Las Cruces New Mexico Dissolution Package to Dissolve Corporation

Description

How to fill out New Mexico Dissolution Package To Dissolve Corporation?

Finding validated forms tailored to your regional laws can be difficult unless you access the US Legal Forms database.

It is an online repository of over 85,000 legal documents for both personal and professional requirements, encompassing a wide range of real-world situations.

All forms are correctly categorized by area of application and jurisdiction, making the search for the Las Cruces New Mexico Dissolution Package to Dissolve Corporation as straightforward as pie.

Maintaining documents organized and aligned with legal standards is crucial. Utilize the US Legal Forms library to always have vital form templates for any situation readily available!

- Check the Preview mode and form details.

- Ensure that you've selected the appropriate one that fulfills your needs and complies with your local jurisdiction requirements.

- Look for another template, if necessary.

- As soon as you spot any discrepancies, use the Search tab above to locate the correct one.

- If it matches your needs, proceed to the next step.

Form popularity

FAQ

Dissolving a New Mexico corporation involves several essential steps. First, ensure that all financial obligations are settled, including taxes and employee wages. After that, you need to file the articles of dissolution with the New Mexico Secretary of State’s office. Using the Las Cruces New Mexico Dissolution Package to Dissolve Corporation simplifies this process and helps you navigate the necessary paperwork efficiently.

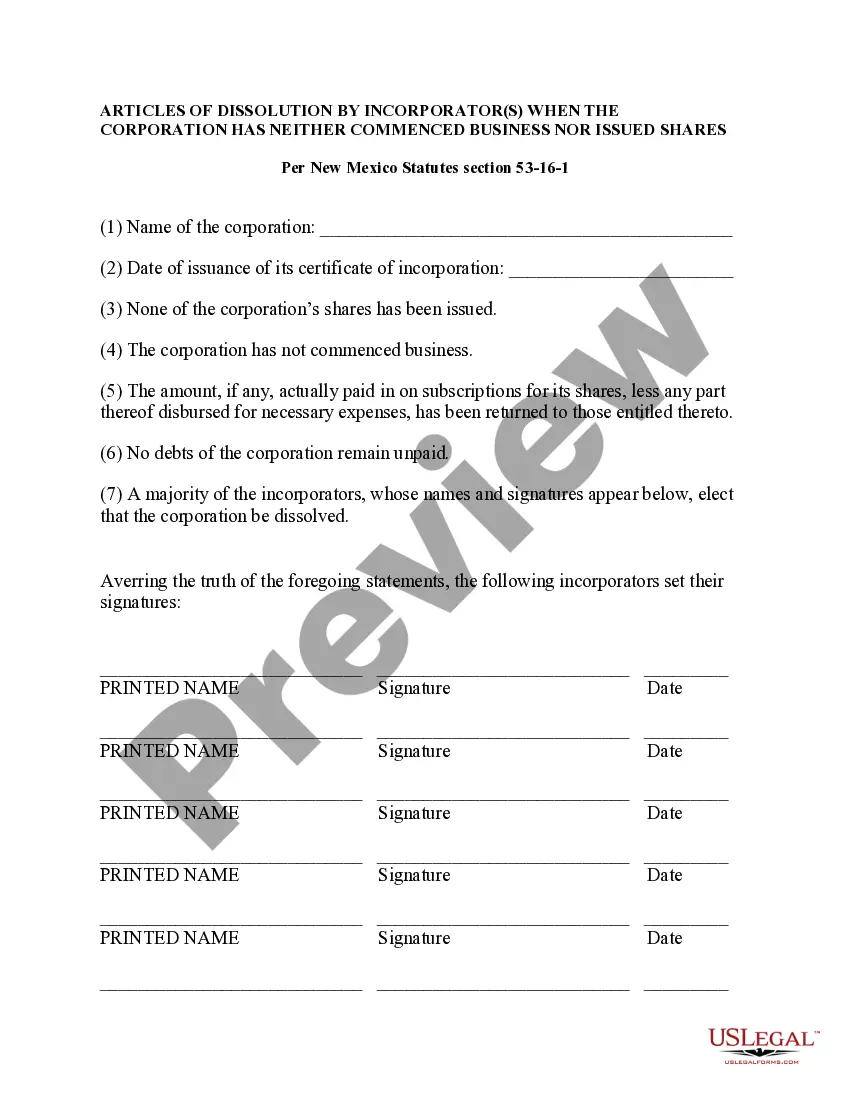

Filling out an articles of dissolution form is straightforward. Start by gathering your corporation's basic information, such as the name and date of incorporation. Next, you will indicate the reason for dissolution and confirm that all outstanding debts are resolved. The Las Cruces New Mexico Dissolution Package to Dissolve Corporation can provide you with a step-by-step guide to ensure you complete the form accurately.

When you decide to dissolve your corporation, you must notify the IRS by filing the appropriate forms. Begin by completing Form 966, which notifies the IRS of your corporation's dissolution. Additionally, ensure you file your final tax return, marking the return as a 'final return.' Using the Las Cruces New Mexico Dissolution Package to Dissolve Corporation simplifies this process by guiding you through the necessary steps and required documentation.

