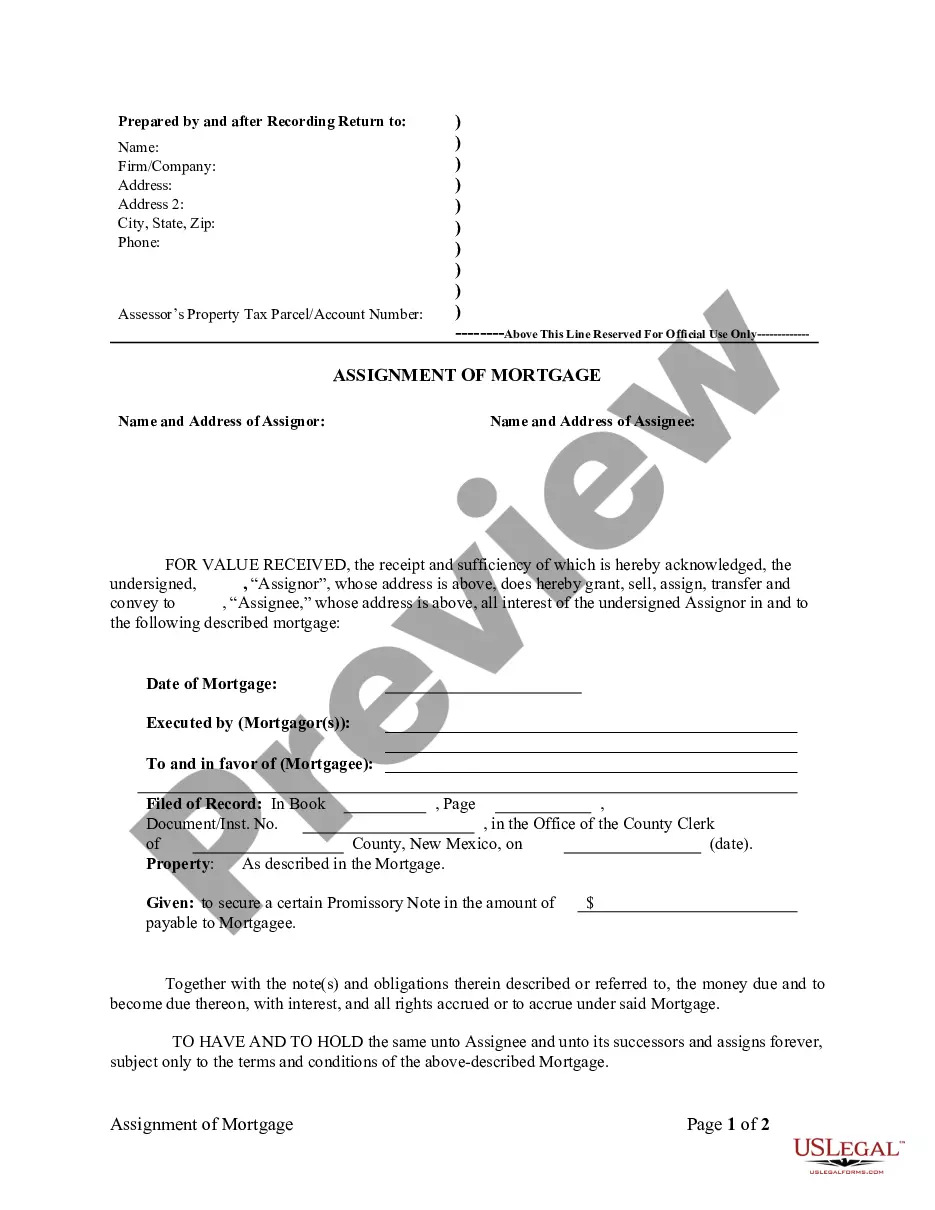

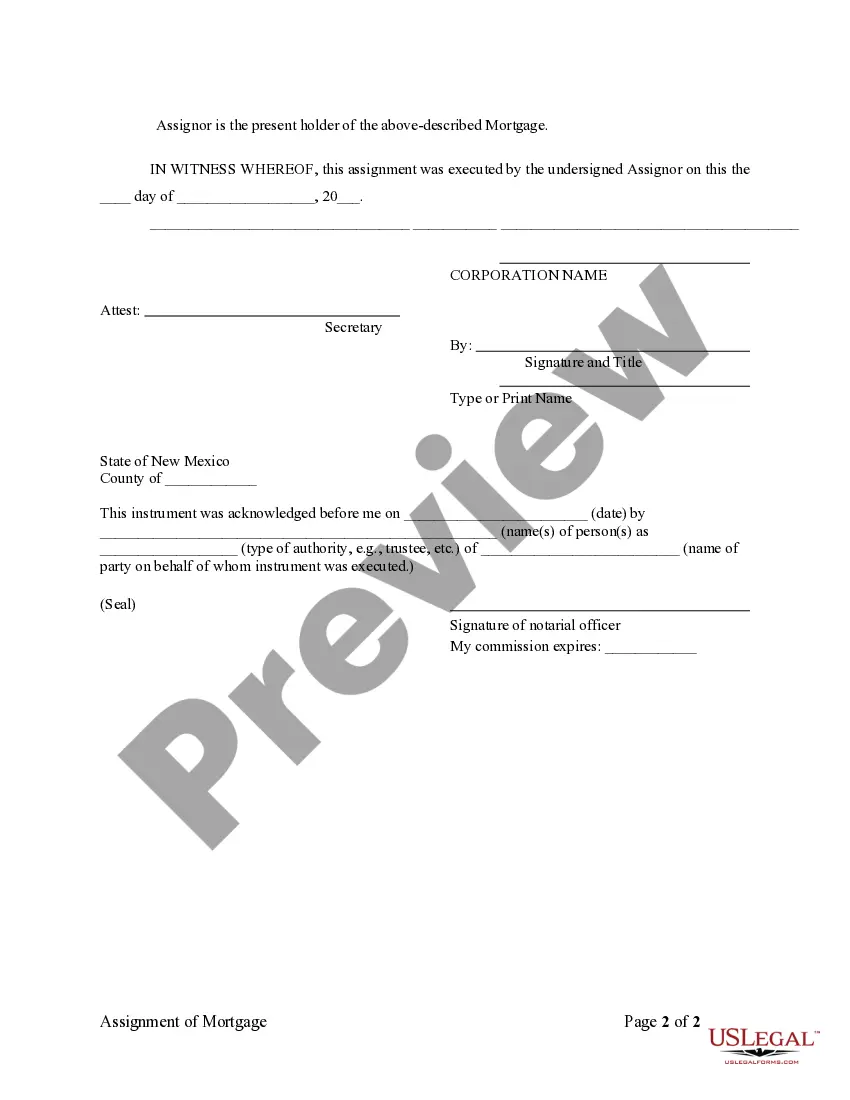

Las Cruces, New Mexico Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Guide Las Cruces, New Mexico is renowned for its picturesque landscapes, vibrant culture, and thriving real estate market. As with any mortgage, a property sale or transfer may require an Assignment of Mortgage. In this article, we will delve into the intricacies of the Las Cruces Assignment of Mortgage by Corporate Mortgage Holder, as well as explore any variations that may exist within this legal process. An Assignment of Mortgage refers to the transfer of a mortgage from one entity to another. In Las Cruces, this assignment is specifically executed by a Corporate Mortgage Holder, a legal entity that holds the mortgage on the property. The assignment document serves as a formal agreement between the existing mortgage holder and the new party that assumes the mortgage responsibilities. In Las Cruces, the Assignment of Mortgage by Corporate Mortgage Holder is a crucial step when ownership of a property transfers from one party to another. This assignment ensures that the new mortgage holder has legal rights and responsibilities over the property. The document specifies the terms and conditions of the mortgage transfer, including the outstanding balance, interest rate, payment schedule, and any other pertinent details. It is important to note that assignments may vary depending on specific circumstances. Different types of Las Cruces Assignment of Mortgage by Corporate Mortgage Holder include: 1. Standard Assignment: This is the most common form of assignment, where the original mortgage holder transfers the mortgage to a new corporate entity. The terms of the loan generally remain unchanged, and the new mortgage holder assumes all the rights and obligations of the original mortgage agreement. 2. Assignment with Modifications: In certain cases, the new corporate mortgage holder may request modifications to the terms of the existing mortgage. This could involve changes to the interest rate, payment schedule, or loan duration. Both parties must negotiate and agree upon the modifications before the assignment is finalized. 3. Assignment of Partial Mortgage: Instead of transferring the entire mortgage, the original corporate mortgage holder may assign only a portion of the mortgage to a new entity. This typically occurs when the property in question is part of a larger financial portfolio or investment strategy. 