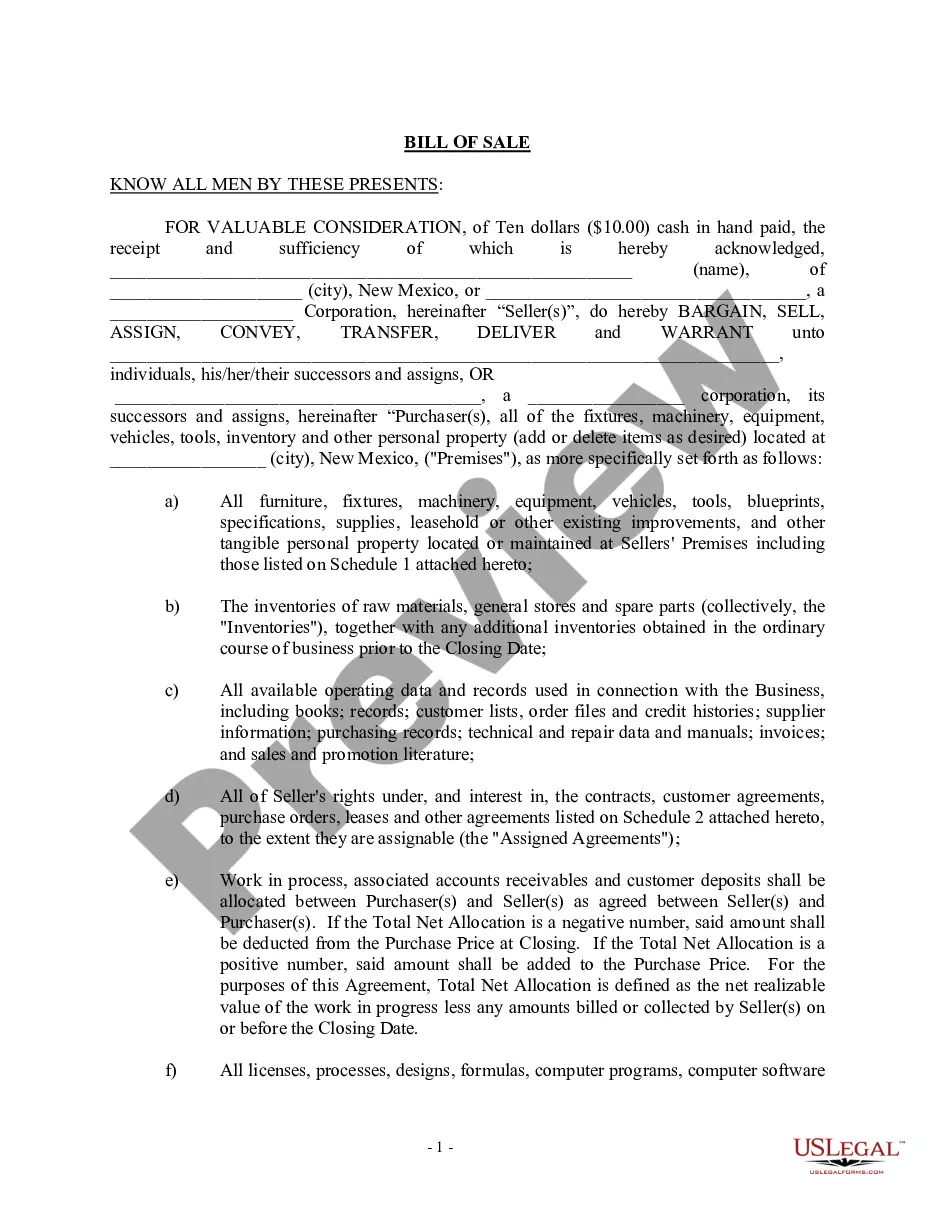

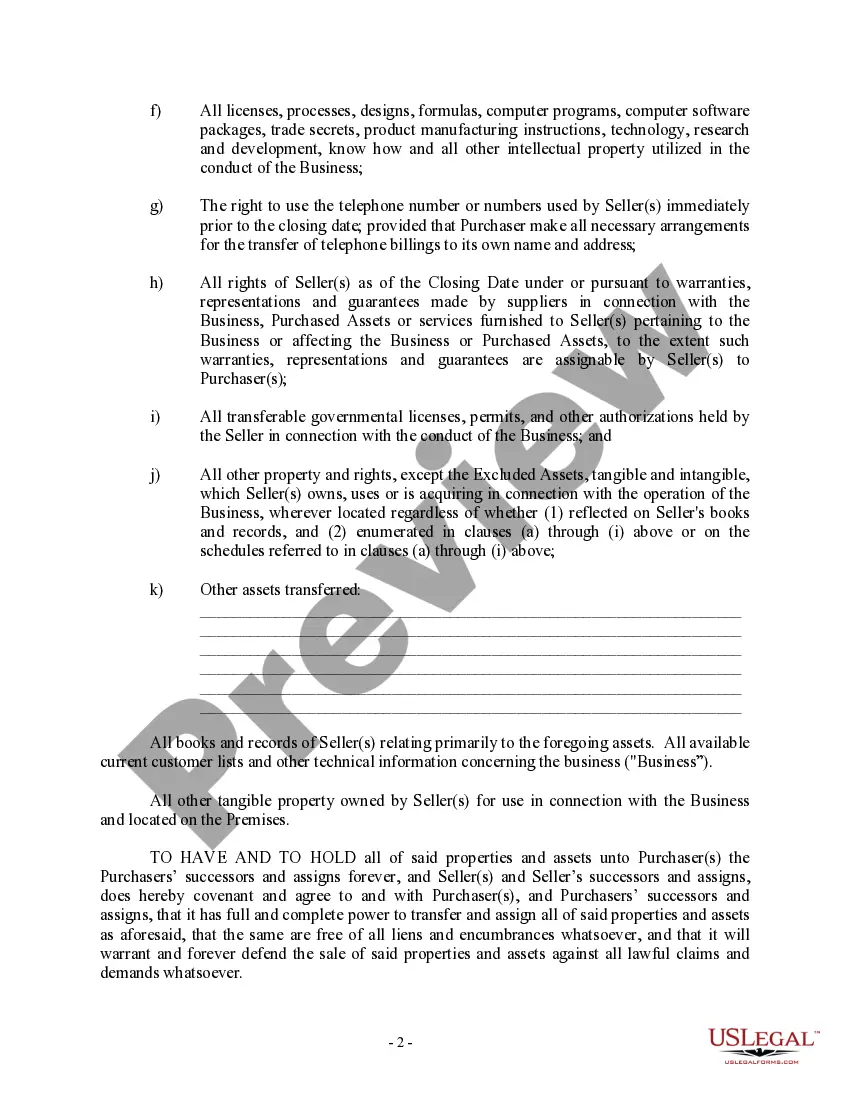

Title: Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller Introduction: The Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document that serves as proof of the transfer of ownership of a business from one party to another. This document outlines the terms and conditions of the sale and provides protection for both the buyer and the seller. In Albuquerque, New Mexico, there are various types of bill of sale forms tailored to specific scenarios related to the sale of a business by an individual or corporate seller. Types of Albuquerque New Mexico Bill of Sale Forms: 1. Albuquerque New Mexico Bill of Sale — Individual Seller: This bill of sale form is specifically designed for individuals who are selling their business. It includes sections to capture key information such as the buyer and seller's details, a description of the business being sold, the purchase price, payment terms, and any conditions or contingencies accompanying the sale. 2. Albuquerque New Mexico Bill of Sale — Corporate Seller: This bill of sale form is intended for corporate sellers selling their business. It includes provisions relevant to corporate transactions, such as corporate resolutions, authorized signatories, and disclosure of any outstanding liabilities or legal issues that may impact the sale. This form aims to protect both parties involved by ensuring transparency and compliance with corporate regulations. 3. Albuquerque New Mexico Bill of Sale — Asset Sale: This specific type of bill of sale focuses on the transfer of specific business assets rather than the entire business itself. Asset sales are common when a buyer intends to acquire select assets from an existing business, such as inventory, equipment, or intellectual property. This form clearly outlines the assets being transferred, the agreed-upon purchase price, and any warranties or guarantees accompanying the assets. 4. Albuquerque New Mexico Bill of Sale — Stock Sale: In the case of a corporate seller, a stock sale occurs when the ownership of a business is transferred through the sale of shares or stocks. This form includes important provisions relating to stock transfers, including the number and type of shares being sold, the purchase price per share, any restrictions on the transfer, and any representations or warranties made by the seller. Conclusion: The Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller offers a comprehensive and legally binding framework for the seamless transfer of business ownership. By utilizing the appropriate form tailored to the specific circumstances of the sale, both the buyer and seller can ensure a transparent and organized transaction. Consulting legal professionals to complete these forms accurately is strongly advised to protect the interests of all parties involved.

Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Albuquerque New Mexico Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Albuquerque New Mexico Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!