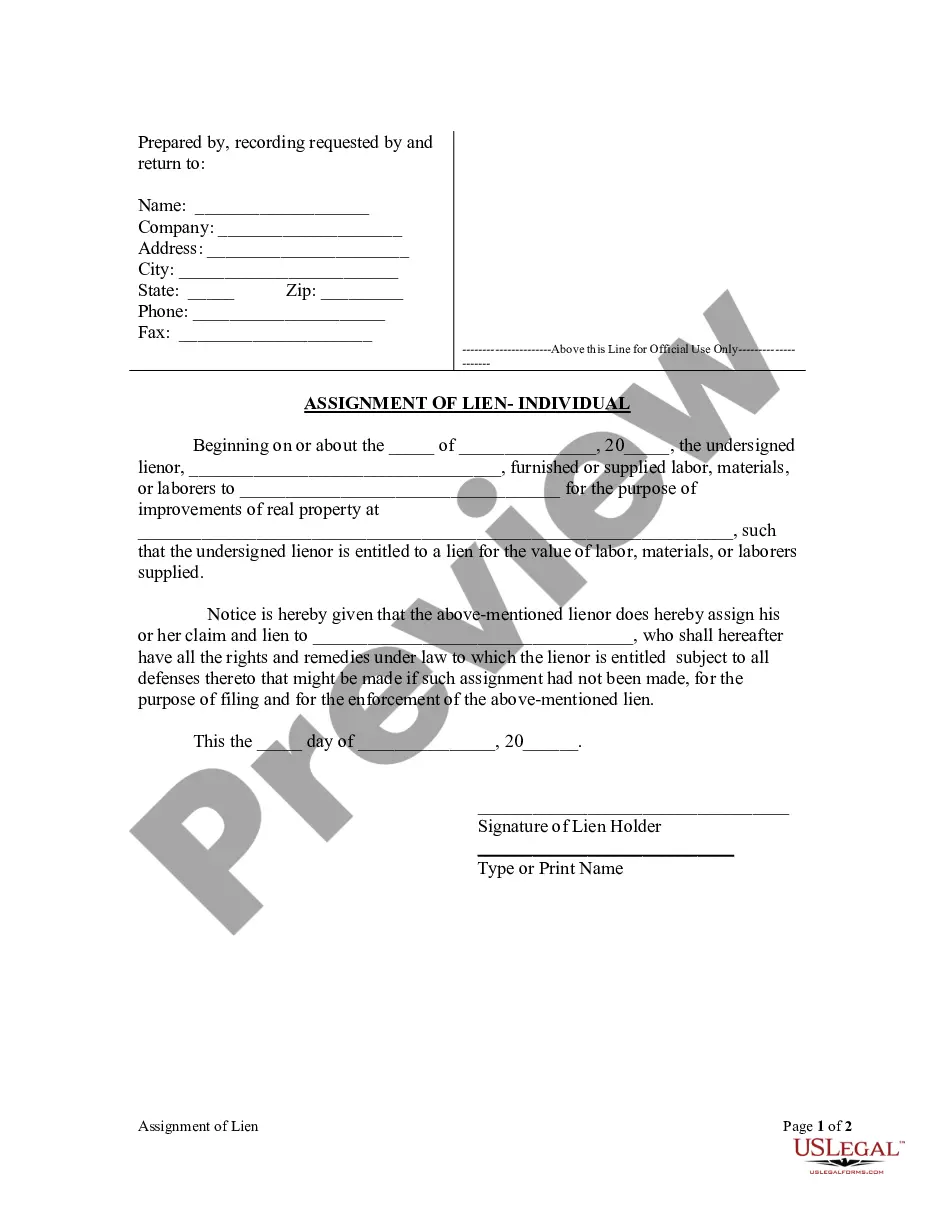

This Assignment of Lien form is for use by an individual lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied, to provide notice that he or she assigns his or her claim and lien to an individual who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

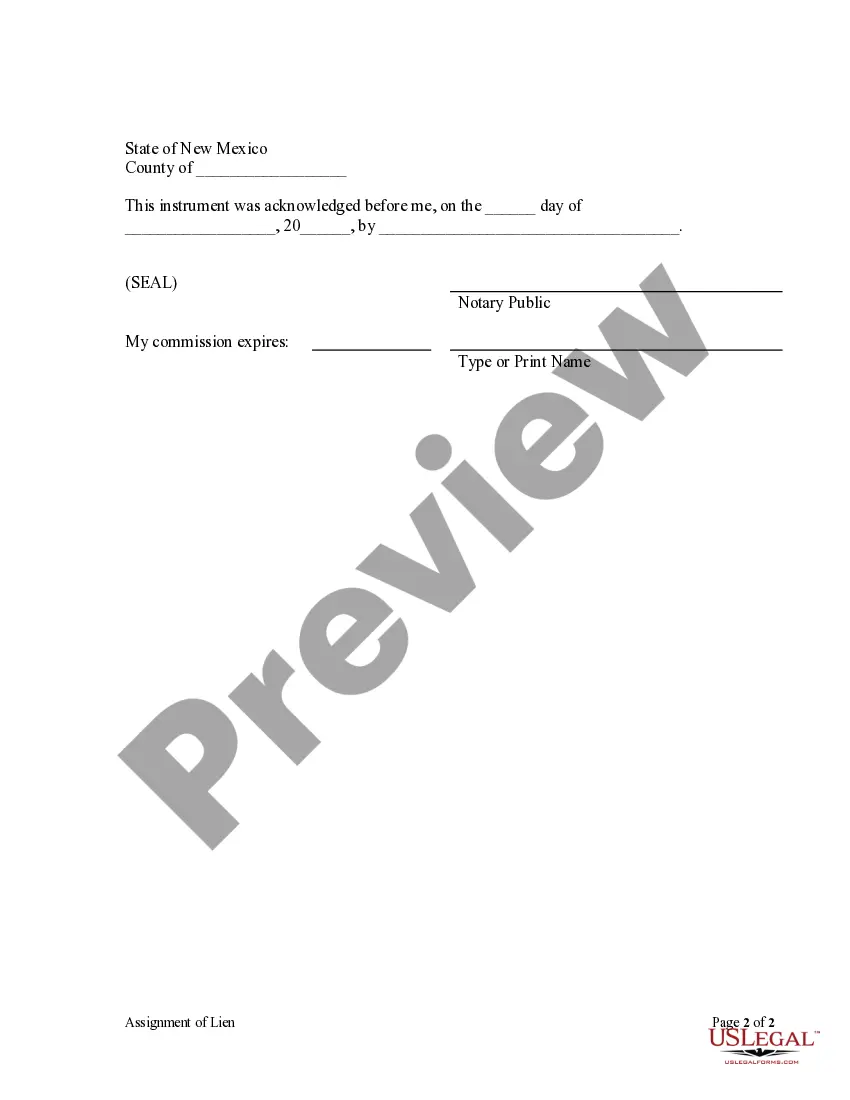

Las Cruces, New Mexico Assignment of Lien — Individual: A Detailed Description In Las Cruces, New Mexico, an Assignment of Lien — Individual refers to the legal transfer of a lien from one party to another. This document is commonly utilized when an individual or entity owes a debt, and the original creditor assigns or transfers the right to collect that debt to another person or organization. The Assignment of Lien ensures a smooth transfer of legal rights and obligations related to the debt, allowing the new lien holder to take appropriate actions to collect the owed amount. There are various types of Las Cruces, New Mexico Assignment of Lien — Individual, including: 1. Mortgage Lien Assignment: This type of lien assignment occurs when a mortgage lender transfers the lien on a property to another entity. This commonly happens during the sale or transfer of a mortgage loan from one financial institution to another. The new owner of the mortgage lien becomes the beneficiary of the debt and assumes the responsibility to collect outstanding payments. 2. Judgment Lien Assignment: A judgment lien assignment occurs when a court grants a creditor a lien against a debtor's property to secure payment of a court-ordered judgment. In some cases, a creditor may choose to assign this judgment lien to another party, typically due to the need for immediate payment or to offload the responsibility and focus on their core business activities. 3. Tax Lien Assignment: When a property owner fails to pay their property taxes, the local tax authority may place a tax lien on the property. In Las Cruces, New Mexico, if the governing jurisdiction allows it, a tax authority may assign the tax lien to another individual or entity for collection purposes. The new lien holder gains the authority to enforce the lien, including potential foreclosure actions if the taxes remain unpaid. 