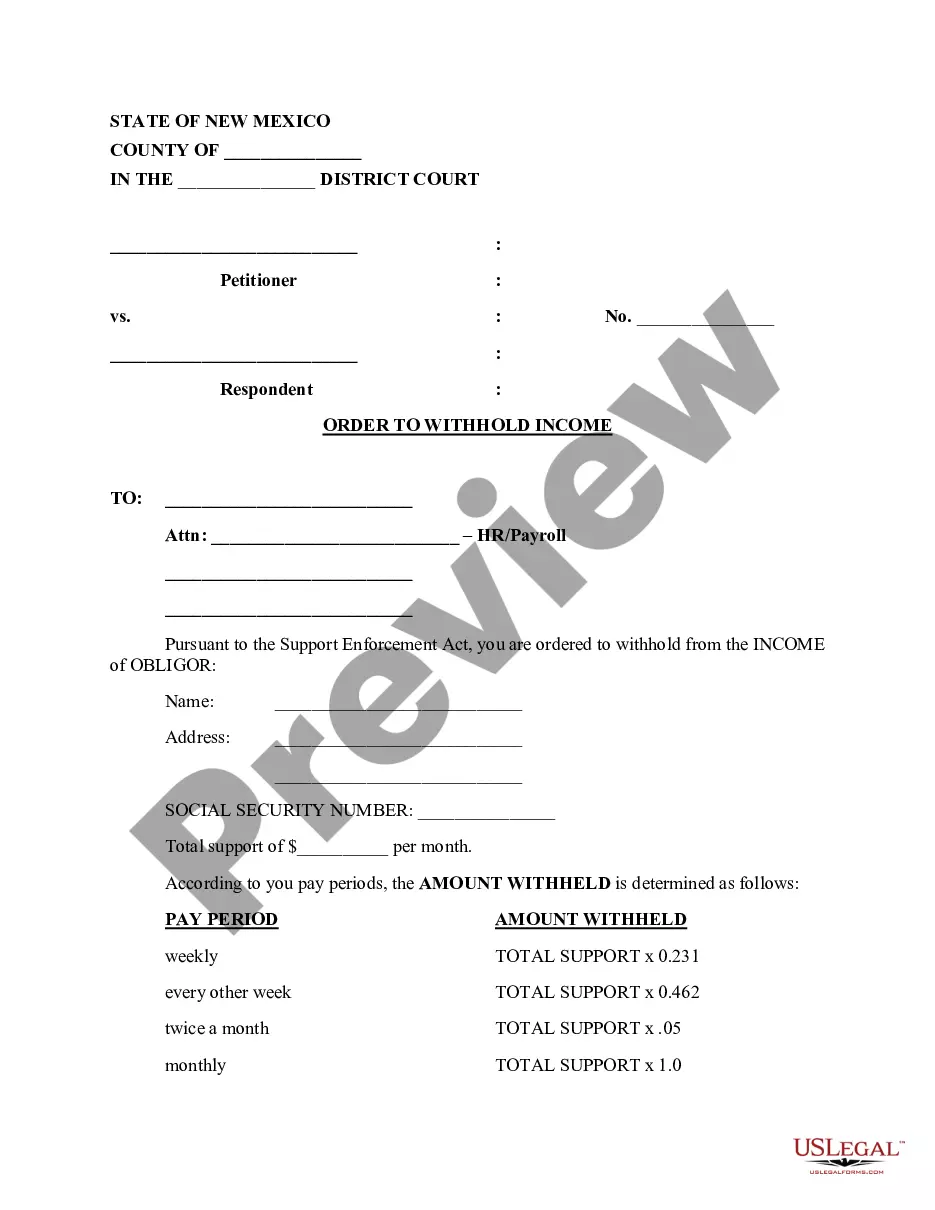

Las Cruces New Mexico Order withholding Income, also known as wage garnishment, is a legal process initiated by a creditor to collect unpaid debts directly from a debtor's income. This court-issued order is designed to ensure that creditors receive the owed amount by deducting a specified portion of the debtor's wages until the debt is fully satisfied. Wage garnishment is a common method employed for collecting defaulted student loans, child support payments, unpaid taxes, and other outstanding debts in Las Cruces, New Mexico. The Las Cruces New Mexico Order withholding Income can be categorized into several types, each pertaining to a specific debt obligation or financial situation. Some common types include: 1. Student Loan Wage Garnishment: For individuals who have defaulted on their student loans, the Department of Education or their designated loan service can obtain an Order to Withhold Income from the court. This type of wage garnishment allows them to withhold a percentage of the debtor's income to repay the outstanding student loan debt. 2. Child Support Wage Garnishment: In cases where the debtor has fallen behind on child support payments, the custodial parent or the state's child support enforcement agency can seek an Order to Withhold Income. This order authorizes the garnishment of wages to provide financial support for the child. 3. Tax Levy: The Internal Revenue Service (IRS) may issue an Order to Withhold Income, commonly referred to as a tax levy, for individuals who have unpaid federal taxes. This type of wage garnishment enables the IRS to collect the owed amount directly from the debtor's income, allowing them to recover the outstanding tax debt. 4. Creditor Wage Garnishment: A creditor, such as a credit card company or a financial institution, can obtain an Order to Withhold Income if they have obtained a judgment against the debtor for an outstanding debt. This garnishment type permits the creditor to deduct a portion of the debtor's wages towards debt repayment. It is important to note that Las Cruces New Mexico Order withholding Income must be issued by a court after due process and with proper legal documentation. The garnishment process must comply with applicable federal and state laws regulating wage garnishment limits and procedures, ensuring that debtors are left with a reasonable income to cover their basic living expenses.

Las Cruces New Mexico Order to Withhold Income

Description

How to fill out Las Cruces New Mexico Order To Withhold Income?

If you are looking for a valid form, it’s extremely hard to find a more convenient platform than the US Legal Forms site – probably the most comprehensive online libraries. Here you can find thousands of document samples for company and individual purposes by types and states, or keywords. Using our advanced search feature, discovering the most recent Las Cruces New Mexico Order to Withhold Income is as elementary as 1-2-3. Additionally, the relevance of each document is proved by a team of professional attorneys that on a regular basis check the templates on our website and update them in accordance with the latest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Las Cruces New Mexico Order to Withhold Income is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the form you require. Check its information and make use of the Preview function to see its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the proper file.

- Confirm your selection. Select the Buy now button. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Las Cruces New Mexico Order to Withhold Income.

Every single template you add to your account does not have an expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to get an additional version for modifying or printing, you may come back and export it again at any moment.

Make use of the US Legal Forms extensive library to gain access to the Las Cruces New Mexico Order to Withhold Income you were looking for and thousands of other professional and state-specific samples on a single platform!