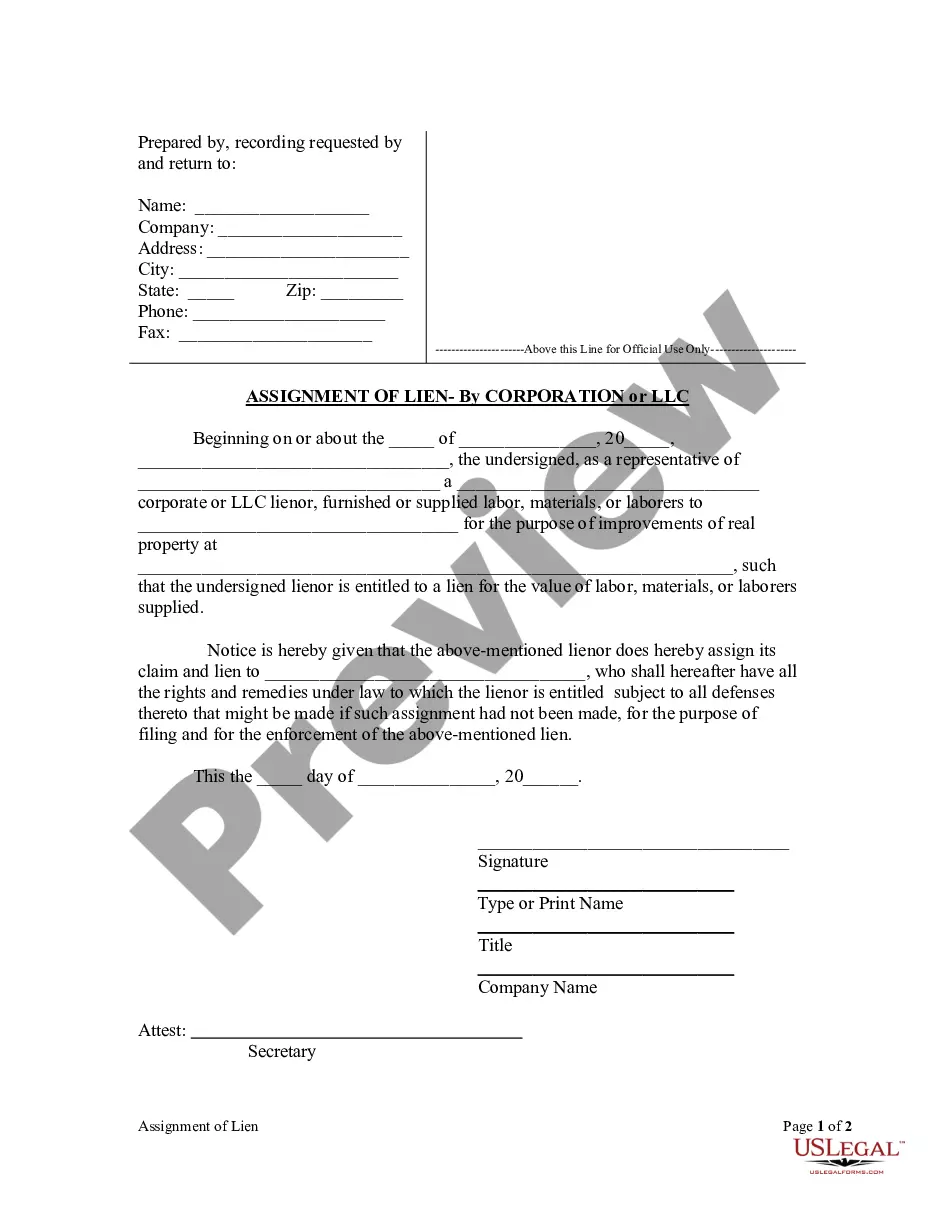

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied, to provide notice that the lienor assigns the lienor's claim and lien to an individual who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

