Las Cruces, New Mexico Assignment to Living Trust: A Comprehensive Guide for Estate Planning In Las Cruces, New Mexico, assigning your assets to a living trust is an essential aspect of estate planning. By creating a living trust, you can ensure that your assets are appropriately distributed to your preferred beneficiaries in a timely and efficient manner, while avoiding probate and minimizing potential tax liabilities. In this comprehensive guide, we will explore the purpose and benefits of an assignment to living trust in Las Cruces, along with different types of living trusts you can choose from. What is an Assignment to Living Trust? An assignment to living trust, also known as a revocable living trust or a family trust, is a legal arrangement through which you transfer your assets into a trust that you control during your lifetime. By doing so, you essentially create a separate legal entity capable of holding and managing your assets, separate from your personal ownership. This ensures a smooth transition of your assets to your beneficiaries according to your wishes upon your death, without the need for probate. Benefits of Assigning Assets to a Living Trust in Las Cruces: 1. Avoids Probate: One of the primary advantages of living trusts in Las Cruces is the avoidance of probate, which can be a lengthy and costly process. By assigning your assets to a living trust, you spare your loved ones from the hassles of navigating the probate court system, ensuring a more efficient distribution of your assets. 2. Privacy: Unlike a will, which becomes public record after probate, a living trust allows for the distribution of assets without public disclosure. This grants you and your family privacy regarding the details of your estate planning. 3. Incapacity Planning: Living trusts provide provisions for incapacity planning, ensuring that your assets are managed and utilized for your care and support if you become incapacitated or unable to manage them yourself. 4. Flexibility and Control: As the creator of the living trust, you retain full control over your assets during your lifetime. You can easily make changes, add or remove assets, or even revoke the trust if your circumstances change. Types of Living Trusts in Las Cruces, New Mexico: 1. Individual Living Trust: This is the most common type of living trust, where a single person creates and assigns assets to the trust. It allows the person full control over the trust during their lifetime and sets up provisions for the distribution of assets upon their death. 2. Joint Living Trust: In a joint living trust, commonly utilized by married couples, both spouses create and assign their assets to the trust. This type of trust provides for the seamless transfer of assets to the surviving spouse upon the death of the first spouse. 3. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be altered or revoked by the creator once established. This type of trust is often utilized for specific estate planning purposes, such as asset protection or minimizing estate taxes. In conclusion, deciding to assign your assets to a living trust in Las Cruces, New Mexico, is a proactive step towards effective estate planning. By bypassing probate, ensuring privacy, and maintaining control over your assets during your lifetime, a living trust grants you peace of mind and provides a solid foundation for the future. Understand the different types of living trusts available and consult with a qualified attorney to determine the best option suitable for your unique situation and goals.

Las Cruces New Mexico Assignment to Living Trust

Description

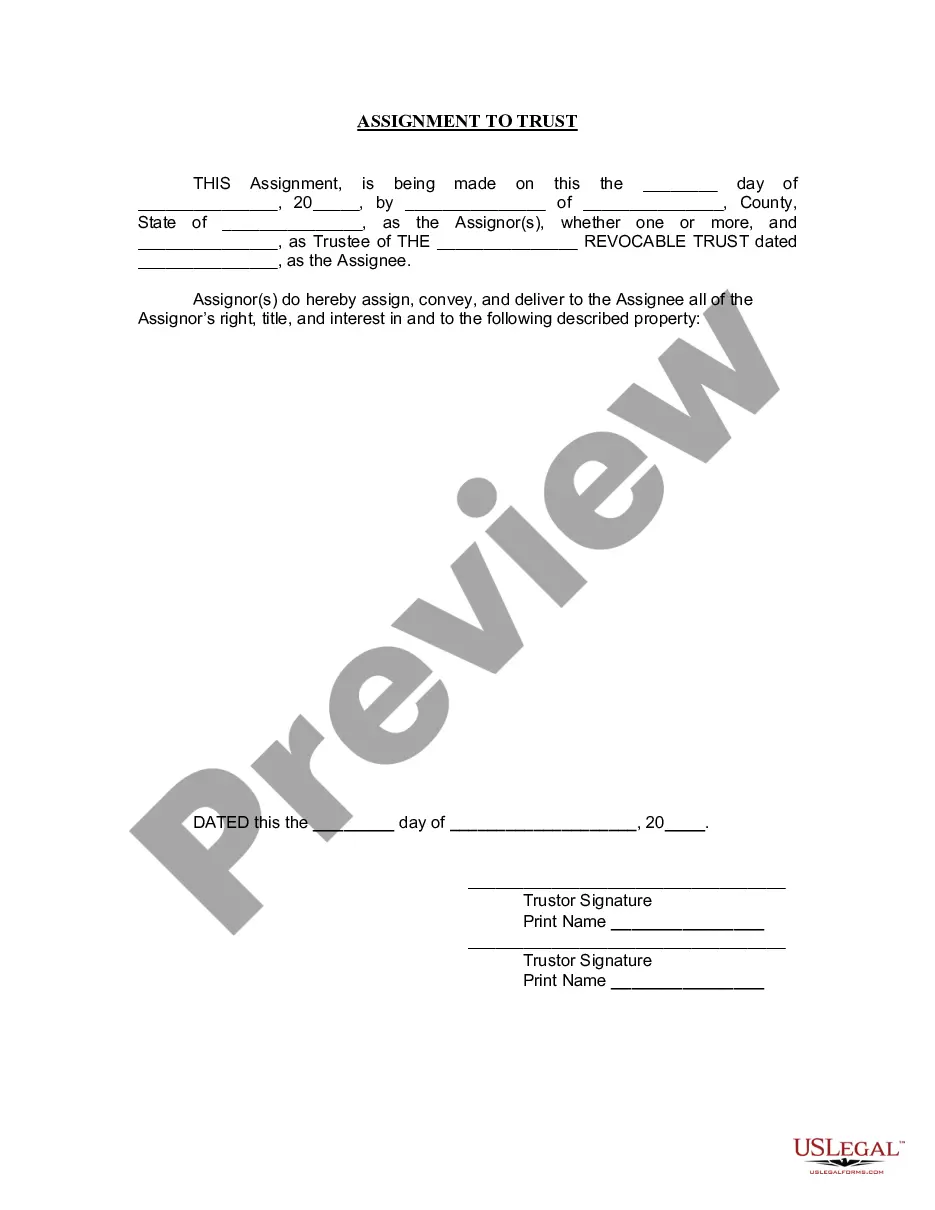

How to fill out Las Cruces New Mexico Assignment To Living Trust?

We always want to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, as a rule, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Las Cruces New Mexico Assignment to Living Trust or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Las Cruces New Mexico Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Las Cruces New Mexico Assignment to Living Trust is suitable for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!