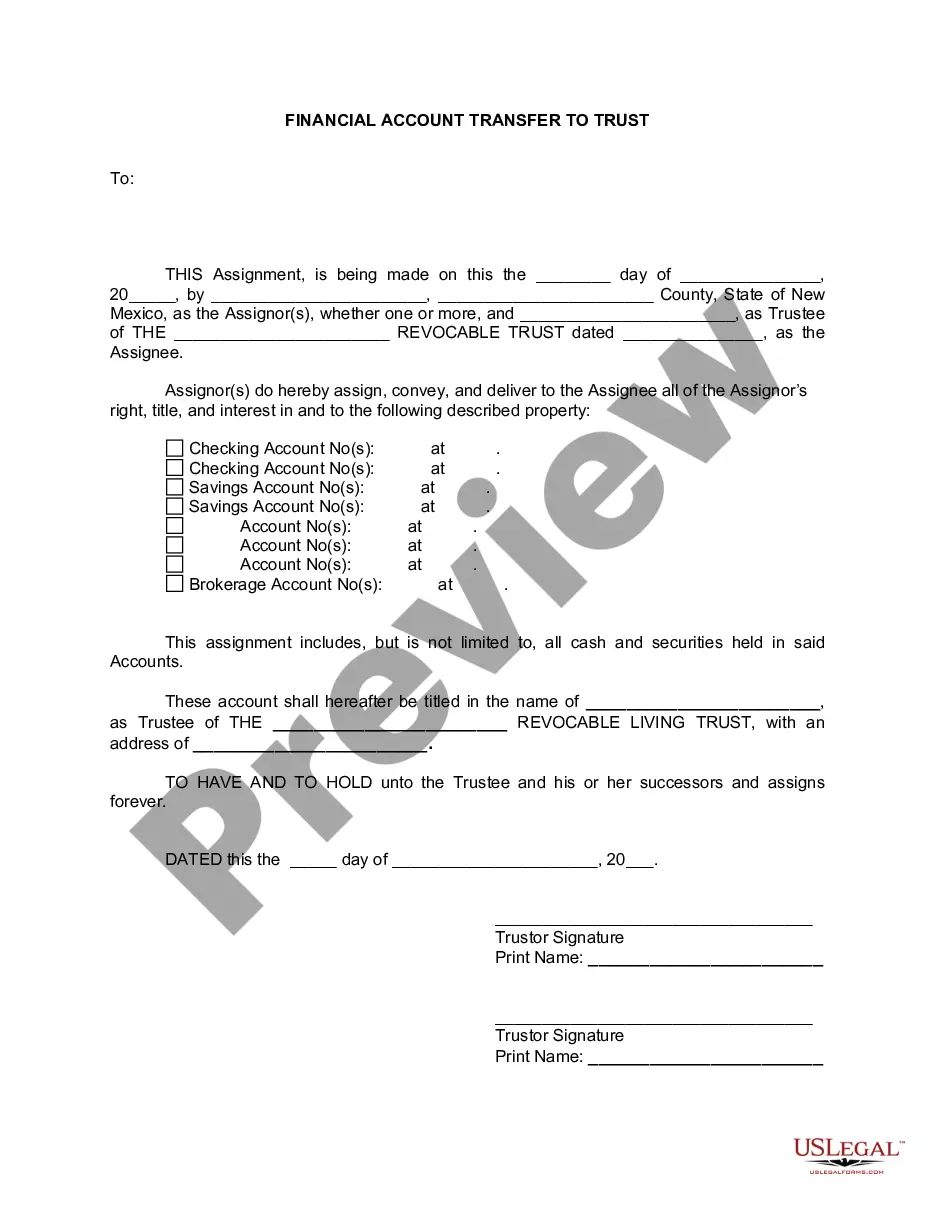

Title: Simplifying Estate Planning: The Las Cruces New Mexico Financial Account Transfer to Living Trust Introduction: In Las Cruces, New Mexico, individuals seeking to protect their assets and simplify the transfer of financial accounts after their passing often turn to living trusts. This article offers a comprehensive overview of financial account transfer to living trusts in Las Cruces, delving into its importance, benefits, process, and common types. Types of Financial Account Transfers to Living Trusts in Las Cruces: 1. Bank Account Transfer: — Understanding how to transfer bank accounts into a living trust in Las Cruces — Simplifying the management and distribution of funds through a trust — The role of the trustee in overseeing bank accounts in a living trust 2. Investment Account Transfer: — Exploring the transfer of investment accounts into a living trust in Las Cruces — Protecting investments and ensuring their seamless transition to beneficiaries — Considerations for different types of investment vehicles within a trust 3. Retirement Account Transfer: — Navigating the process of transferring retirement accounts to a living trust in Las Cruces — Avoiding potential tax consequences and optimizing asset distribution — Understanding the specific rules and implications for different retirement accounts 4. Real Estate Account Transfer: — Transferring real estate accounts to a living trust: A comprehensive guide for Las Cruces residents — Protecting real estate assets from probate and ensuring a smoother transition — Addressing considerations related to property taxes, mortgages, and title transfers Benefits of Las Cruces New Mexico Financial Account Transfer to Living Trust: — Probate avoidance: Understand how a living trust can bypass the time-consuming and expensive probate process for your financial accounts. — Privacy protection: Discover how a living trust offers confidentiality for your financial affairs by avoiding the public probate records. — Efficient asset management: Learn how a living trust enables seamless management and distribution of your financial accounts according to your wishes. — Incapacity planning: Explore how a living trust can provide for the management of your financial affairs in case of incapacitation. — Minimization of estate taxes: Discover how a well-structured living trust can minimize estate taxes, potentially preserving more wealth for beneficiaries. Process of Financial Account Transfer to Living Trust in Las Cruces: 1. Appointing a trustee: Understand the importance of choosing a trustworthy individual or entity to manage your living trust. 2. Gathering necessary documents: Identify the key documents required for transferring different types of financial accounts to a living trust, such as account statements, titles, and beneficiary designations. 3. Contacting financial institutions: Follow step-by-step instructions for notifying banks, investment firms, and other financial entities about the transfer of accounts into the trust. 4. Completing necessary paperwork: Learn about the specific forms and legal documents needed to effectuate the transfer and update account ownership. 5. Asset re-titling and beneficiary designation: Explore the process of changing ownership on accounts and designating beneficiaries to ensure a seamless transfer to the living trust. Conclusion: The financial account transfer process to a living trust in Las Cruces, New Mexico, offers numerous benefits in terms of probate avoidance, asset management, and tax planning. By understanding the different types of account transfers and following the necessary steps, individuals can protect their assets, simplify their estate plans, and provide for their loved ones in a seamless manner. Consult with a qualified estate planning professional in Las Cruces to ensure compliance with state laws and achieve personalized results.

Las Cruces New Mexico Financial Account Transfer to Living Trust

Description

How to fill out Las Cruces New Mexico Financial Account Transfer To Living Trust?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Las Cruces New Mexico Financial Account Transfer to Living Trust becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Las Cruces New Mexico Financial Account Transfer to Living Trust takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Las Cruces New Mexico Financial Account Transfer to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!