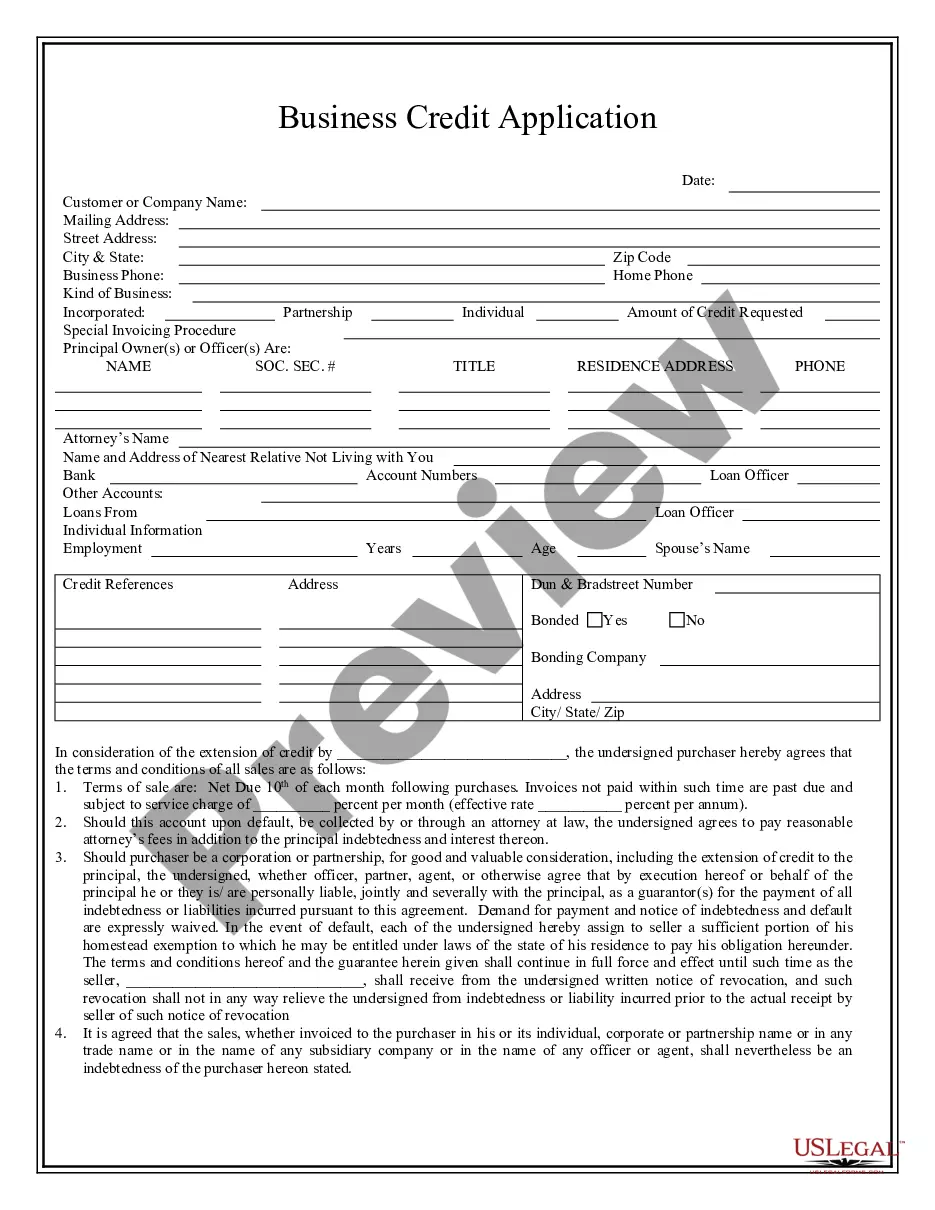

Las Cruces, New Mexico is a vibrant city known for its thriving business community. When it comes to securing funds for business growth or managing cash flow, the Las Cruces New Mexico Business Credit Application is an essential tool for local entrepreneurs. This application allows businesses to apply for credit from financial institutions based in Las Cruces, helping them access much-needed capital to meet their operational expenses, expand their business, or invest in new projects. The Las Cruces New Mexico Business Credit Application typically requires businesses to provide detailed information about their company's financial standing, such as annual revenue, cash flow projections, current debts, and assets. Additionally, businesses may need to include their business plan, marketing strategies, and industry analysis to showcase their potential for success. Furthermore, there are different types of Business Credit Applications available in Las Cruces, New Mexico, catering to the diverse needs of businesses. These may include: 1. Small Business Credit Application: Designed specifically for startups and small businesses, this application offers credit options tailored to the unique challenges faced by these enterprises. It prioritizes simplicity and flexibility to help businesses access funds quickly. 2. Corporate Credit Application: Geared towards medium to large-scale businesses, this application caters to companies with higher credit requirements. It may involve more extensive documentation and provide access to larger credit limits, enabling companies to fund significant investments, mergers, or acquisitions. 3. Line of Credit Application: This application offers businesses a revolving line of credit, allowing them to withdraw funds as needed and repay them over time. It provides flexibility and working capital to manage day-to-day expenses, such as inventory, payroll, or equipment maintenance. 4. Equipment Financing Application: This type of application focuses on providing credit specifically for the purchase or leasing of business equipment. By using the equipment itself as collateral, businesses can obtain the necessary financing to upgrade their machinery, technology, or vehicles. Regardless of the specific type, the Las Cruces New Mexico Business Credit Application aims to facilitate the economic growth of local businesses by granting them access to credit opportunities. It is a vital resource for entrepreneurs seeking financial support and acts as a catalyst for job creation, innovation, and prosperity within the Las Cruces business community.

Las Cruces New Mexico Business Credit Application

Description

How to fill out Las Cruces New Mexico Business Credit Application?

If you are searching for a valid form template, it’s impossible to find a better place than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can find thousands of document samples for organization and individual purposes by categories and regions, or key phrases. Using our advanced search option, discovering the most up-to-date Las Cruces New Mexico Business Credit Application is as elementary as 1-2-3. Furthermore, the relevance of every document is confirmed by a group of expert attorneys that regularly check the templates on our platform and revise them in accordance with the latest state and county regulations.

If you already know about our system and have a registered account, all you should do to get the Las Cruces New Mexico Business Credit Application is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the form you want. Look at its description and utilize the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search option at the top of the screen to get the appropriate record.

- Affirm your choice. Choose the Buy now button. Next, pick your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Las Cruces New Mexico Business Credit Application.

Every single template you save in your profile has no expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to receive an additional duplicate for enhancing or printing, you can return and download it again anytime.

Take advantage of the US Legal Forms professional collection to gain access to the Las Cruces New Mexico Business Credit Application you were looking for and thousands of other professional and state-specific samples on one platform!