4. Assignment to a Service: Corporate mortgage holders may also assign the mortgage to a designated loan service. This assignment occurs when a mortgage holder wishes to outsource the collection of mortgage payments, management of escrow accounts, and customer service tasks associated with the loan. In Las Cruces, the Assignment of Mortgage by Corporate Mortgage Holder must comply with state and federal laws governing mortgage transfers and lending practices. It is advisable for both parties involved in the assignment to seek legal counsel to ensure compliance and protect their interests. In conclusion, the Las Cruces Assignment of Mortgage by Corporate Mortgage Holder is a crucial legal process that facilitates the transfer of mortgage rights and obligations between parties. Understanding the different types of assignments within this framework can help individuals navigate the intricacies involved in the mortgage transfer process in Las Cruces, New Mexico.

Las Cruces New Mexico Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Las Cruces New Mexico Assignment Of Mortgage By Corporate Mortgage Holder?

If you are looking for a valid form, it’s extremely hard to choose a more convenient place than the US Legal Forms website – one of the most considerable online libraries. With this library, you can find thousands of form samples for organization and personal purposes by categories and regions, or key phrases. With the high-quality search feature, finding the newest Las Cruces New Mexico Assignment of Mortgage by Corporate Mortgage Holder is as easy as 1-2-3. Additionally, the relevance of each file is verified by a group of professional lawyers that on a regular basis check the templates on our website and revise them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Las Cruces New Mexico Assignment of Mortgage by Corporate Mortgage Holder is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you require. Read its description and utilize the Preview option (if available) to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to get the needed document.

- Affirm your decision. Click the Buy now option. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Select the format and download it to your system.

- Make adjustments. Fill out, modify, print, and sign the received Las Cruces New Mexico Assignment of Mortgage by Corporate Mortgage Holder.

Each and every form you save in your profile does not have an expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to have an extra version for modifying or creating a hard copy, feel free to return and export it once more at any time.

Make use of the US Legal Forms professional catalogue to get access to the Las Cruces New Mexico Assignment of Mortgage by Corporate Mortgage Holder you were seeking and thousands of other professional and state-specific samples on a single platform!