Las Cruces, New Mexico Chapter 13 Plan is a legal provision under the United States Bankruptcy Code that allows individuals with regular income to create a repayment plan to settle their debts over a specific period of time. This plan aims to provide debtors with an opportunity to reorganize their financial obligations and make affordable monthly payments, while also protecting their assets from liquidation. The Las Cruces Chapter 13 Plan offers an effective solution for individuals who have a steady income but are struggling to meet their debt obligations. It allows debtors to consolidate their debts and make a single monthly payment to a trustee, who then distributes the funds among the creditors as specified in the plan. There are several types of Las Cruces Chapter 13 plans that cater to different financial situations. These include: 1. Traditional Chapter 13 Plan: This is the most common type of Chapter 13 plan, which involves repaying a portion of the debtor's unsecured debts over a period of three to five years. The exact repayment amount and duration depend on the individual's income, expenses, and the nature of their debts. 2. Simplified Chapter 13 Plan: This plan is designed for debtors with lower incomes and smaller debts. It streamlines the repayment process by reducing the required paperwork and allowing for an expedited repayment period. 3. Extended Chapter 13 Plan: In some cases, debtors may need a longer period to repay their debts due to significant financial constraints or high debt amounts. The extended Chapter 13 plan allows for a repayment period of up to seven years, offering a more feasible repayment structure for those with larger debt loads. 4. Modified Chapter 13 Plan: In situations where a debtor's financial circumstances change during the course of the Chapter 13 plan, a modified plan may be necessary. This could involve adjusting the repayment amount, duration, or even adding or removing certain debts from the plan. Overall, the Las Cruces Chapter 13 Plan provides individuals in financial distress with a viable alternative to address their debts without facing complete liquidation. It offers a structured repayment approach that allows debtors to regain control of their finances and work towards a fresh start.

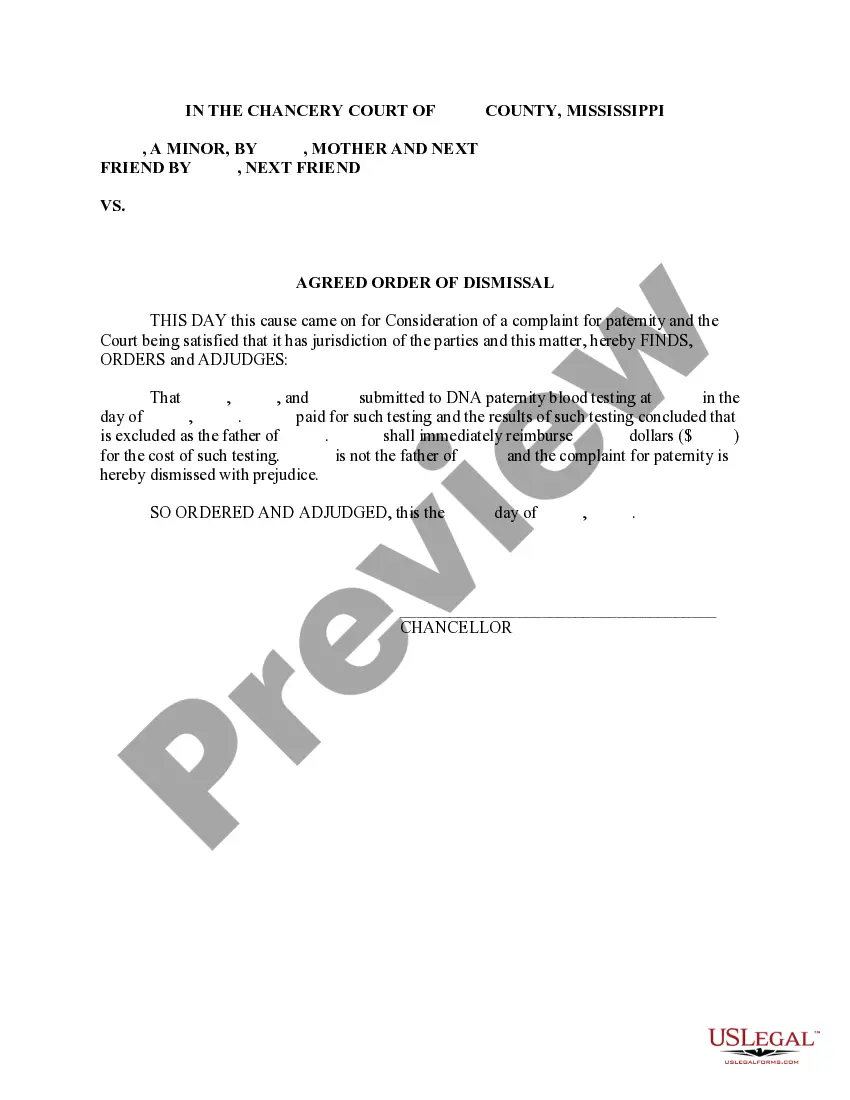

Las Cruces New Mexico Chapter 13 Plan

Description

How to fill out Las Cruces New Mexico Chapter 13 Plan?

Do you need a trustworthy and affordable legal forms supplier to buy the Las Cruces New Mexico Chapter 13 Plan? US Legal Forms is your go-to choice.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Las Cruces New Mexico Chapter 13 Plan conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Las Cruces New Mexico Chapter 13 Plan in any provided file format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.