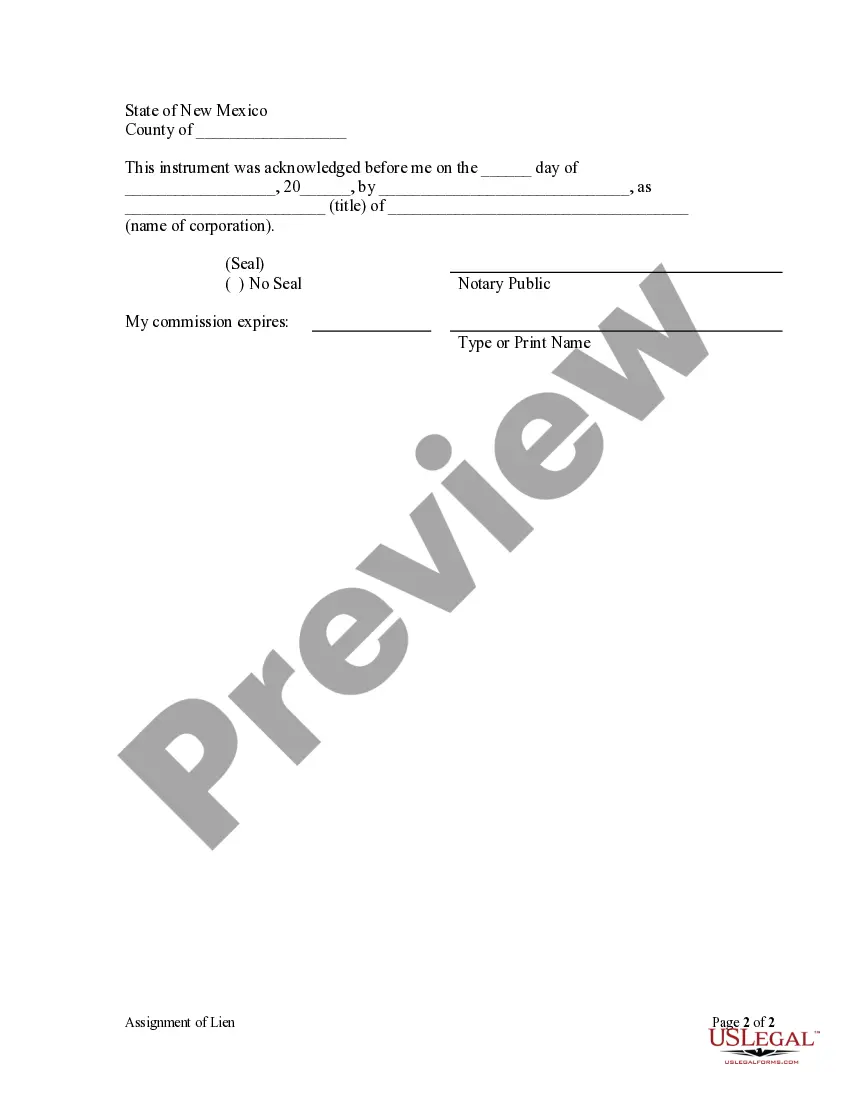

Las Cruces, New Mexico is a vibrant city known for its rich history, diverse culture, and stunning natural landscapes. Located in Donna Ana County, the city is home to numerous corporations and LCS that play a significant role in its economic growth. In certain cases, these business entities may encounter situations where an assignment of lien becomes necessary. An assignment of lien refers to the transfer of a lien from one party to another, typically when a debt or obligation is being transferred. In Las Cruces, there are different types of Assignment of Lien — Corporation or LLC that can take place. Let's explore these variations: 1. Assignment of Lien — Corporation: When a corporation in Las Cruces holds a lien against a property or asset and needs to transfer the lien to another entity, an Assignment of Lien — Corporation occurs. This type of assignment ensures the legal transfer of the corporation's rights to the lien, thereby allowing the new entity to become the lien holder. 2. Assignment of Lien — LLC: Similar to corporations, limited liability companies (LCS) in Las Cruces can also hold liens on properties or assets. In cases where an LLC wants to transfer its lien rights to another entity, an Assignment of Lien — LLC takes place. This process allows the LLC to assign its rights, interests, and obligations related to the lien to another party. 3. Assignment of Subordinate Lien — Corporation or LLC: Sometimes, a subordinate lien may exist alongside a primary lien on a property or asset. In such cases, if the corporation or LLC holding the subordinate lien wishes to transfer its rights and obligations to another entity, an Assignment of Subordinate Lien — Corporation or LLC occurs. This type of assignment ensures a smooth transfer of the subordinate lien while preserving the hierarchy of the liens on the property or asset. Overall, Las Cruces, New Mexico, experiences various types of Assignment of Lien — Corporation or LLC transactions, each catering to specific scenarios. Whether it's the transfer of a primary lien, subordinate lien, or the assignment of lien rights from a corporation or LLC, these processes are vital for maintaining legal obligations while facilitating the growth and financial transactions of businesses in the city.Las Cruces, New Mexico is a vibrant city known for its rich history, diverse culture, and stunning natural landscapes. Located in Donna Ana County, the city is home to numerous corporations and LCS that play a significant role in its economic growth. In certain cases, these business entities may encounter situations where an assignment of lien becomes necessary. An assignment of lien refers to the transfer of a lien from one party to another, typically when a debt or obligation is being transferred. In Las Cruces, there are different types of Assignment of Lien — Corporation or LLC that can take place. Let's explore these variations: 1. Assignment of Lien — Corporation: When a corporation in Las Cruces holds a lien against a property or asset and needs to transfer the lien to another entity, an Assignment of Lien — Corporation occurs. This type of assignment ensures the legal transfer of the corporation's rights to the lien, thereby allowing the new entity to become the lien holder. 2. Assignment of Lien — LLC: Similar to corporations, limited liability companies (LCS) in Las Cruces can also hold liens on properties or assets. In cases where an LLC wants to transfer its lien rights to another entity, an Assignment of Lien — LLC takes place. This process allows the LLC to assign its rights, interests, and obligations related to the lien to another party. 3. Assignment of Subordinate Lien — Corporation or LLC: Sometimes, a subordinate lien may exist alongside a primary lien on a property or asset. In such cases, if the corporation or LLC holding the subordinate lien wishes to transfer its rights and obligations to another entity, an Assignment of Subordinate Lien — Corporation or LLC occurs. This type of assignment ensures a smooth transfer of the subordinate lien while preserving the hierarchy of the liens on the property or asset. Overall, Las Cruces, New Mexico, experiences various types of Assignment of Lien — Corporation or LLC transactions, each catering to specific scenarios. Whether it's the transfer of a primary lien, subordinate lien, or the assignment of lien rights from a corporation or LLC, these processes are vital for maintaining legal obligations while facilitating the growth and financial transactions of businesses in the city.