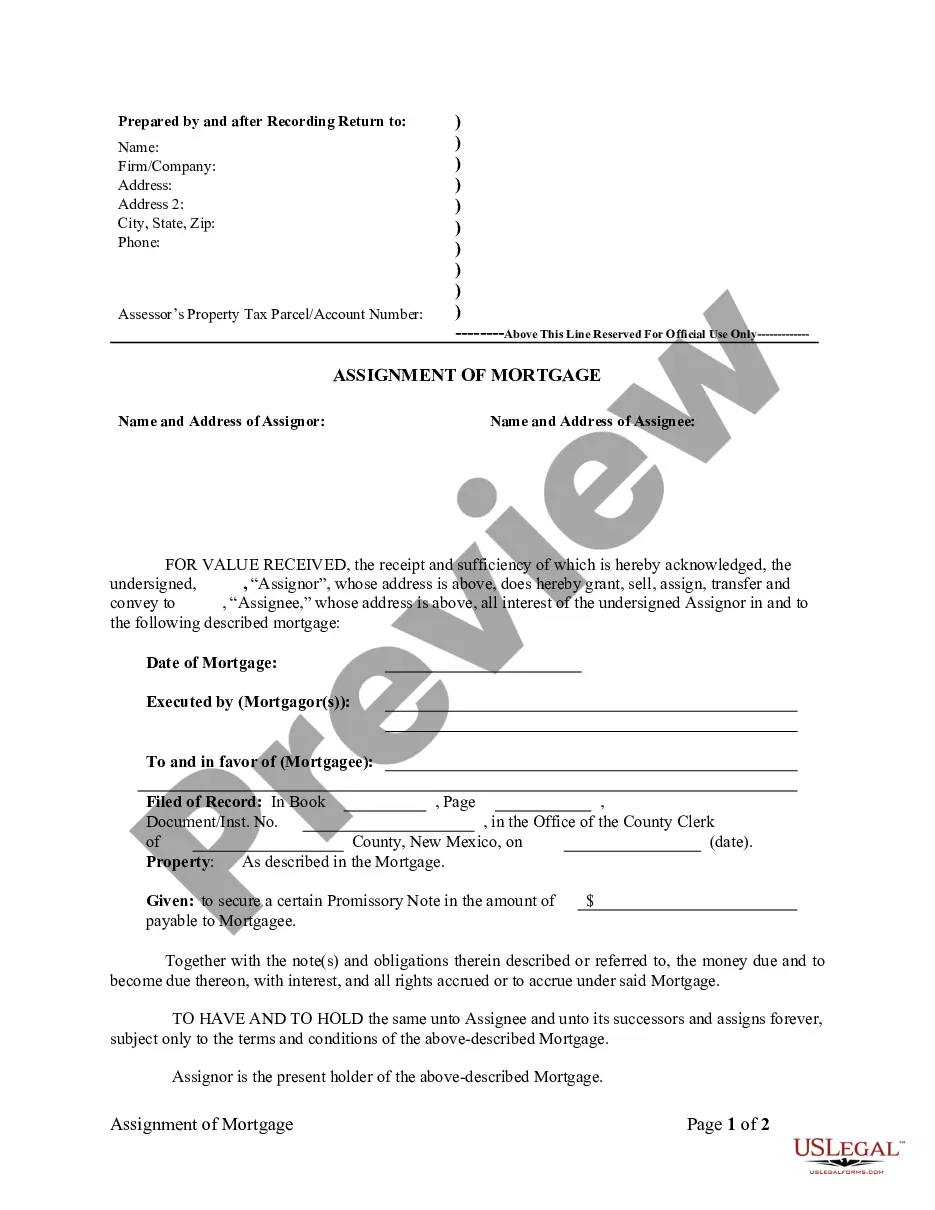

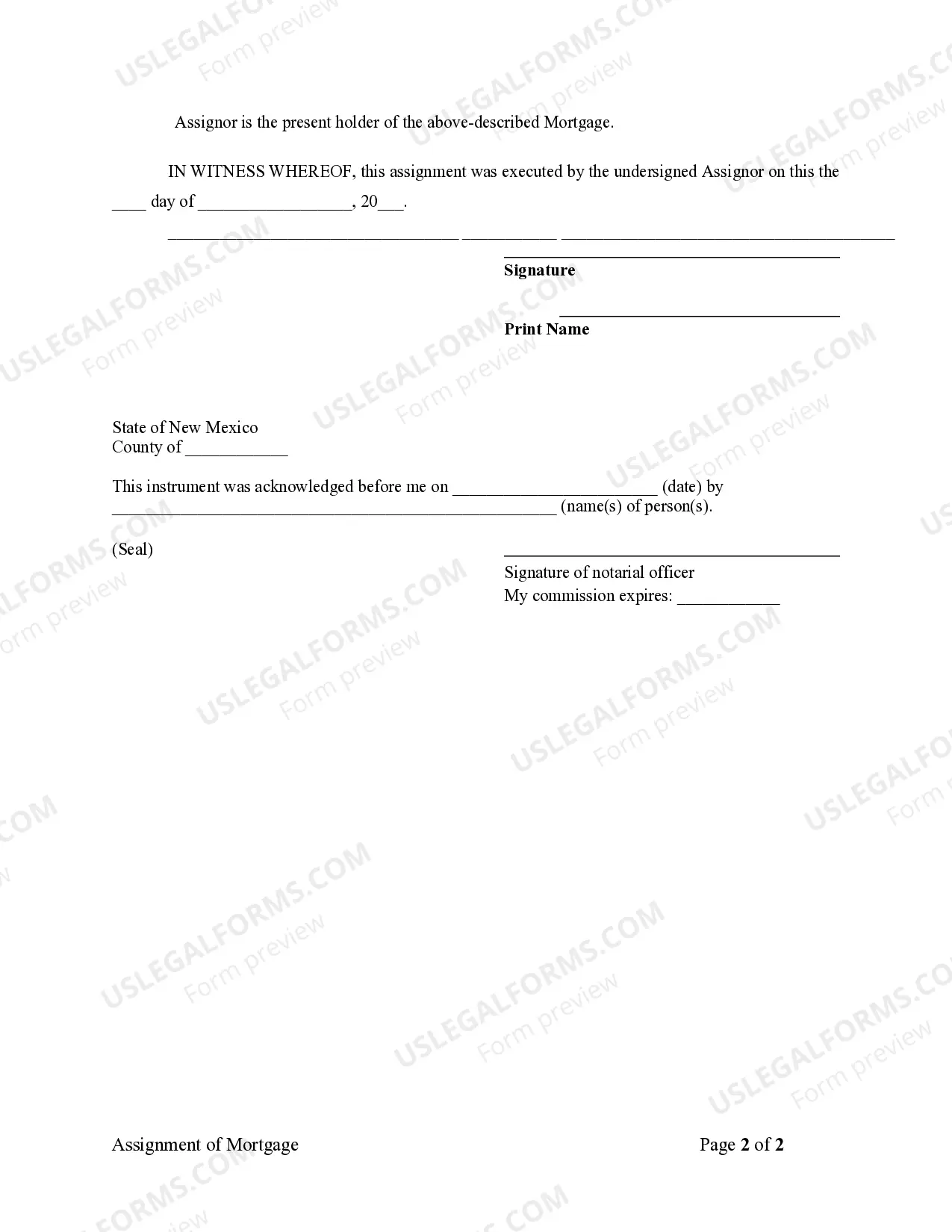

Las Cruces, New Mexico Assignment of Mortgage by Individual Mortgage Holder is a legal document that transfers the ownership rights of a mortgage loan from one individual mortgage holder to another. This assignment typically occurs when the original mortgage holder decides to sell or transfer their interest in the mortgage to another party. This process allows for the smooth transition of mortgage ownership without the need for refinancing or altering the terms of the original mortgage agreement. The Las Cruces Assignment of Mortgage by Individual Mortgage Holder is an important legal instrument in the real estate industry. By assigning the mortgage, the original mortgage holder essentially sells their rights and obligations to collect mortgage payments to a new party. The new mortgage holder, also known as the assignee, steps into the shoes of the original mortgage holder and assumes all the rights, interests, and responsibilities associated with the mortgage loan. There are several types of Las Cruces Assignment of Mortgage by Individual Mortgage Holder that may occur based on the specific circumstances of the transaction. Some common types include: 1. Voluntary Assignment: This type of assignment happens when the original mortgage holder willingly transfers their rights to another party. It often occurs when the original mortgage holder wants to sell the mortgage loan for liquidity or investment purposes. 2. Involuntary Assignment: In some cases, the assignment of mortgage can occur involuntarily. This may happen due to foreclosure proceedings or when a court orders the transfer of the mortgage to another party as part of a legal judgment. 3. Partial Assignment: A partial assignment of mortgage occurs when only a portion of the mortgage loan is transferred to a new mortgage holder. This could be done to divide the risk or when multiple parties are involved in financing the mortgage. 4. Full Assignment: A full assignment of mortgage occurs when the entire mortgage loan is transferred to a new mortgage holder. This type of assignment is most common when the original mortgage holder wants to completely divest their interest in the mortgage. 