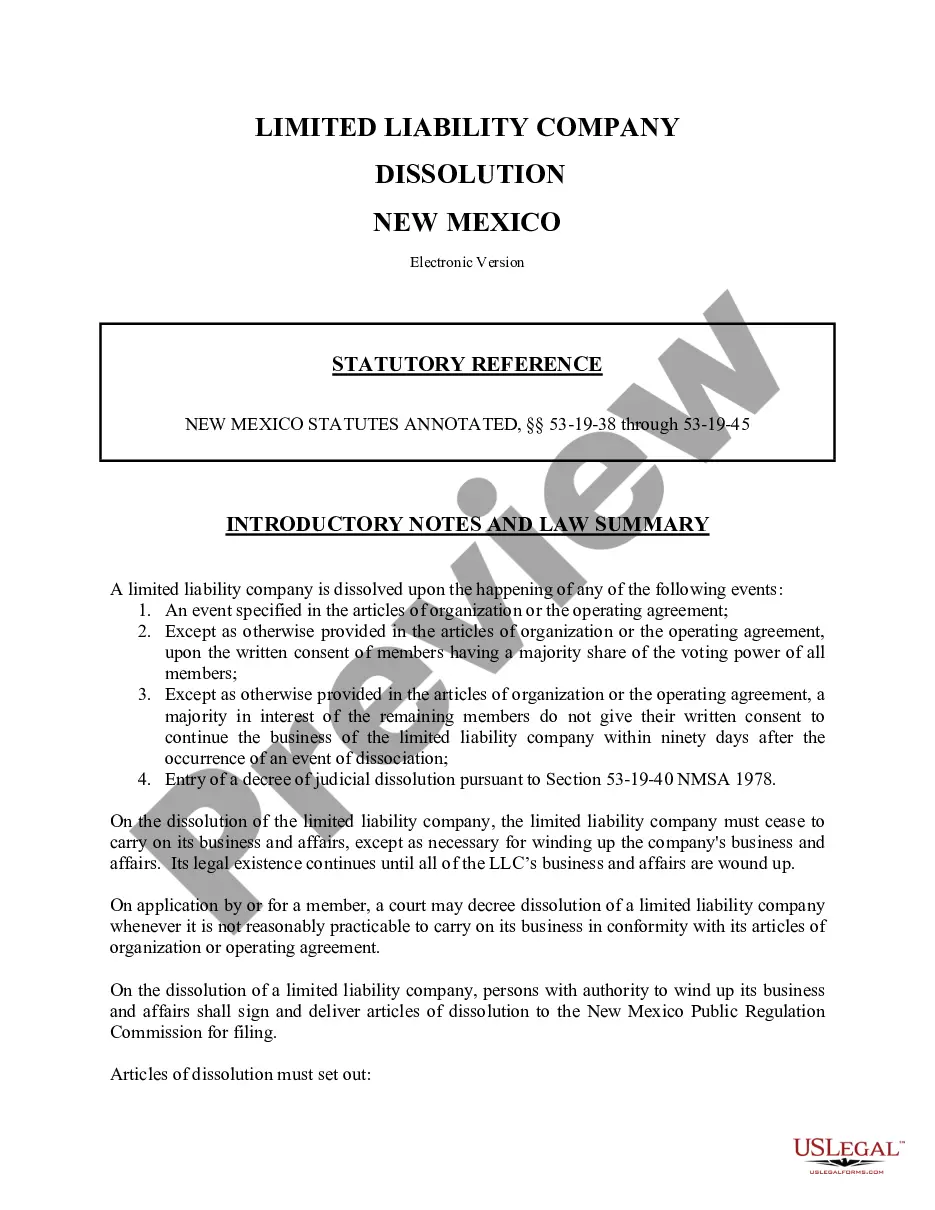

Dissolving a corporation involves several key steps: first, you must get the consent of your shareholders, then file the dissolution documents with the state, and finally, settle any outstanding debts and obligations. Furthermore, you need to notify relevant creditors and complete any final tax returns. By exploring a Las Cruces New Mexico Dissolution Package to Dissolve Corporation, you can access resources and tools that simplify these essential steps.

To dissolve a corporation in New Mexico, you need to file the appropriate dissolution paperwork with the New Mexico Secretary of State. This involves submitting a completed dissolution form along with the required fees. Utilizing a Las Cruces New Mexico Dissolution Package to Dissolve Corporation can guide you through these steps, making the process clearer and more efficient for you.

The New Mexico Nmbtin BTIN, or Business Tax Identification Number, is a unique identifier assigned to businesses operating in New Mexico. It is essential for tax purposes and helps streamline your business's financial transactions. When you use a Las Cruces New Mexico Dissolution Package to Dissolve Corporation, having this number on hand can simplify the process of dissolution and ensure compliance with local regulations.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

The business entity must: File the appropriate dissolution, surrender, or cancellation form(s) with the SOS within 12 months of filing the final tax return....Requirements for SOS File all delinquent tax returns. Pay all delinquent tax balances, including penalties, fees, and interest. File a revivor request form.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

C corporations should file Form 1120, U.S. Corporation Income Tax Return, and check the box that this is their final return. This form must be filed by the 15th day of the fourth month after you close your business.