4. Mechanic's Lien Assignment: In the construction industry, a contractor, subcontractor, or supplier who has not received payment for work performed or materials supplied on a property can file a mechanic's lien. This lien asserts a claim against the property until the debt is resolved. In some cases, the original lien holder may choose to assign the mechanic's lien to another party to expedite the process of debt recovery. When an Assignment of Lien — Individual occurs in Las Cruces, New Mexico, it is crucial for all parties involved to consult legal professionals to ensure compliance with state laws and regulations. Proper documentation and recording of the assignment are essential to protect the rights and interests of both the original lien holder and the new assignee. In conclusion, Las Cruces, New Mexico Assignment of Lien — Individual involves the transfer of a lien from one party to another. Different types of lien assignments include mortgage lien assignments, judgment lien assignments, tax lien assignments, and mechanic's lien assignments. Seeking expert legal advice is crucial during this process to ensure compliance with the law and protect the rights of all parties involved.Las Cruces, New Mexico Assignment of Lien — Individual: A Detailed Description In Las Cruces, New Mexico, an Assignment of Lien — Individual refers to the legal transfer of a lien from one party to another. This document is commonly utilized when an individual or entity owes a debt, and the original creditor assigns or transfers the right to collect that debt to another person or organization. The Assignment of Lien ensures a smooth transfer of legal rights and obligations related to the debt, allowing the new lien holder to take appropriate actions to collect the owed amount. There are various types of Las Cruces, New Mexico Assignment of Lien — Individual, including: 1. Mortgage Lien Assignment: This type of lien assignment occurs when a mortgage lender transfers the lien on a property to another entity. This commonly happens during the sale or transfer of a mortgage loan from one financial institution to another. The new owner of the mortgage lien becomes the beneficiary of the debt and assumes the responsibility to collect outstanding payments. 