Title: Understanding Albuquerque, New Mexico Notice of Dishonored Check — Civil Introduction: In Albuquerque, New Mexico, individuals who find themselves involved in a dishonored check situation may receive a Notice of Dishonored Check — Civil. This legal document serves to inform the recipient about the bounce or non-payment of a check. This article aims to provide a comprehensive understanding of what a Notice of Dishonored Check is, its implications, and potential consequences. We will explore different types of bad checks, common reasons for dishonored checks, and the steps both parties can take to resolve such issues. 1. What is a Dishonored Check? A dishonored check, often referred to as a bad check or bounced check, is a check issued by an account holder that cannot be processed due to insufficient funds, a closed account, or other violations of writing and cashing checks. When a check is dishonored, the payee or recipient can take legal action by filing a Notice of Dishonored Check — Civil. 2. Types of Albuquerque Notice of Dishonored Check — Civil: a) Insufficient Funds: This type of dishonored check occurs when the issuer has insufficient funds in their bank account to cover the amount stated on the check. b) Closed Account: A closed account check takes place when the issuer closes their bank account before the recipient deposits or cashes the check. c) Violations and Irregularities: Dishonored checks can also occur due to various violations, such as missing or incorrect information on the check, forgery, or altered amounts. 3. Implications of a Notice of Dishonored Check — Civil in Albuquerque, New Mexico: Receiving a Notice of Dishonored Check — Civil means that the payee intends to pursue legal action to recover the money owed, including requesting restitution for additional fees incurred. In Albuquerque, such cases are generally resolved in small claims court, where both parties present their arguments, evidence, and witnesses. The court may order the issuer to pay the original amount, additional fees, or damages. 4. Common Reasons for Dishonored Checks: a) Insufficient funds in the issuer's account. b) A recent change in the account status, such as closure or suspension. c) Writing a check without ensuring that the funds are available to cover the amount. d) Illegible or incorrect information, including a mismatch between the written and numerical amount. e) Forged signatures or unauthorized alterations to checks. 5. Resolving Dishonored Check Issues: a) Communication: It is advisable for both parties to establish open lines of communication to resolve the matter mutually. The payee should contact the issuer, informing them about the dishonored check and its consequences. b) Verification: The issuer should investigate the situation, including reconciling their accounts, verifying if a mistake has occurred, or identifying potential fraudulent activity. c) Payment Arrangements: Depending on the situation, the parties may negotiate a payment plan to settle the debt, potentially avoiding legal action or court involvement. d) Legal Action: If all other attempts to resolve the matter fail, the payee can proceed with filing a Notice of Dishonored Check — Civil to seek legal recourse. Conclusion: Understanding the implications of a Notice of Dishonored Check — Civil in Albuquerque, New Mexico is crucial for both parties involved in a dishonored check situation. Prompt communication, verification, and a willingness to resolve the matter amicably can often lead to a mutually satisfactory outcome. However, if an agreement cannot be reached, legal action may be necessary to enforce payment of the dishonored check.

