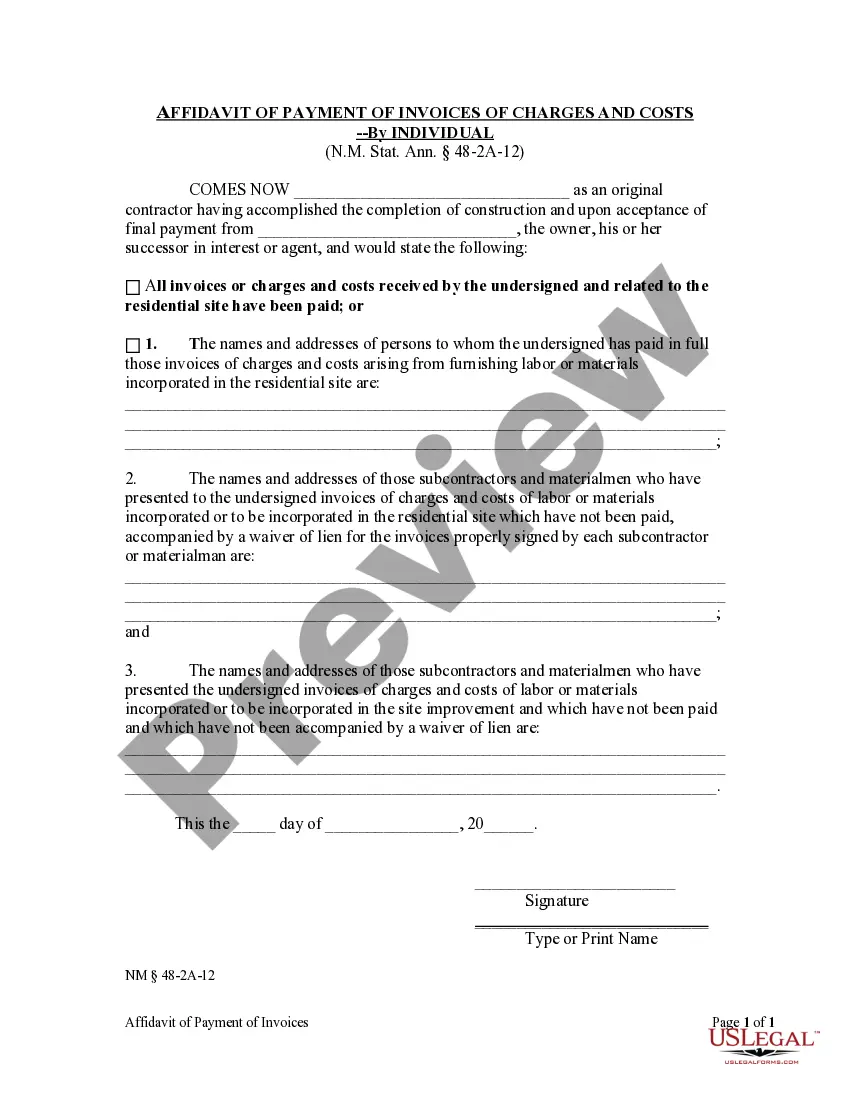

This Affidavit of Payment of Invoices of Charges and Costs form is for use by an individual original contractor having accomplished the completion of construction and upon acceptance of final payment from the owner, his or her successor in interest or agent, to state either that all invoices or charges and costs received by the contractor and related to the residential site have been paid, or to provide the names and addresses of persons to whom the contractor has paid in full those invoices of charges and costs arising from furnishing labor or materials incorporated in the residential site, the names and addresses of those subcontractors and materialmen who have presented to the contractor invoices of charges and costs of labor or materials incorporated or to be incorporated in the residential site which have not been paid (accompanied by a waiver of lien for the invoices properly signed by each subcontractor or materialman), and the names and addresses of those subcontractors and materialmen who have presented the contractor invoices of charges and costs of labor or materials incorporated or to be incorporated in the site improvement and which have not been paid and which have not been accompanied by a waiver of lien.

The Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual is an important legal document that confirms the payment of invoices, charges, and costs by an individual in Las Cruces, New Mexico. This affidavit serves as proof of payment and is often required in various legal or financial proceedings. Below are some key points to understand about this affidavit: 1. Purpose: The Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual is used to verify that an individual has made full payment of all outstanding invoices, charges, and costs related to a specific transaction, service, or legal matter in Las Cruces, New Mexico. 2. Contents: The affidavit typically includes details such as the individual's name, address, contact information, the invoice or charge details, payment date, payment method, and the total amount paid. 3. Legal Validity: The affidavit holds significant legal weight as it is a sworn statement made under penalty of perjury. Therefore, it is crucial to provide accurate and truthful information in the affidavit. 4. Notary Public: To ensure the authenticity and validity of the affidavit, it is advisable to sign it in the presence of a notary public. The notary public will verify the identity of the individual and attest to the validity of the signature. 5. Utility: The Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual is often required in legal disputes, debt settlements, insurance claims, or any situation where proof of payment is necessary. It helps to avoid misunderstandings or disputes regarding non-payment. There are usually no different types of Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual. However, it's important to note that different templates or formats may exist, varying in minor details or appearance. It's crucial to use the specific template provided by the relevant authority or legal professional to ensure compliance with local requirements. Keywords: Las Cruces New Mexico, affidavit, payment, invoices, charges, costs, individual, legal document, proof of payment, legal validity, notary public, debt settlement, insurance claims.

The Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual is an important legal document that confirms the payment of invoices, charges, and costs by an individual in Las Cruces, New Mexico. This affidavit serves as proof of payment and is often required in various legal or financial proceedings. Below are some key points to understand about this affidavit: 1. Purpose: The Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual is used to verify that an individual has made full payment of all outstanding invoices, charges, and costs related to a specific transaction, service, or legal matter in Las Cruces, New Mexico. 2. Contents: The affidavit typically includes details such as the individual's name, address, contact information, the invoice or charge details, payment date, payment method, and the total amount paid. 3. Legal Validity: The affidavit holds significant legal weight as it is a sworn statement made under penalty of perjury. Therefore, it is crucial to provide accurate and truthful information in the affidavit. 4. Notary Public: To ensure the authenticity and validity of the affidavit, it is advisable to sign it in the presence of a notary public. The notary public will verify the identity of the individual and attest to the validity of the signature. 5. Utility: The Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual is often required in legal disputes, debt settlements, insurance claims, or any situation where proof of payment is necessary. It helps to avoid misunderstandings or disputes regarding non-payment. There are usually no different types of Las Cruces New Mexico Affidavit of Payment of Invoices of Charges and Costs — Individual. However, it's important to note that different templates or formats may exist, varying in minor details or appearance. It's crucial to use the specific template provided by the relevant authority or legal professional to ensure compliance with local requirements. Keywords: Las Cruces New Mexico, affidavit, payment, invoices, charges, costs, individual, legal document, proof of payment, legal validity, notary public, debt settlement, insurance claims.