2. Judgment Lien Assignment: A judgment lien assignment occurs when a court grants a creditor a lien against a debtor's property to secure payment of a court-ordered judgment. In some cases, a creditor may choose to assign this judgment lien to another party, typically due to the need for immediate payment or to offload the responsibility and focus on their core business activities. 3. Tax Lien Assignment: When a property owner fails to pay their property taxes, the local tax authority may place a tax lien on the property. In Las Cruces, New Mexico, if the governing jurisdiction allows it, a tax authority may assign the tax lien to another individual or entity for collection purposes. The new lien holder gains the authority to enforce the lien, including potential foreclosure actions if the taxes remain unpaid. 4. Mechanic's Lien Assignment: In the construction industry, a contractor, subcontractor, or supplier who has not received payment for work performed or materials supplied on a property can file a mechanic's lien. This lien asserts a claim against the property until the debt is resolved. In some cases, the original lien holder may choose to assign the mechanic's lien to another party to expedite the process of debt recovery. When an Assignment of Lien — Individual occurs in Las Cruces, New Mexico, it is crucial for all parties involved to consult legal professionals to ensure compliance with state laws and regulations. Proper documentation and recording of the assignment are essential to protect the rights and interests of both the original lien holder and the new assignee. In conclusion, Las Cruces, New Mexico Assignment of Lien — Individual involves the transfer of a lien from one party to another. Different types of lien assignments include mortgage lien assignments, judgment lien assignments, tax lien assignments, and mechanic's lien assignments. Seeking expert legal advice is crucial during this process to ensure compliance with the law and protect the rights of all parties involved.