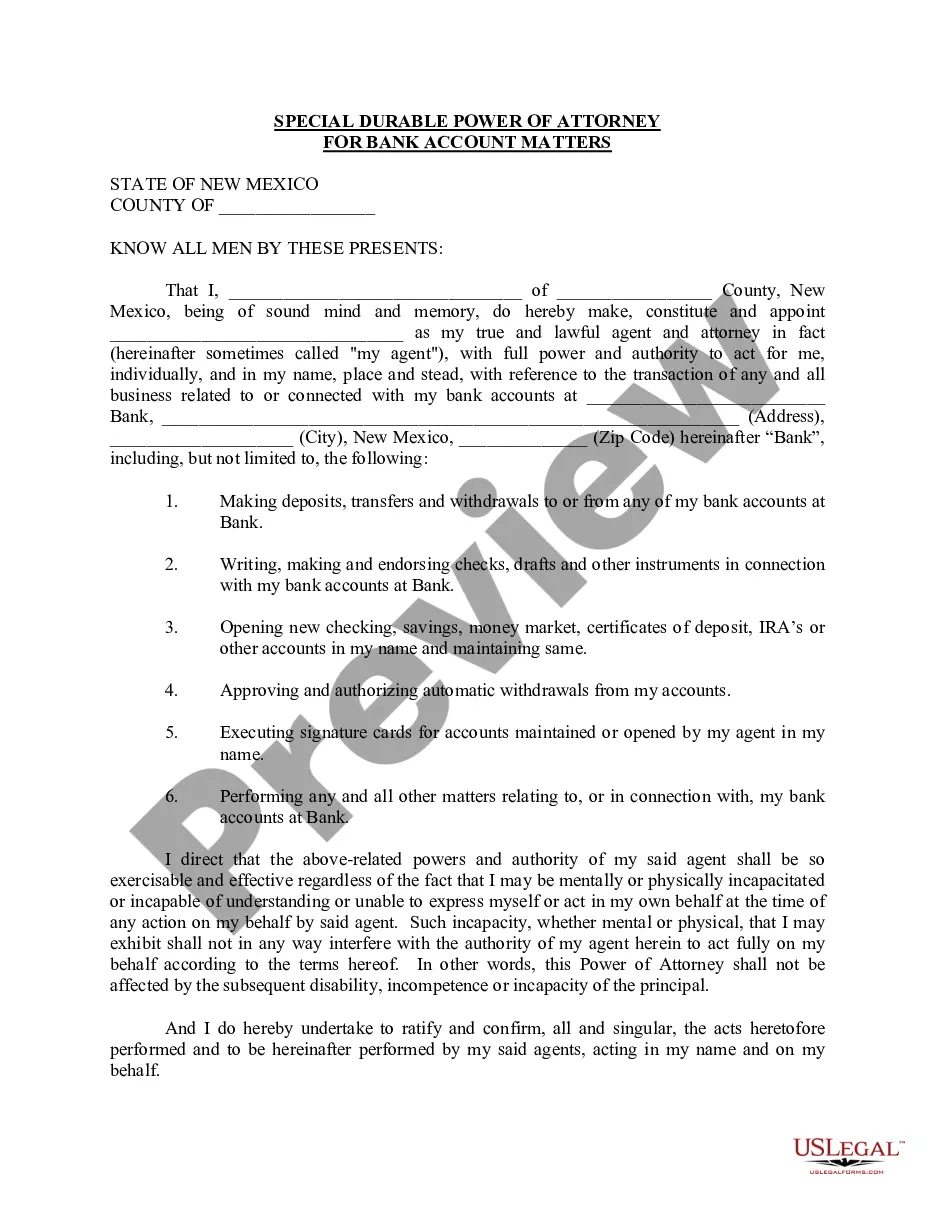

Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific authority to an appointed individual, known as the agent or attorney-in-fact, to handle various banking matters on behalf of the principal. This document is created to ensure that someone trusted can manage the principal's bank accounts and make financial decisions in case the principal becomes incapacitated or unable to manage their funds. The Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters allows the agent to perform a range of tasks related to the principal's bank accounts. These tasks may include depositing and withdrawing funds, writing checks, transferring money between accounts, paying bills, and managing other financial transactions. The powers granted to the agent can be tailored to the specific needs and requirements of the principal. There are different types of Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters, which can provide varying levels of authority to the agent based on the principal's preferences. Some common types include: 1. Limited Power of Attorney for Bank Account Matters: This type grants the agent specific and limited authority to handle only certain banking matters as specified by the principal. It may include tasks such as depositing checks and paying bills, while excluding other financial decisions. 2. General Power of Attorney for Bank Account Matters: With this type, the agent has broad authority to manage all aspects of the principal's bank accounts. They can perform tasks like opening and closing accounts, investing funds, and conducting transactions on behalf of the principal. 3. Springing Power of Attorney for Bank Account Matters: This type becomes effective only when a specific condition or event stated in the document occurs. For example, it may become active if the principal becomes incapacitated or unable to manage their finances. It is crucial to draft the Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters carefully to ensure it aligns with the principal's wishes and complies with state laws. Consulting with an attorney experienced in estate planning and elder law is highly recommended ensuring the document's validity and to address any specific concerns or requirements of the principal.

Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Las Cruces New Mexico Special Durable Power Of Attorney For Bank Account Matters?

Are you looking for a reliable and affordable legal forms supplier to buy the Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Las Cruces New Mexico Special Durable Power of Attorney for Bank Account Matters in any provided format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal paperwork online once and for all.