5. Assignee's Rights and Responsibilities: Once the assignment takes place, the new mortgage holder assumes the rights and responsibilities associated with the mortgage. This includes the right to collect mortgage payments, enforce the terms of the mortgage agreement, and initiate foreclosure proceedings if necessary. Las Cruces, New Mexico Assignment of Mortgage by Individual Mortgage Holder is a fundamental legal process that allows for the transfer of mortgage ownership. Whether executed voluntarily or involuntarily, these assignments play a crucial role in the real estate industry, facilitating the buying and selling of mortgage loans between individuals. It is important for all parties involved to understand the terms and implications of the assignment to ensure a smooth and legally sound transfer of mortgage ownership.

Las Cruces New Mexico Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Las Cruces New Mexico Assignment Of Mortgage By Individual Mortgage Holder?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law education to create such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our service offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Las Cruces New Mexico Assignment of Mortgage by Individual Mortgage Holder or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Las Cruces New Mexico Assignment of Mortgage by Individual Mortgage Holder in minutes using our reliable service. In case you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

However, if you are unfamiliar with our platform, make sure to follow these steps before obtaining the Las Cruces New Mexico Assignment of Mortgage by Individual Mortgage Holder:

- Ensure the form you have chosen is specific to your area considering that the regulations of one state or county do not work for another state or county.

- Review the document and read a brief outline (if available) of cases the document can be used for.

- If the form you picked doesn’t meet your requirements, you can start again and look for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the Las Cruces New Mexico Assignment of Mortgage by Individual Mortgage Holder once the payment is through.

You’re all set! Now you can proceed to print out the document or complete it online. In case you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.