Albuquerque Bad

Description

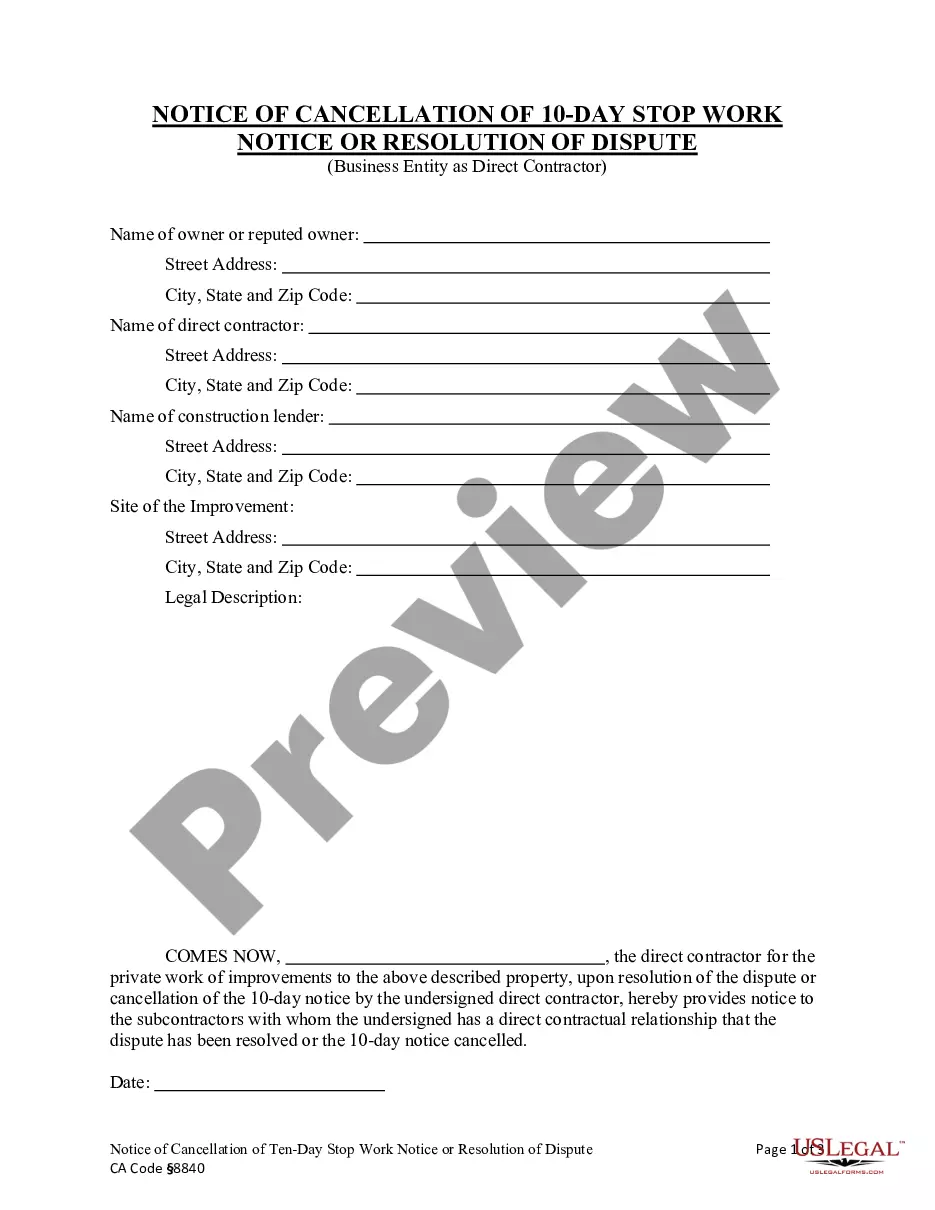

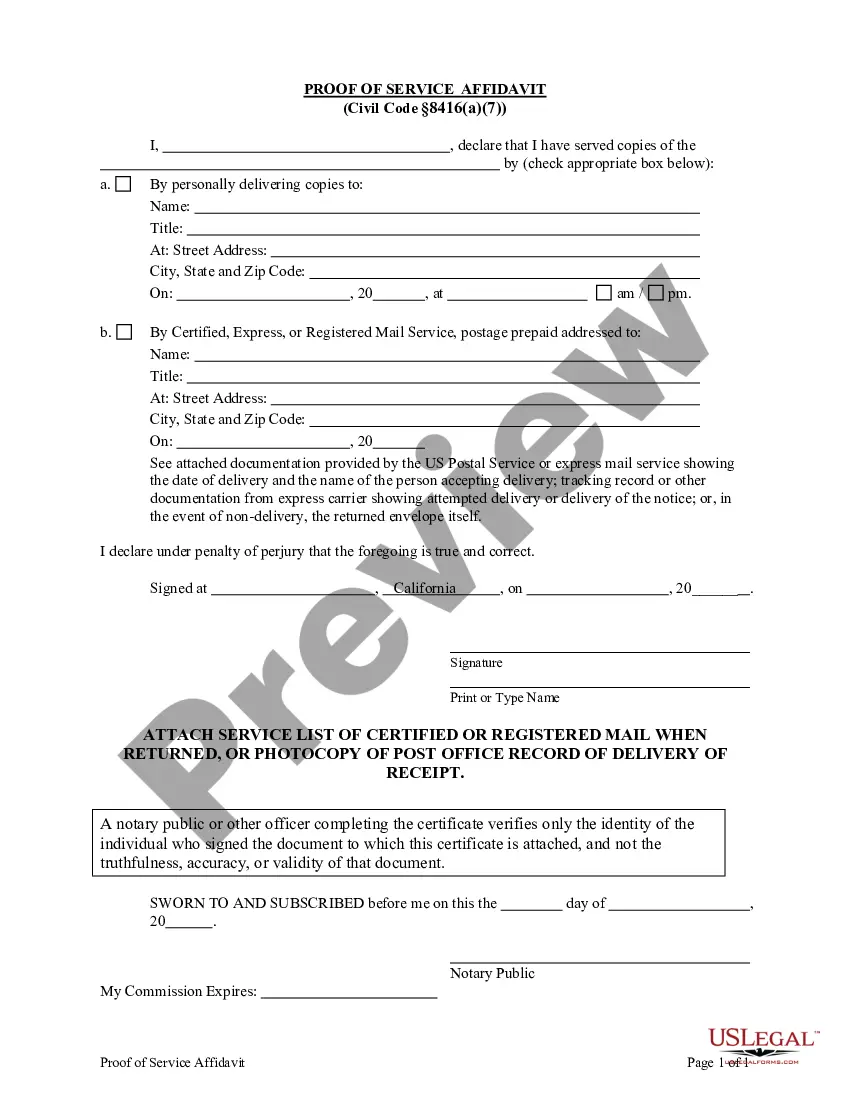

How to fill out Albuquerque New Mexico Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Albuquerque New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Albuquerque New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Albuquerque New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!